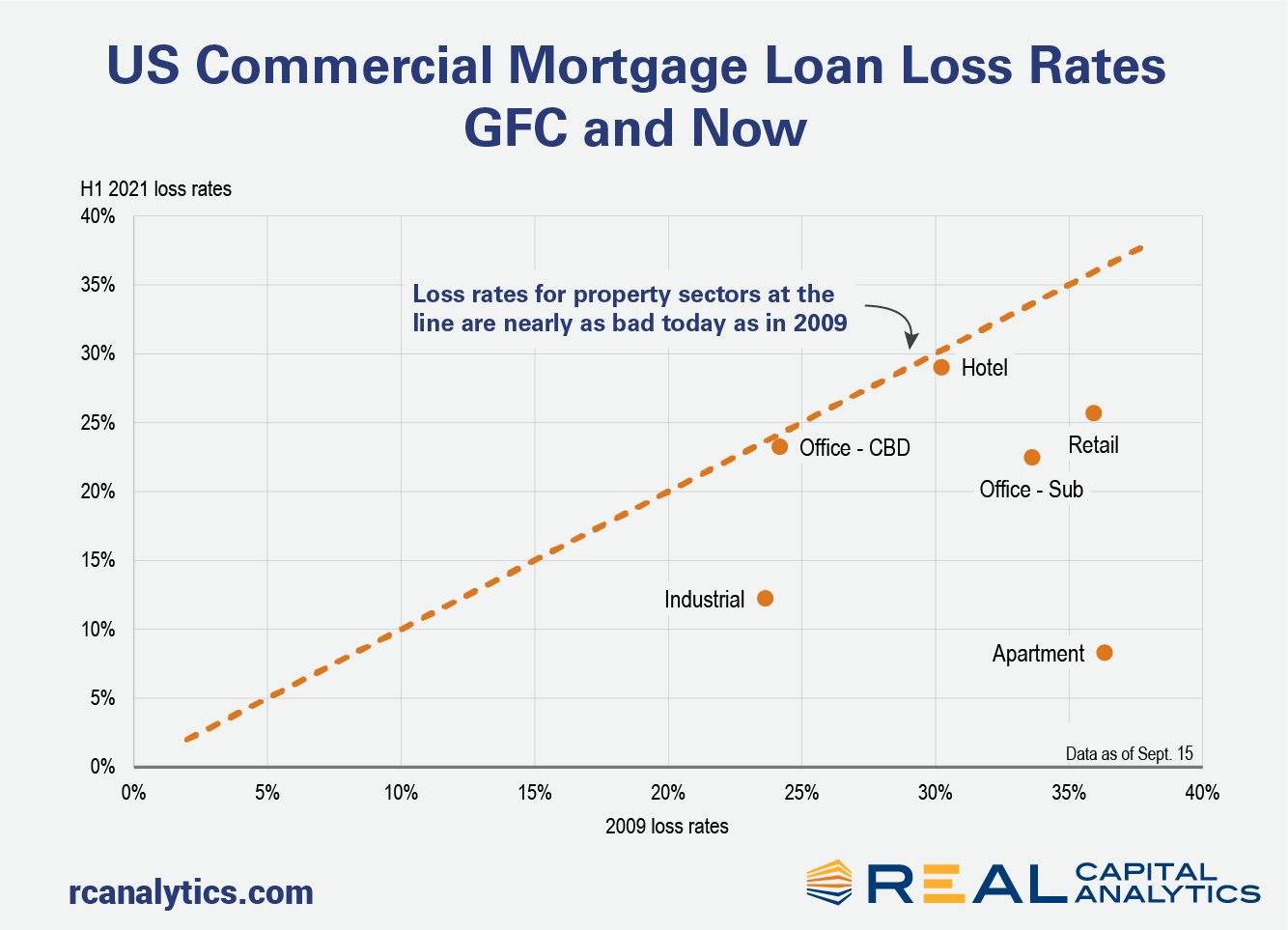

A year and a half into the Covid-19 pandemic and loss rates for U.S. commercial real estate loans are not looking that bad. With the exception of the hotel and CBD office sectors, loss rates so far are well below the pace set through this stage of the Global Financial Crisis. The macroeconomic factors driving loan performance were simply different in this downturn.

Investor tolerance for risk has followed a unique path during the Covid-19 downturn, one that varies from that seen during the GFC. A general guide to risk tolerance can be seen in the spread between the yield of the 10yr UST and the yield of the Moody’s Baa corporate bond. This spread was above 400 bps for nine months from October 2008 to June 2009; in the Covid era this level of risk aversion was only evident for a two-week period in March 2020. More tolerance for risk has translated to better credit availability this time around.

Credit availability was the key challenge in the last downturn: a downward spiral started when falling commercial property prices led lenders to pull back, which in turn led to further price declines as owners unable to refinance had to sell into a panicked market, and so on. This downward spiral continued until central banks and various regulators stepped in to put a floor under the market. The challenge this time around is to market fundamentals, and the property sectors experiencing the worst relative loan loss rates are generally those where there is the most handwringing around the future income fundamentals for the sector.

CBD offices experienced loan loss rates of 24% in 2009, meaning lenders on CBD office properties lost 24% of the value of the loan when there was a default situation. Into midyear 2021, loss rates are slightly lower yet still close to the previous period at a 23% loss rate. Hotels are also nearly as bad as before. Loss rates for H1 2021 were 29% versus a 30% loss rate in 2009.

Retail, however, is an exception to this notion that fundamentals matter. Part of the challenge here is the heterogeneity across the retail property sector. The commentariat decries the future of the mall due to increased online shopping, but prices have held up especially well in the broader market for shop space and those properties serving up grocery-focused consumer activity.

Other property sectors where market fundamentals are less concerning are simply not exhibiting the sharp losses experienced a year and a half after the start of the GFC. Owners have generally been able to refinance as needed and have not been forced to sell assets at distressed pricing into a downturn.

The apartment sector is performing particularly well, with loss rates less than 10% so far versus losses just above 36% at this point after the GFC. Back then of course, wildly aggressive CMBS lending in the apartment sector and condo redevelopment loans were the bulk of the problem.

This is not to say that loss rates will not increase more. For the apartment sector in particular, there are a number of loans that are potentially distressed given the extensive forbearance in this cycle. Again though, regulators in this crisis put a floor under the market. One big difference is that this time around, there was not the dithering over many months to determine how to set that floor.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.