Credit Benchmark have released the end-month Industry Monitor for November, based on the final and complete set of the contributed credit risk estimates from 40+ global financial institutions.

COVID has led to waves of downgrades across many sectors, with an unprecedented number of Fallen Angels. While there have also been some clear COVID winners, Rising Stars have so far been in a minority. But with vaccines now being rolled out, an end to the economic crisis could be in sight even for some of the hardest-hit sectors.

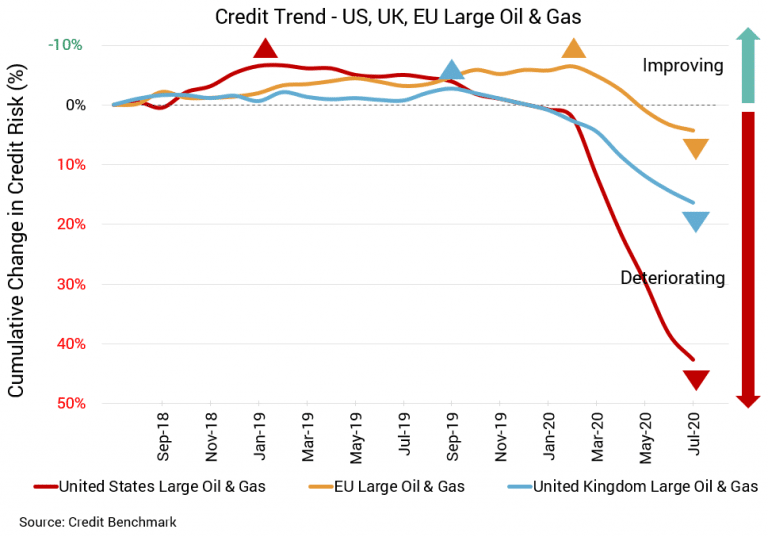

If there’s one major sector that has borne the brunt of problems during COVID, it’s the US energy sector. Credit quality deterioration may not be as pronounced in the UK or EU energy sectors, but similar industry strains exist in both. Prices remain below their pre-pandemic levels, and demand will likely remain weakened until normal transportation habits and schedules return. The threat of COVID remains ever-present.

Credit Benchmark have released the November Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 30,000 credit analysts at 40 of the world’s leading financial institutions.

The outlook for the US retail sector is now less bleak than in earlier months. After disappointing sales data in September, data released in October was more upbeat, even amid ongoing concerns about the economy. The economic situation is similar in the UK, with sales data released in September and October showing gains despite ongoing weaknesses in the economy, but credit quality for the UK retail sector continues to deteriorate.

The rays of light within credit markets are slowly growing. Known as Rising Stars, companies moving from high-yield or “junk” to investment-grade status are increasing across many sectors. According to the latest consensus credit data from Credit Benchmark, which tracks collective credit quality estimates of lenders to firms in various sectors, the total number of new Rising Stars has increased by 24 since the previous update.

The number of Fallen Angels – companies whose credit quality has shifted from investment-grade to high-yield or “junk” status – continues to increase, yet each update brings a smaller total number than the last.

Once again, no news may be good news for the US housing sector. There are positive forces, such as interest rates for mortgages at or near record lows, and a potential trend of buyers moving away from urban areas amongst other factors that may buoy demand for housing and support construction. Similar trends are occurring in the UK housing market, where mortgage demand is red hot.

Challenges in the energy sector are numerous and persistent. These challenges are perhaps most evident in the US energy sector, where strained prices and weakened demand have accompanied months of reduced travelling for professional and personal reasons. Bankruptcies are increasing. Some firms are doing better than others, yet few are in great shape.

The worst may not yet have arrived for the US auto industry. In fact, there were some signs of recovery in Q3. But when a smaller-than-expected drop in sales is considered a good sign, it’s no surprise the credit quality for the industry is still in poor shape. The UK is experiencing similar issues, and is also dealing with concerns about Brexit. What’s more, a growth in COVID cases continue to weigh on economic recovery in each country.

The winners and losers in the virus crisis are becoming clearer. China reports a strong economic rebound while Western economies continue to struggle. Hotels and airlines fight for their survival while online fulfilment and delivery logistics firms cannot hire staff quickly enough. And real estate is seeing a “race for space” in residential markets, but serious viability issues in some commercial lines – Bloomberg report that Land Securities will sell a quarter of their total portfolio, mainly lightening up on retail and leisure.

Credit Benchmark have released the October Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 30,000 credit analysts at 40 of the world’s leading financial institutions.

Retail sales may be rising, even if the pace in August was lower than anticipated, but retailers themselves continue to struggle. The number of store closings in the US has remained higher than openings most weeks, bankruptcies are at a notable high and there’s potential for more in the months ahead, including many well-known brands.

Leveraged Loans continue to divide investor opinion. Values declined as part of the High Yield rout earlier this year, but they have been slower to recover. Winnie Cisar, Head of Credit Strategy at Wells Fargo points to a simple lack of liquidity, which is only now filtering back into the Leveraged Loan space with prices closing the gap vs. general High Yield.

Amid an onslaught of negative credit news, there are some bright spots. So-called Rising Stars, sectors whose credit quality has moved from high-yield or “junk” status to investment-grade, are growing, slowly but surely.

Fallen Angels – companies whose credit quality has shifted from investment-grade to high-yield or “junk” status – continue to grow in number but at a slower pace than what we’ve been seeing for the past several months.

With emergency government funding set to expire at the end of September, US Airlines are planning mass layoffs after a more than 80% collapse in revenues. The more cash rich carriers – such as SouthWest and Delta – have avoided Federal loans so far, hoping to tough it out until a vaccine arrives, with the prospect of a large increase in market shares for the survivors.

The besieged US energy sector continues to see credit deterioration, and with a multitude of problems facing the industry there is little cause for optimism. In the US, energy companies were supplying fewer barrels of gas per day even with the recovery in consumption, and shale producers are facing a cash crunch. Meanwhile, European oil producers are questioning whether it’s worth drilling.

With the economic picture still murky, no news may be good news for the US and UK housing sectors. Credit quality has seen little change in each region with the most recent update. Recent positive signs in the US and UK markets may suggest continued stabilization. But as noted last month, the UK is experiencing its worst recession on record and the sector’s credit prospects may limited for some time. There’s more reason for optimism for the US, according to some reports.

Credit Benchmark have released the September Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 30,000 credit analysts at 40 of the world’s leading financial institutions. The CCI tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment for industrials.