Online grocery has become one of the most dynamic spaces in e-commerce, with third-party providers and grocers themselves experimenting with new models. But how do third-party services compare to sales directly from the grocer websites? In today’s Insight Flash, we take advantage of CE Receipt’s unique ability to capture the online sales of grocers such as Kroger to compare online growth trajectories, average items per basket, and average price per item.

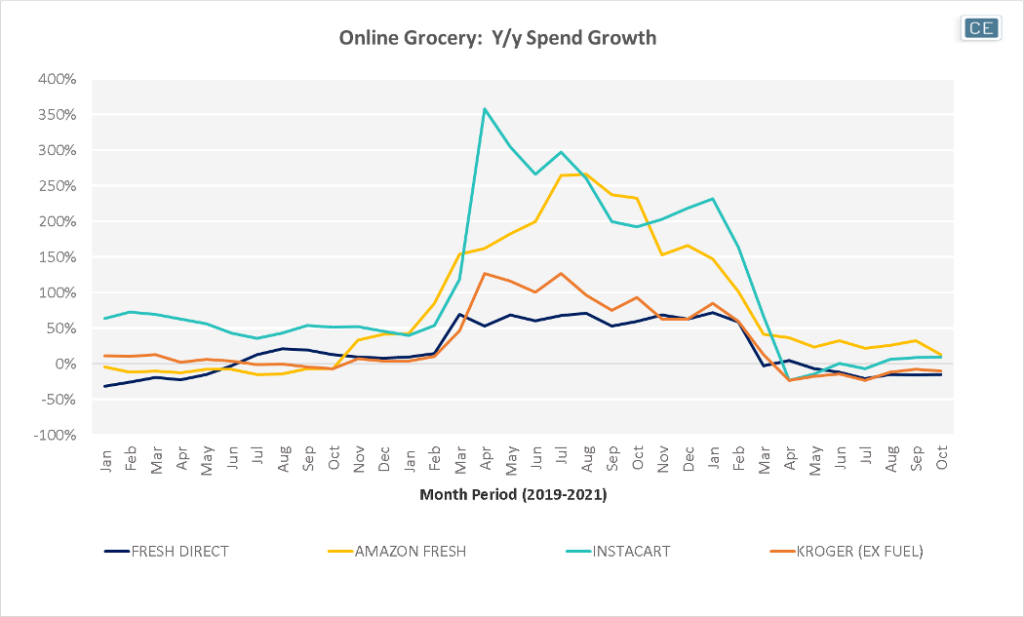

In the online grocery game, Amazon Fresh and Instacart have been the belles of the ball. Although Amazon Fresh lagged for most of 2019, it was beginning to pick up steam in the late fall with spend growth dramatically accelerated above 100% by the COVID-19 pandemic. Instacart spend growth averaged above 50% in 2019, lagging Amazon Fresh in March but quickly ramping capacity for growth 250%-350% in April through August of 2020. Lapping those large gains, Amazon Fresh has shown stronger growth in recent months, with Instacart growth entering negative territory in the Spring of 2021. Although Instacart growth did turn positive once the toughest compares were passed, it still hasn’t hit double digit spend growth since March while Amazon Fresh growth was above 20% until October, when it dropped to 13%.

Online Spend Growth

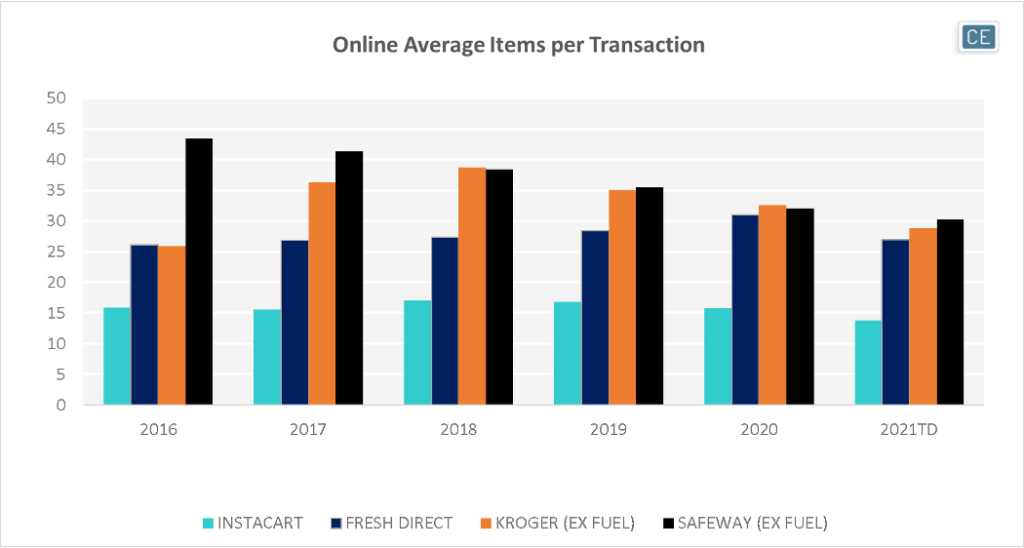

Despite the explosive growth of third-party delivery services, traditional grocers Safeway and Kroger actually see bigger baskets in their direct online orders. So far in 2021, Safeway orders have had an average of 30.3 items while Kroger orders have had an average of 28.9. Fresh Direct has 11% fewer items per transaction while Instacart has 55% fewer. Kroger has seen the strongest growth in items per order at 12% since 2016. Fresh Direct has lagged with 3% growth, while Safeway and Instacart have seen declines in items per transaction of -30% and -13%, respectively.

Online Items per Transaction

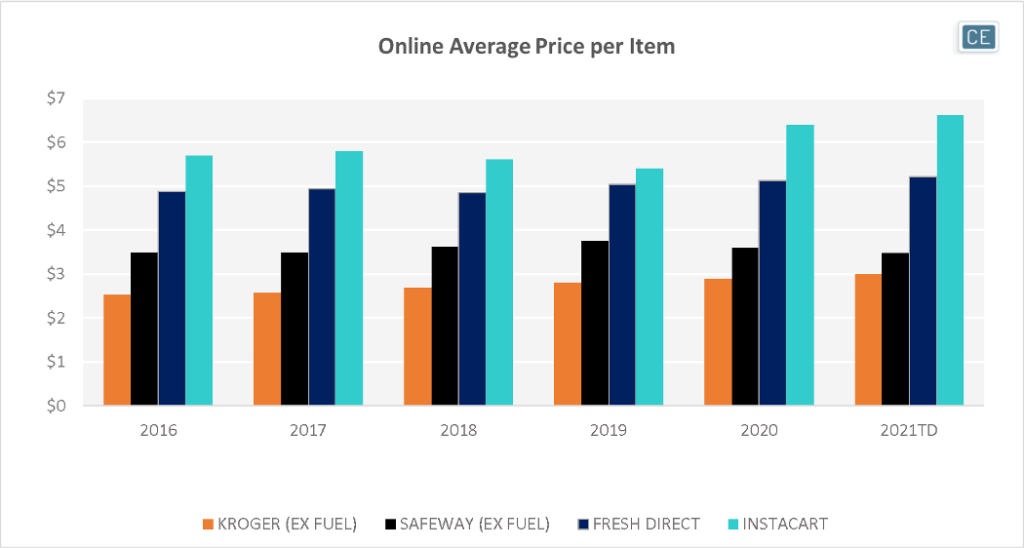

But more items doesn’t necessarily mean higher end. Although they have more items per basket, Kroger and Safeway actually have the lowest price per item – $2.99 for Kroger and $3.48 for Safeway so far this year. That compares to $5.21 for Fresh Direct and $6.62, more than double Kroger, for Instacart.

Online Spend per Item

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.