Ahead of the Spotify and Wayfair quarterly earnings reports we have used our data to explore some insights into the online performance of the companies:

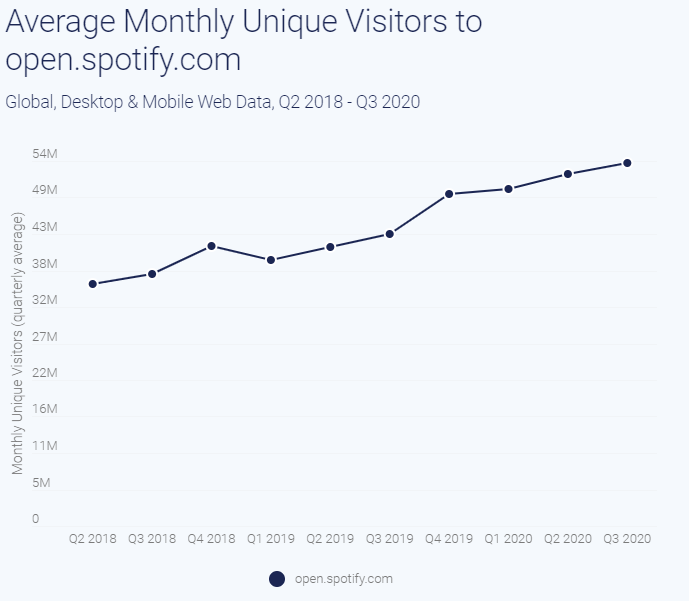

Spotify

Monthly unique visitors (MUVs) to open.spotify.com, Spotify’s online music platform, continued to grow in Q3; continuing the upward trend since Q2 2018. YoY growth in Q3 was 24.2% maintaining the >20% YoY growth in MUVs to the site since the beginning of this year.

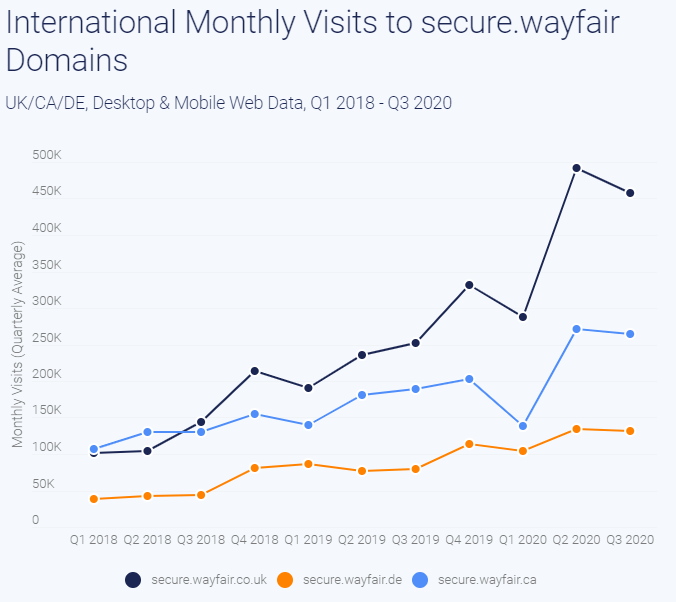

Wayfair

Monthly visits to Wayfair’s payment page, secure.wayfair, experienced YoY growth in all three international markets during the quarter. The UK received both the highest number of average monthly visits to the payment page and the strongest YoY growth at 81.1%. Germany, despite having the largest TAM of the three international markets, received the lowest number of visits to the page in Q3, but experienced a 64.7% YoY growth; and Canada experienced the lowest YoY growth, however this still reached 40%.

Following the strong QoQ growth in visits to secure.wayfair in all three international markets last quarter, in Q3 we see a drop in visits. That said, this remains higher (significantly higher in the case of the UK and Canada) than the number of visits to the domain seen up until Q2.

To learn more about the data behind this article and what Similarweb has to offer, visit https://www.similarweb.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.