Share of Homes Selling at or Above List Price Reached New Highs in February 2021

Since the pandemic began over a year ago, a supply shortage of for-sale homes has fueled home price growth. The national CoreLogic Home Price Index posted double-digit year-over-year growth in February. In other words, home price growth has doubled since the time just before the pandemic. With mortgage rates near historical lows, some home buyers are willing—and newly able—to pay a premium to secure their dream home. As a result, more than half of homes were sold at or above list price in February 2021.

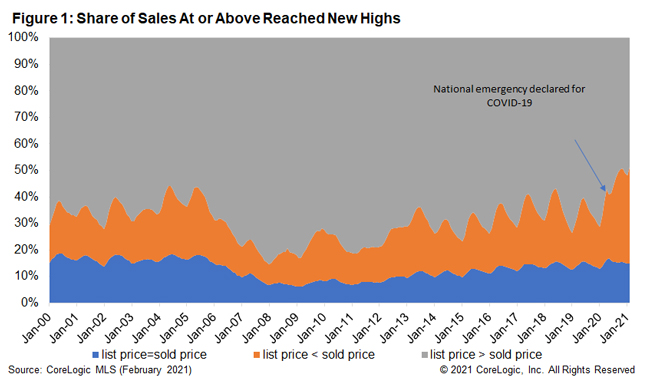

Figure 1**[1]** shows the share of homes that sold at a price above, equal to or below the list price. Starting from July 2020, the share of homes selling at or above list price (orange and blue areas in Figure 1) reached and exceeded the previous peak in June 2004. In February 2021, that share reached a new high of 51.4% of total sales – almost triple the level during the trough in January 2008, and more than 10 percentage points higher than March 2020 when pandemic began.

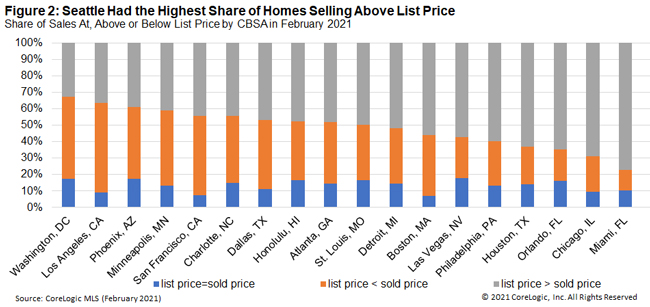

Still, housing markets are different across the nation, and sales and listing patterns vary geographically. Figure 2 shows the share of homes that sold at, above, or below their list prices in 20 metropolitan areas during February 2021. Seattle had the largest share of homes – 73.8% – that sold for at least the list price. Denver and Washington, D.C., followed with 71% and 67.5% selling for the list price or more, respectively. Miami had the lowest share –22.8% – of homes selling at or above the list price in February.

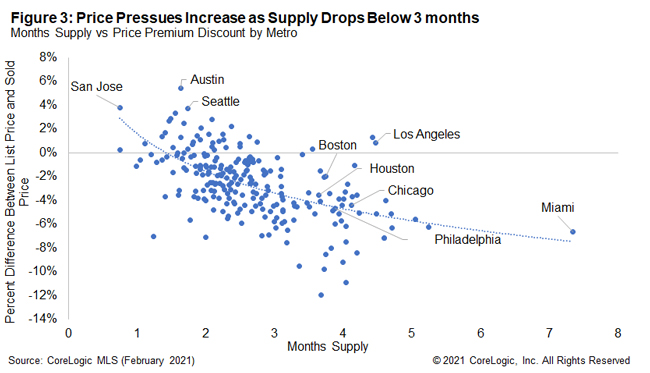

As the total supply of houses drops below three months’ worth, price pressures rapidly increase. Figure 3 shows the price premium or discount and months’ supply for over 200 metropolitan areas in February 2021.

In San Jose, where the supply has been thin, homebuyers paid 3.8% more than the asking price on average. On the other hand, in a market like Miami, where the months’ supply was relatively high, homebuyers were able to negotiate below asking prices, with average discounts of 6.6% in February.

With both for-sale inventory and mortgage rates at historically low levels, motivated home buyers are facing strong competition in this sellers’ market. Homes are sold fast with less room for negotiation.

The increase in COVID-19 vaccine availability and adoption could help release inventory and price pressure as more potential sellers feel safer to put their homes on the market.

[1] The U.S. statistics are based on data for 51 metropolitan areas. Each of these metros has at least 50% coverage since 2000. CoreLogic MLS data coverage usually increases over time, which might also contribute to inventory increases.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.