Loan application volume, mortgage rates, and lenders underwriting standards have been impacted by the COVID-19 pandemic. For example, the mortgage interest rate is at a record low and purchase loan application trend highlights strong demand for home buying.[1] Lenders may have changed their underwriting standards in response to these trends and economic uncertainty. This blog compares the credit attributes for conventional conforming loans in the second quarter of 2020 to the same quarter of last year.

Average debt-to-income (DTI) ratios for conventional conforming home-purchase loans dropped during the second quarter of 2020 from the same quarter in 2019. In contrast, the average loan-to-value (LTV) ratios during this time rose. Additionally, the average credit score rose. On net, the drop in DTI ratios may reflect the relaxing of affordability pressures for homebuyers in the face of declining mortgage rates in 2020.

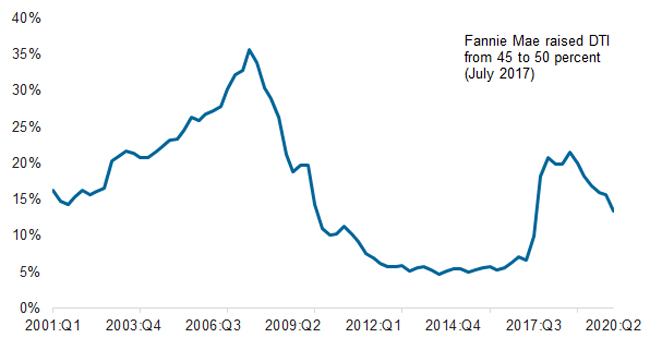

Figure 1: Share Of Conforming Conventional Home Purchase Loans With Dti Ratio Above 45 Percent

The credit-risk attributes of borrowers have shown dramatic variation in the last 20 years. DTI and LTV ratios, along with credit scores, are three important factors in mortgage underwriting. Since 2014, credit-loosening policies by the Government-Sponsored Enterprises (GSEs) have helped boost higher DTI and LTV ratios.[2] Figure 1 shows the share of new conventional conforming home-purchase loans with a DTI ratio above 45% rose sharply after Fannie Mae put its new policy into effect. The share, holding steady between 5% to 7% from early 2012 up to Fannie Mae’s announcement, had reached its peak of 21% in the fourth quarter of 2018 and started dropping in early 2019 and was 13% in second quarter of 2020. The average DTI ratio for conventional conforming home-purchase loans dipped by one point to 35% from the second quarter of 2019 to the second quarter of 2020.

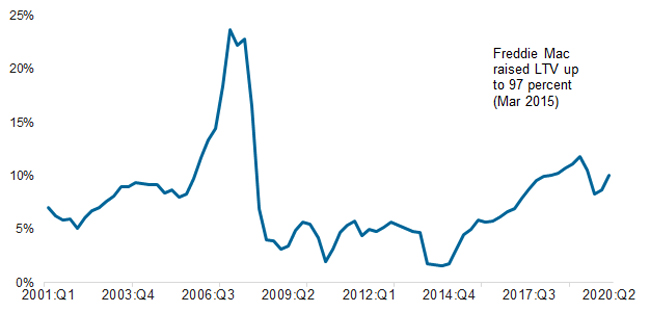

Figure 2: Share Of Conforming Conventional Home Purchase Loans With Ltv Ratio Above 95 Percent

Similarly, Figure 2 shows that the share of new conventional conforming home-purchase loans with an LTV ratio above 95% started to rise in early 2015 following the GSEs’ announcement. The share was less than 2% in 2014 but rose gradually and reached 12% in the second quarter of 2019 and was the highest since 2008. The share started to drop in third quarter of 2019 but rose again in the second quarter of 2020 to 10%. The average LTV ratio for home-purchase loans in the second quarter of 2020 was 84 percent, up by one point from the same quarter of 2019.

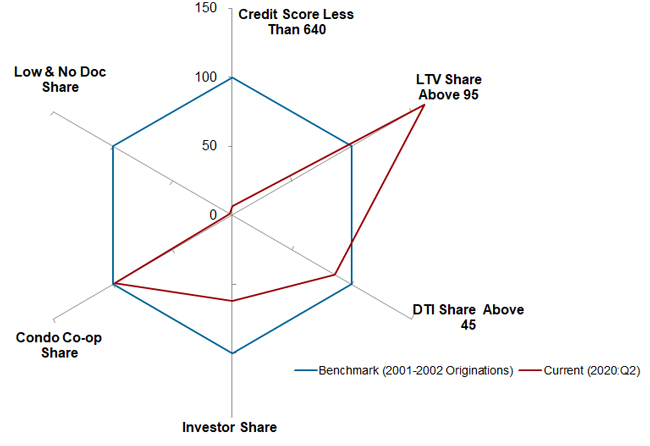

Though both DTI and LTV standards have been relaxed in the past few years, there has been no change in credit score standards. During the second quarter of 2020, the average credit scores for the homebuyers with conventional conforming home-purchase loans rose by three points from the same quarter in 2019. The average credit score was much higher than the pre-housing crisis level. For example, the average credit score of homebuyers was 705 in 2001, but dramatically rose during the Great Recession in 2008, and was 757 the second quarter of 2020. In addition to high credit score standards, those high DTI and LTV loans in 2020 were fully documented and are thus different than the pre-housing crash high DTI and LTV loans, in which many of the latter were low/no documentation loans.

Figure 3: Six Credit Risk Attributes For Conforming Conventional Home Purchase Loans: Q3 2019 Compared With 2001 2002

Figure 3 compares six indicators of underwriting and credit risk during a benchmark time period to present day for conventional conforming home-purchase loans. The blue hexagon represents an index of credit-risk attributes in the benchmark period and the red polygon represents characteristics of loans originated in the second quarter of 2020, relative to the benchmark. The share of borrowers with a credit score less than 640 as well as the low/no documentation loan share were both down significantly compared to the 2001-2002 benchmark level. In contrast, the share of new loans with an LTV ratio higher than 95% was 66% higher than the benchmark level. Share of new loans with a DTI ratio above 45% was 12% lower than the benchmark level. The condo/co-op share was just 2% lower than the benchmark level, and the investor-owned share was 38% lower than the benchmark level.

Mortgage rates had started to decline in early 2019. As the Fed continued to cut interest rates to help the economy, mortgage rates continued to push downward and have reached a record low. Rates have dropped by almost 1 percentage point in the second quarter of 2020 from the same quarter in 2019. The decline in share of loans with a DTI ratio above 45% reflects the improving affordability attributed to low mortgage interest rate throughout the year.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.