Jumbo-conforming mortgage rate spread widened during the pandemic

Low interest rates during the pandemic didn’t favor homebuyers with large-balance mortgage loans the same way as it did other homebuyers. While the mortgage rate dropped to a record low in 2020, the jumbo-conforming mortgage rate spread widened. In other words, jumbo loans were relatively more expensive than conforming loans.

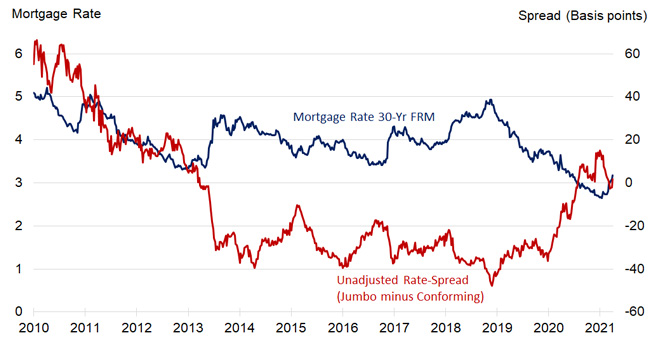

Figure 1 illustrates a 12-year trend of the 30-year fixed mortgage rate (the blue curve) and the unadjusted rate spread between jumbo loans and conforming loans (the red curve). The unadjusted rate spread is simply the difference between the mortgage interest rate of jumbo loans and conforming loans, without controlling for credit risk factors, upfront fees, or points. Before 2013, mortgage rates for jumbo loans were higher than for conforming loans; this is shown by the rate-spread being greater than zero. When the unadjusted rate spread drops below zero, this indicates that jumbo loans have a lower contract rate; if the unadjusted rate spread moves above zero, this indicates that, conversely, conforming loans are cheaper.

Figure 1: Weekly Mortgage Rate versus Jumbo-Conforming Spread

Correlation Coefficient: -0.72 (April 2013 – March 2021)

Movement in interest rates alone may help explain some of the variation in the jumbo-conforming spread, especially since 2013. The figure shows that the mortgage rate and the jumbo-conforming rate spread are inversely correlated. For example, as the mortgage rate dropped during the first eight months of 2019, the spread went up.

The increase in the spread could have resulted from a series of record low mortgage rates during the pandemic which led to a jump in refinance application volume. And because of a limited secondary market for jumbo loans and insufficient staffing at many lending companies, bottlenecks in jumbo-loan production were reflected in a rise of the spread. However, as the interest rate started to inch up in 2021, the unadjusted spread gap has narrowed slightly.

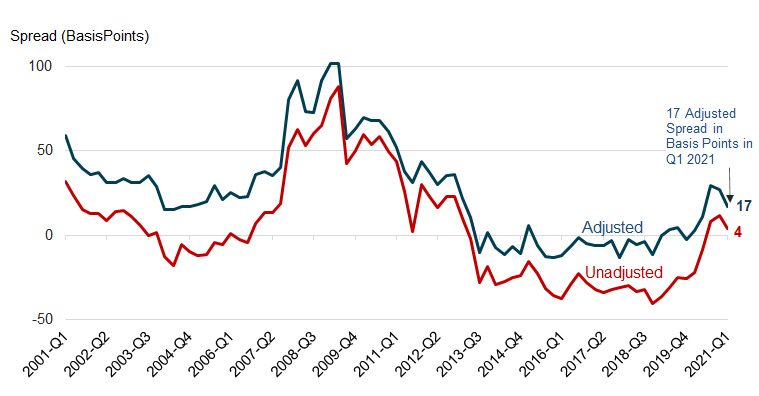

The jumbo-conforming spread may have been influenced by the lower credit risk attributes of jumbo loan borrowers and risk-based pricing and differences in scale economies and property location. Figure 2 plots the adjusted jumbo-conforming spread after controlling for these attributes. The overall pattern of adjusted spread followed the pattern of unadjusted spread.****

Figure 2: Adjusted Quarterly Jumbo-Conforming Spread Estimates, 2001 Q1-2021 Q1 (Average 2013 – 2019 was -5 Basis Points)

(A Negative Spread Means Jumbo is Less Expensive)

The adjusted estimates show that the spread went up from 4 basis points (with no adjustments for differences in attributes as shown in Figure 1) to 17 basis points for the adjusted estimate in the first quarter of 2021. The adjusted spread widened by 14 basis points from the first quarter of 2020 to the first quarter of 2021 but narrowed from the fourth quarter of 2020 by 10 basis points. The third quarter of 2020’s mortgage rate spread was the highest since the first quarter of 2013. The refinance boom resulting from record low mortgage rates and lenders’ increased caution in the jumbo market because of economic uncertainty are likely behind the rise in the spread during the pandemic.

In sum, the close tie between the adjusted spread and unadjusted spread supports that jumbo loans, even after controlling for a variety of attributes, were more expensive than conforming loans.

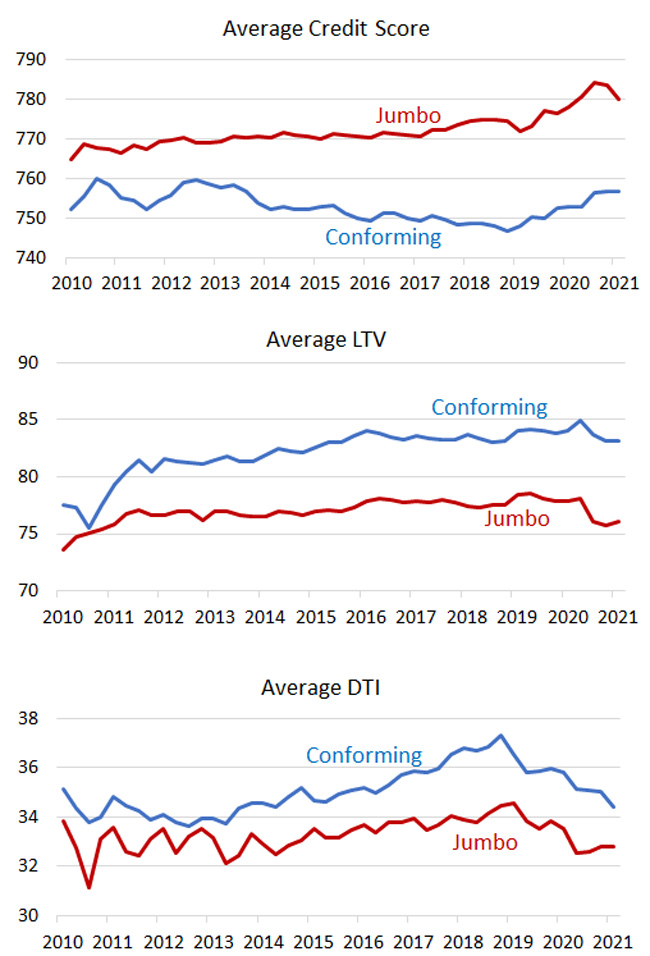

In general, today’s jumbo loans have a higher credit underwriting standard than conforming loans (Figure 3). Nearly all jumbo loans are fully documented and made to prime borrowers, lowering credit risk across the two dimensions. In comparing jumbo and conforming loans originated in 2021, the average credit score for a jumbo loan was 23 points higher than a conforming loan’s average credit score. Jumbo loans had a lower loan-to-value ratio by 7 percentage points and lower debt-to-income ratio by 2 percentage points.

Figure 3: Average Credit Risk Variables for Homebuyers with 30-Year Fixed Conventional Mortgages and Jumbo Mortgages

Despite the higher underwriting standard for jumbo loans and risk-based pricing, the spread was higher during the pandemic as lenders curbed their appetite for jumbo loans. With the market uncertainty and increased risk resulting from the pandemic, and a surge in refinance applications, some lenders even suspended offering jumbo loans. However, as the interest rate inched up in 2021 the spread narrowed slightly. If further increases in long-term interest rates occur in the coming year, then the jumbo-conforming spread is likely to narrow further, and jumbo rates may once again dip below conforming rates.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.