Starbucks to Hit Big?

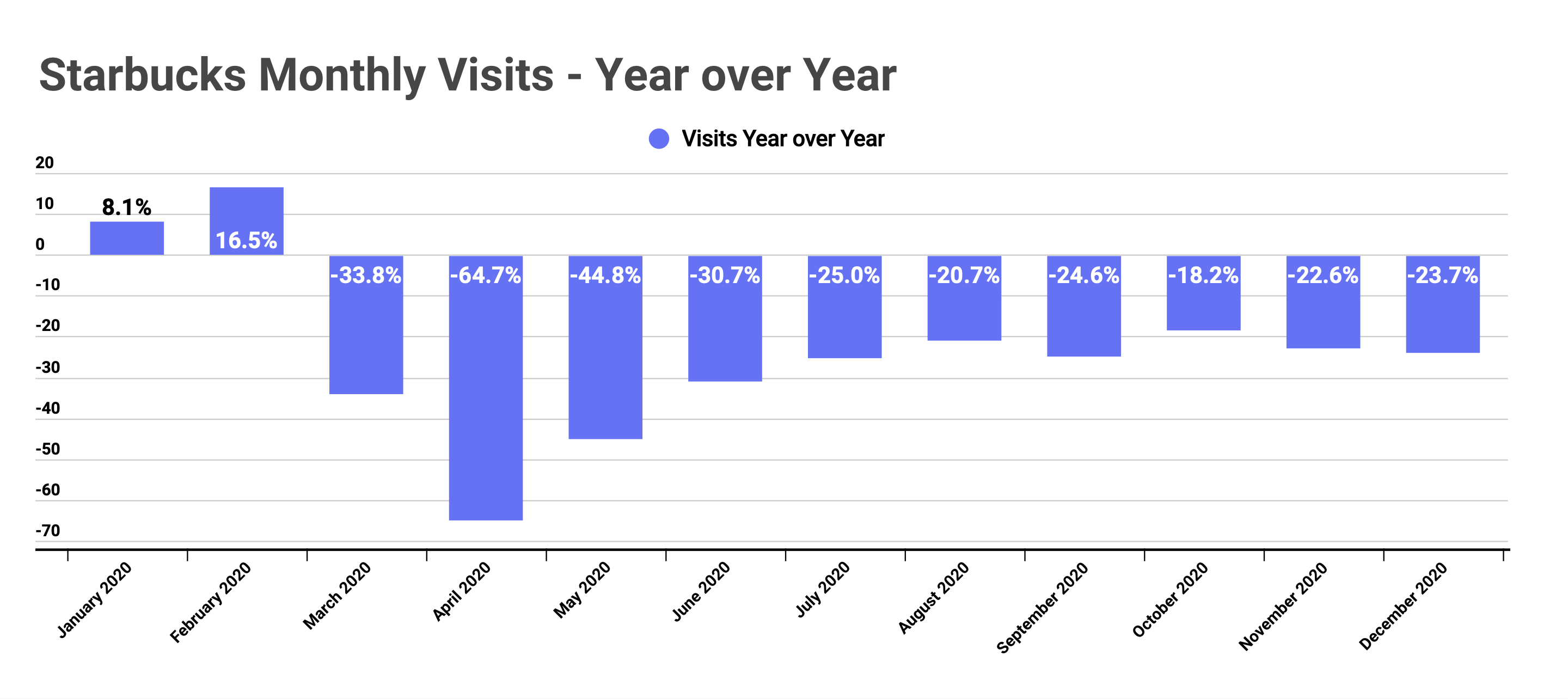

Looking at visits to Starbucks overall in 2020 saw a tremendous start with visits up 12.3% on average in January and February year over year. And post-shutdown, the brand was recovering strongly before being hit hard by a resurgence of COVID cases during an especially critical time. In 2019, Black Friday and Thursday, December 26th marked the two highest-visit days by far for the brand nationwide, and November and December were the two strongest months for visits overall.

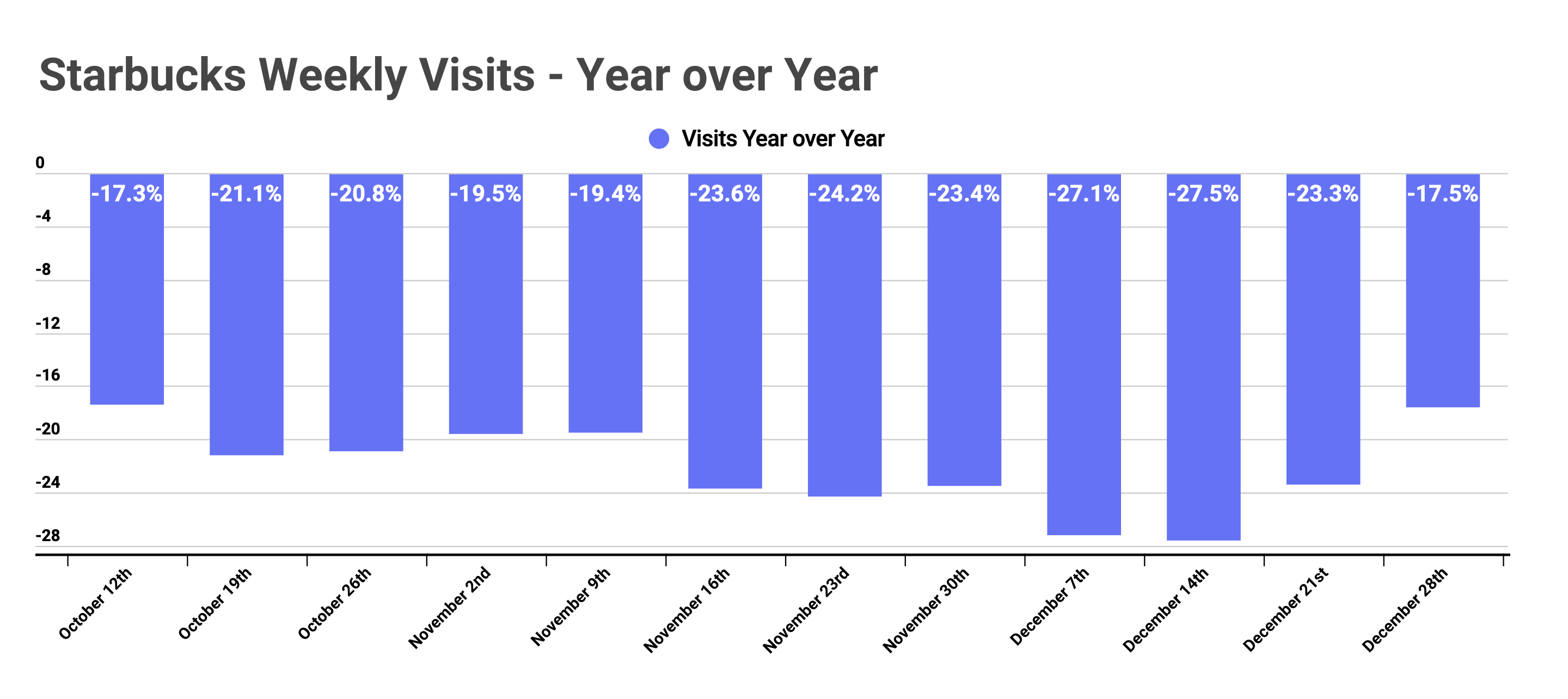

Yet, seasonality was poorly timed in 2020, and the rise in COVID cases clearly limited the brand’s forward progress. Visits in November and December were down 22.6% and 23.7% year over year after having seen the visit gap close to within 18.2% in October – the best result since the pandemic began.

But, there are reasons to expect better things in 2021. Firstly, visits trended sharply in the right direction in late December with visits the week beginning December 28th down just 17.5%, the best mark since the week beginning October 12th. And critically, this week was being compared to an especially strong week in 2019, making the result all the more impressive.

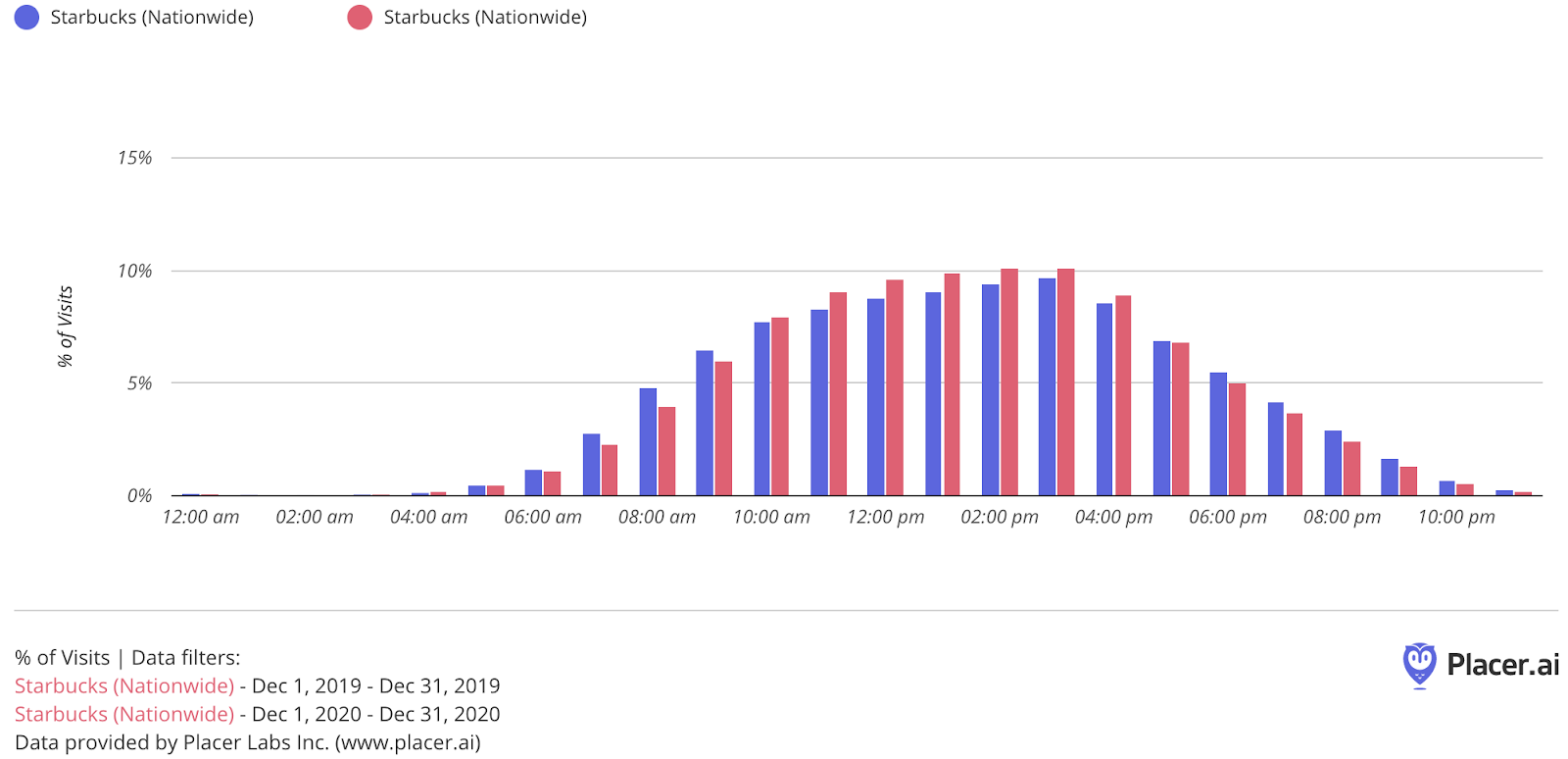

Secondly, 2021 could portend a confluence of very positive factors for the coffee giant. Starbucks is producing this recovery while still operating without several core elements. Looking at December visits, the morning is still seeing a significant decline as work and school routines change, and city traffic declines significantly. In 2020, 13.4% of visits came between 6 am and 10 am, while that number was 15.3% in 2019. But the length of visit is also declining, with a 4.0% drop year over year in December visit duration. Even more extreme, the percentage of visits that take between 15 and 29 minutes rose by over 15% further indicating that people are spending less time in their local Starbucks.

And this speaks to the opportunity. Starbucks has managed to drive visits without having access to one of its normal strengths. As the morning traffic surge returns, the brand could see a significant and acute recovery. Additionally, expect longer duration visits to return especially as more professionals look to work from home. The ability to get away for a few hours is a welcome benefit and could enable Starbucks to see larger order sizes as customers look to enhance their working hours with more drinks and food while at a location. And this doesn’t even take into consideration the growing strength of order online, pick up in store options.

If Starbucks can retain its former areas of strength while leaning into potential ‘work from home, while away from home’ benefits, the results could be exceptional.

Tuesday Morning’s Opportunity

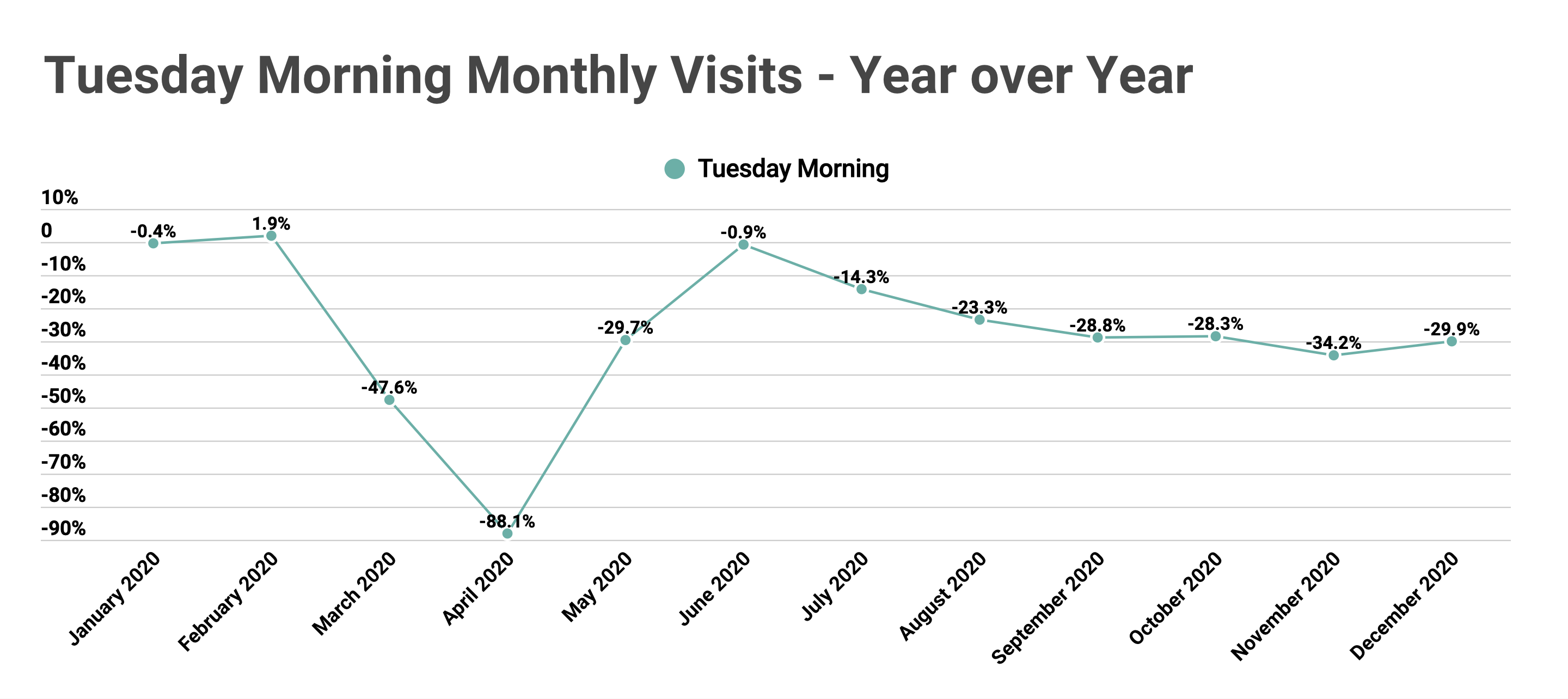

A home goods brand with an orientation towards high value seems like an especially winning combination in 2021. And this is exactly the scenario facing Tuesday Morning as it exits bankruptcy. While the brand faced financial challenges at a uniquely untimely time, it enters into 2021 well-aligned with key trends. Shoppers are still heavily oriented to home improvement and they are looking for price-conscious deals.

And apart from just seeing visits rebound slightly in December with visits down 29.9%, after having been down 34.2% in November, there is another positive sign of recovery. Tuesday Morning saw a 2.4% increase in visit duration indicating the potential for larger basket sizes and also saw a shift up in terms of the household income of its core audience. In December 2020, Tuesday Morning saw a 0.7% shift in the number of customers earning between $75,000 to $100,000 a year at the expense of those earning between $50,000 to $75,000. This shift, when aligned with its value offering and increased visit duration could help Tuesday Morning rebound faster than expected. The key will be effectively targeting and engaging with this audience so as to drive a sustainable relationship.

Will Starbucks return to its former glory in 2021? Can Tuesday Morning take advantage of an advantageous post-bankruptcy environment?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.