One year into the pandemic and clearly the current market downturn is not like the last one just over a decade ago. Commercial property prices have not been the adjustment mechanism for the disruptions from the pandemic — deal volume has suffered instead. A functioning debt market with far higher levels of liquidity than in the last crisis is a big part of the difference between these recessions.

Liquidity is not just a story about volume. To measure trends in liquidity in the equity portion of the capital stack, Real Capital Analytics publishes a composite scoring system looking at numerous indicators that can influence a market. Factors such as the unique number of buyers, the share of institutional capital, and other inputs paint a picture on one’s ability to achieve expected pricing in a market. Using one of those indicators pointed at the U.S. commercial mortgage market shows that liquidity has largely held up over the last year.

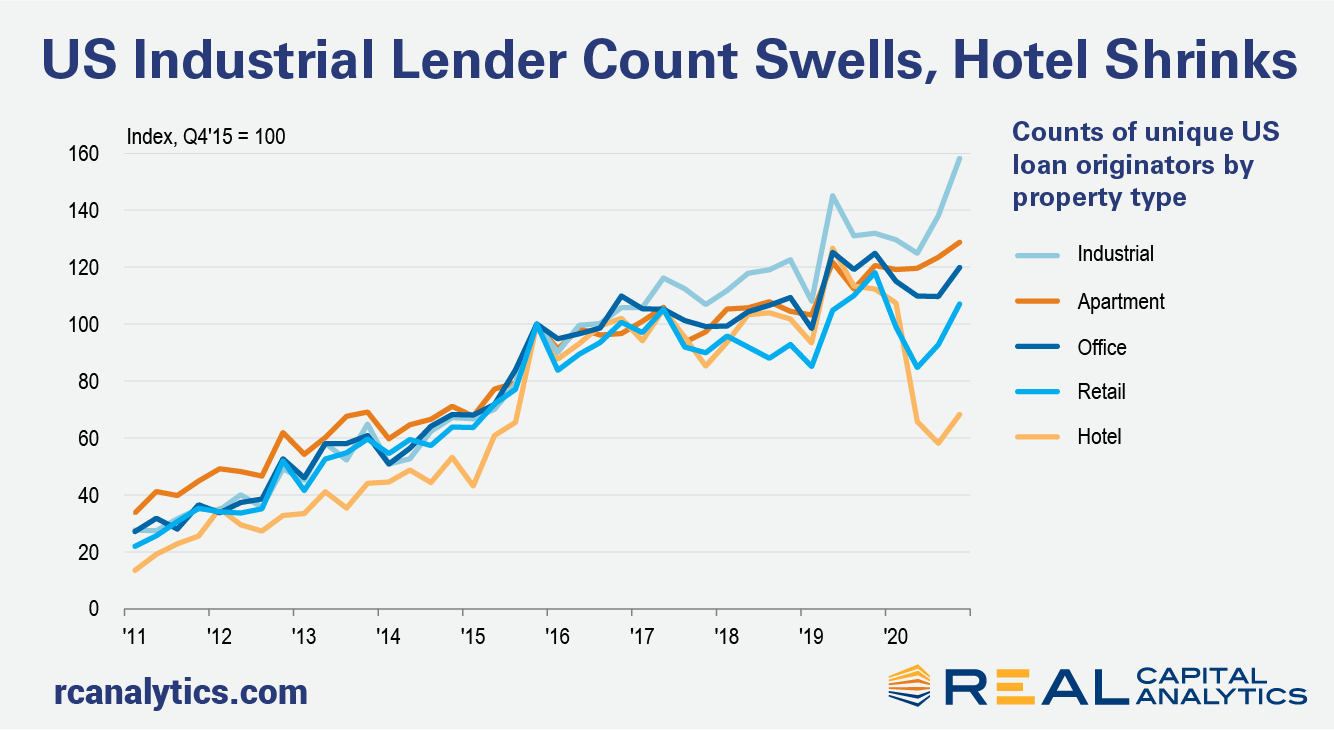

Counting the number of unique loan originators by property sector shows that competition in the lending markets grew steadily from 2011 to 2017. The last recession removed a number of participants from the market but in the recovery period the number of originators grew. More unique loan originators means more options for equity investors looking to acquire or refinance properties.

There was not much of a pullback in the number of active lenders throughout the pandemic. Aside from the hotel market which ended 2020 with 39% fewer unique loan originators than at the end of 2019, most property sectors posted only slight declines in market participation. The number of lenders active in the industrial market continued at about the same pace of growth seen since 2017, and the count at the end of 2020 was 20% higher than seen a year prior.

The challenge in the Global Financial Crisis was that lending dried up quickly in the face of a credit crunch. Cash-flowing assets could not be refinanced and owners were forced to sell at ruinous prices. This time around, without a significant contraction in the number of lenders for most property sectors, prices have fared much better.

In our US Capital Trends report to be published next week, we will show that the value of assets refinanced each quarter last year often exceeded the value of sales. While there remains a large pool of distressed debt out there to be resolved, the fact that lenders were able to step up and provide financing throughout the crisis seems to have blunted the worst-case fears of price declines on par with those of the last downturn.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.