In this Placer Bytes, we break down the sustained success of Kroger, the recoveries of Casey’s and GameStop, and analyze what Dave & Buster’s struggles mean for experiential.

Hail to Kroger

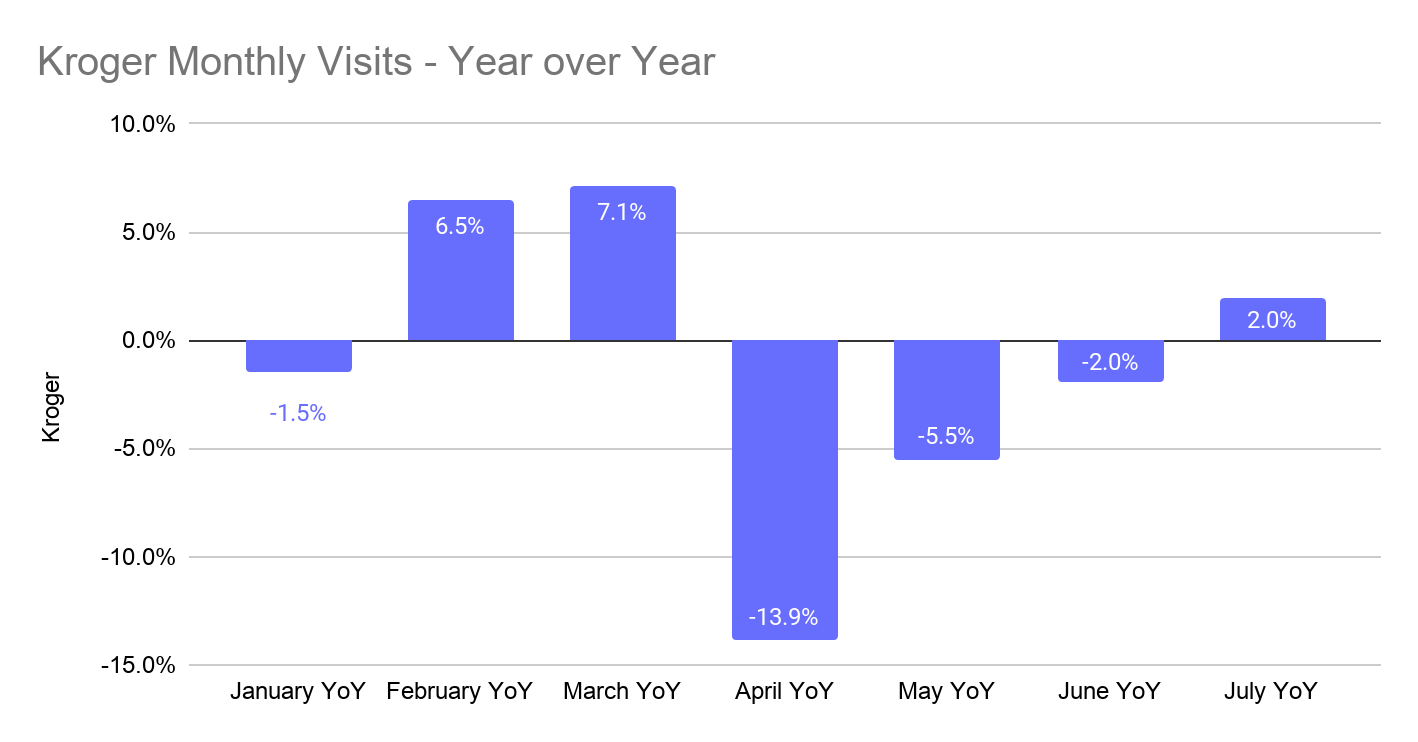

We’ve spoken ad nauseam about the strength traditional grocers have shown amid the pandemic and recovery. And have also dedicated a great deal of time to discussing the changes in customer visitation patterns. So, it should be of no surprise to see the unique strength Kroger has been showing over recent months. After surges in traffic in February and March, the brand’s visits were performing relatively well throughout the pandemic. But by July, visits had returned to year-over-year growth with a 2.0% jump in visits.

This is a trend that is demonstrating staying power with weekly visits since the week of July 27th showing an average 2.5% increase on the equivalent weeks in 2019. And visits aren’t just increasing, visitors are spending more time at Kroger locations with a year-over-year jump of 5.3% in July and August 2020 compared to the same period in 2019. But, perhaps the most impressive element of Kroger’s story is that it is not among the best-positioned grocers at this point in 2019. Should Kroger prove capable of leveraging this short-term boost, the impact could be significant and lasting.

GameStop’s Recovery?

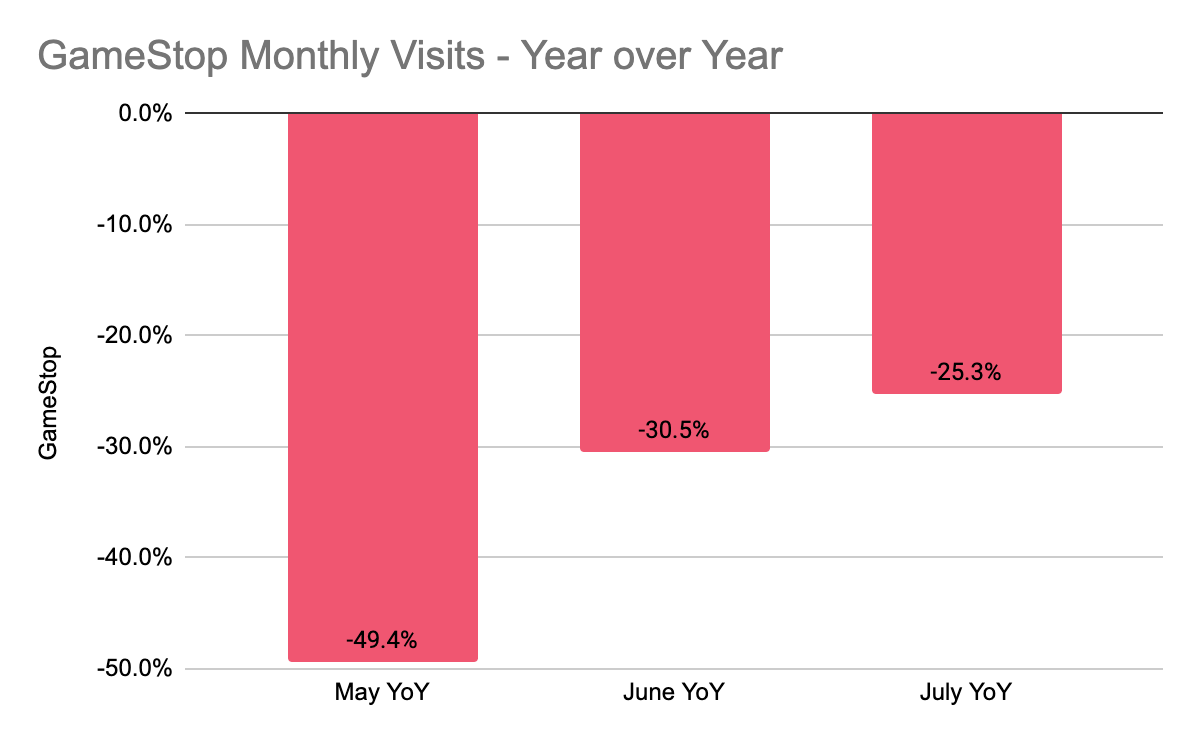

Yes, visits were still down 25.3% year over year in July. But is it so crazy to think the pandemic could have provided a significant boost for GameStop? The brand has seen visits steadily rising towards 2019 levels, and visits for the weeks of August 3rd, August 10th, and August 17th were down 20.7% on average, a seeming next step on its path to normalcy. And with stay-at-home orders boosting digital orientation, video games and consoles could see a boost.

Could we still see closures considering the massive footprint? Yes. But if these are handled properly, a more optimized GameStop could be a powerful offline brand to reckon with.

Casey’s General

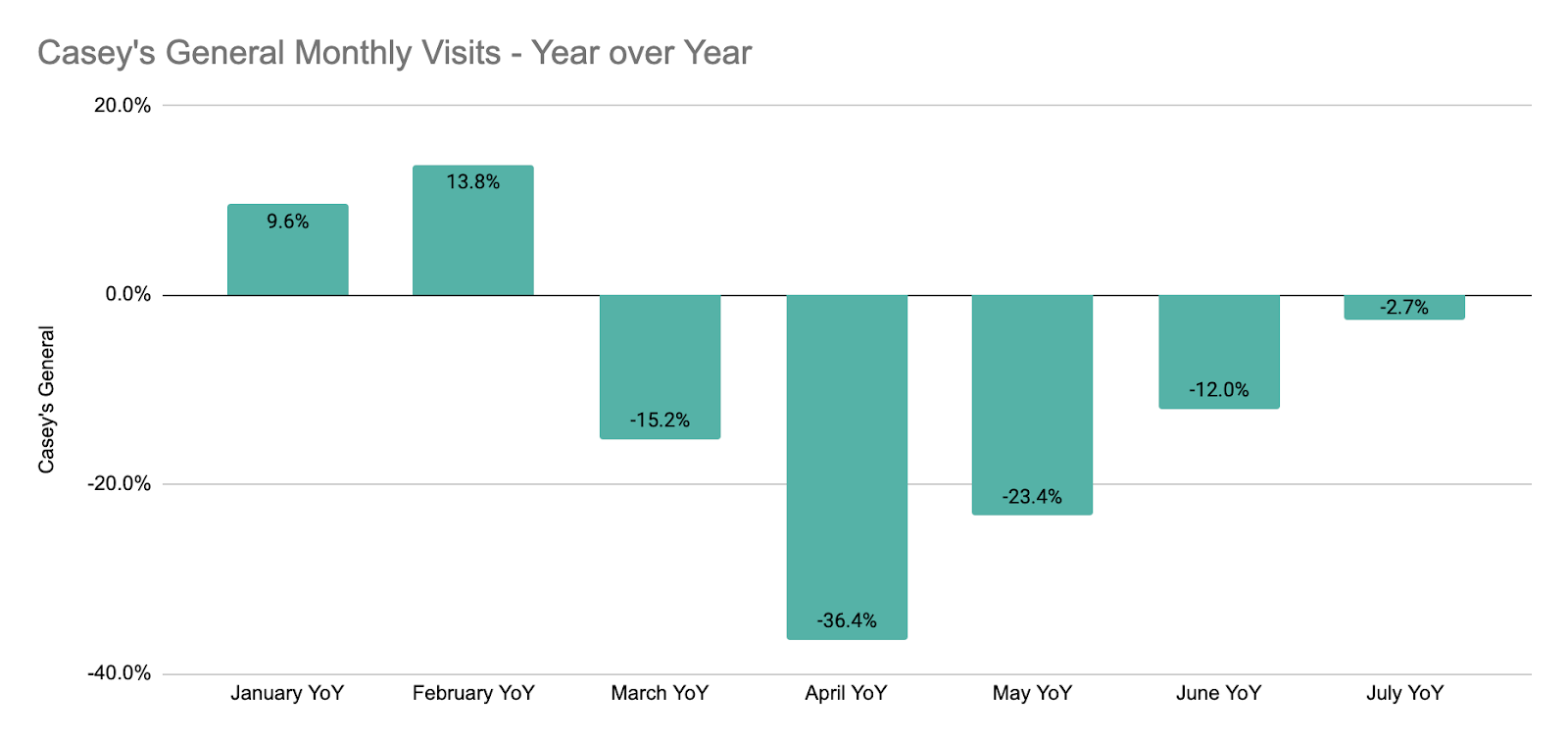

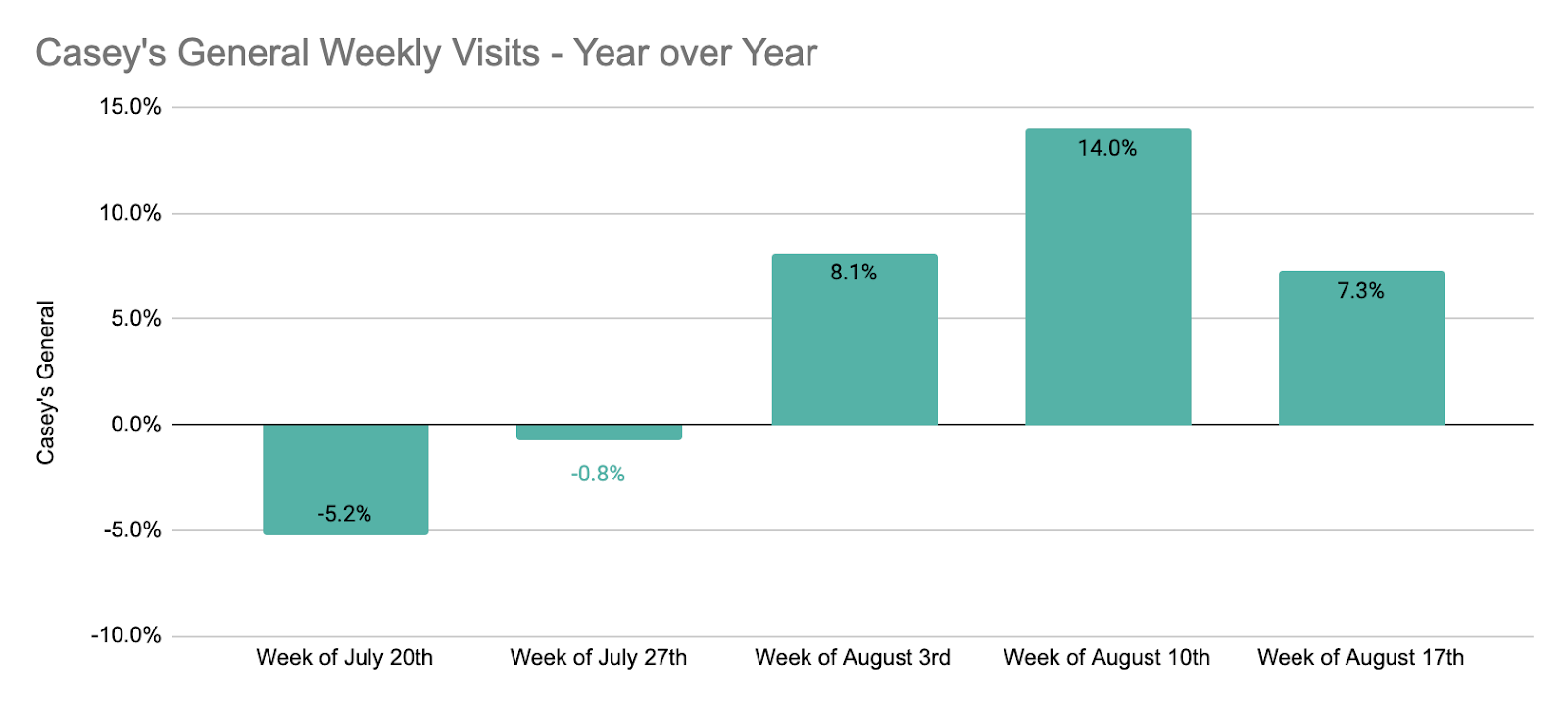

Casey’s General traffic was hit hard during the pandemic with visits dropping 36.4% year over year in April, but the brand was closing in on 2019 levels in July. Visits were down just 2.7% in July after having been down 12.0% in June.

And the pace is picking up with the weeks beginning August 3rd, August 10th and August 17th up 8.1%, 14.0% and 7.3% respectively year over year. These numbers are significant because they look awfully close to the growth numbers the brand was posting in early 2020, pre-pandemic. This is not just a strong indication of this brand’s return, but also a sign of a wider recovery as brands like this rely heavily on typical movement patterns to and from work, school, shopping trips and more.

What Dave & Buster’s Means for Experiential

Dave & Buster’s success was built around the fact that it was more than a restaurant, with a major focus on watching sports and playing games. And with being games paused, the brand certainly felt the impact of the pandemic.

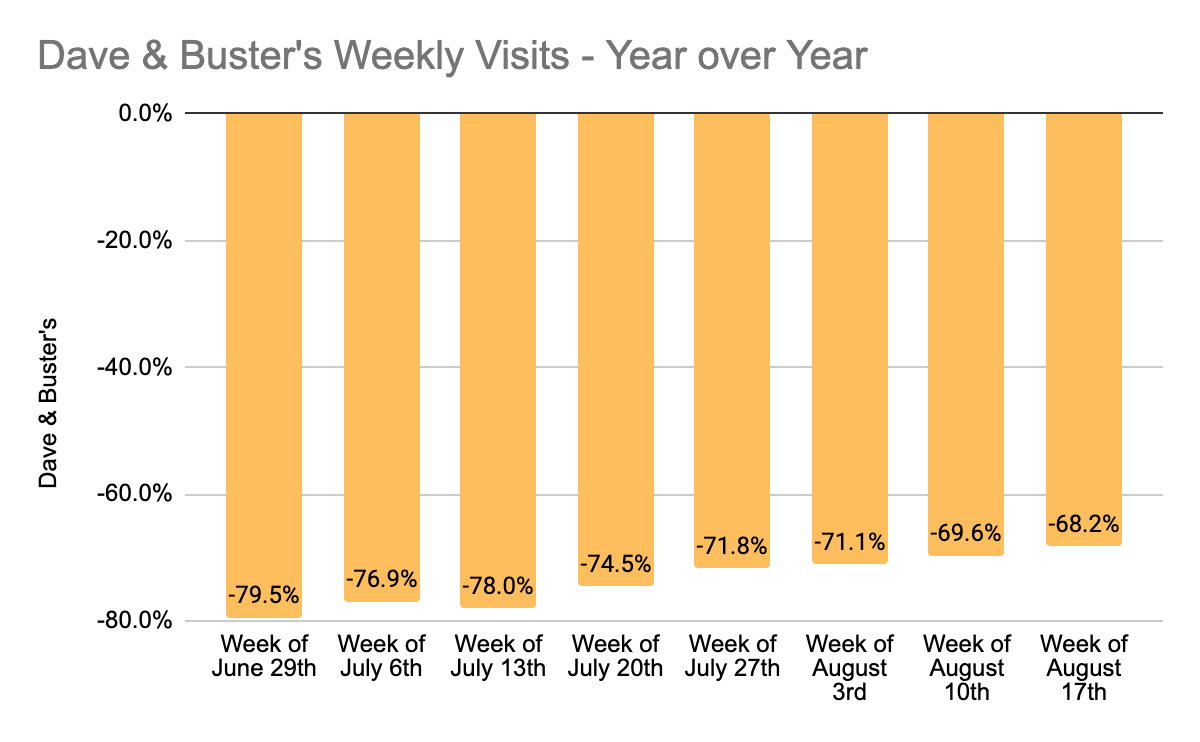

So progress for the brand should be taken as a very positive sign. Visits nationwide were down 68.2% the week of August 17th – far behind the wider dining category which was down 27.9% the same week. But this still marks a far better result than the week of June 29th, when visits were down 79.5% year over year. Is experiential dining back? No. Could Dave & Buster’s be a critical indicator of the sector’s return? Yes.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.