In late August and early September 2020, STR conducted quantitative research using STR’s Traveler Panel. We set out to examine attitudes to travel in this ‘new COVID world’ and to evaluate early experiences among travelers at a time when many economies were reopening and the industry was seeking to capitalize on pent up demand.

Decisions, decisions: Where to stay to feel safe?

In our first blog of this series, we found that travelers demonstrate a continued, albeit lower than “normal”, interest in travel during this era of COVID-19. We also reported that 43% of travelers had booked and/or undertaken a trip during the first two months after lockdown in July and August. In this second edition we investigate further and learn about the types of accommodation to which travelers are drawn and how satisfied they are with their experience in this new world of ever-evolving guidelines.

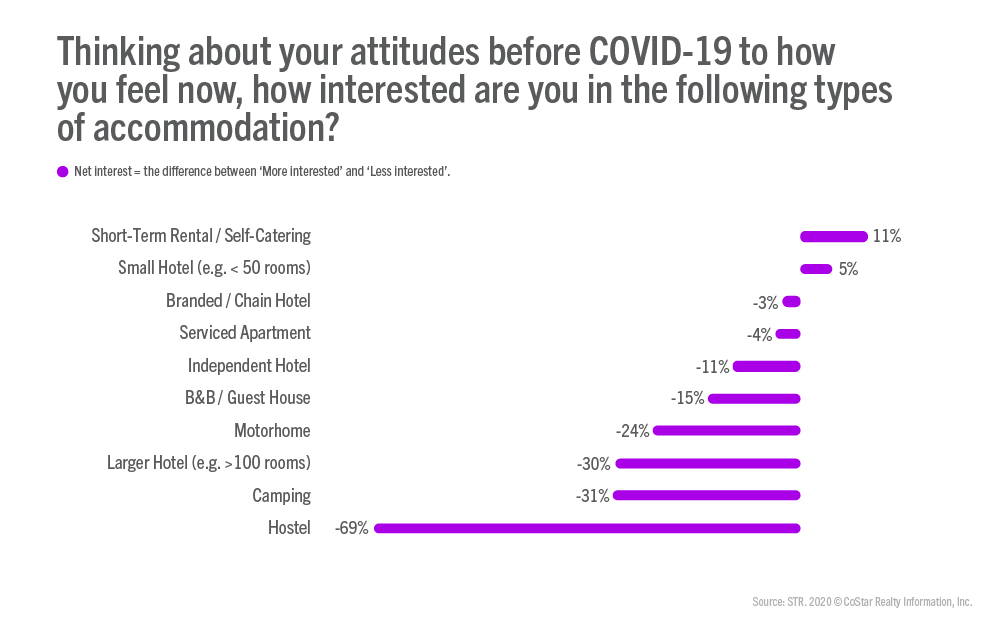

Hostels saw the steepest decline. That is perhaps unsurprising given the communal nature of this type of accommodation, which is unlikely to be considered desirable in today’s world. Meanwhile, the strongest growth in interest was for short-term rental / self-catering properties which recorded a net interest figure of 11%.

Reflecting a theme that consumers are now seeking to minimize interactions with others, interest in larger hotels has fallen while smaller hotels saw a small net increase in interest.

Again, indicating a shift in consumer attitude and behavior, travelers demonstrated more interest in branded hotels compared with independently operated hotels.

So, why do smaller properties and holiday rentals seem more attractive? And why do brands stand out more than independent hoteliers during these uncertain times?

The consensus from our survey is that travelers are pragmatically favoring accommodation that leads to encountering less people. Additional benefits associated with non-serviced accommodation, such as being more in control of cleanliness, social distancing and food preparation, has also contributed to increasing levels of interest in holiday rentals. The following word cloud illustrates the sentiment clearly:

Why are you more interested in short-term rental / self-catering accommodation?

The desire for distance and avoidance of people is reflected in the trends identified by STR for the summer period. This trend showed demand recovery in regional areas ahead of recovery in cities. The drop in demand for larger hotels is also illustrated in recent VisitEngland accommodation occupancy reports provided by STR. Data to the end of July 2020 compared to the same period last year shows that room occupancy has declined much more significantly for hotels with 100+ bedrooms compared to smaller properties, and, in particular, properties with 25 or less rooms. The rationale appears to be consistent—larger hotels in busier areas means more people, which is what travellers are looking to avoid.

How can hotels win back traveler interest?

Travelers felt that branded hotels would pay more attention to COVID-19 protocols and have more information available on the precautions they are taking, thus building confidence.

That said, although branded hotels were of more interest than independent hotels overall, there were diverse views regarding preferred forms of accommodation during these unprecedented times. For example, we found that for some travelers, smaller independent properties were considered more desirable as they would be more careful with their cleaning—and there would be less people. This traveler sums up the pros and cons very neatly:

‘I think with larger hotels, including brand name hotels, there will be an expectation of a cleaning regiment that will be established and maintained. The potential downside is that there could be a lot of people present, which would be expected with larger hotels. Smaller hotels and B&B accommodation would similarly have an appeal because they would generally have less people.’

Overall, the findings represent somewhat of a paradox as travelers are more interested in smaller properties but they also tend to prefer branded over independent properties—a category of hotel that tends to have fewer rooms compared to branded hotels.

It is perhaps unsurprising that travelers are avoiding larger properties and busy conurbations amid the ongoing pandemic. However, the irony is, hotels are working harder than ever before to keep properties clean and guests safe—rightly so, based on traveler opinion.

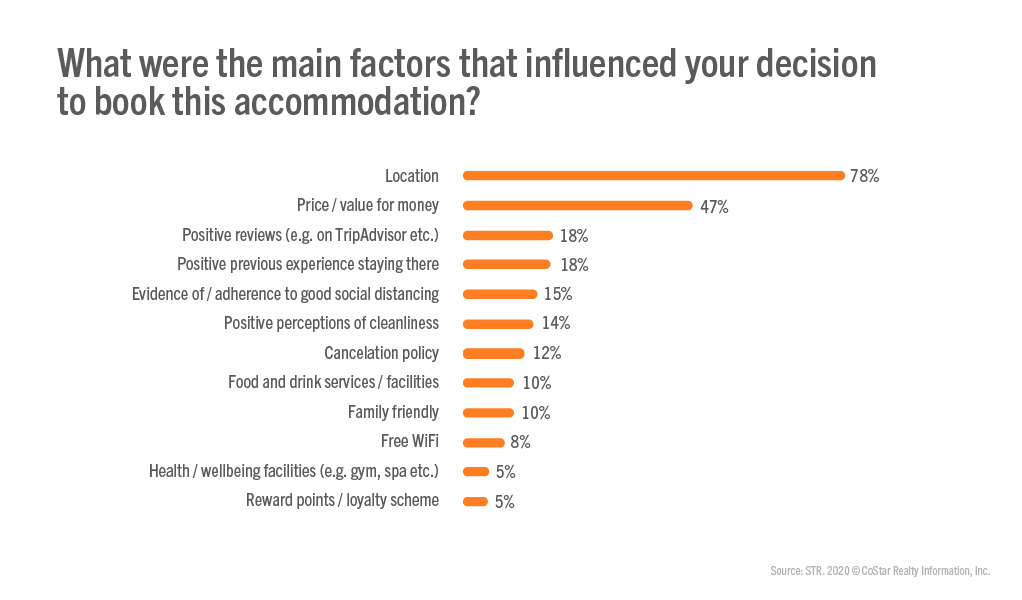

When we asked respondents to highlight the key influencing factors when booking accommodation, the the usual suspects of location and price were top of the list. However, cleanliness and adherence to social distancing are now key considerations for decision making, so hotels are on the right track.

All is not lost: Hotels are still the most popular form of accommodation

It would seem that industry efforts have not been in vain either. Encouragingly, when we asked travelers where they had booked or planned to book for their next break, hotels were still the most popular form of accommodation with 41% booking a hotel compared to 22% booking a short-term rental or self-catering property. Among North American travelers, hotel bookings accounted for 51%, while holiday rentals were at 14%. These findings highlight a strong preference for hotels in this region.

This strong foundation provides hotels with a platform to build back consumer confidence that they offer a safe and welcoming break. In addition, industry standard and ‘stamp of approval’ initiatives will help to build trust and reassurance amongst travelers. These initiatives are likely to be particularly helpful for independent operators as they provide reassurance of adherence to guidelines in the absence of a brand name.

Is there any evidence that all this effort is paying off?

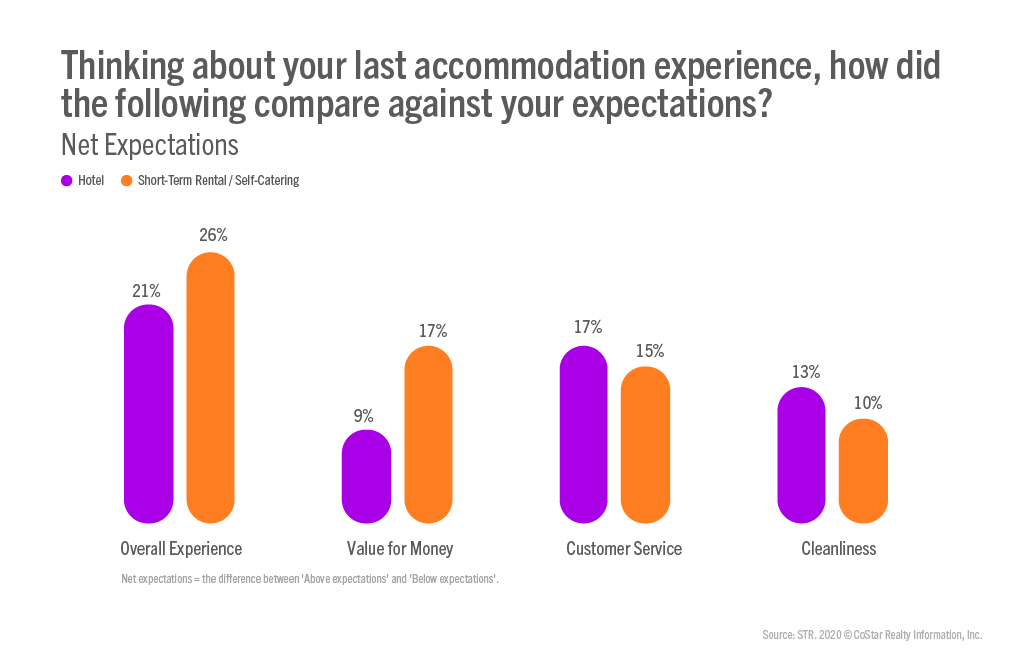

Curious to gauge early opinion amongst those who had ventured out for a leisure break, we asked how travelers’ experiences matched against their expectations. By analyzing the net score between those who stated that their expectations had been exceeded versus those who stated that their expectations had not been met, we see that hotels perform well at 21% for overall experience although this is below the score of holiday rentals (26%).

Holiday rentals were also viewed as better value for money. However, promisingly, hotels scored slightly better in terms of cleanliness and customer service. It is in these areas where hotels can really make a difference.

Net Expectations = the difference between above expectations and below expectations.

Net Expectations = the difference between above expectations and below expectations.

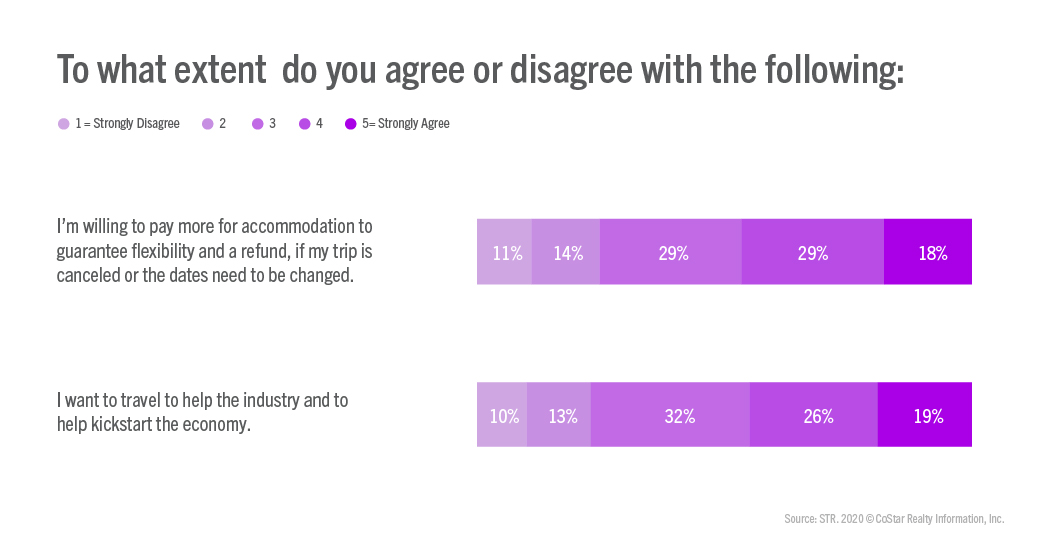

On top of this, many travelers want to support the industry with 45% agreeing with the statement ‘I want to travel to help the industry and kick start the economy’ and 47% being ‘willing to pay more for flexibility and guaranteed refunds’.

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.