With international and business travel caught in the everchanging crossfire of quarantine rules and other COVID-19 restrictions, staycations became a significant driver of the occupancy gains that have emerged since the beginning of the pandemic. STR’s Tourism Consumer Insights team continues to keep a close eye on traveler and tourism trends as the industry moves through the most optimistic point of the pandemic. The twists and turns of the pandemic have contributed to seismic changes in tourism. In this latest installment of our Tourism After Lockdown blog series, we evaluate post-pandemic recovery scenarios for domestic and international leisure travel.

After an auspicious start to its performance recovery, Mumbai’s hotel industry appeared ready to continue setting the trend for urban markets in 2021. However, a second wave of COVID-19 cases has called a temporary halt to the market’s success. Fortunately, strong domestic demand and corporate confidence, the drivers behind the market’s earlier recovery in 2020, remain poised to push performance again once cases are under control. More recently, Mumbai welcomed back corporate travelers, which helped lift demand in the first quarter of 2021. An institutional quarantine requirement helped drive demand as well, as travelers arriving from or transiting through several major world regions were required to undergo a 10-day institutional quarantine.

A strong return of leisure travel has created much cause for celebration during the early months of 2021. In the U.S., hotel room demand in March was the country’s highest level recorded since the start of the pandemic. To fully recover, however, the industry needs both leisure and the various segments of business travel to return. To track evolving trends in the tourism and hospitality industry, and examine everchanging attitudes to travel, STR conducted a quantitative survey in February 2021 among 1,333 respondents from its Traveler Panel. In this latest installment of Tourism After Lockdown, we look at the potential recovery path of business travel. In this research, travelers primarily represented the United Kingdom, other countries in Europe, and North America. Sentiment about business travel was captured among those who had previously traveled for business pre-pandemic.

The week of 4-10 April was all about demand. The number of U.S. room nights sold surged to 22 million, which was the most since the start of the pandemic. As a result, occupancy reached 59.7%, also the highest level of the past year. On a total-room-inventory (TRI) basis, which includes temporarily closed hotels because of the pandemic, U.S. occupancy reached 56.6%—yes, that was another pandemic-era high. On average, the industry sold 3.2 million rooms per day during the week. A year ago, daily demand was a third of that.

Mass COVID-19 vaccination programs are underway across the globe and providing the tourism and hospitality industry a much-needed confidence boost following 12 months or so of seismic declines. However, with lockdowns still in place for some regions and the emergence of new virus variants, predicting future travel demand remains challenging. To track evolving consumer trends in the sector, and examine everchanging attitudes on travel, STR conducted a quantitative survey in February 2021 among 1,333 respondents from its Traveler Panel. According to our latest research, consumers did not lose their appetite to travel as most (66%) had planned, booked, or undertaken travel since the start of the year. Moreover, despite national and regional lockdowns, and widespread advice to avoid non-essential travel across the globe, underlying demand for travel remains strong as three quarters of travelers intend to undertake an overnight trip by the end of 2021.

Weekly RevPAR rose to US$65.34, which was a 4.2% increase week over week and the industry’s highest level of the past 56 weeks when indexed to 2019. RevPAR has increased week over week all but three times this year. STR’s Market Recovery Monitor reflected the country’s stronger overall RevPAR performance with 73 markets either in Recovery or Peak categories. More encouraging, only 20 markets were in the Depression category, the least of the past 53 weeks. Top 25 Markets are also improving, and as a group, entered the Recession phase for the first time.

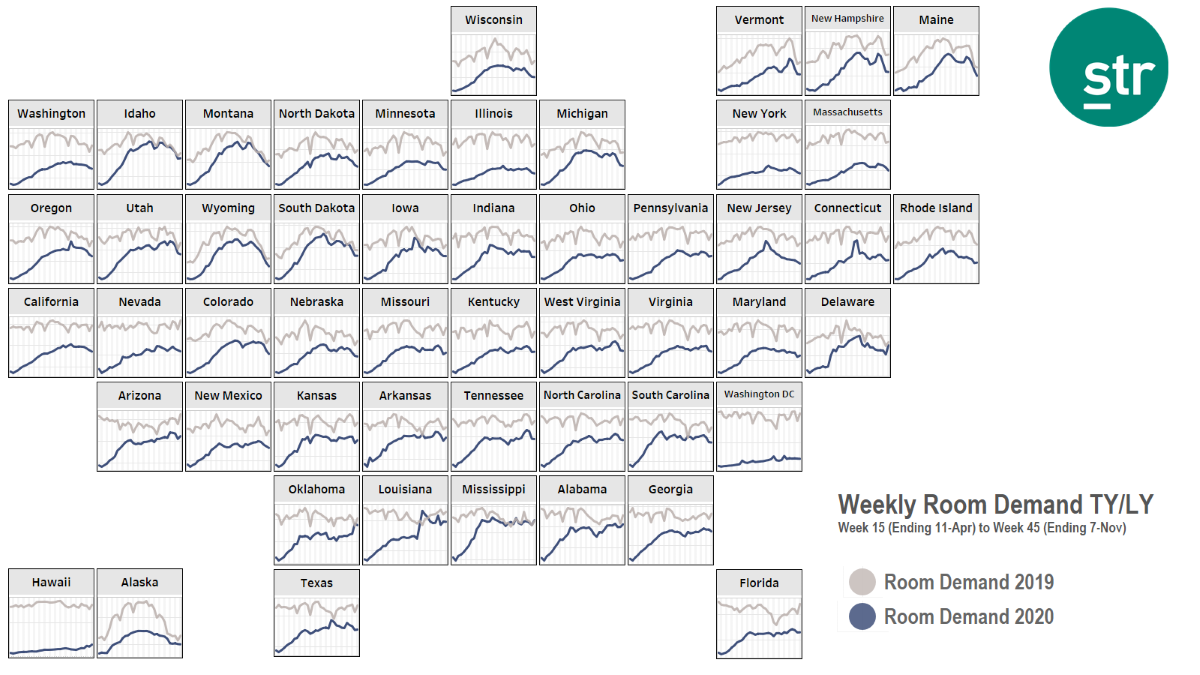

STR’s latest 51-chart demand map through 13 March 2021 shows that most states are moving closer to their levels from the same time last year. Unfortunately, those demand levels from comparable periods in 2020 were lowered substantially by the earliest pandemic lockdowns. A clear majority of states have made solid progress in shrinking the tremendous demand deficits that developed during the worst times of the pandemic. However, current bookings shortfalls from pre-pandemic times remain significant, particularly in a handful of states dominated by the largest urban markets.

Hotels in the Middle East have shown resilience throughout the pandemic, with performance at higher levels compared to other parts of the world. Those higher levels have been highlighted by the region’s key markets. Dubai was virtually the only tourist destination open for international leisure travel, while Abu Dhabi hosted the International Defense Exhibition (IDEX) in person in late February 2021 with zero quarantine requirements for international arrivals.

Knowing you might not have time to watch our full webinars, we are pleased to continue our series of COVID-19 webinar summaries. In this latest edition, we talk performance in the Asia Pacific region. Demand gradually improving in Mainland China

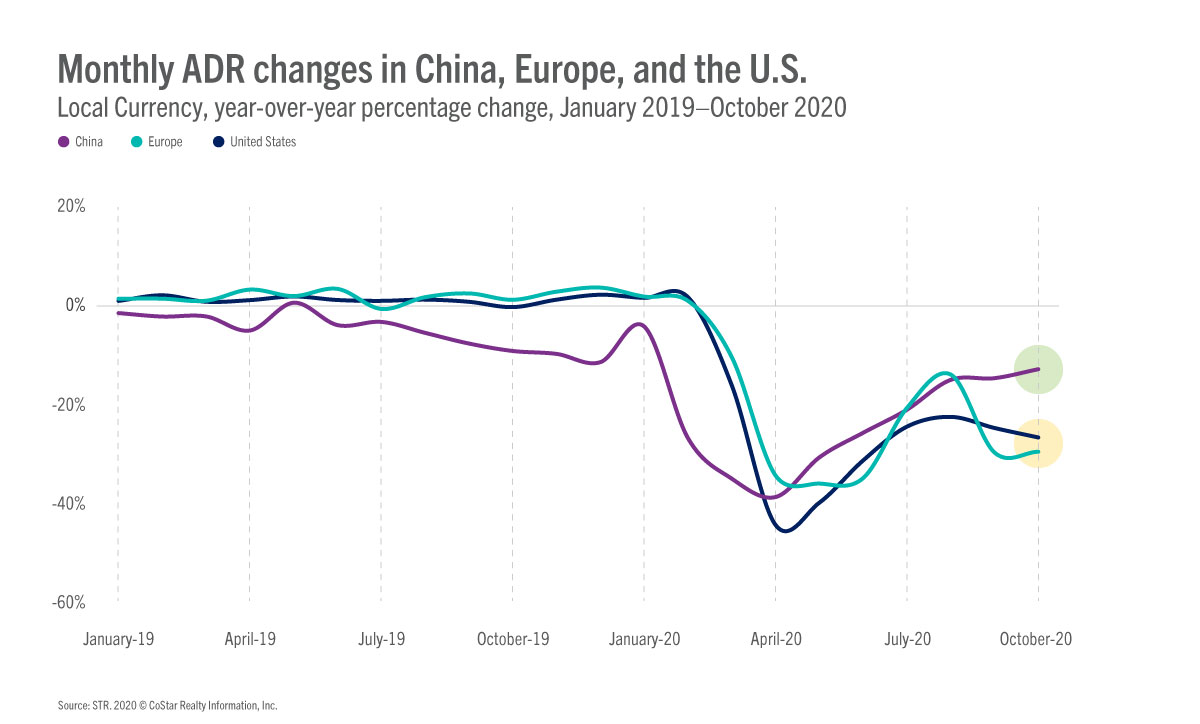

In April 2020, as part of the significant economic damage caused by COVID-19, hotel average daily rate (ADR) in China, Europe, and the United States dropped 40% below pre-pandemic levels. Since that point, rates in all three regions have improved, but hotels in China are much closer to reaching pre-pandemic ADR.

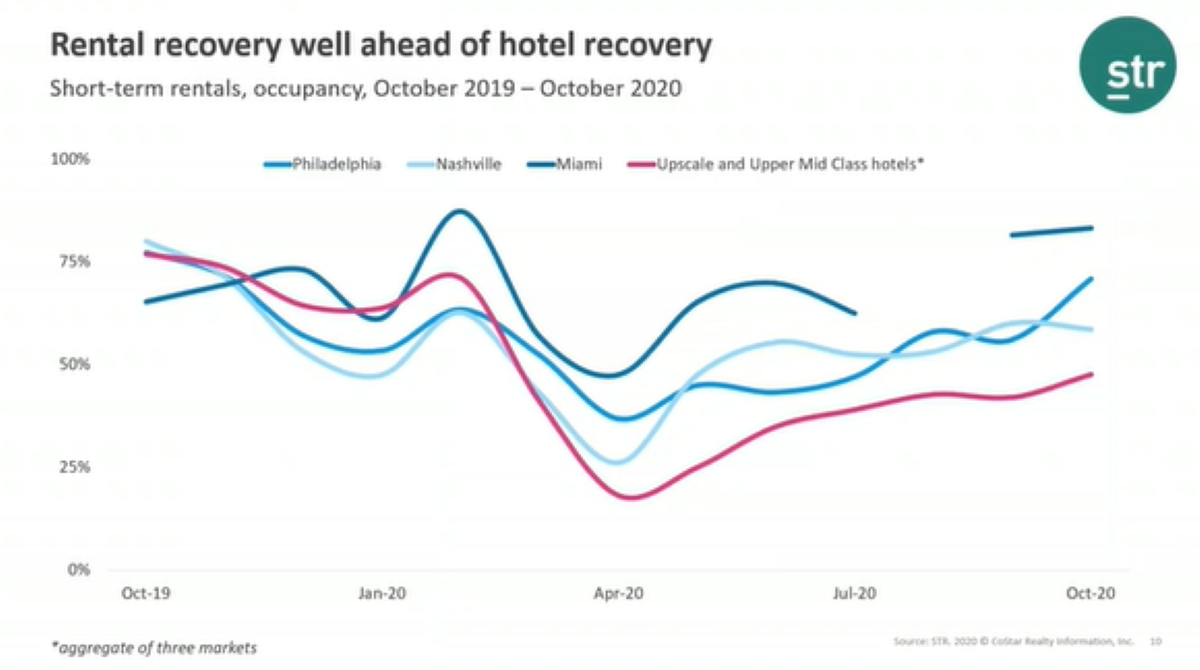

Knowing you might not have time to watch our full webinars, we are pleased to continue our series of COVID-19 webinar summaries. In this latest edition, we talk performance in alternative accommodations.

In a recent blog post, we covered how the summer months provided U.S. hotels with an increase in leisure travelers, a welcome change that lifted the industry from the pandemic performance lows of the spring. Naturally, we expected that leisure travel to dry up and overall hotel performance to retreat due to the return to school and a persistent lack of corporate and business travel.

Knowing you might not have time to watch our full webinars, we are pleased to continue our series of COVID-19 webinar summaries. In this latest edition, we talk performance in the Latin America region. Some markets heading in the right direction

Turkey’s hotel average daily rate (ADR) has grown exponentially in recent months despite the global pandemic depressing rates most everywhere else in the world. Globally the impacts of COVID-19 have weighed heavily on hotel performance, but in Turkey, several unique macroeconomic factors have aligned to impact rate over and beyond the effects of the pandemic.

Most of the U.S. continues to see a sizable gap in weekly demand when measuring this year vs. last year (TY/LY). After STR’s October update, 44 states experienced less room demand through the week ending 7 November (week no. 45 of the year).

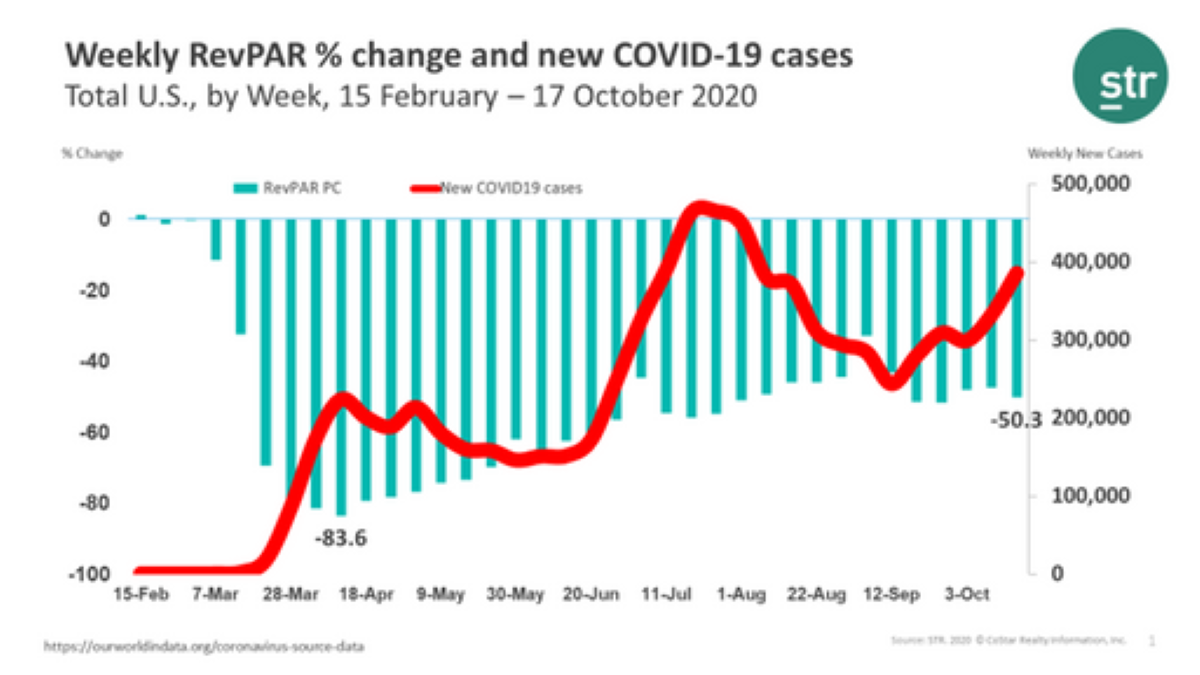

With new COVID cases on the rise and risk mitigation the name of the game, most companies will continue working from home and business travel will remain negligible, stymying further RevPAR improvement.

In late August and early September 2020, STR conducted quantitative research using STR’s Traveler Panel. We set out to examine attitudes to travel in this ‘new COVID world’ and to evaluate early experiences among travelers at a time when many economies were reopening and the industry was seeking to capitalize on pent up demand.

In late August and early September 2020, STR conducted quantitative research using STR’s Traveler Panel. We set out to examine attitudes to travel in this ‘new COVID world’ and to evaluate early experiences among travelers at a time when many economies were reopening and the industry was seeking to capitalize on pent up demand.

The twists and turns of the COVID-19 pandemic have contributed to seismic changes in tourism, which has included the cessation of international travel for some countries. As a whole, we have witnessed long-lasting shifts in consumer behavior and attitudes, producing an increase in active travel, soaring levels of e-commerce and, yes, even ballooning rates of pet ownership.

Major economies in Europe, including the U.K. and those in the Eurozone, recently confirmed what we already suspected. Economies across the continent have entered an economic recession because of the impact of COVID-19—an impact that has been devastating for the hospitality industry.