What markets/regions have seen the highest adoption of ecommerce apps? 🌎

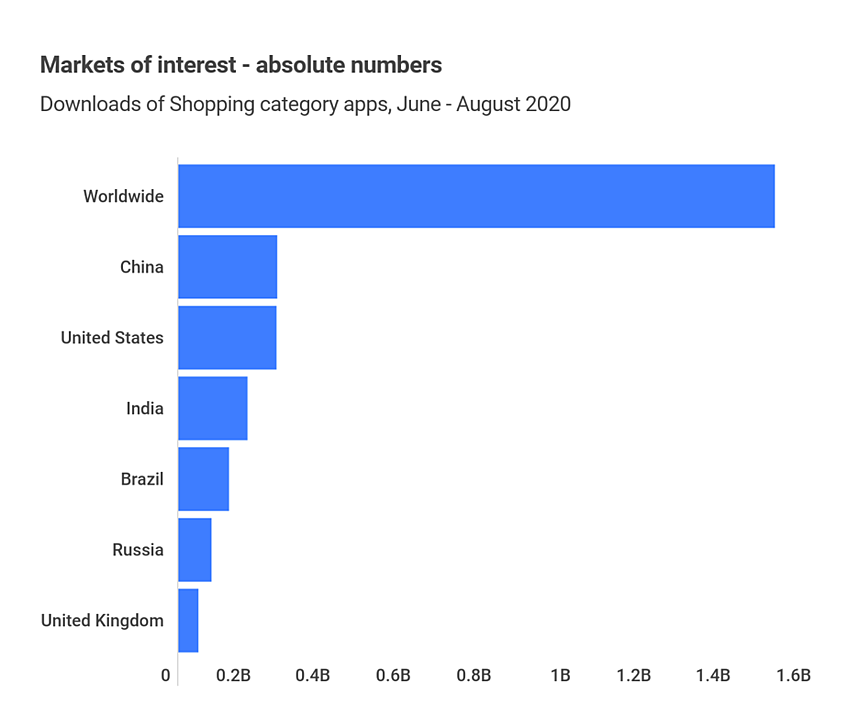

Best way to measure adoption is by looking at number of downloads. Downloads, or “new installs,” equate to new users. This summer, Shopping apps were downloaded most in China, U.S., India, Brazil, Russia and the U.K. These countries, combined, make up 62% of global Shopping app downloads.

Brazil has shown the most growth at 50% YoY (June - August). In fact, aggressive user acquisition in Brazil has the country surpassing the U.S. in non-organic installs. Still, U.S. leads by rate of organic installs– a sign of a more mature market.

Which markets offer the most opportunity? 💰

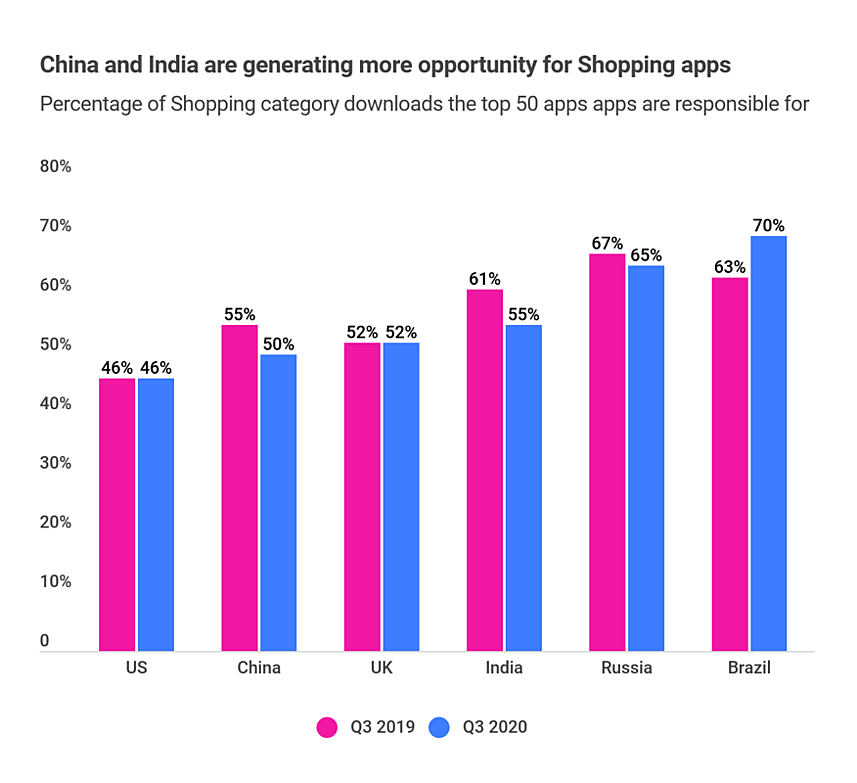

Growth is high and so is opportunity. In mature markets, like the U.S. and U.K., people are willing to stray away from heavy-hitters, like Amazon. This gives younger ecommerce players the chance to compete. China and India are also showing signs of opportunity for younger ecommerce apps; the top 50 Shopping apps in those regions received a smaller percentage of downloads this year compared to last.

Looking at actual sales, China is by far the safest bet. The majority of the country’s shopping occurs online. Plus, China is expected to produce $2 trillion in ecommerce sales this year…if that sounds like a lot, it’s because it is (it’s more than 50% of total global sales).

In the U.S., which verticals are seeing the most demand/growth? 📈

In the U.S., which verticals are seeing the most demand/growth? 📈

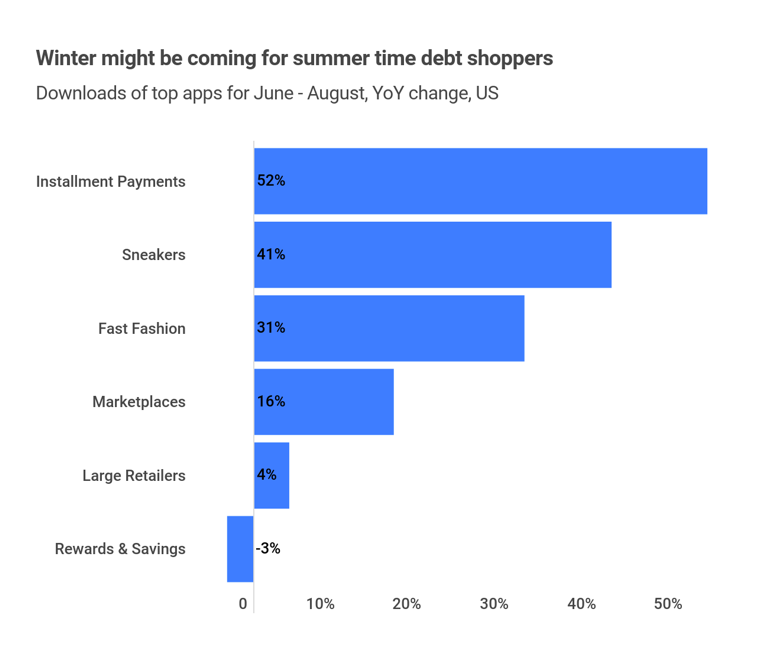

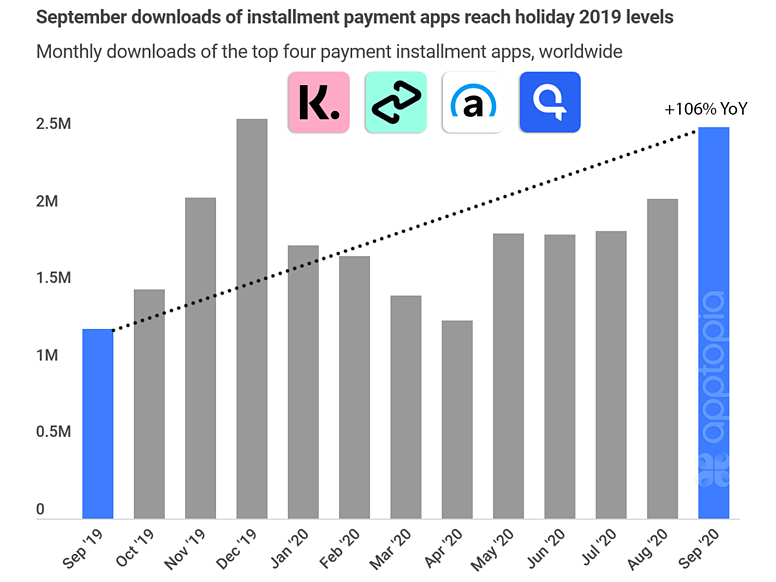

Installment-payment apps, like Klarna or Affirm, followed by Sneaker and Fast-fashion apps. It should be noted, however, that Large Retailers represent the largest absolute number of users. Also, Rewards & Savings apps saw a decline in new downloads, but an increase in usage.

What recommendations do you have for ecommerce players? ✍️

One of the reasons why China succeeds in ecommerce is because of their willingness to stay at the forefront of tech and marketing. This means testing new channels, creatives, offers, and utilizing tools like social media. Don’t be afraid of livestream sales or TikTok influencers.

Also, find opportunity within your current customer base through retargeting campaigns. Retargeting can help you re-capture your audience, and turn those window-shoppers into buyers.

Finally, consider updating your product. Perfect example: integrating installment-payment providers into your checkout experience. There’s high-demand for these apps, meaning people are willing to shop, as long as they have access to this type of payment option.

What are your expectations for Q4 and 2021? 🔮

October = develop strategy; November = test offers + promotions; December = optimize and scale.

Marketers are likely to spend more on user acquisition in Q4. This, however, will pay off, as consumers are likely to “comfort revenge shop” going into 2021.

During the months ahead, we’re also going to see more social media campaigns. Brands that can create a whole social event or experience will likely see the most success (think Single’s Day by Alibaba, or Prime Day by Amazon). And brands that meet people where they are (cough TikTok cough Discord), will be able to leverage and benefit from highly-engaging user-generated content (UGC).

To learn more about the data behind this article and what Apptopia has to offer, please reach out to Connor Emmel at cemmel@apptopia.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.