Lower Average Debt-to-Income and Loan-to-Value Ratios, Higher Credit Score in Q4 2020 Compared to Q4 2019

Three important factors in mortgage underwriting are debt-to-income (DTI) ratios, loan-to-value (LTV) ratios and credit scores. Over the course of the pandemic, we have seen a decrease in the average DTI and LTV as well as an increase in the average credit score of loan applicants. There are two possible reasons for this change: either the risk attributes of applicants have changed, or lenders’ credit underwriting standards have changed due to an uncertain economic outlook.

In comparing the last full quarter before the global pandemic struck (Q4 2019) with fourth quarter of 2020, we can determine the cause of these shifting trends.

Examining Debt-to-Income Ratios

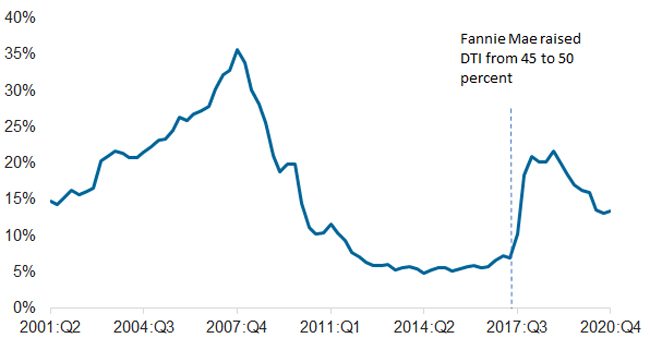

Of new conventional conforming home-purchase loans, the share with a DTI ratio above 45% rose sharply in 2017 after Fannie Mae accepted loans with higher DTIs, as shown in Figure 1. This share, holding steady between 5% to 7% from early 2012 up to Fannie Mae’s announcement, had reached its post-Great Recession peak of 21% in the fourth quarter of 2018 and started dropping in early 2019. It had shrunk to 13% in the fourth quarter of 2020.

At the same time, the average DTI ratio for new conventional conforming home-purchase loans dipped by one percentage point to 35% from the fourth quarter of 2019 to the fourth quarter of 2020. The decline in the average DTI and in the share of loans with a DTI ratio above 45% largely reflects the sharp decline in mortgage interest rates to record lows.

Figure 1: Share of Conforming Conventional Home-Purchase Loans with DTI Ratio Above 45 Percent

Examining Loan-to-Value Ratios

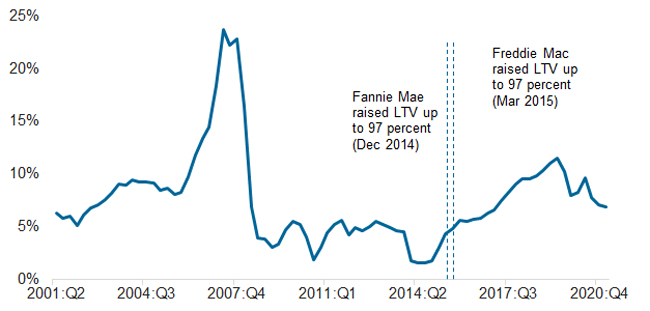

Similarly, Figure 2 shows that the share of new conventional conforming home-purchase loans with an LTV ratio above 95% started to rise in early 2015 following the government-sponsored enterprises’ (GSEs) announcement of higher maximum LTVs. The share was less than 2% in 2014 but rose gradually and reached 12% by the second quarter of 2019, the highest since 2008. By the fourth quarter of 2020, the share of high LTV loans fell to 7%. The average LTV ratio for home-purchase loans in the fourth quarter of 2020 was 82%, a decline of one percentage point since the same quarter of 2019.

Figure 2: Share of Conforming Conventional Home-Purchase Loans with LTV Ratio Above 95 Percent

Examining Credit Scores

Though both DTI and LTV standards have relaxed in the past few years, there has been no relaxation in credit score standards. During the fourth quarter of 2020, the average credit score for homebuyers with conventional conforming home-purchase loans rose by four points as compared to the same quarter in 2019.

In fact, the average credit score was much higher than the pre-housing crisis level. In 2001, a homebuyer’s average credit score was 705, but this rose dramatically during the Great Recession in 2008, and by the fourth quarter of 2020, it had reached 762.

Comparing Credit-Risk Attributes for Mortgage Originations with Mortgage Applications

Comparing risk attributes of mortgage originations with mortgage applications helps to isolate whether the change in credit risk trend is due to the change in applicant’s characteristics or due to the change in lenders’ underwriting standards.

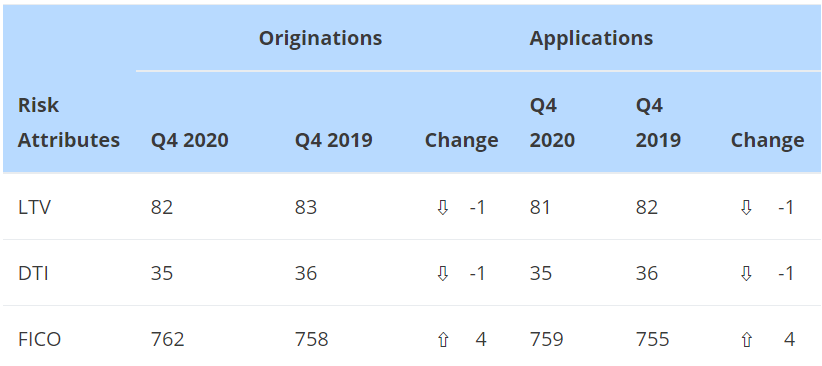

Table 1: Comparing Averages of Credit-Risk Attributes for Mortgage Originations and Applications for Conforming Conventional Home-Purchase Loans

The loan application data shows that the risk attributes of applicants changed, becoming less risky in the fourth quarter of 2020 compared to same quarter in 2019 (Table 1). The change in averages of applicants’ risk attributes is comparable to the change in averages of loan originations risk attributes. The average credit score rose by 4 points for both applications and originations, and average ratios of LTV and DTI dropped by one percentage point for both applications and originations.

The similar changes in averages of risk-attributes between applications and originations shows that the changes in LTV, DTI, and credit scores of loan originations over the past year are the result of applicants’ risk decreasing.

The averages of risk attributes may have changed as some of the prospective homebuyers in early 2020 who worked in industries that were hard hit by the pandemic recession and unable to buy during 2020 may have had lower average credit scores and/or less financial wealth. Additionally, lower rates during the pandemic recession helped to reduce average DTI among applicants. Thus, the credit risk attributes of applicants did change due to the pandemic and became “less risky” in the fourth quarter of 2020.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.