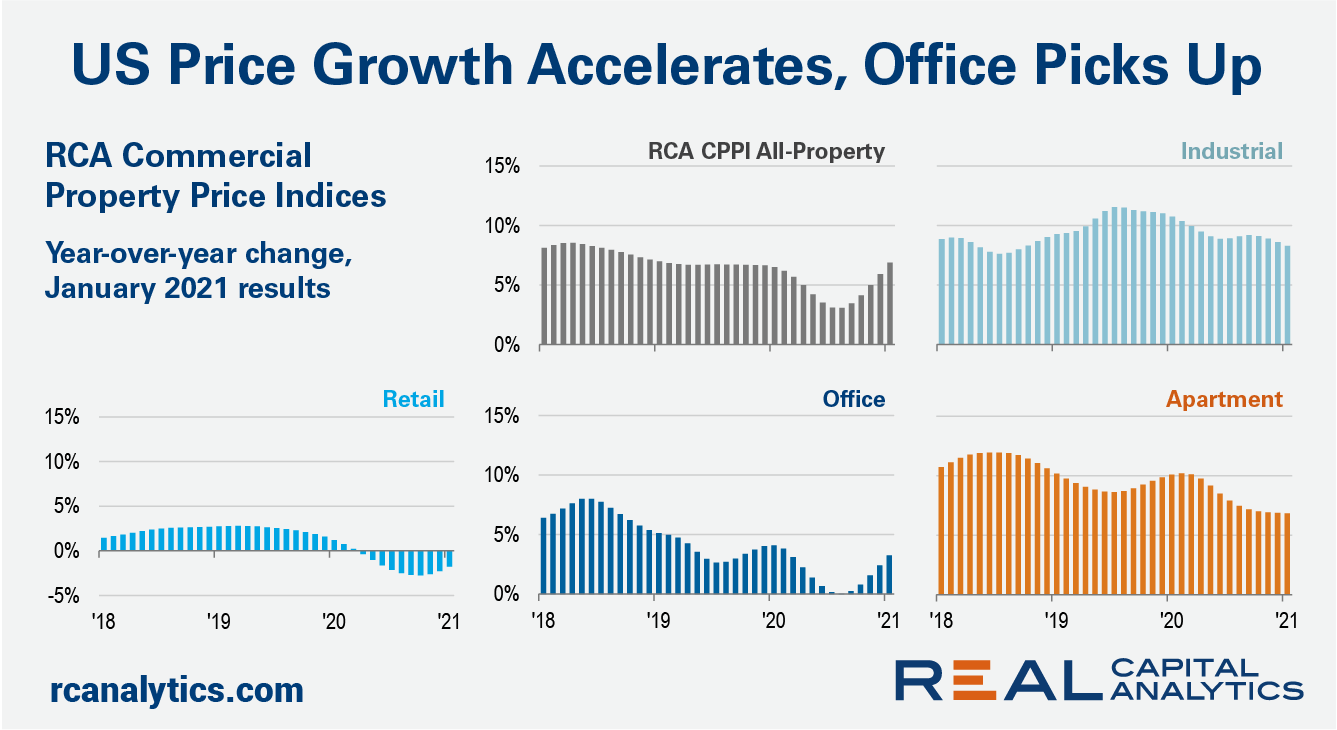

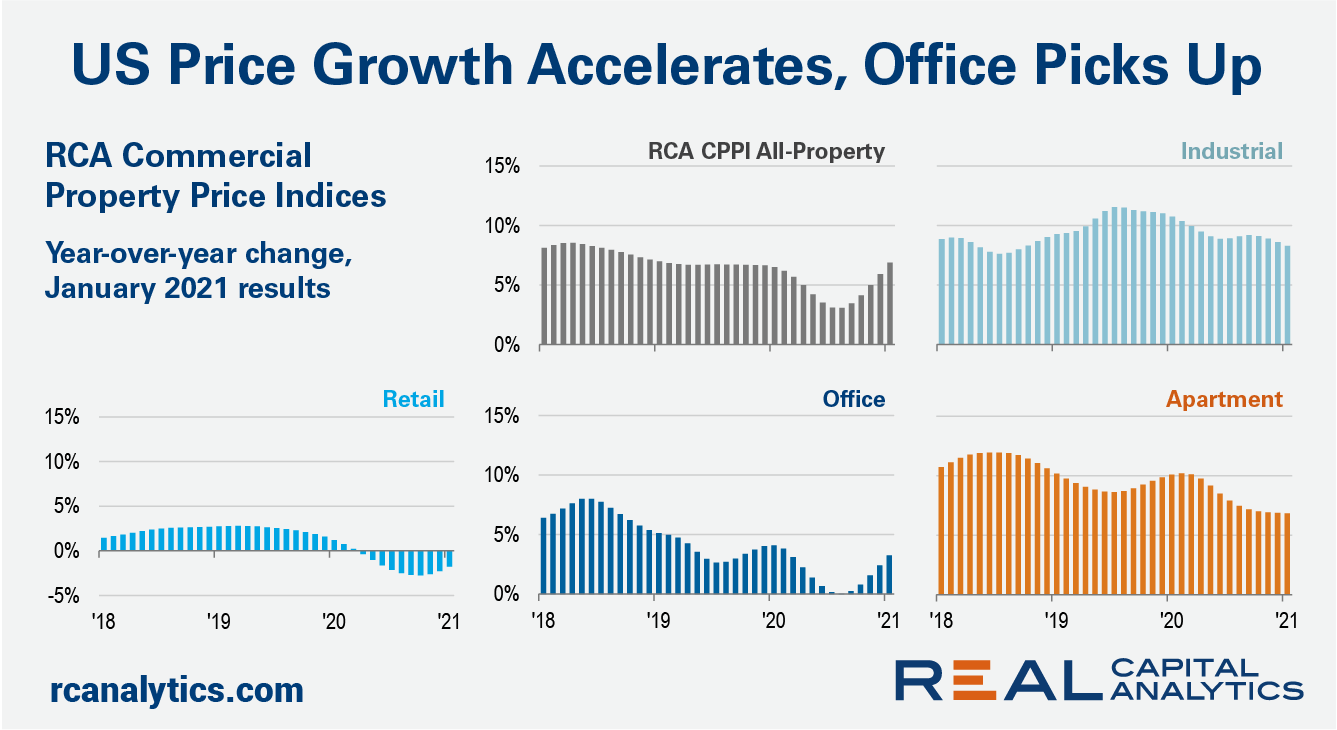

The pace of U.S. commercial property price growth accelerated in January, climbing back near the growth rates seen before Covid-19 struck, the latest RCA CPPI: US summary report shows. The US National All-Property Index rose 6.9% from a year ago and 1.2% from December.

The acceleration in price growth comes even as deal volume slumped again in January following December’s record haul, as shown in US Capital Trends, also released this week.

Office prices rebounded into the new year, up 3.3% from January 2020. As recently as August this index was posting no annual growth. Suburban offices drove the increase in January.

Prices in the industrial sector grew 8.3% annually, again taking the top spot among all the property types. Multifamily price growth registered at 6.8%, hovering around the 7% rate seen in recent months.

The retail sector again registered the worst annual price trends of the major property sectors, falling 1.8% from a year prior.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.