In this Placer Bytes we take a bite out of McDonald’s, dive into the data surrounding Yum! Brands and check in on The Cheesecake Factory.

McDonald’s

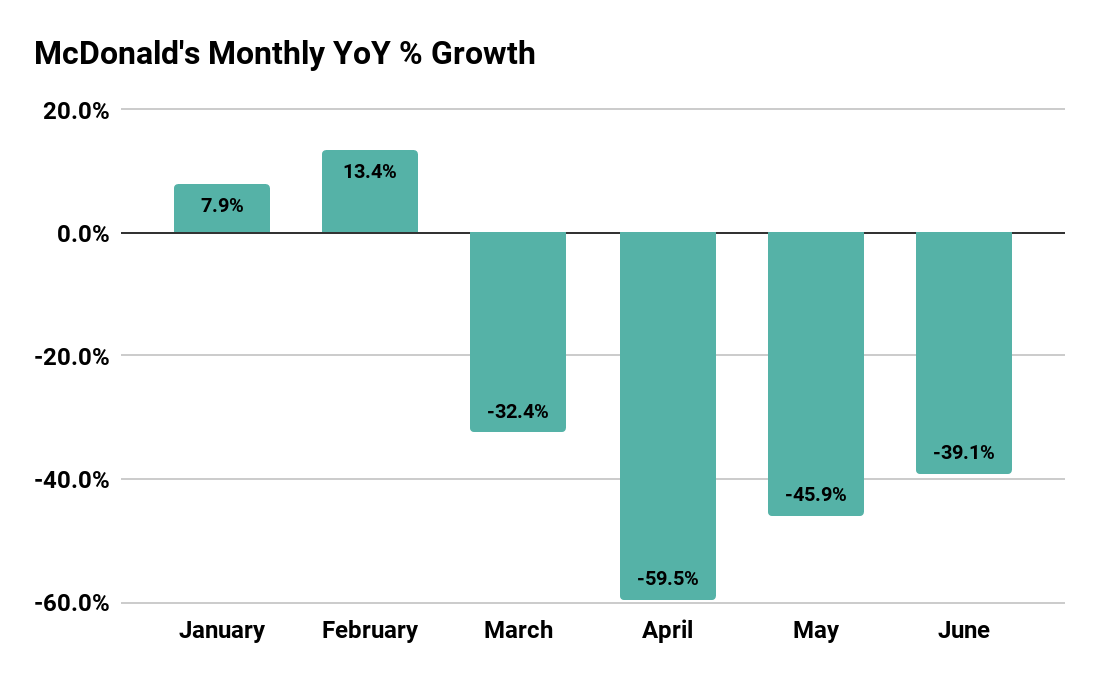

One of the top QSR players, McDonald’s had a strong start to 2020. Monthly traffic for the brand was up year-over-year 7.9% and 13.4% for January and February respectively. But as COVID hit, visits quickly decreased in March and dropped down to a year-over-year decline of 60.0% in April.

The recovery kicked off quickly for McDonald’s visits in the spring. May visits were down just 45.9% and June saw visits down 39.1% year over year. Although traffic was still down significantly, visits were showing signs of a return.

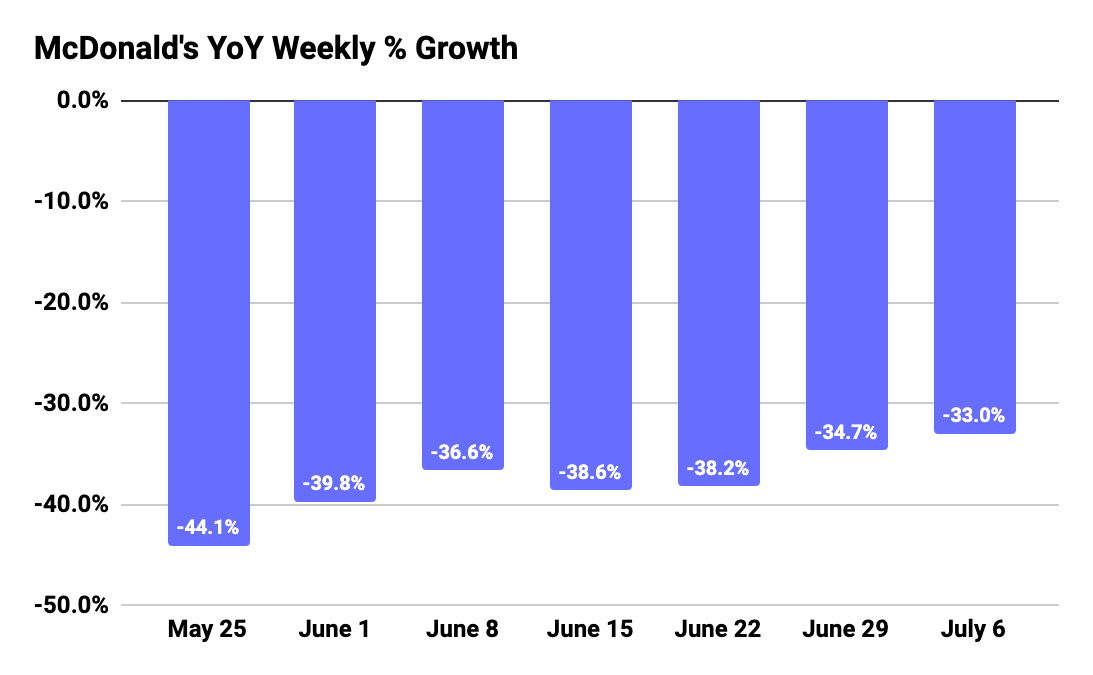

More importantly, the brand’s recovery pace was increasing. Almost every week, McDonald’s showed positive momentum, bringing it ever closer to “normalcy”. Visits for the week of June 29th, which included the July 4th weekend, were down 34.7%. While still a long way from 2019 numbers, this marked a 5.9% increase in visits compared to the previous week. And, visits for the week of July 6th were down just 33.0% year over year, the best mark since the crisis kicked off in March.

And McDonald’s is a uniquely interesting case considering it is heavily geared to morning commutes while also having a strong delivery and takeaway system. The wider economic recovery could play a huge role here, bringing commuters back to their routine morning coffee and breakfast sandwich. And with strong delivery mechanisms in place, its short term losses from in-store visits could be heavily mitigated.

Yum! Brands

Yum! Brands announced earlier this year that it would be shifting efforts to focus on more digital initiatives, and the hope is that this push will help mitigate losses from offline visits at least in the short term. But, even with digital enhancements the brands’s portfolio of restaurants which includes KFC, Taco Bell and Pizza Hut, has been hit hard with in-store traffic declines due to coronavirus.

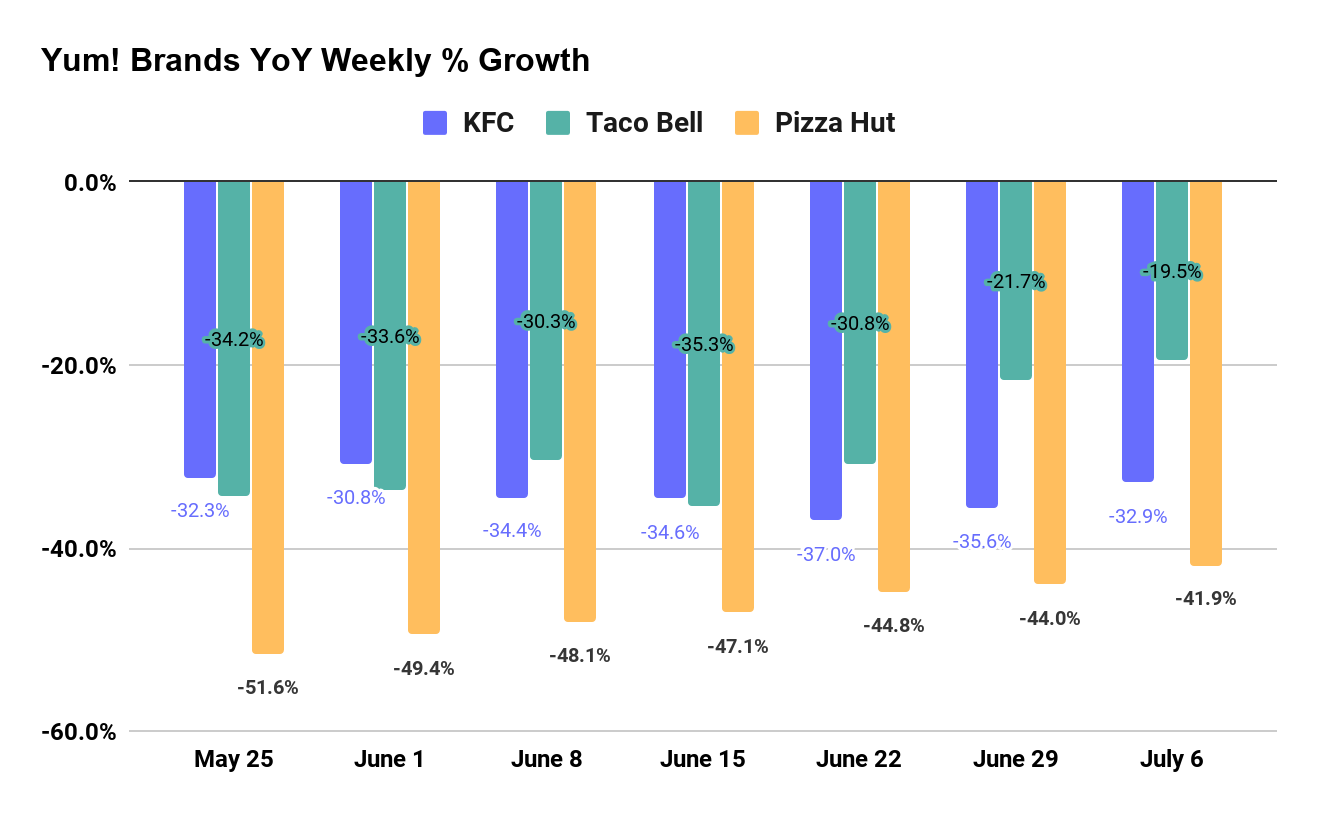

But when looking at the pace of recovery for all three brands, we see positive trends emerging. Pizza Hut is on a steady trajectory back to pre-COVID levels, with every week since May 25th bringing the brand ever closer to 2019 levels. Importantly, Pizza Hut may be the least reliant on in-store visits with the bulk of its attention being placed on delivery.

Taco Bell, a consumer favorite, is also bouncing back quite nicely – with visits for the week of July 6th down only 19.5% year over year. This is a huge step forward from visit declines of 34.2% the week of May 25th.

KFC, which recently inserted itself into the Chicken Wars conversation, is the only brand of the group that seems to be stagnating of late. Visits in May were down 32.0% year over year, a very impressive mark, but by June they were down 34.6% year over year. Looking at weekly visits, traffic the week of May 25th was down 32.3% year over year and over a month later they were down 32.9% year over year the week of July 6th.

Much of this stagnation after such a strong resurgence from lower levels in April may stem back to location. California, Texas and Florida are, by far, the states with heaviest distribution of KFC locations, something that becomes more problematic when those three states are also the center of a resurgence in COVID cases. So while the brand did show strength returning to this level, it is possible it will need to see a stronger health recovery before it can recapture 2019 numbers.

The Cheesecake Factory

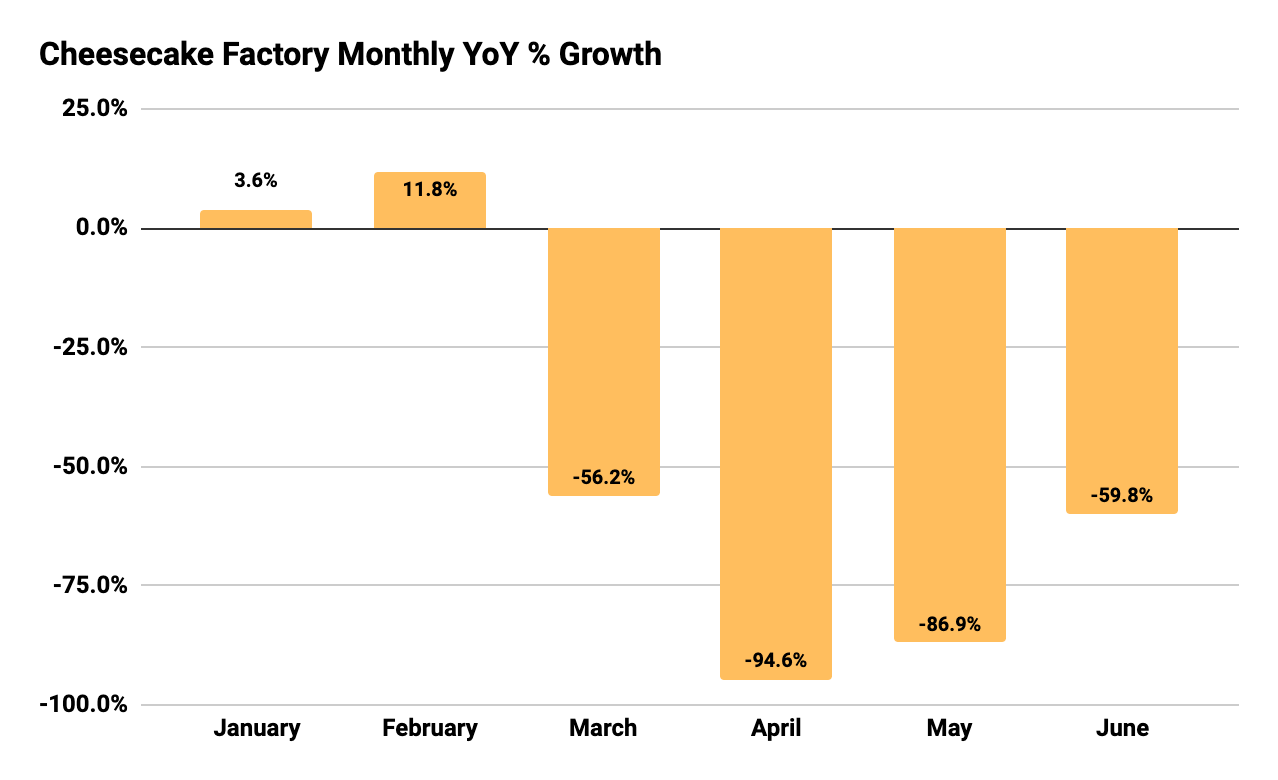

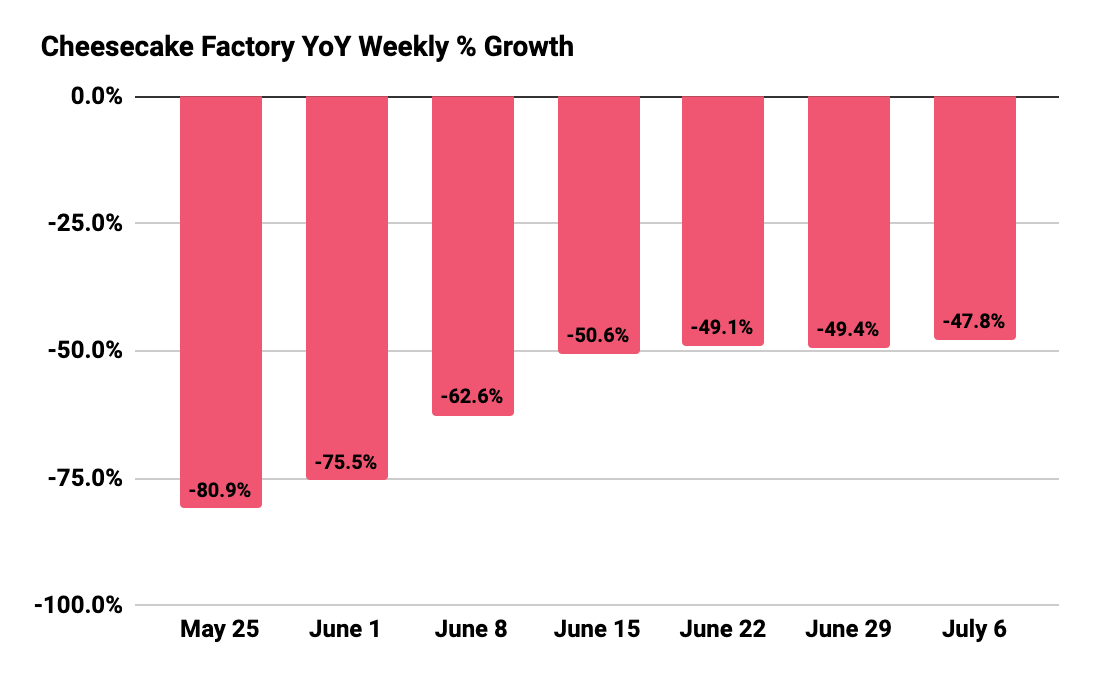

The Cheesecake Factory was off to a strong 2020, with visits for January and February up 3.6% and 11.8% respectively year over year. And, despite traffic bottoming out at 94.6% down in April, visits for the restaurant have been rapidly increasing. Traffic for June improved to 59.8% down year over year, a massive increase from May when year-over-year visits were down 86.9%.

And, all the more impressive is the pace at which the brand is bouncing back. Every week since May 25th, outside of the week of June 29th (which included a July 4th weekend), has seen an improvement in year-over-year numbers. Nonetheless, visits do appear to be plateauing though much of this may relate back to the resurgence of cases in key states.

Will Yum! Brands’s shift toward digital initiatives prove to be beneficial for its portfolio? Can Cheesecake Factory keep up its recovery pace? How will McDonald’s continue to perform with a consumer behavior shift away from breakfast and morning commutes?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.