Nordstrom recently announced that it was taking a stake in four brands owned by UK retailer ASOS: Topshop, Topman, Miss Selfridge, and HIIT. As part of the agreement, Nordstrom will be the exclusive North American retailer for Topshop and Topman, making it the only brick-and-mortar outlet for these brands. Additionally, shoppers will be able to pick up online Asos purchases at Nordstrom stores. In today’s Insight Flash, we look at US sales of these brands and whether the relationship makes strategic sense, focusing on cross-shop and overlapping demographics.

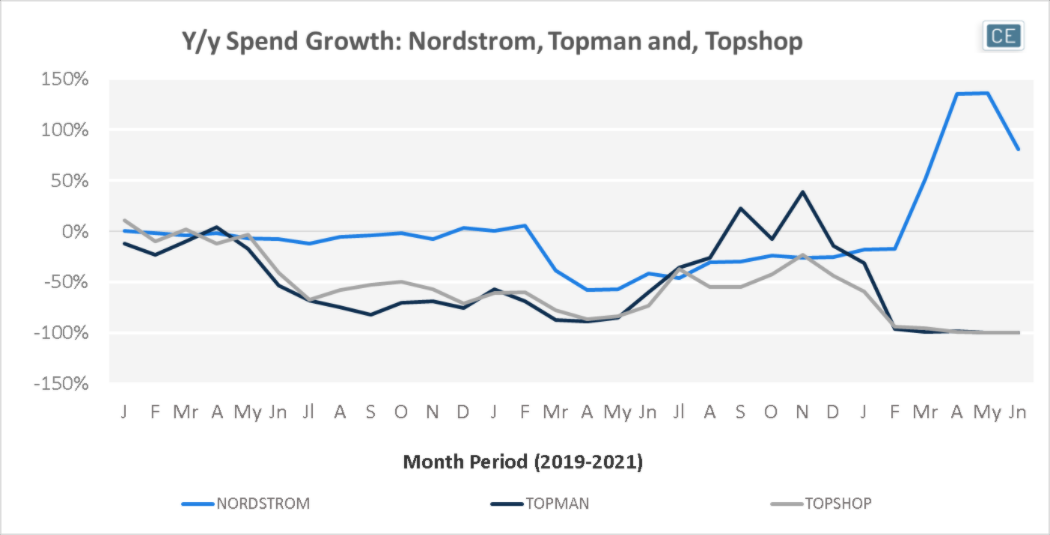

The Topshop brands have moved in and out of the US DTC market over the past few years, although availability through Nordstrom has persisted. The brand made a big push for brick-and-mortar US stores in 2014, but this only lasted a few years and the company announced in May 2019 it was closing its US stores. Topshop’s parent Arcadia Group entered bankruptcy administration in November 2020, with Asos purchasing its brands in February 2021 and beginning to sell them through its site.

Brand Sales

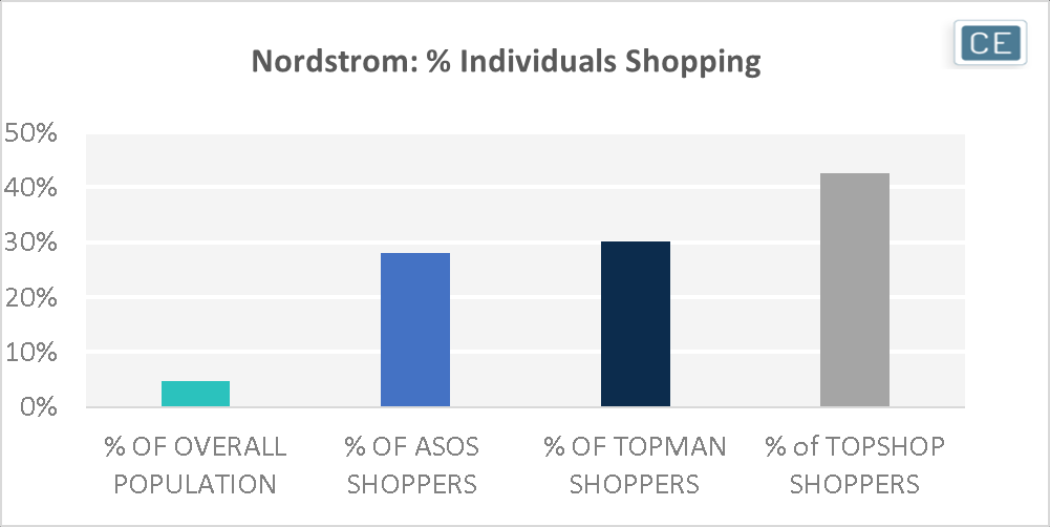

Cross-shop analysis emphasizes the benefits of partnerships. Although less than 5% of the overall US population has made a purchase at Nordstrom in the last year, 28% of Asos shoppers have, 30% of Topman direct shoppers have, and a substantial 43% of Topshop direct shoppers have. These numbers are especially relevant for Topshop and Topman as they do not include Nordstrom shoppers purchasing the brands from Nordstrom itself, but only those shopping the sites directly. With so many of Asos, Topman, and Topshop shoppers so naturally inclined to shop at Nordstrom to begin with, stronger relationships with all of these brands present a large opportunity to bring an even larger segment of their customers into Nordstrom stores more often, and for those picking up Asos purchases to add impulse Nordstrom items to their basket when in the stores.

Cross-Shop

Note: Among those who shopped listed brand as a direct retailer in the 364 days ending 7/4/2021, percent who also shopped Nordstrom

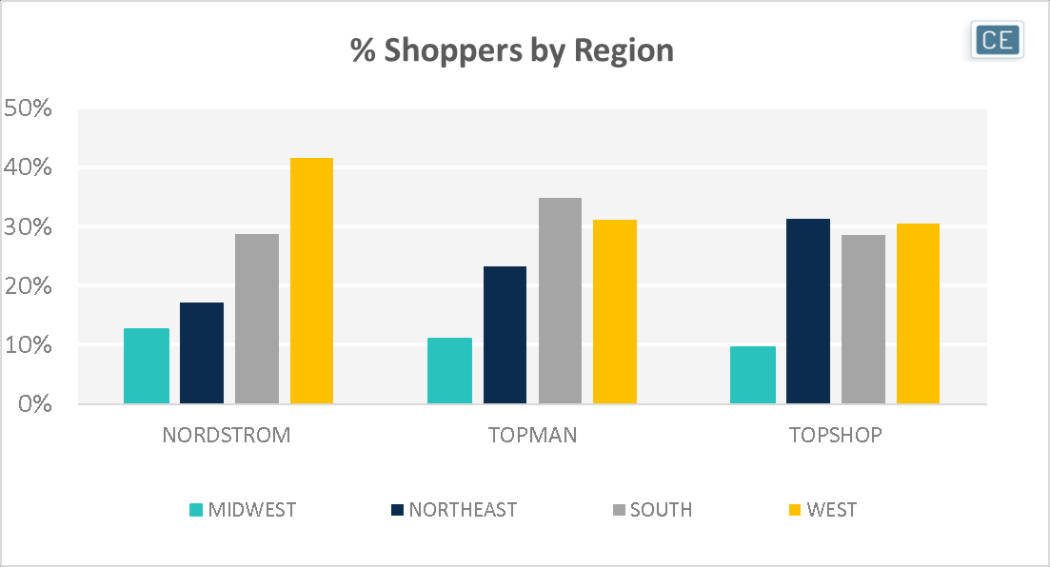

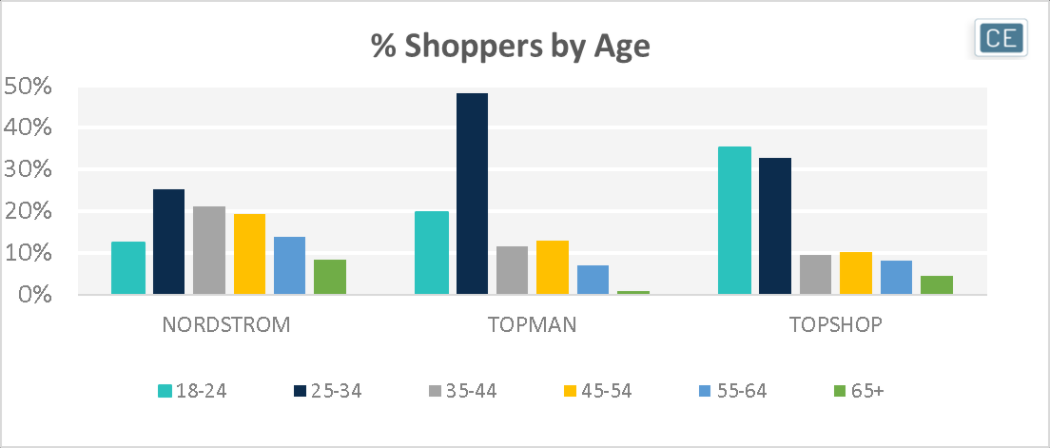

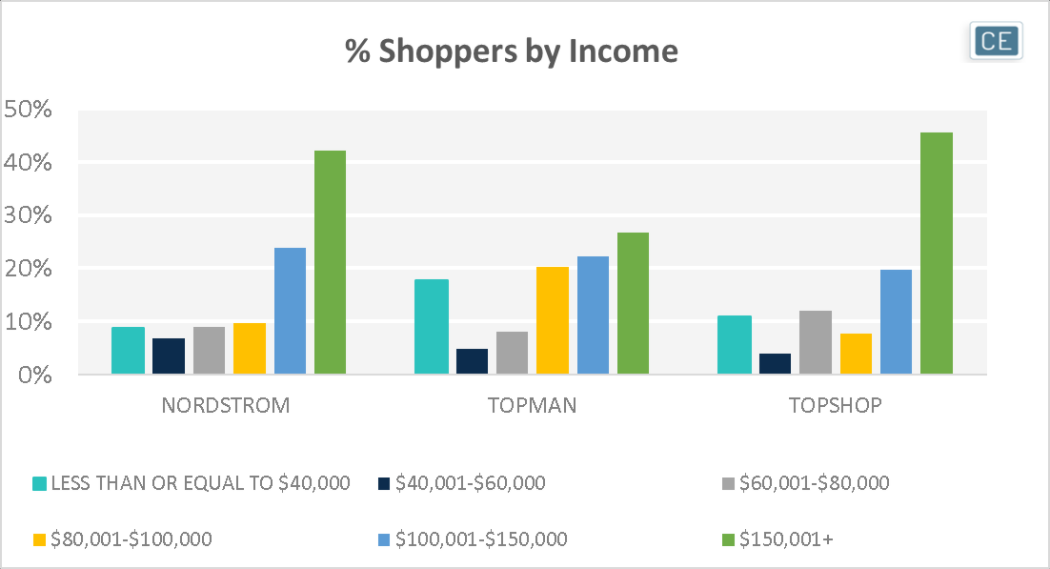

A deeper tie to the Topshop and Topman brands has the potential to give Nordstrom more access to important demographics. Although Nordstrom shoppers are more likely to live in the West, Topshop and Topman have been more popular in the Northeast, a market Nordstrom is trying to penetrate further with measures like its recently opened New York City flagship. Additionally, Topshop and Topman attract a much younger audience – over one third of Topshop purchasers in our panel are in the 18-24 age group, and over two thirds of Topshop and Topman shoppers are under 35. Income demographics are similar across the brands, meaning Nordstrom doesn’t have to worry about these new demographics eroding its upscale image.

US Demographics

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.