As the road to recovery continues, we looked at a leading indicator of returning to normal behavior: fitness spending and gym attendance. We also checked in on home fitness leader Peloton given its pandemic-driven spotlight.

Note that parts of this analysis calculate growth relative to two years prior – written throughout as “Yo2Y” – in order to benchmark current performance against “normal” consumer levels.

Key Takeaways

Mountain Climbers

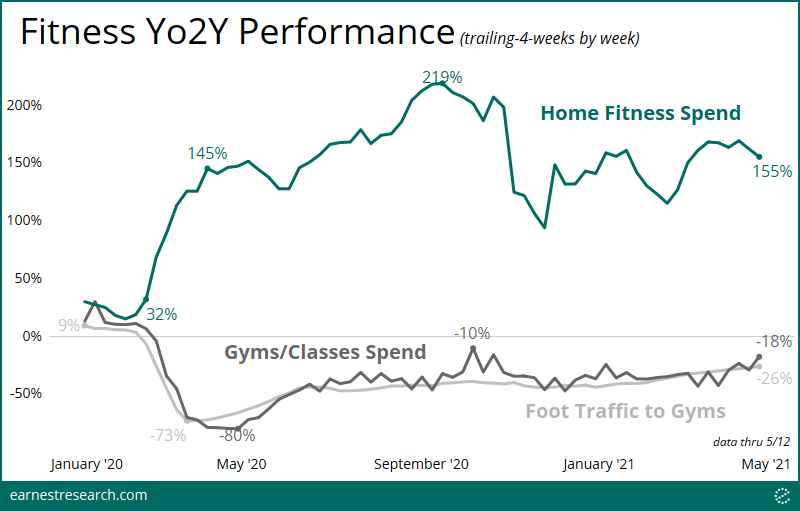

It may not be surprising to see the explosive growth of the home fitness category last year, as people hunkered down at home and put a pause on in-person gym memberships. Home fitness sales climbed steadily beginning with March 2020 stay-at-home orders, peaking to over 200% Yo2Y growth in September of last year. Sales then dropped off during the 2020 holiday period and rebounded again in January 2021, where they have since remained elevated at around 150% vs. two years prior.

Meanwhile, spending at gyms and exercise classes charts something of a more gradual jog to normalcy, peaking at -10% spend in October last year, giving back some of the gains, before climbing to -18% Yo2Y in May of this year. Foot Traffic, which tracks actual gym attendance rather than intention to get fit, has seen a more gradual path, climbing to -26% Yo2Y most recently.

Share Shifts

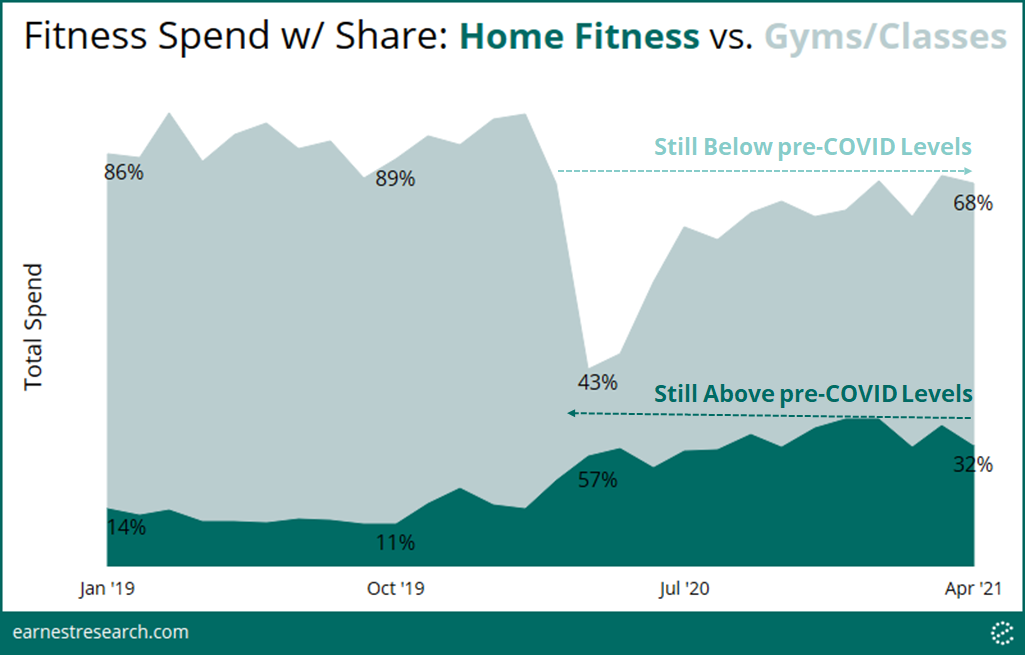

Importantly, however, spending at gyms and exercise classes are still below pre-COVID levels. The COVID-driven spike in home fitness spending hasn’t let off either, maintaining its post-COVID elevated levels through April 2021.

With traditional gyms deflated and home fitness spend inflated, the share of the fitness market has now materially changed, with home fitness spend at 32% and gyms/exercise spend at 68% as of April ‘21, notably very different than their pre-COVID share of ~10% and ~90%, respectively.

(Un)Vaccinated Gyms

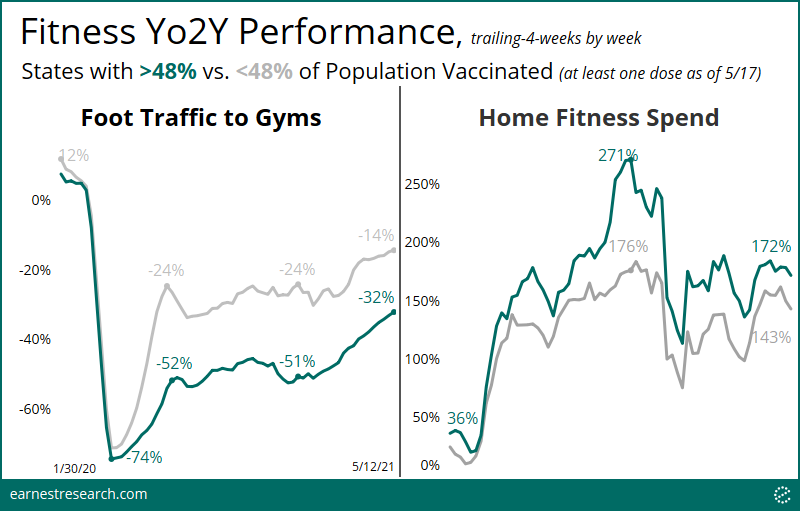

Following the trend found in our recent analysis of the The (Un)Vaccinated Consumer, gym visitation for less-vaccinated states is trending higher than more-vaccinated states by 18 points; albeit this gap has narrowed from the ~30 points gap it had last year.

Not too surprisingly, states with a greater number of COVID cases early on now see higher vaccination rates, driving the inverse relationship with home fitness spend, which is elevated in these states at 28 points of outperformance—albeit down from a peak delta of nearly 100 points.

Peloton, Still Spinning

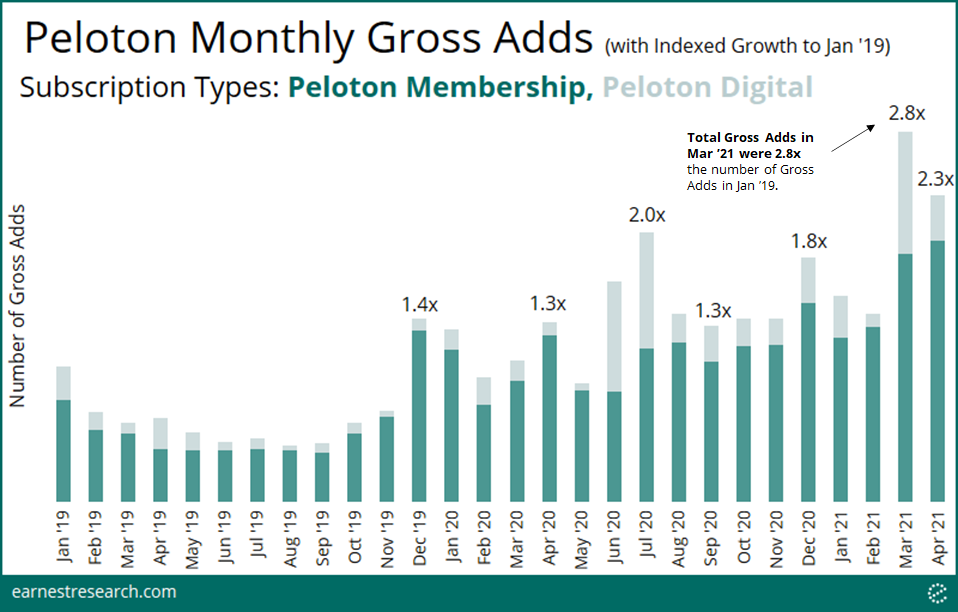

With home fitness in the post-COVID spotlight, we looked at market leader Peloton over the past year.

Indeed, monthly gross adds onto the home fitness platform continue to climb. While gross adds began to increase at the end of 2019, reaching 1.4x the levels seen in Jan ‘19, the summer of ‘20 saw this indexed growth double, then slow a bit in the fall, only to return to 2x growth by year-end. Further, aided by the third stimulus payment, March ‘21 gross adds supercharged again to almost 3x growth, letting up only slightly in April.

*Peloton Membership refers to their Connected Fitness subscription type, which requires a Peloton equipment purchase; Peloton Digital refers to their digital app, which provides access to Peloton’s digital library.

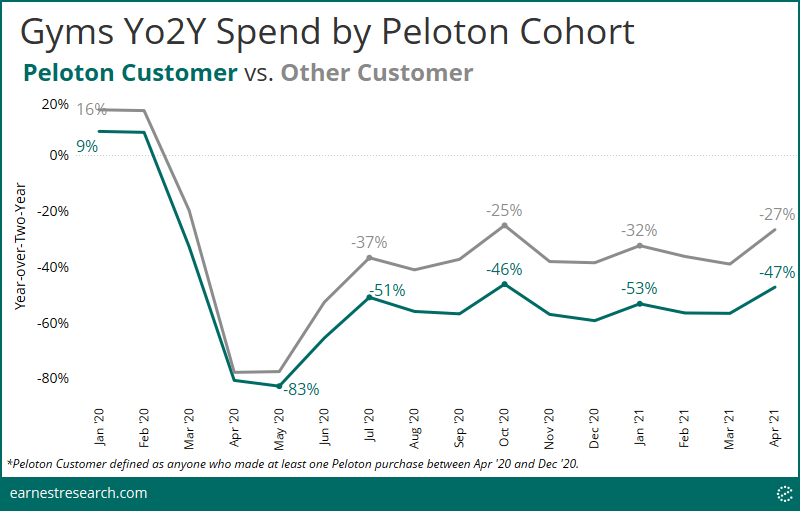

Do Peloton customers also go to the gym? Increasingly less so. But they spend more on Athleisure and Home Furnishing.

It’s perhaps not surprising that Peloton members resist going back to the gym. After all, that is the value proposition of the at home fitness market. The wide and steady gap of roughly 20 points of underperformance is interesting to monitor.

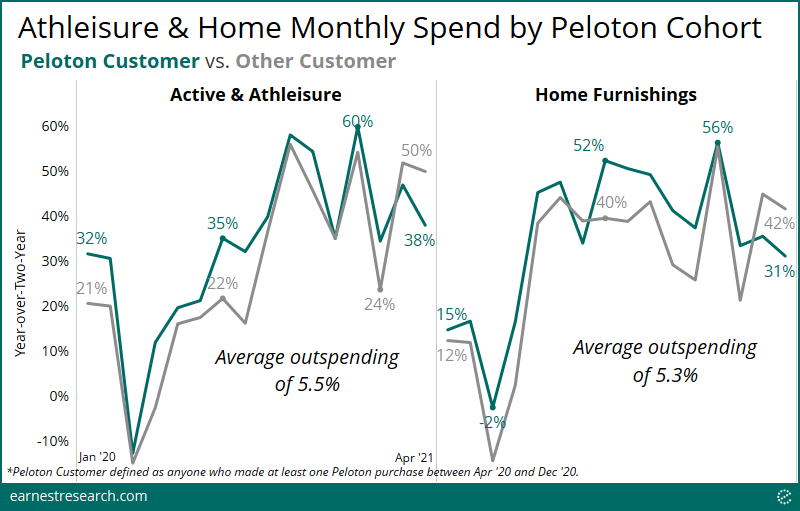

While Peloton enthusiasts may not be leaving their homes to workout, they still want to look good while sweating and they invest in their surroundings, as evidenced by Peloton members outspending their peers in the Athleisure and Home Furnishing categories.

Peloton members have outspent their non-member counterparts in both categories by roughly 5 points on average, since Jan ‘20. Almost every month saw members outspend non-members, save for the most recent month of April ‘21.

No wonder the two industries teamed up this past summer.

To learn more about the data behind this article and what Earnest Research has to offer, visit https://www.earnestresearch.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.