New Extensions May Afford Hard-Hit Homeowners Opportunity to Find Financial Footing

Recent announcements of forbearance extension by the Federal Housing Finance Agency (FHFA) came on the heels of millions of forbearance plans that are about to expire at the end of March under the CARES Act. The new extensions allow an additional six months’ stay in forbearance, making borrowers eligible for a total of 18 months of temporary payment relief.

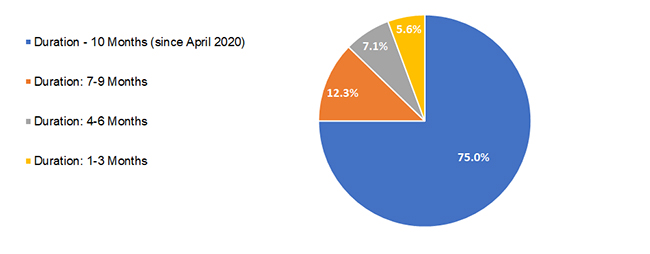

Figure 1: 3-in-4 Forbearances Near Expiration before FHFA’s New Extension Policy, January 2021

The latest loan performance data from CoreLogic reveals that 75% of the pandemic forbearance-loan pool consists of loans in forbearance since April (Figure 1). The percentage amounts to an estimated 2.1 million loans nearing expiration without the new extensions. Borrowers who are on a COVID-19 forbearance plan as of February 28, 2021, are eligible for the extensions. Given the eligibility requirement, it remains to be seen from incoming data how many borrowers who are not already in forbearance as of February 28 could also apply for forbearance as an insurance.

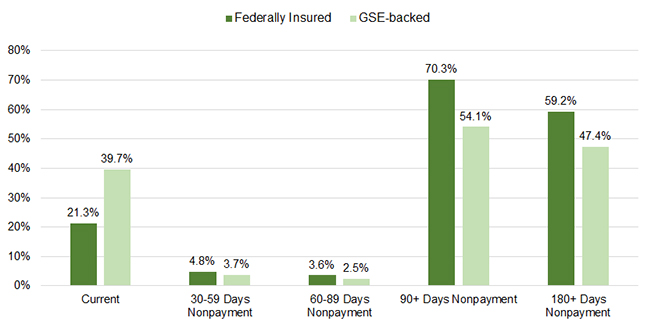

Figure 2: Payment Status of Active Forbearances, January 2021

Importantly, the extensions will provide many struggling borrowers who have not been able to keep up with their regular mortgage payments with continued payment relief, as well as adding time to regain their financial footing.

As shown in Figure 2, a large portion of forbearance plans in both federally insured and GSE-backed loan pools have been in nonpayment for an extended time. At the end of January 2021, nearly 60% of federally insured loans and close to one half (47.4%) of GSE-backed loans have not made a payment in the last six months (or since August 2020). Serious delinquency rates (only technically speaking, since loans in forbearance are not considered in default) are staggering, especially among federally insured loans: 70.3% of all federally insured forbearances are in 90+ days nonpayment, followed by 54.1% in the GSE-backed forbearance-loan pool.

It is expected that the extensions will also lead to a further build-up of missed payments by the time the forbearance ends. The severity of cumulating missed payments could put some homeowners at the risk of foreclosure and losing their homes – if resuming regular payment is no longer affordable even with a post-forbearance loan modification.

The coming months will be critical to a smooth post-forbearance resolution of forbearance plans. With more jobs coming back in the economy in the coming months, many borrowers are likely to find themselves in an improved job or financial situation which will allow them to start normal payment and exit forbearance through a repayment plan or loan modification.

According to IHS Markit’s latest economic forecast, the unemployment rate is projected to drop below 6% in Q2 and by Q3 – when a big wave of forbearance plans is expected to conclude under the current FHFA policy – down further to 5.5%. In addition to providing continued financial relief, the new extensions will buy time for many hard-hit homeowners as their jobs could soon come back in the ongoing recovery now that the worst of the pandemic is likely behind us. Meanwhile, as home prices are expected to continue steady climb through the spring and summer homebuying seasons, rising home equity could help borrowers in post-forbearance loan modifications and prevent foreclosure.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.