The CoreLogic Homeowner Equity Insights report, is published quarterly with coverage at the national, state and Core Based Statistical Area (CBSA)/Metro level and includes negative equity share and average equity gains. The report features an interactive view of the data using digital maps to examine CoreLogic homeowner equity analysis through the first quarter of 2022. Negative equity, often referred to as being “underwater” or “upside down,” applies to borrowers who owe more on their mortgages than their homes are worth. Negative equity can occur because of a decline in home value, an increase in mortgage debt or both.

Any home loan that doesn’t comply the Qualified Mortgage (QM) rules is referred to as non-QM. The Dodd-Frank Wall Street Reform and Consumer Protection Act imposed an obligation on lenders to make a good-faith effort to determine applicants have the ability to repay a mortgage, which is known as the ability-to-repay (ATR) rule. The act also mandates the QM cannot have risky loan features like negative-amortization, interest-only, balloon payments, terms beyond 30 years and no excessive points and fees. The QM must also satisfy at least one the following criteria:

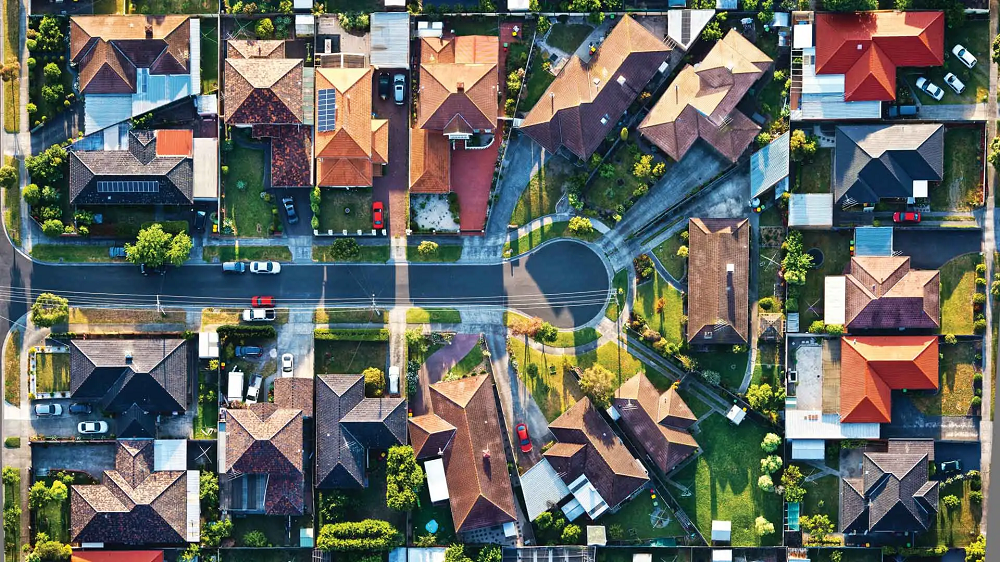

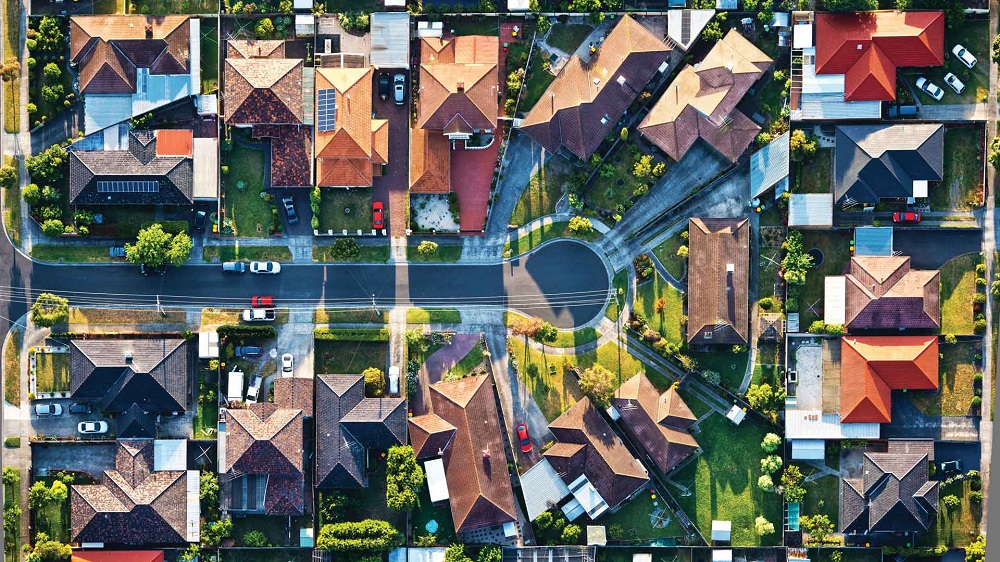

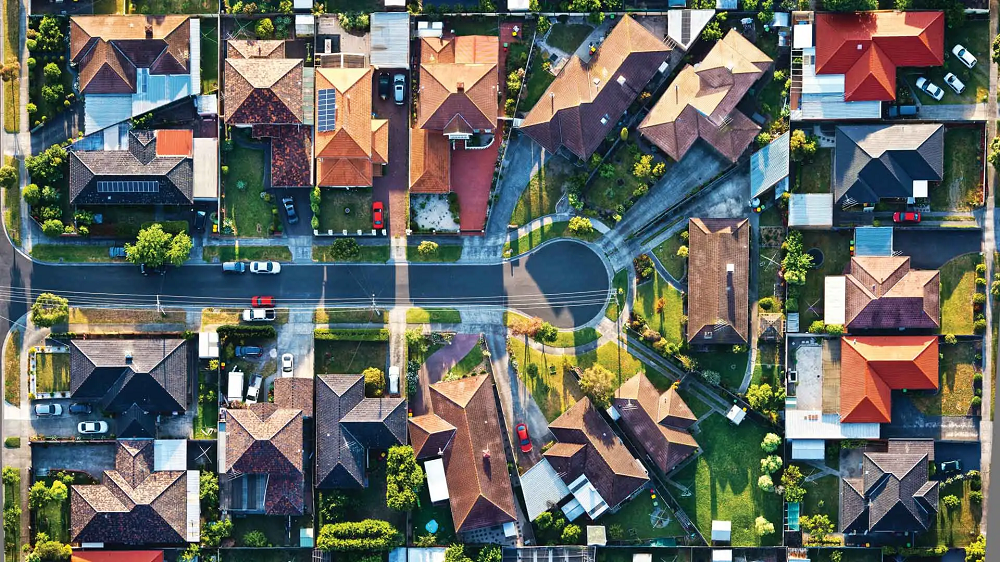

CoreLogic, a leading global property information, analytics and data-enabled solutions provider, today released its latest Single-Family Rent Index (SFRI), which analyzes single-family rent price changes nationally and across major metropolitan areas. U.S. single-family rent price growth continued at a record pace in March, up 13.6% from one year earlier. Slim inventory continues to squeeze renters, as do robust home price gains – both familiar culprits in declining affordability.

The CoreLogic Loan Performance Insights report features an interactive view of our mortgage performance analysis through February 2022. Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To more comprehensively monitor mortgage performance, CoreLogic examines all stages of delinquency as well as transition rates that indicate the percent of mortgages moving from one stage of delinquency to the next.

Home prices rose a whopping 20% over the past year and rents on single-family homes were up 13%, according to the CoreLogic national Home Price Index and Single-Family Rent Index. With prices up more than rent, is it a sign that homes are overvalued? Price growth that outstrips rent gains over an extended period could be a sign that homes are overvalued if capitalization rates, otherwise called cap rates, had remained unchanged. A cap rate is used by real estate professionals to convert net operating income on an investment property into a market value.

If you are a homeowner living in California, Florida or parts of Missouri and have not already had installed solar panels or new roofing with a PACE loan, there is still a good chance that you know a friend or neighbor who has, or you’ve been pitched by private contractors selling PACE. PACE is an abbreviation for Property Assessed Clean Energy. As the name indicates, PACE provides financing for green and renewable energy home improvements, although it is not limited to such. Retrofitting properties with energy upgrades is costly, and PACE provides incentives such as 100% long-term financing.

National home prices increased 20.9% year over year in March 2022, according to the latest CoreLogic Home Price Index (HPI®) Report . The March 2022 HPI gain was up from the March 2021 gain of 11.1% and was the highest 12-month growth in the U.S. index since the series began in 1976. While home price growth is expected to slow over the next 12 months, the CoreLogic HPI Forecast shows that the year-over-year change in the HPI will remain in the double digits for the rest of this year.

CoreLogic, a leading global property information, analytics and data-enabled solutions provider, today released its latest Single-Family Rent Index (SFRI), which analyzes single-family rent price changes nationally and across major metropolitan areas. U.S. rent prices continued their double-digit gains in February, rising 13.1% from one year earlier to hit another new record as the highest in the history of the index. Warmer areas of the country again posted the largest price hikes, with rents in Miami up 39.5% from February 2021.

The nation’s overall delinquency rate was 3.3% in January. All U.S. states and metro areas posted year-over-year decreases in delinquencies.In January 2022, 3.3% of home mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure), which was a 2.3-percentage point decrease from January 2021 according to the latest CoreLogic Loan Performance Insights Report . This is the lowest recorded overall delinquency rate in the U.S. since at least January 1999.

Recent price indexes show that inflation is at a 40-year high. Supply chain disruptions have led to a spike in prices for various goods, which has added to the cost of construction and delayed home completions. Housing is a big part of every family’s monthly spending, so when housing costs go up, it also adds to inflation measurement. Rent is the main way that housing costs enter U.S. inflation metrics. For owner-occupied homes, the government estimates a rental equivalent to assign value to the flow of housing services.

There is a notable difference between young homebuyers, those aged 30 and below, and older millennial homebuyers, ages 31 to 40. Generally, older millennials have advanced further in their careers, have a more stable income and are already homeowners who are considering a move-up purchase. In contrast, younger people have more financial challenges when competing to buy homes since they are just beginning their careers; have less or no credit history; limited or no savings and generally lower levels of income.

The Mountain-West region is the hottest housing market in the country. Of the 20 cities covered in the S&P CoreLogic Case-Shiller Home Price Index, Phoenix had the fastest year-over-year appreciation in December 2021, growing 32.5% annually. Another popular market was Denver, where prices increased 109% compared to the previous peak in August 2006. Right behind Denver was Boise, Idaho. According to the CoreLogic Home Price Insights Report, Boise real estate appreciated 22% in 2021, and the average homeowner equity increased by $64,000 from December 2020 to December 2021.

In response to the outbreak of COVID-19 and the resulting economic shocks experienced by the U.S. and global economies, the Federal Reserve slashed its target interest rate to nearly zero and kept it between 0% and 0.25% from March 15, 2020, until March 16, 2022, when the Fed announced it will raise the target interest rate by 25 basis points to 0.25-0.5%. For existing homeowners, the resulting low interest rates meant opportunities for billions of dollars of savings in mortgage interest, prompting millions of homeowners to refinance their existing mortgage for a lower rate.

U.S. single-family rent growth increased 12.6% in January 2022, the fastest year-over-year increase in over 16 years, according to the CoreLogic Single-Family Rent Index (SFRI). January marked the 10th consecutive month of record-level rent growth. The index measures rent changes among single-family rental homes, including condominiums, using a repeat-rent analysis to measure the same rental properties over time. Annual rent growth in January 2022 was more than triple the gain recorded in January 2021 and more than quadruple the increase from January 2020.

The nation’s overall delinquency rate was 3.4% in December. All stages of delinquencies showed year-over-year decreases in December. In December 2021, 3.4% of home mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure) , which was a 2.4-percentage point decrease from December 2020 according to the latest CoreLogic Loan Performance Insights Report. This is the lowest recorded overall delinquency rate in the U.S. since at least January 1999.

An unexpected side effect of the pandemic has been the extraordinary rise in home prices during 2021. That has increased the need for jumbo loans — mortgage loans that exceed the loan limits of Fannie Mae and Freddie Mac. When mortgage rates dropped at the onset of the pandemic in 2020, the effects were felt immediately in the market for conforming loans — mortgages that can be packaged into federally backed mortgage securities. Mortgage rates on jumbo loans were slower to come down and reached an all-time low during 2021.

National home prices increased 19.1% year over year in January 2022, according to the latest CoreLogic Home Price Index (HPI®) Report. The January 2022 HPI gain was up from the January 2021 gain of 9.4% and was the highest 12-month growth in the U.S. index since the series began in 1976. While home price growth is expected to slow over the next 12 months, the CoreLogic HPI Forecast shows that the year-over-year change in the HPI will remain in the double digits for at least the first seven months of 2022.

The CoreLogic Home Price Insights report features an interactive view of our Home Price Index product with analysis through January 2022 and forecasts through January 2023. CoreLogic HPI™ is designed to provide an early indication of home price trends. The indexes are fully revised with each release and employ techniques to signal turning points sooner. CoreLogic HPI Forecasts™ (with a 30-year forecast horizon), project CoreLogic HPI levels for two tiers—Single-Family Combined (both Attached and Detached) and Single-Family Combined excluding distressed sales.

The nation’s overall mortgage delinquency rates have improved significantly over the last year, according to the latest CoreLogic Loan Performance Insights Report. Data shows the serious delinquency rate for November 2021 declined 1.9 percentage points from 12 months prior to 2%. When compared to the peak serious delinquency rate for mortgages in August 2020, the rate last November was down 2.3 percentage points. Declines in local unemployment rates, a rapid rise in home prices and demand for housing have helped reduce the overall delinquency rate. Loan product mixes also contribute to the national delinquency rate, and this blog explores mortgage default trends by loan type.

U.S. single-family rent growth increased 12% in December 2021, the fastest year-over-year increase in over 16 years, according to the CoreLogic Single-Family Rent Index (SFRI). The index measures rent changes among single-family rental homes, including condominiums, using a repeat-rent analysis to measure the same rental properties over time. The December 2021 increase was more than three times the December 2020 increase, and while the index growth slowed in the summer of 2020, rent growth returned to its pre-pandemic rate by October 2020.