Homebuyers Exodus from New York, San Jose and San Francisco Slowed Down in 2021

The pandemic has influenced homebuyers’ decision on where to buy a home. Our previous analysis showed that homebuyers who relocated to another metro in 2020 were often choosing metros that were either adjacent to their current location, had a lower cost of living or both. Although homebuyers were considering affordability and proximity while buying homes even before COVID-19, the migration rate grew during the pandemic. With the combination of low inventory, low interest rates and a shift to a more flexible working environment, more people moved out of expensive metros in search of affordability and a different set of outdoor amenities — such as warmer weather, mountain vistas, or lower-density communities –during the pandemic.

However, as more people are vaccinated and the economy improves, many companies are expecting employees to return to their office. This may be shifting homebuyers’ location choices once again. The following analysis uses the CoreLogic Loan Application Data to highlight the trends in owner-occupant homebuyer mobility and migration in 2021 (January through July), focusing on the metros with the most in- and out-migration of potential homebuyers as compared to the previous two years.

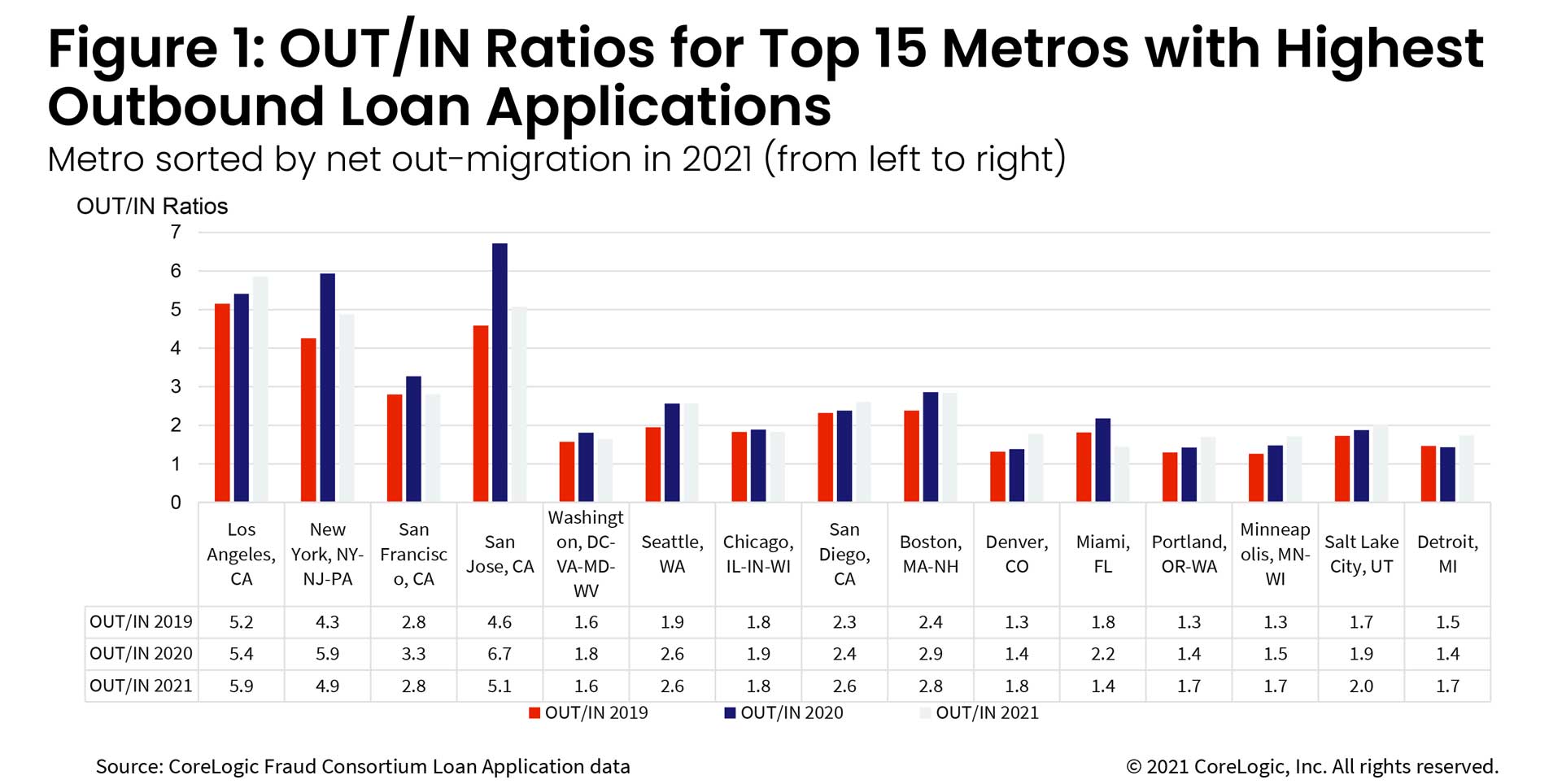

Figure 1 shows the OUT/IN ratio for the top 15 metros with the highest out-migration loan application activity. The OUT/IN ratio for most of these metros remained about the same in 2021. However, the ratio dropped in 2021 compared to 2020 in some expensive coastal metros such as New York, San Jose and San Francisco. For example, the ratio for New York was 5.9 in 2020, meaning that for each application to buy in New York by a nonresident, there were about six applications by New Yorkers to buy outside the New York metro area. That ratio decreased to 4.9 in 2021 but remained higher than the pre-pandemic level of 4.3 in 2019.

The metros in Figure 1 are sorted from left to right by net out-migration in 2021; this shows that Los Angeles experienced the highest net out-migration among all the metros from January to July of 2021. New York had the second highest out-migration in this period, followed by San Francisco and San Jose. In 2020, New York experienced the highest net out-migration of homebuyers among all the metros.

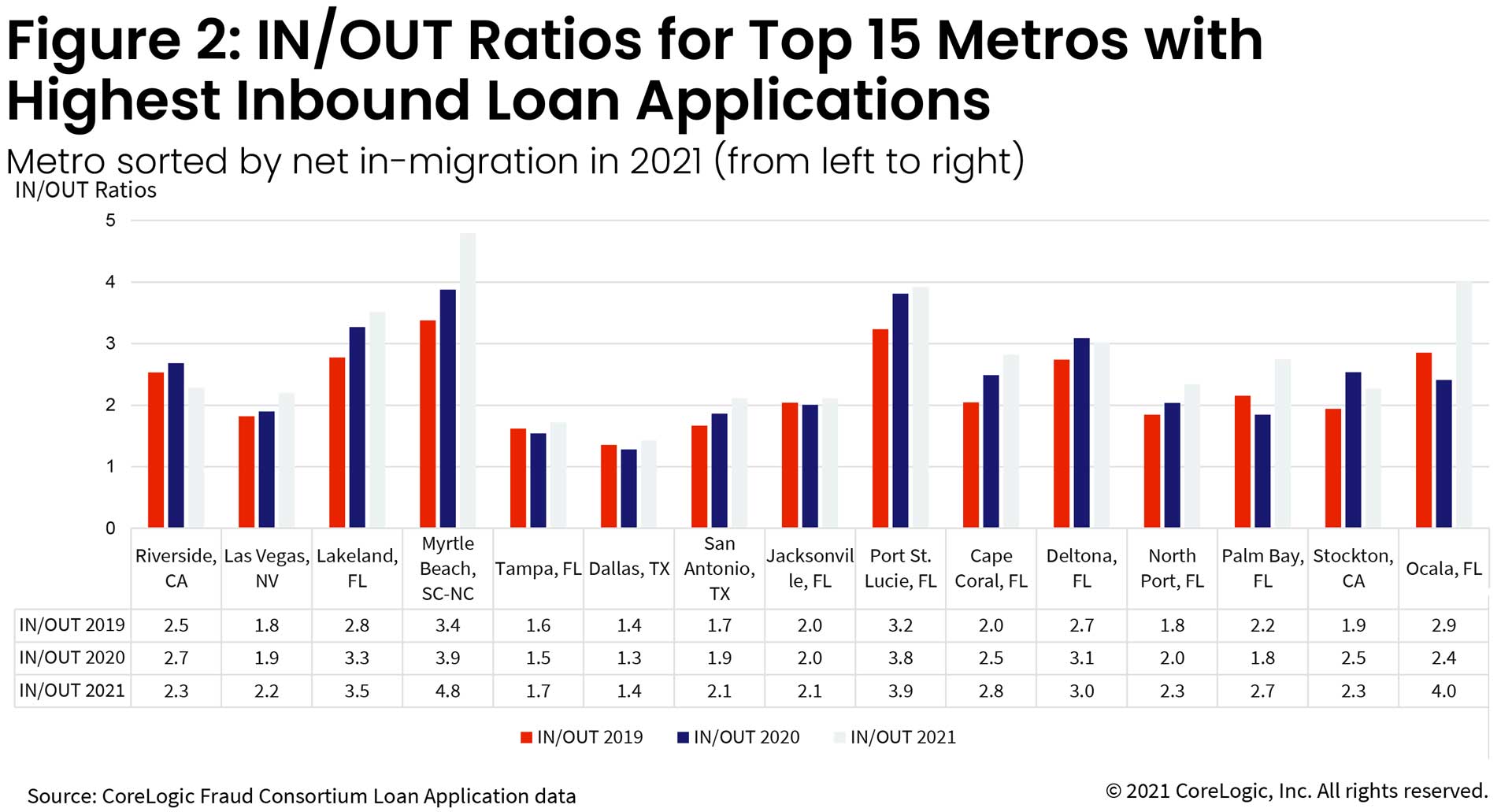

Similarly, Figure 2 shows the IN/OUT ratio for the top 15 metros with the highest in-migration loan application activity. The IN/OUT ratio for most of these metros remained about the same or increased this year, meaning that more people moved into these metros than moved out. The only exceptions were in Riverside and Stockton, California, where the IN/OUT ratio decreased presumably because more Californian applicants are moving out of the state.

The metros in Figure 2 are sorted from left to right by net in-migration in 2021. Riverside, California, had the highest in-migration activity, followed by Las Vegas, Lakeland, Florida, and Myrtle Beach, South Carolina.

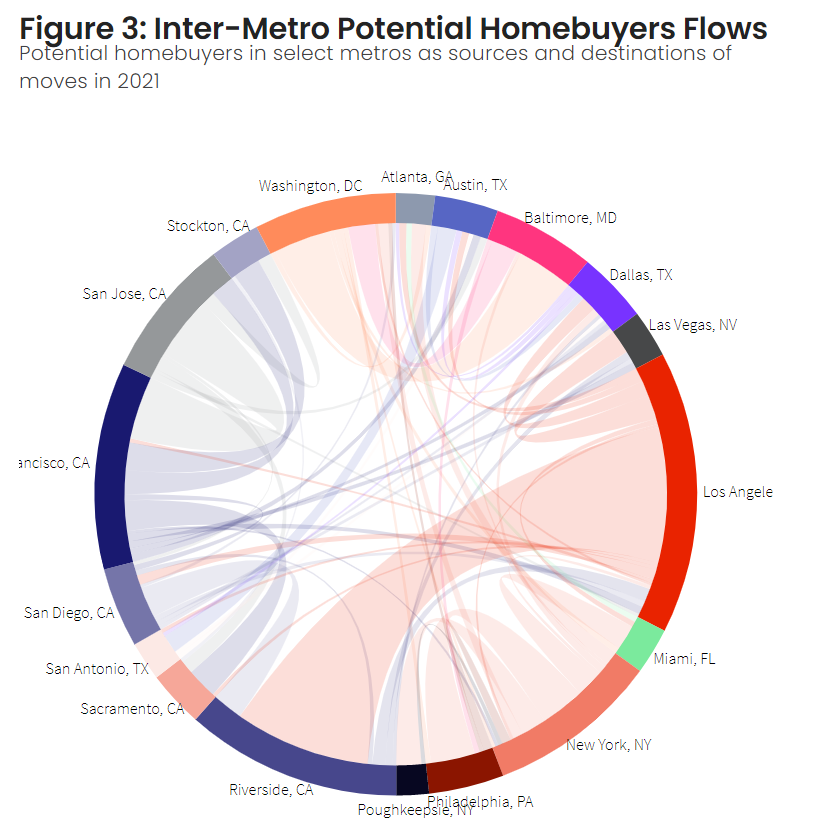

Figure 3 shows a chord diagram tracking the inter-metro migration of potential homebuyers in the select metros in 2021. The highest-cost metros, such as Los Angeles, San Francisco and New York, lost applicants to more affordable metros nearby. For example, Los Angeles and San Diego had a net loss of potential homebuyers to Riverside, California.

Similarly, New York lost a good share of its potential homebuyers to affordable neighboring metros, such as Philadelphia; Poughkeepsie, New York; Allentown, Pennsylvania; and Bridgeport, Connecticut, and warmer metros, such as Miami; Atlanta; Charlotte, North Carolina; and Tampa, Florida.

Though Miami gained applicants from high-cost areas such as New York and Washington, D.C., Miami residents moved to more cost-friendly Florida metros such as Port St. Lucie, Cape Coral, Jacksonville and Lakeland, Florida.

Affordability, outdoor amenities, and job opportunities have always been important factors of migration, but their relative importance changed during the pandemic. Remote work reduced the need to live near an employer and allowed families to broaden their home-buying search, while affordability and other external amenities accelerated the homebuyer’s migration rate. Moving forward, as affordability continues to be an important consideration for homebuyers, we are likely to see more applicants buying in less expensive markets in the near future.

However, as more people return to working in offices in more expensive metros, we also are likely to see some changes in the ratio of homebuyers moving in compared to the number of homebuyers moving out. For example, lower OUT/IN ratios in New York, San Jose and San Francisco in 2021 compared with 2020 may indicate that people are slowly returning to the office.

In sum, flexibility to work remotely has enabled households to relocate to lower-density markets which sets the pandemic experience apart from pre-pandemic.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.