Conventional serious delinquency rates lower than pre-pandemic; however, rates for FHA and VA slightly higher

The nation’s overall mortgage delinquency rates have improved significantly over the last year, according to the latest CoreLogic Loan Performance Insights Report. Data shows the serious delinquency rate for October 2022 declined one percentage point from 12 months prior to 1.2%. Compared to the peak serious delinquency rate for mortgages in August 2020, the rate in October was down three percentage points, which was mostly driven by strong labor market conditions since the U.S. economy reopened. While serious delinquencies for all types of mortgages have declined over the past two years, it is important to look at the trends by loan type as some loans are more sensitive to changes in a macroeconomic environment.

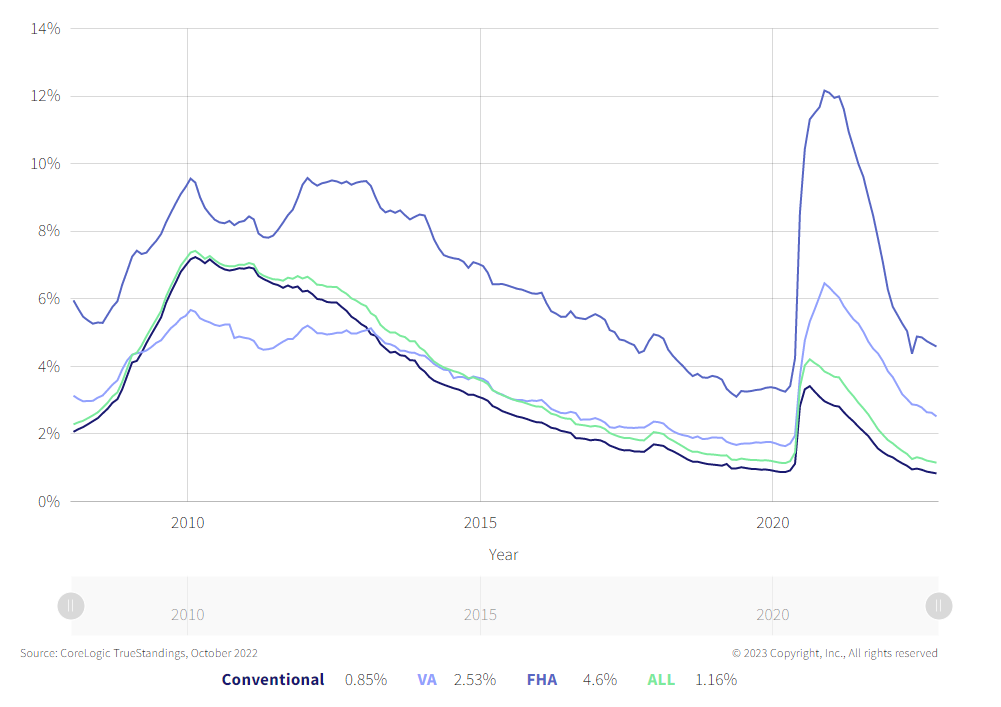

As of October 2022, the serious delinquency rates for Federal Housing Administration (FHA), U.S. Department of Veterans Affairs (VA) and conventional loans were 4.6%, 2.5% and 0.8%, respectively (Figure 1). The serious delinquency rate decreased for all loan types in October 2022 compared with a year prior when COVID-related delinquencies spiked.

Figure 1: Serious Delinquency Rate for All Mortgage Loan Types Down from One Year Ago

In October, the year-over-year serious delinquency rate for FHA loans fell 3.2 percentage points, for VA loans, it dropped 1.9 percentage points, and for conventional loans, the rate decreased 0.7 percentage points.

CoreLogic data shows the serious delinquency rate for FHA loans was about five times higher than the serious delinquency rate for conventional loans. To note, serious delinquency rates for FHA loans have historically been higher compared to other mortgage types

The serious delinquency rates for overall and conventional were lower for October 2022 than before the pandemic. However, the serious delinquency rates for FHA and VA are still slightly higher than the pre-pandemic level. The serious delinquency rate for FHA and VA loans in November 2020 reached a high that surpassed even the peak seen post-Great Recession.

Homeowners with FHA loans are more likely to be low-to-moderate income workers, and the pandemic had a more adverse impact on those homeowners as compared to those with conventional loans. Also, an increase in recent years in refinance activity among FHA borrowers who were now able to obtain conventional financing has led to a transfer of a large number of current FHA loans into the conventional servicing book, leaving higher-risk FHA loans outstanding. As an example, FHA to conventional refinances accounted for about 11% of all refinances in 2022 compared with just 2% in 2012 and 8% in 2019.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.