CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released its latest Single-Family Rent Index (SFRI), which analyzes single-family rent price changes nationally and across major metropolitan areas.

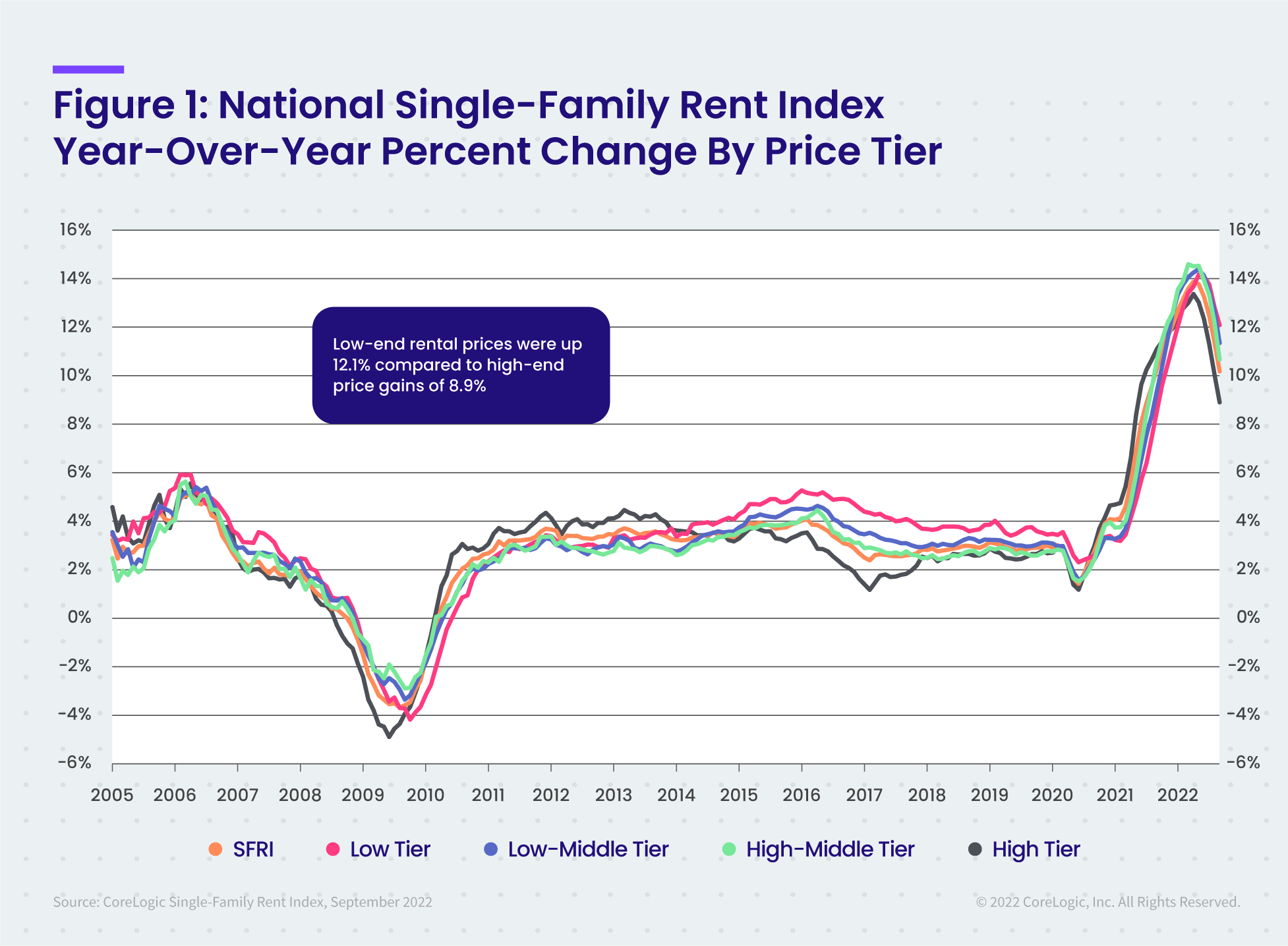

Consistent evidence of a single-family rental market cooldown follows nearly two years of above-trend rental price hikes. Year-over-year single-family rent growth slowed for the fifth consecutive month in September 2022 to 10.2%, down from a high of 13.9% in April 2022. Additionally, rent growth this September was slightly below that of September 2021. The rent increase slowdown comes as inflation stretches tenants’ pocketbooks.

“Annual single-family rent growth decelerated for the fifth consecutive month in September but remained at more than twice the pre-pandemic growth rate,” said Molly Boesel, principal economist at CoreLogic. “High mortgage interest rates may be causing potential homebuyers to hit pause and remain renters, keeping pressure on rent prices. However, the monthly rent change was negative in September, resuming the typical seasonal pattern for the first time since 2019, which could signal the beginning of rent price growth normalization.”

To gain a detailed view of single-family rental prices, CoreLogic examines four tiers of rental prices. National single-family rent growth across the four tiers, and the year-over-year changes, were as follows:

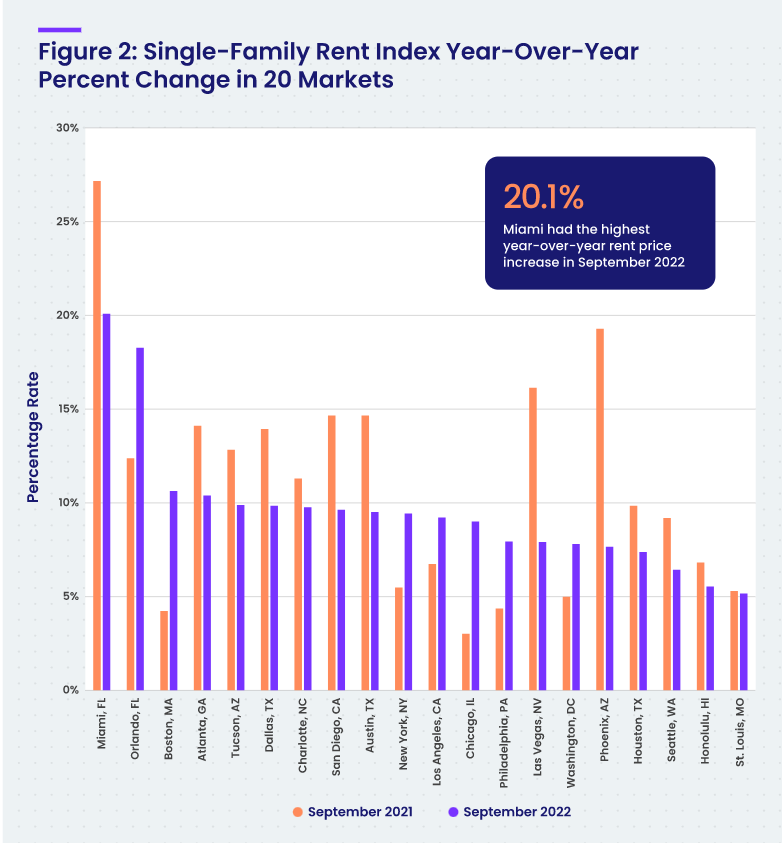

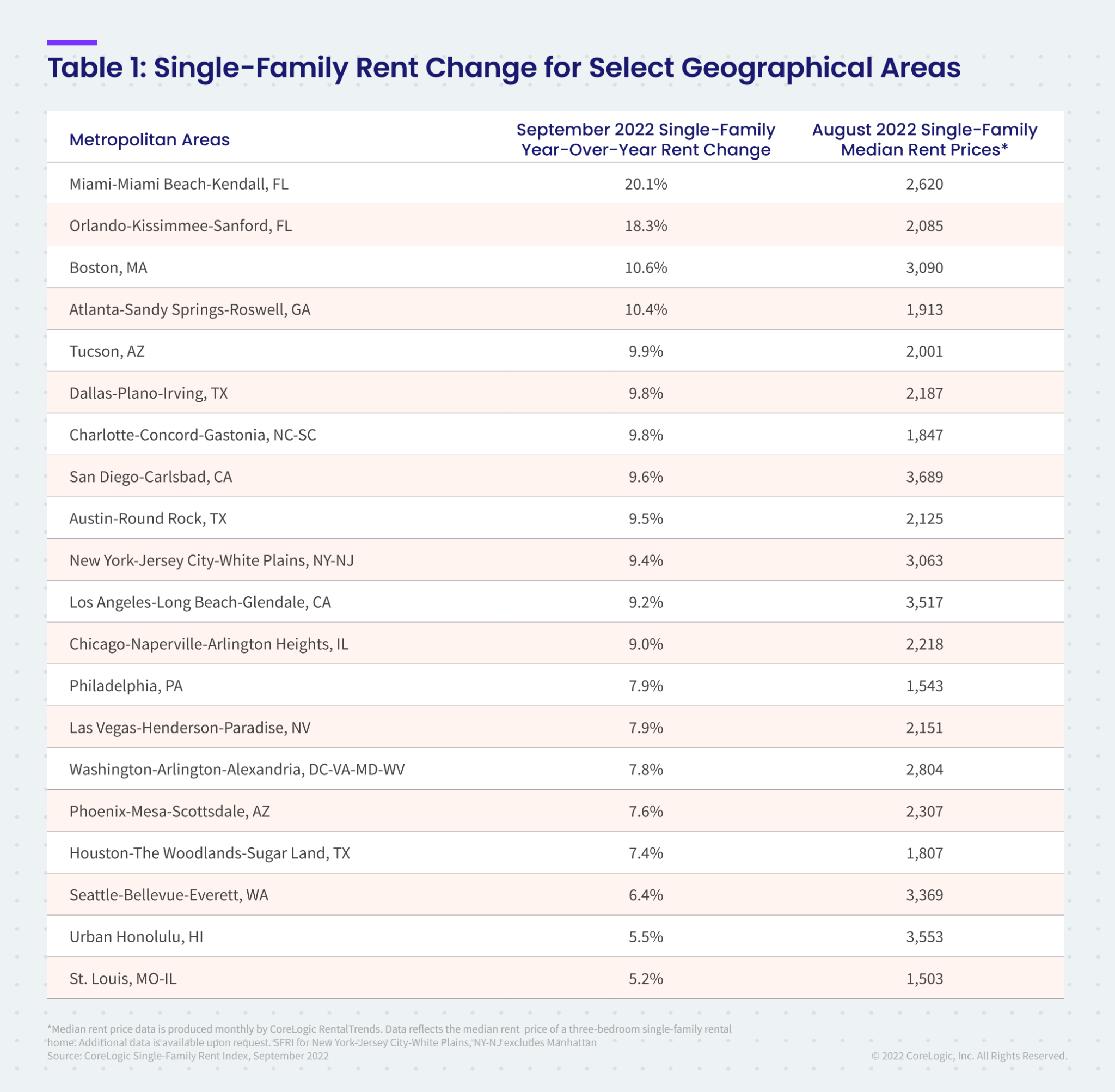

Of the 20 metro areas shown in Table 1, Miami posted the highest year-over-year increase in single-family rents in September 2022 at 20.1%. Orlando, Florida recorded the second-highest gain at 18.3%, while Boston ranked third at 10.6%. St. Louis posted the lowest annual rent price gain at 5.2%. While rent growth in many fast-growing metros has decelerated compared to last September, return to offices, colleges and cities is driving rent growth higher in other metros where increases were lagging, such as Boston, New York, Chicago and Philadelphia.

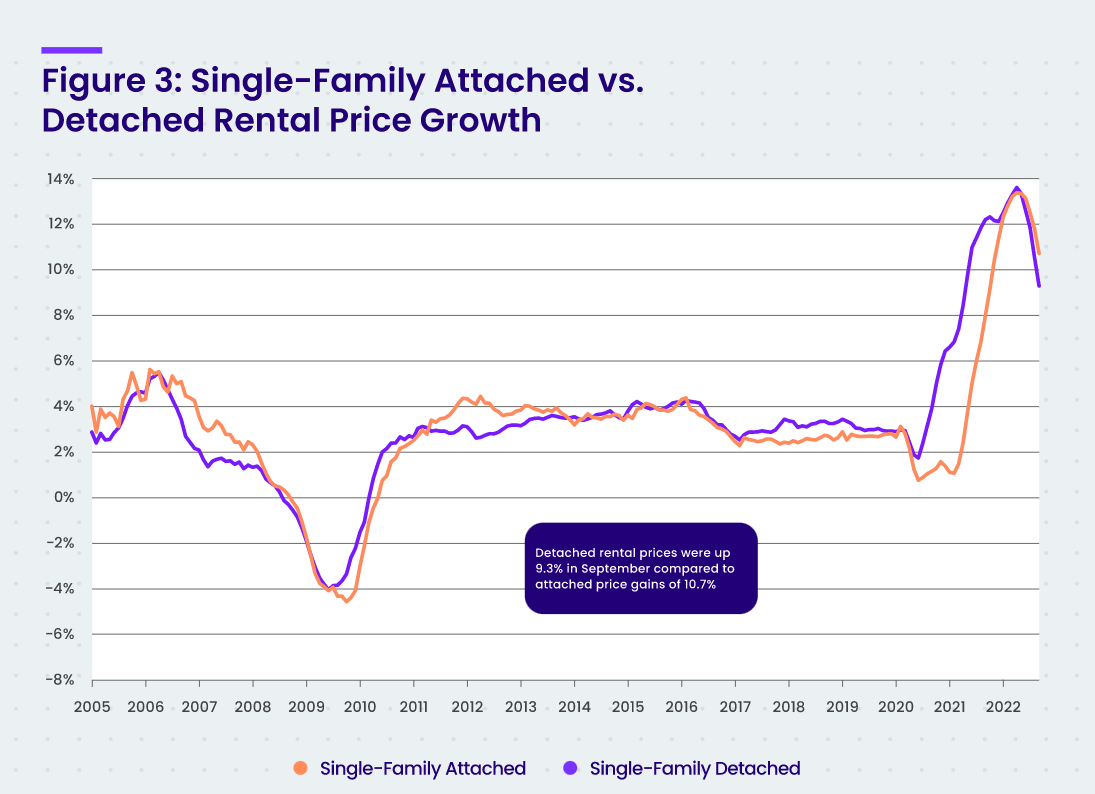

Differences in rent growth by property type emerged after COVID-19 took hold, as renters sought standalone properties in lower-density areas. This trend drove an uptick in rent growth for detached rentals in 2021, while the gains for attached rentals were more moderate during this time. “As single-family rent prices continued growing at a rapid pace, preferences for attached rentals began to emerge in early 2022, and by summer had higher increases than detached properties. Attached single-family rental prices grew by 10.7% year over year in September compared to the 9.3% increase for detached rentals,” said Boesel. “However, detached rental price growth is still outpacing that of attached homes on a two-year basis, a respective 22.6% increase compared with 19.6%.”

Methodology

The single-family rental market accounts for half of the rental housing stock, yet unlike the multifamily market, which has many different sources of rent data, there are minimal quality adjusted single-family rent transaction data. The CoreLogic Single-Family Rent Index (SFRI) serves to fill that void by applying a repeat pairing methodology to single-family rental listing data in the Multiple Listing Service. CoreLogic constructed the SFRI for close to 100 metropolitan areas — including 47 metros with four value tiers — and a national composite index. The indices are fully revised with each release to signal turning points sooner.

The CoreLogic Single-Family Rent Index analyzes data across four price tiers: Lower-priced, which represent rentals with prices 75% or below the regional median; lower-middle, 75% to 100% of the regional median; higher-middle, 100%-125% of the regional median; and higher-priced, 125% or more above the regional median.

Median rent price data is produced monthly by CoreLogic RentalTrends. RentalTrends is built on a database of more than 11 million rental properties (over 75% of all U.S. individual owned rental properties) and covers all 50 states and 17,500 ZIP codes.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.