As worldwide inflation has increased the costs of food, are customers keeping their taste for Meal Kits? In today’s Insight Flash, we look at trends for the top Meal Kit companies in the US and UK, focusing on spend growth, pricing, and retention.

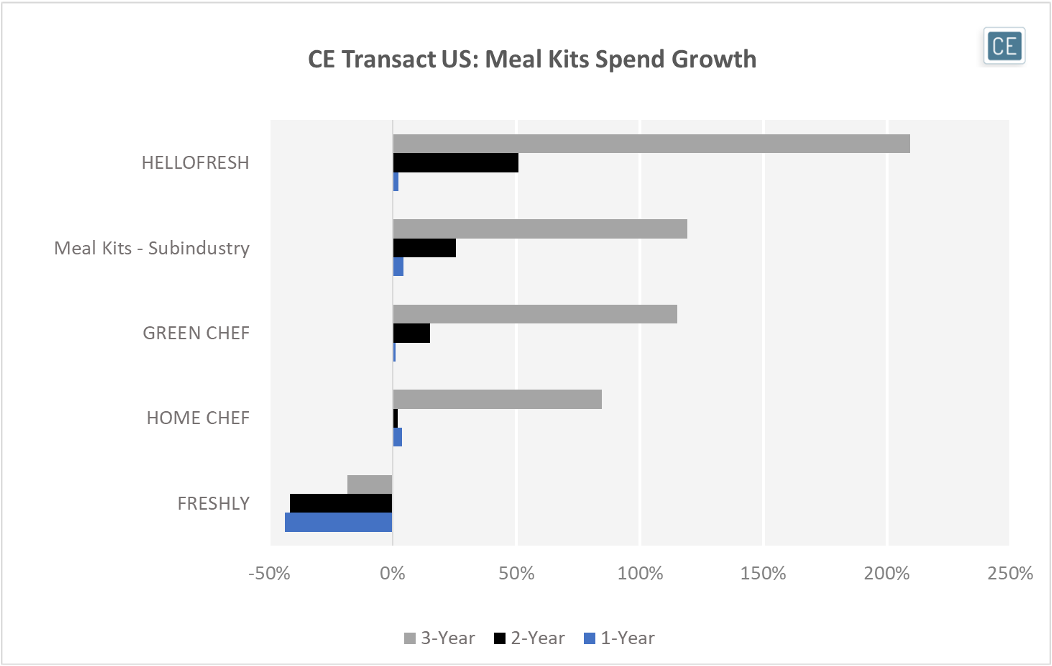

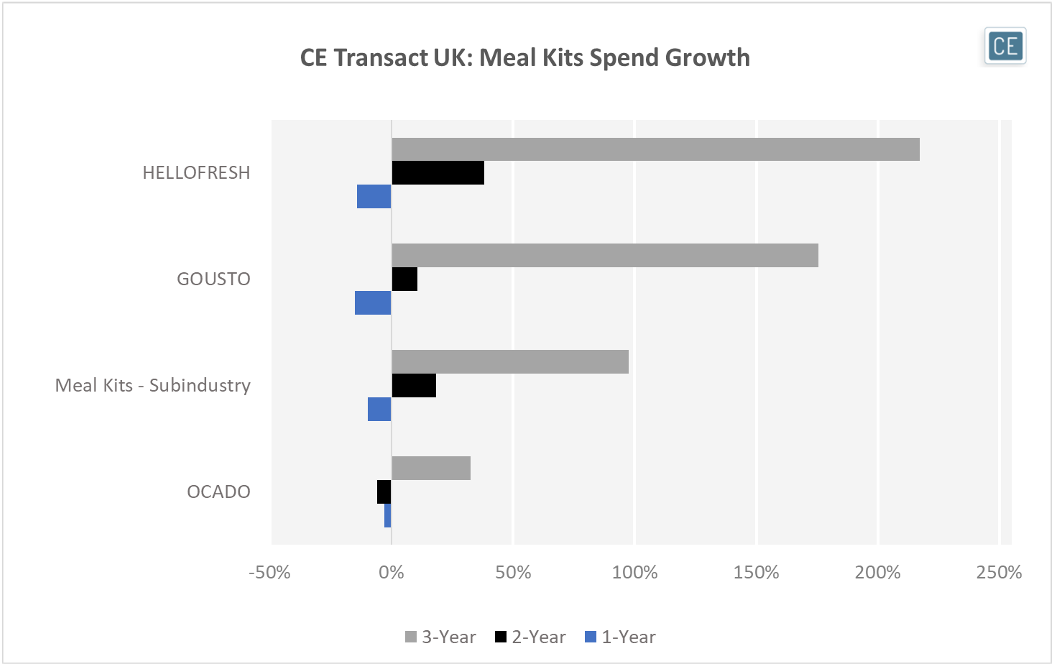

In the US, Meal Kits subindustry growth has been stronger than in the UK over the last 35 days on a one-year, two-year, and three-year basis. Compared to three years ago, spend in the US was up 119% versus a still healthy 97% for the UK, 25% versus 18% compared to two years ago, and a positive 4% versus negative -10% compared to last year. On both a two-year and three-year basis, HelloFresh has grown the most across the US and UK, but when compared to last year Home Chef is showing stronger US growth and Ocado (which also directly delivers groceries) has been showing less negative UK growth.

Spend Growth

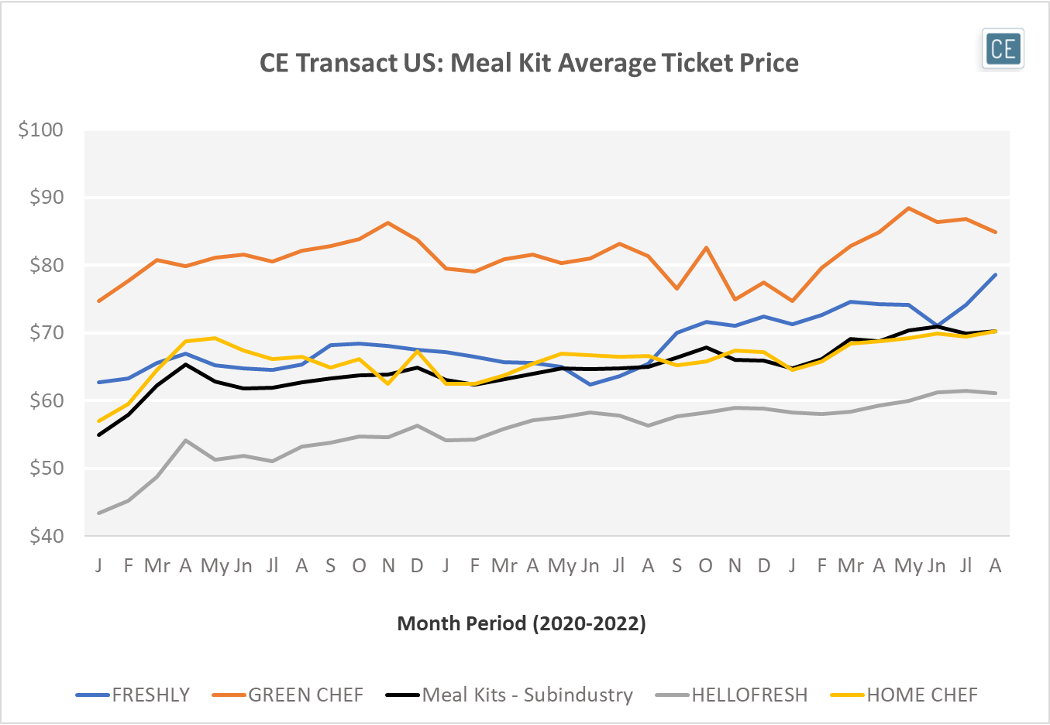

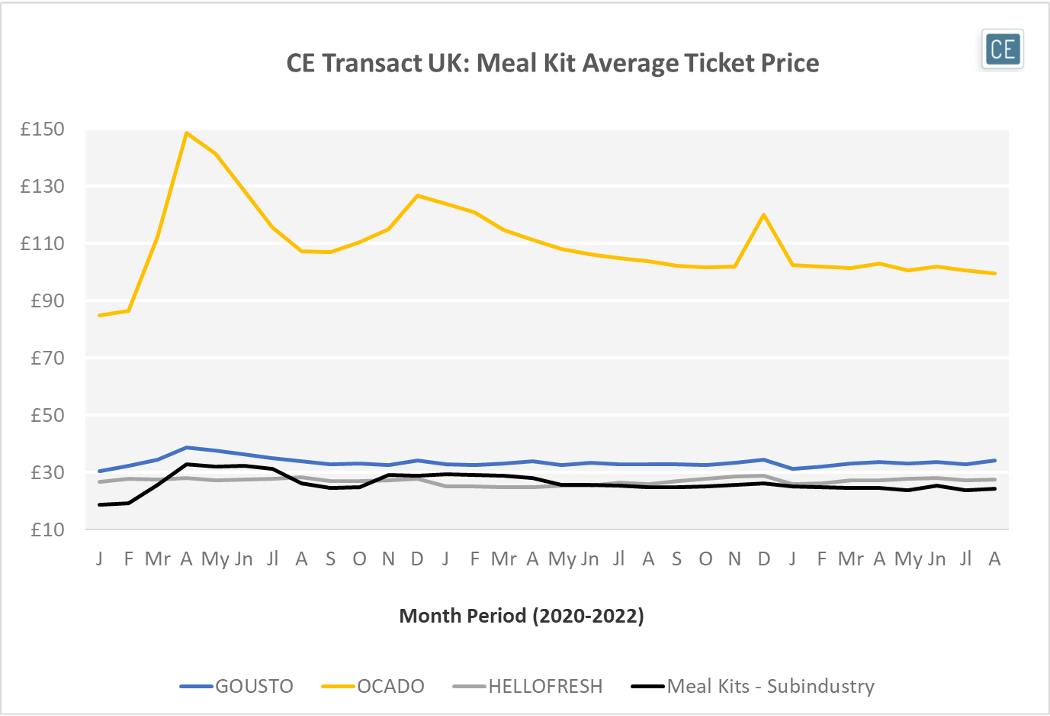

Within the US, Green Chef has seen the highest priced basket among the top Meal Kit services, with August’s average ticket 20% higher than the subindustry overall. Although Home Chef offers a larger variety of billing frequency options, the average ticket is relatively close to the subindustry average. Freshly has had the largest increase in average transaction, up 20% y/y in August. HelloFresh is the cheapest of the top services in the US, as well as in the UK where its average ticket is close to the subindustry average. Gousto’s average transactions are slightly higher, while Ocado shows the highest spend per order given it’s more diverse array of options.

Pricing

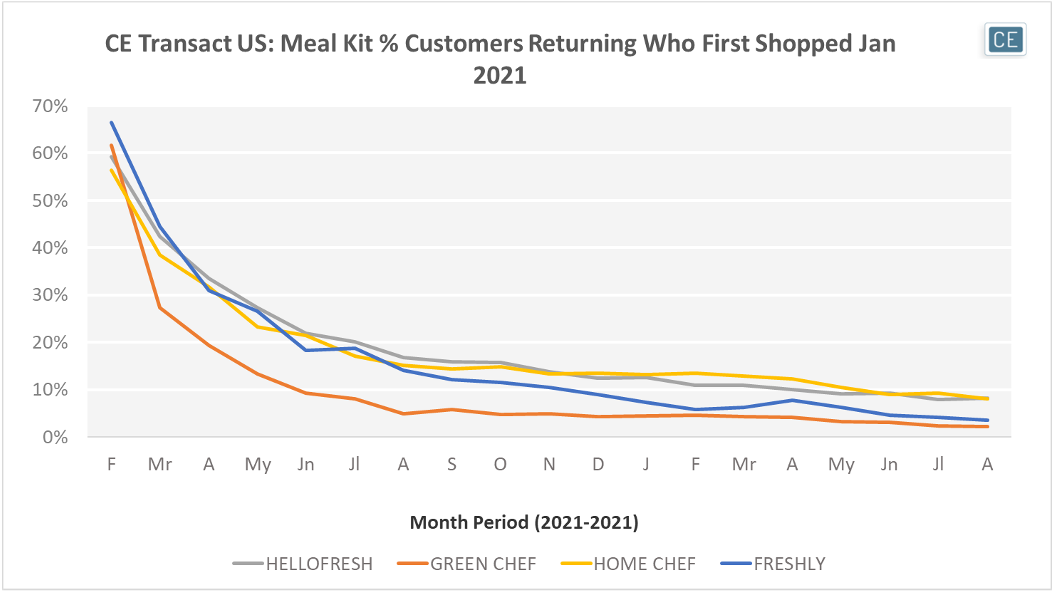

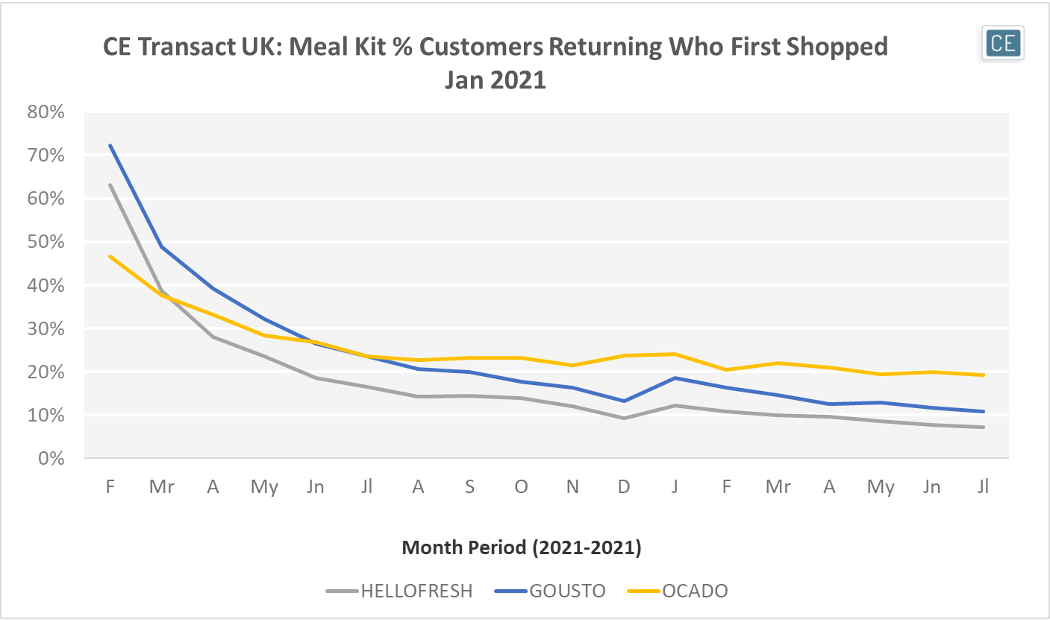

In a space crowded with free box marketing, retention has been low. Looking at shoppers who first signed up for each Meal Kit brand in January 2021, the highest percentage of returning customers in the US in August 2022 has been for HelloFresh at 8.3%, followed closely by Home Chef at 8.1% (although some Home Chef customers may be choosing to purchase their boxes in Kroger groceries). Freshly’s repeat order rate was only 3.5%, and Green Chef’s only 2.3%. In the UK, repeat order rates were higher than all of the US brands for Guosto at 10.9% of customers returning 18 months after the first purchase, while Hello Fresh rates were lower than in the US at 7.3%. Ocado’s grocery delivery capability afforded it the highest repeat order rate at 19.3%.

Retention

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.