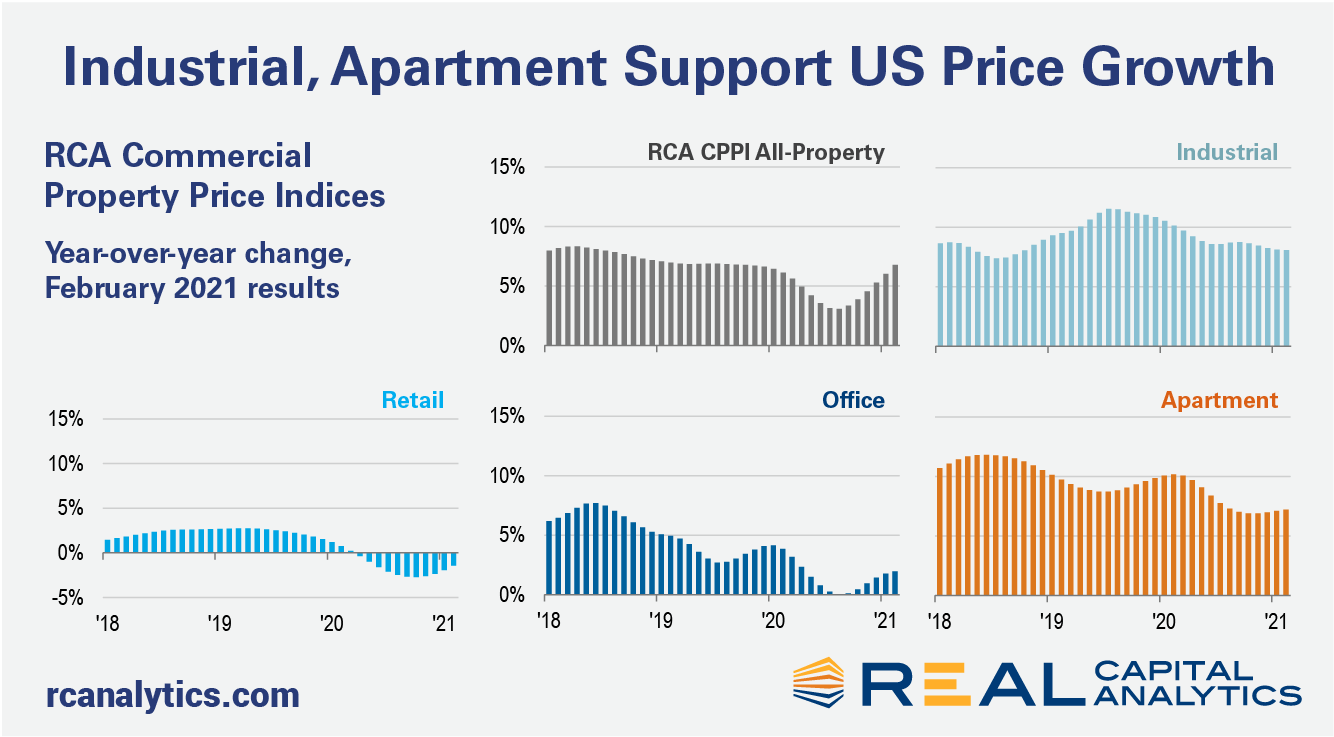

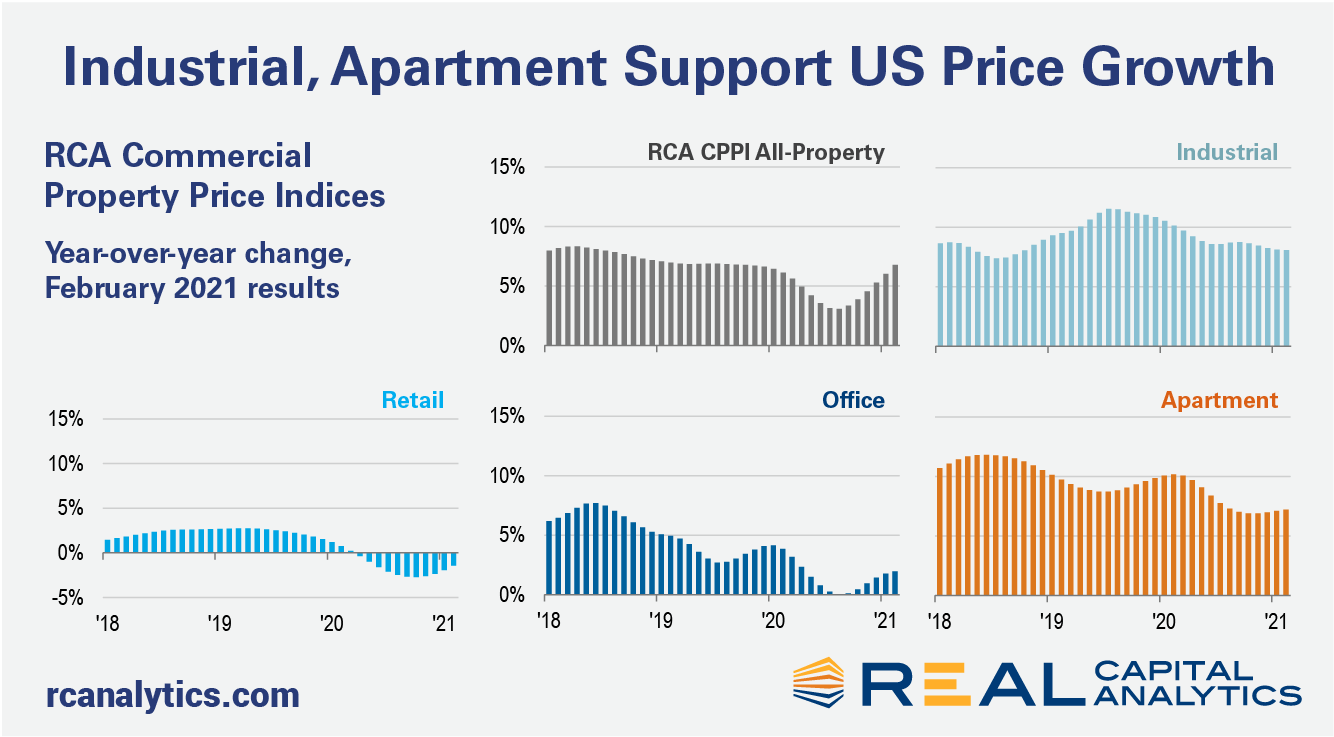

The annual pace of U.S. commercial property price growth reached 6.8% in February, a rate comparable to the months preceding the country’s initial coronavirus lockdowns, the latest RCA CPPI: US summary report shows. The US National All-Property Index rose 0.9% in February from January.

The office index increased 2.0% year-over-year in February. Prices in the office market have slowly crept back from the middle of last year when the index was flat, but are still only increasing at half the rate seen a year ago. Suburban office prices kept the office index afloat last month, gaining 2.2% year-over-year.

The retail sector was again the only major property type with declining prices, dropping 1.4% over the last year. Apartment prices rose 7.2%, posting annual growth similar to the pace seen in the last seven months.

Prices in the industrial sector rose the fastest in February, up 8.1% year-over-year. Investor interest in industrial property has jumped because of logistics demand and, more recently, demand for cold storage space.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.