Torrid ($CURV)- the popular plus-size women’s clothing brand joined the New York Stock Exchange on July 1st, with an opening market valuation of $2.3B dollars. Earnest compared Torrid shoppers with those of major competitors like Lane Bryant and ELOQUII for a comprehensive view of the brand.

Key Takeaways

The Plus-Size Market

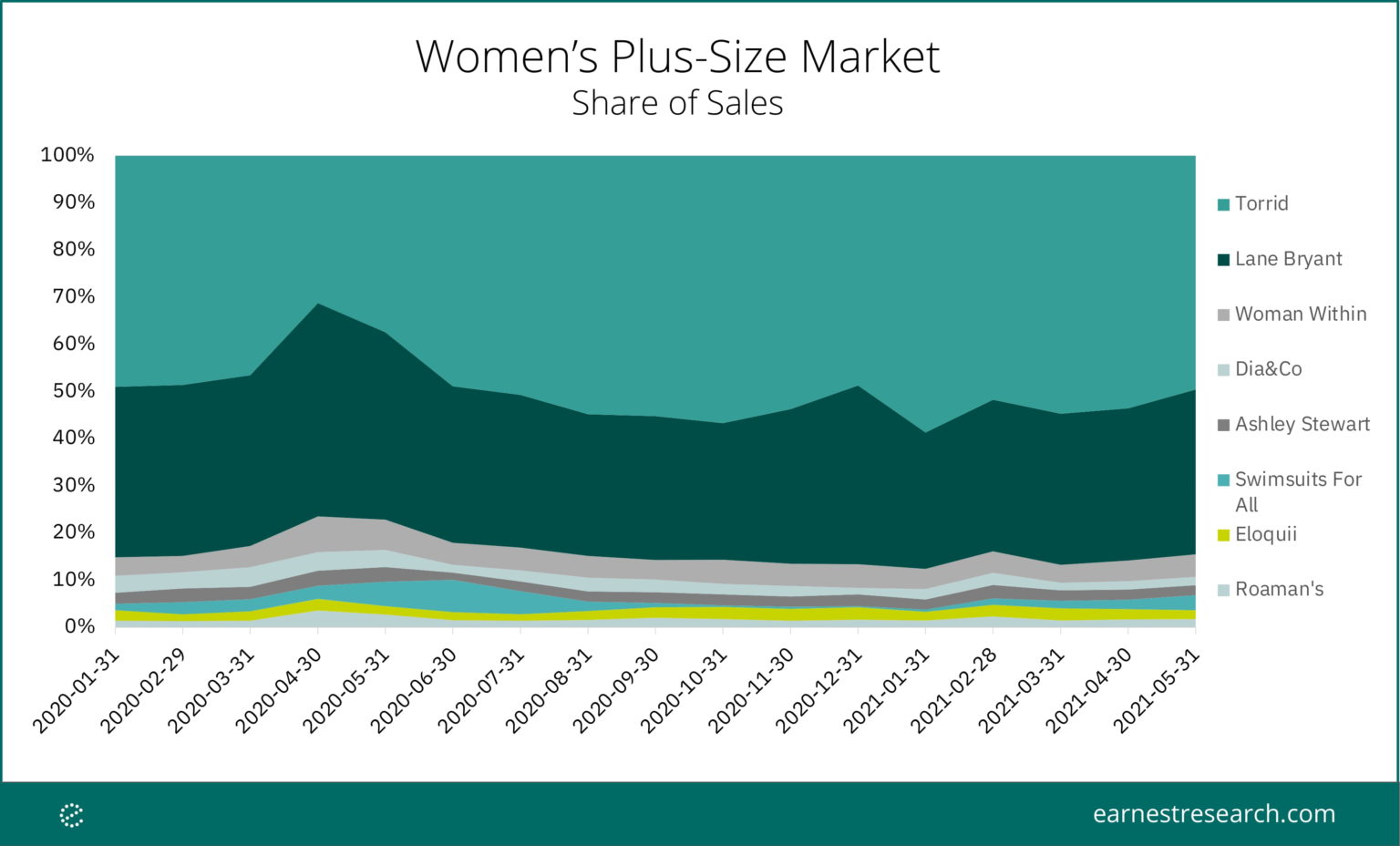

According to Torrid CEO, Liz Munoz, part of Torrid’s success (and its secret sauce), lies in its omnichannel approach. Torrid currently has around 600 physical stores, but attributes 70% of its sales to online purchases. According to Earnest data, Torrid held 50% of the plus-size women’s market in share of total sales (in-store and online) and 45% of the share of online sales against competitors like Lane Bryant and Woman Within in May.

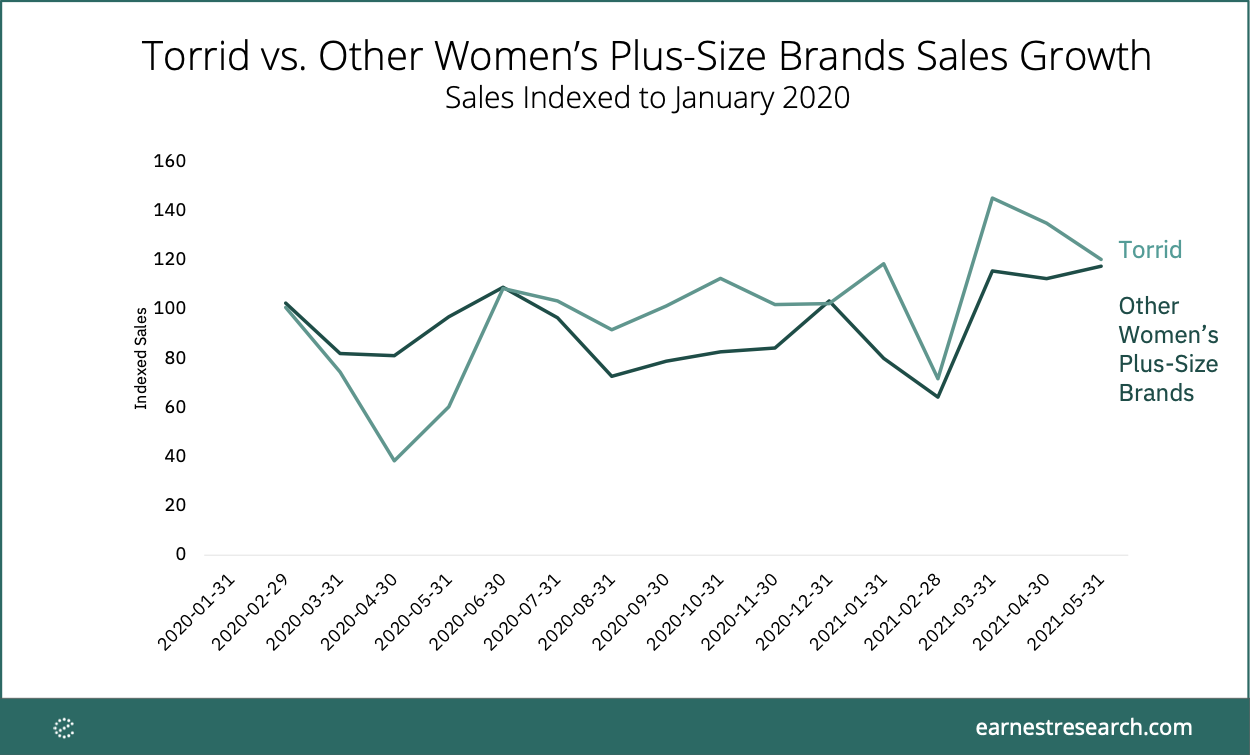

Torrid has been around since the days of Hot Topic (it branched off in 2015) and outperformed competitors like Lane Bryant and Dia & Co since June 2020, with the exceptions of ELOQUII, Woman Within, and Roaman’s, which saw absolute sales grow above 2019 levels in April and May.

Other women’s plus-size brands include Dia & Co, Ashley Stewart, Eloquii, Roaman’s, Swimsuits for All, and Woman Within.

Getting to Know the Torrid Shopper

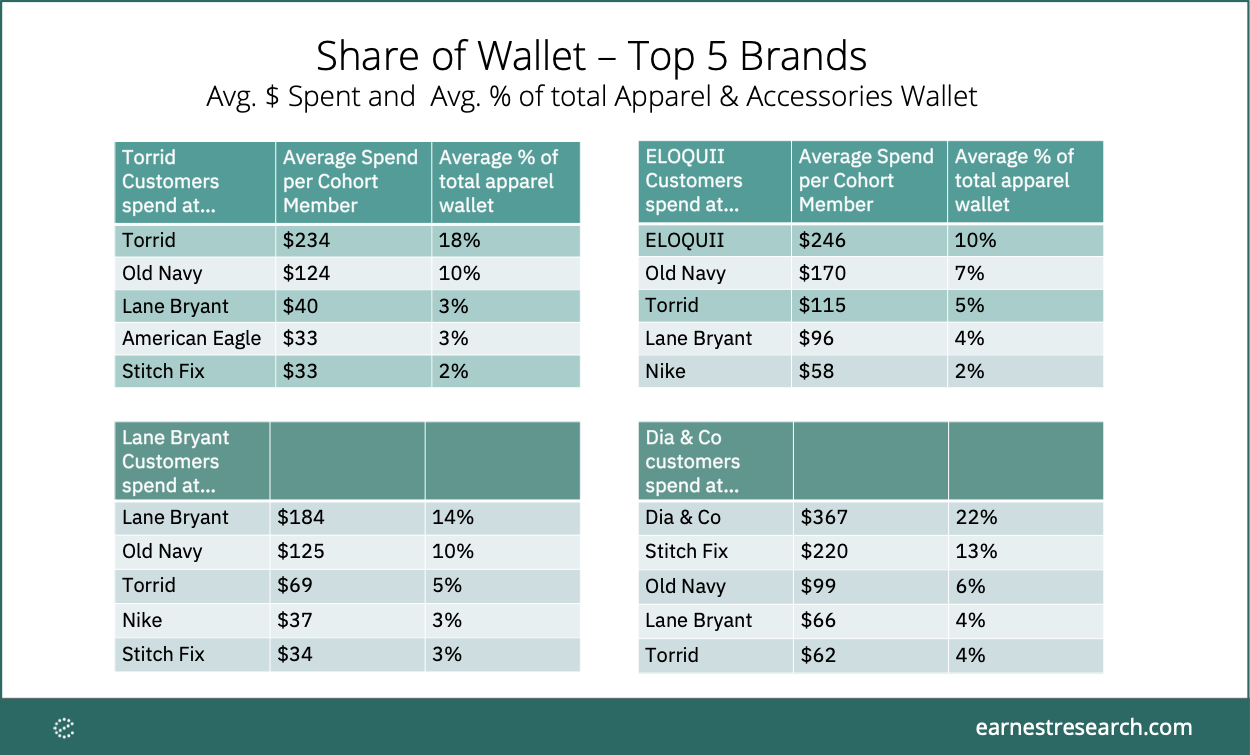

In order to paint a fuller picture of the Torrid shopper, Earnest analyzed the share of customer wallet – or how much each brand’s customers spent across a category – for Torrid and several of its competitors. Torrid customers spent 18% of their total Apparel and Accessories wallet at Torrid from April 2020 to March 2021, while Lane Bryant shoppers spent 14% of their apparel wallet at Lane Bryant. The ecommerce brand Dia & Co led the group, capturing 22% of their customer’s apparel wallet.

Totals will not add up to 100 as only the top 5 brands are shown.

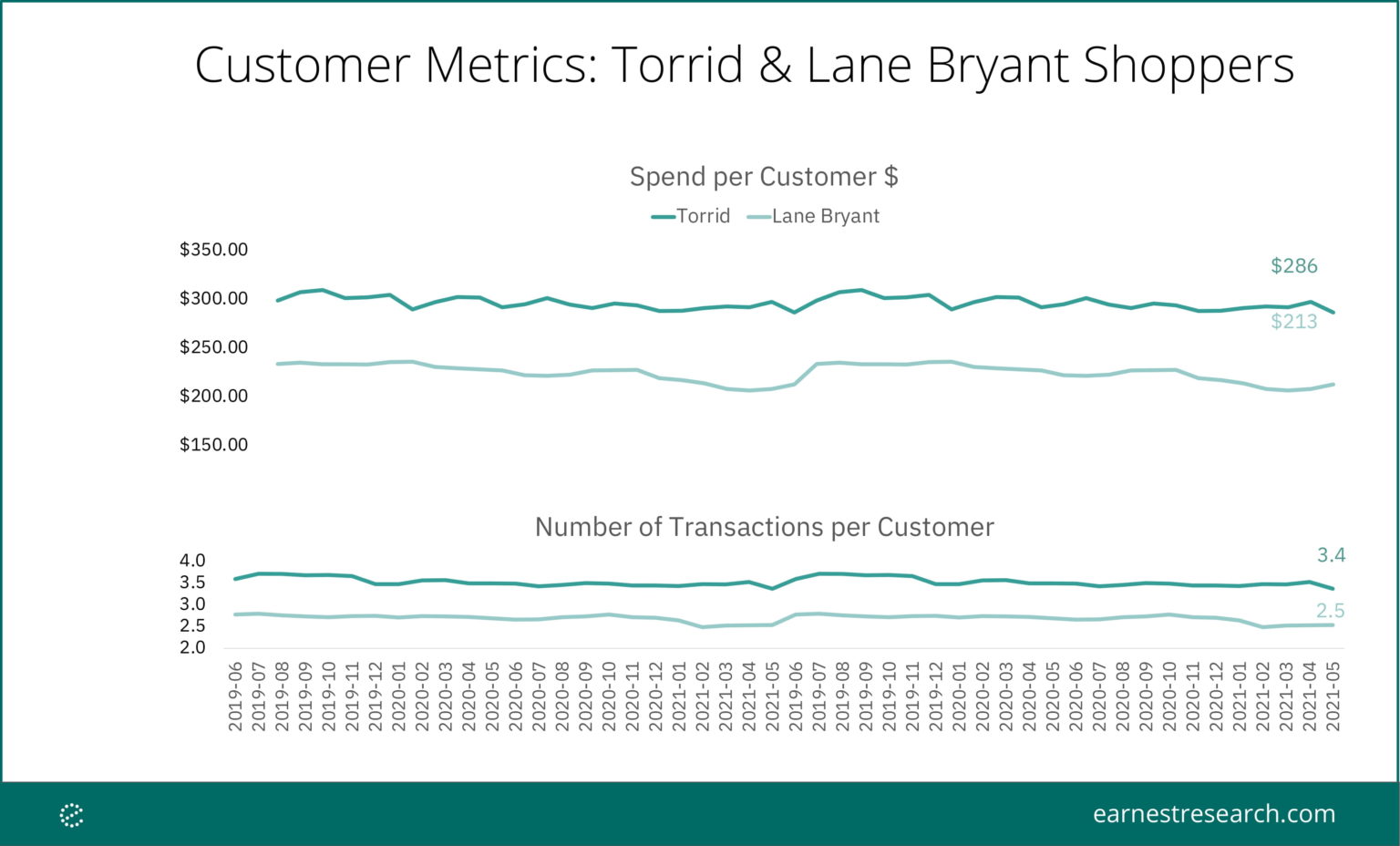

It’s perhaps not surprising that the two most popular plus-size brands – Lane Bryant and Torrid – share a sizable customer base. Earnest data shows that 25% of Lane Bryant customers shopped at Torrid and 19% of Torrid customers shopped at Lane Bryant in May 2021 on a 12-month trailing basis, but those customers spent more and shopped more often at Torrid. Customers who shopped at both brands spent $286 at Torrid on average in May 2021 and transacted 3.4 times that month, compared to $213 spent at Lane Bryant and 2.5 transactions.

Metrics are calculated for customers who shopped at both Lane Bryant and Torrid at least once in the past 12 months.

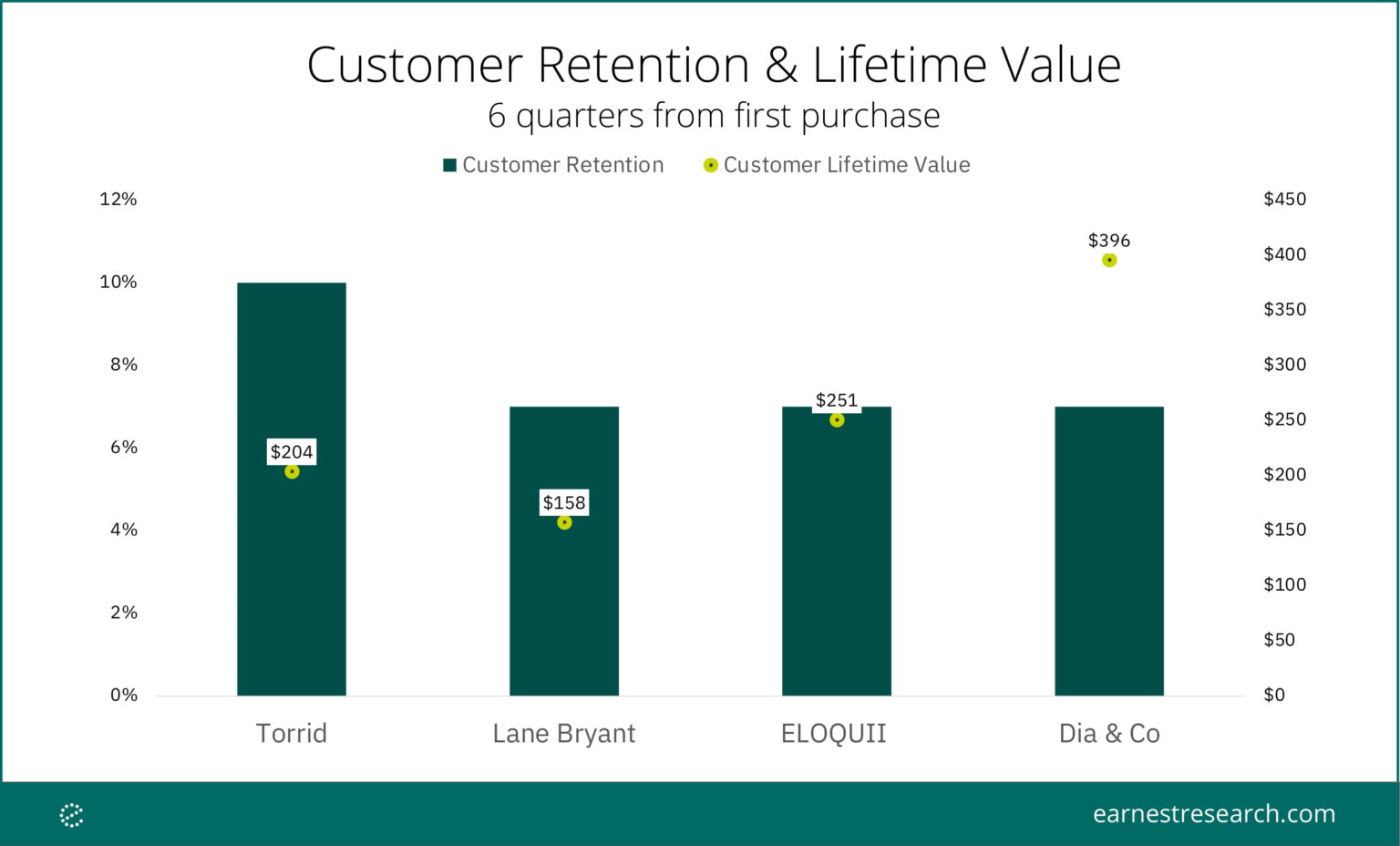

Perhaps most crucial to Torrid and any retailer is how long they are able to retain their customers. Looking at the 2019 cohort of customers, Torrid retained almost 11% of these customers 6 quarters later, while Lane Bryant, ELOQUII, and Dia & Co retained about 7% in the same time period.

The above chart shows customer retention and lifetime value for the 2019 cohort – or customers who made their first purchase in 2019.

There is one category where Torrid does not lead its competition – Customer Lifetime Value. Looking at the same 2019 cohort, Torrid customers spent $204, compared to $396 at Dia & Co and $251 at ELOQUII one and a half years after making their first purchase. As more retailers and brands embrace inclusive sizing, time will tell if Torrid will remain competitive in a growing market.

To learn more about the data behind this article and what Earnest Research has to offer, visit https://www.earnestresearch.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.