Appraisers need to account for data lags in rapidly changing markets

To use a technical term, housing markets across the nation are “hot.” The news is filled with stories of bidding wars, homes selling in hours and homes selling significantly above the list price — not to mention listing inventory at record low levels and supply-chain constraints pushing lumber prices up 42% YoY in March, adding to new construction costs.

Certainly, the housing market has been a bright spot during the COVID-19 pandemic. Post-pandemic demand for housing with more space inside and out, combined with fewer new and existing homes for sale has resulted in an inventory shortage. While housing market conditions do vary across the nation almost without exception, home price growth has accelerated.

Recently, we observed buyers paying prices above listing price and higher than the market data available to appraisers can support. This difference is known as “the appraisal gap,” and in studying it, we see several interesting correlations between home price appreciation, buyers paying more than listing price and buyers paying more than the appraised value.

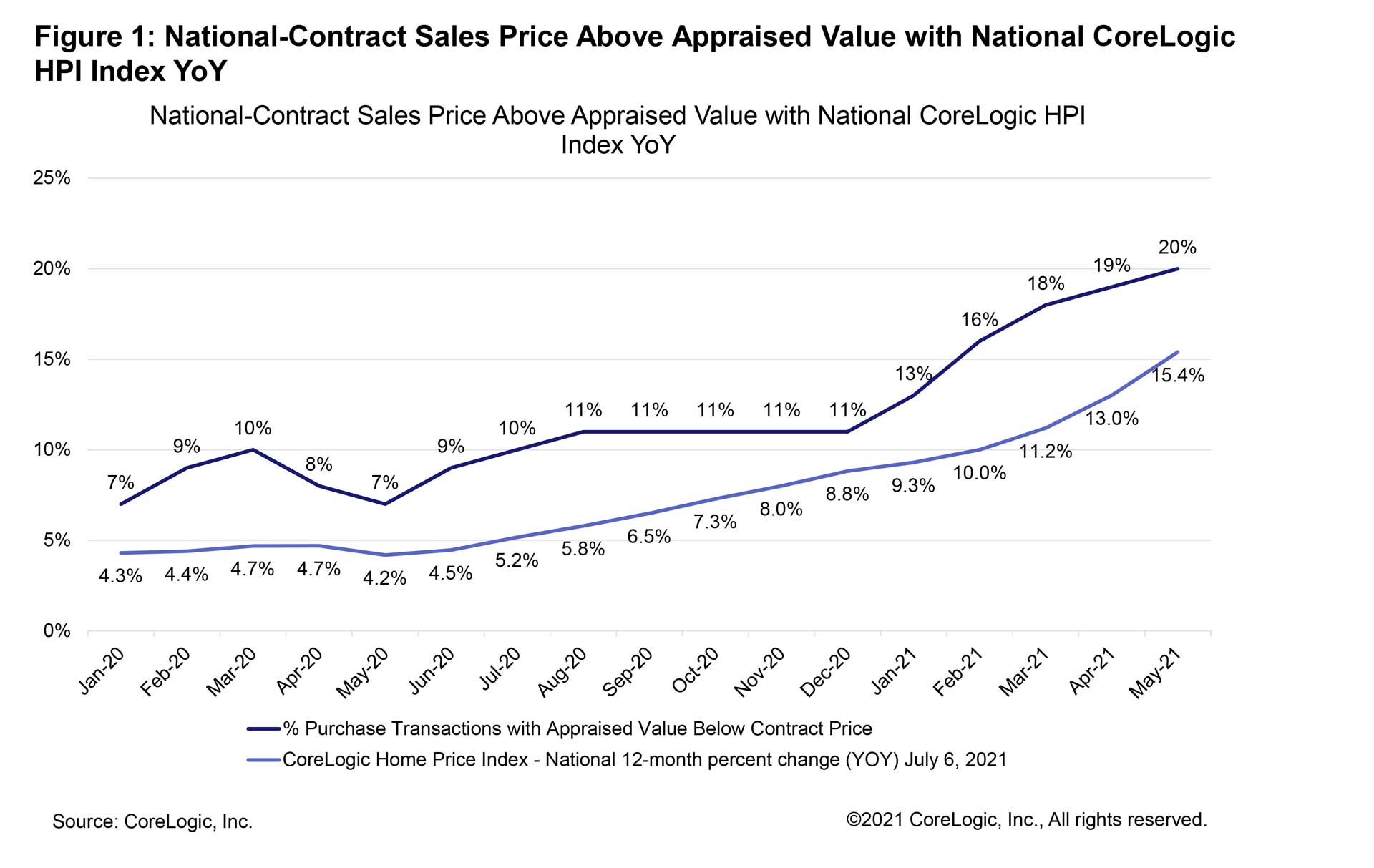

The chart below shows national trends of home-price growth and the percentage of appraisal values below the contract sales price provided to the appraiser.

Beginning in January 2020, nationally, 7% of purchase transactions had a contract price above the appraisal, but by May 2021, the frequency had increased to 19% of purchase transactions. As expected, the frequency of a contract price being below the appraised value decreased from 69% in January 2020 to 52% one year later. The frequency of the appraised value matching the contract sales price remained relatively flat, moving from 24% to 29%.

Homebuyers can be negatively impacted when the contract sales price is above the appraised value as lenders use the lower of two values to calculate the loan-to-value (LTV) ratio. This scenario can require borrowers to bring more cash to closing to “close the gap,” or they may need to pay for mortgage insurance as their LTV is higher than planned. In the worst-case scenario, the sale falls through as the anticipated financing doesn’t work out.

During the same period, the CoreLogic Home Price Index (HPI) began a steady climb, moving from 4% annual growth in January 2020 to 15% through May 2021. As we look at the HPI and the appraisal data together, we can clearly see that home price growth and the frequency of the contract price being above the appraisal are on the same trajectory. There are several potential explanations.

An appraiser’s objective is to estimate the market value of a home on a given day. Appraisers rely on recent arm’s length sales data — evidence of buyer and seller decisions — upon which to base their opinion of value. But transactional sales data can lag; for example, a sales price may be negotiated two months before closing; meanwhile, the prices offered by buyers have continued to increase. This reality impacts the ability of appraisers to easily account or adjust for current market conditions when the market is rapidly changing. Regardless, appraisers must include market condition adjustments in their appraisal analysis when warranted by market evidence. It is important to note that not all completed sales transactions are indicative of rational buyer behavior; appraisers must analyze the data and decide.

The data clearly shows the impact of fast-moving markets and buyer behavior — specifically a willingness to pay a premium price — on the homebuying, mortgage and appraisal process. Appraisers complete relatively complex analyses to ensure their market condition adjustments are representative of the market. We see buyers bidding up prices and paying above listing price — a value the seller’s listing agent thought to be representative of the market. When buyers feel the unusual pressure of a shortage, they appear to be more than willing to pay a premium to get the home.

As rates rise and the supply of homes increases, the unusual artifacts of the pandemic in the residential real estate markets will subside, and we will all together discover what the new normal is for the home selling, buying and financing process.

For now, appraisers working in the fastest-moving market in recent memory will need to continue to do their homework to understand, explain and support recent trends as well as the forecast trends where they do appraisal work.

It is probable that home price growth will moderate in the next year as evidenced in the CoreLogic HPI forecast: The U.S. home price index is expected to rise 3.4% from May 2021 to May 2022. As market conditions change to a normal supply and demand scenario, the frequency of contract sales prices being higher than appraised values will likely revert back to a more normal rate of approximately 7-9%.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.