In this Placer Bytes, we dive into Disney World’s reopening, Planet Fitness’s unique opportunity, and Best Buy’s stellar recovery.

Disney Reopening

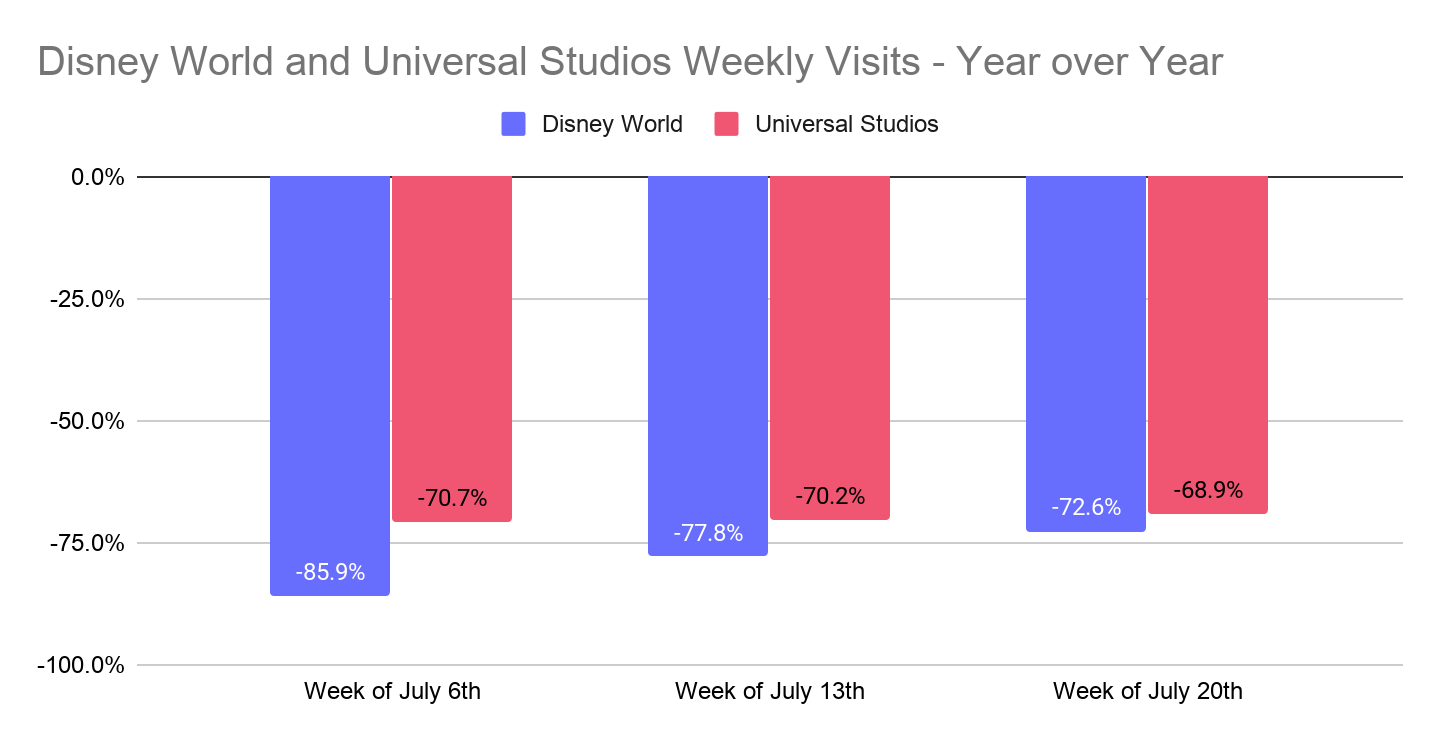

When Disney reopened in a hard-hit Florida, there was little anticipation of normalcy, but many felt the reopening failed to live up to expectations. Even comparing weekly visits to crosstown theme park rival Universal Studios saw Disney with larger gaps in terms of year-over-year traffic for the weeks of July 6th and July 13th. Yet, not only is the growth coming for Disney, but even the gap with Universal is also closing. By the week of July 20th, Disney visits were down 72.6% year over year compared to Universal visits that were down 68.9%. This is a significantly smaller gap than the week of July 6th, when Disney visits were down 85.9% to a gap of just 70.7% for Universal.

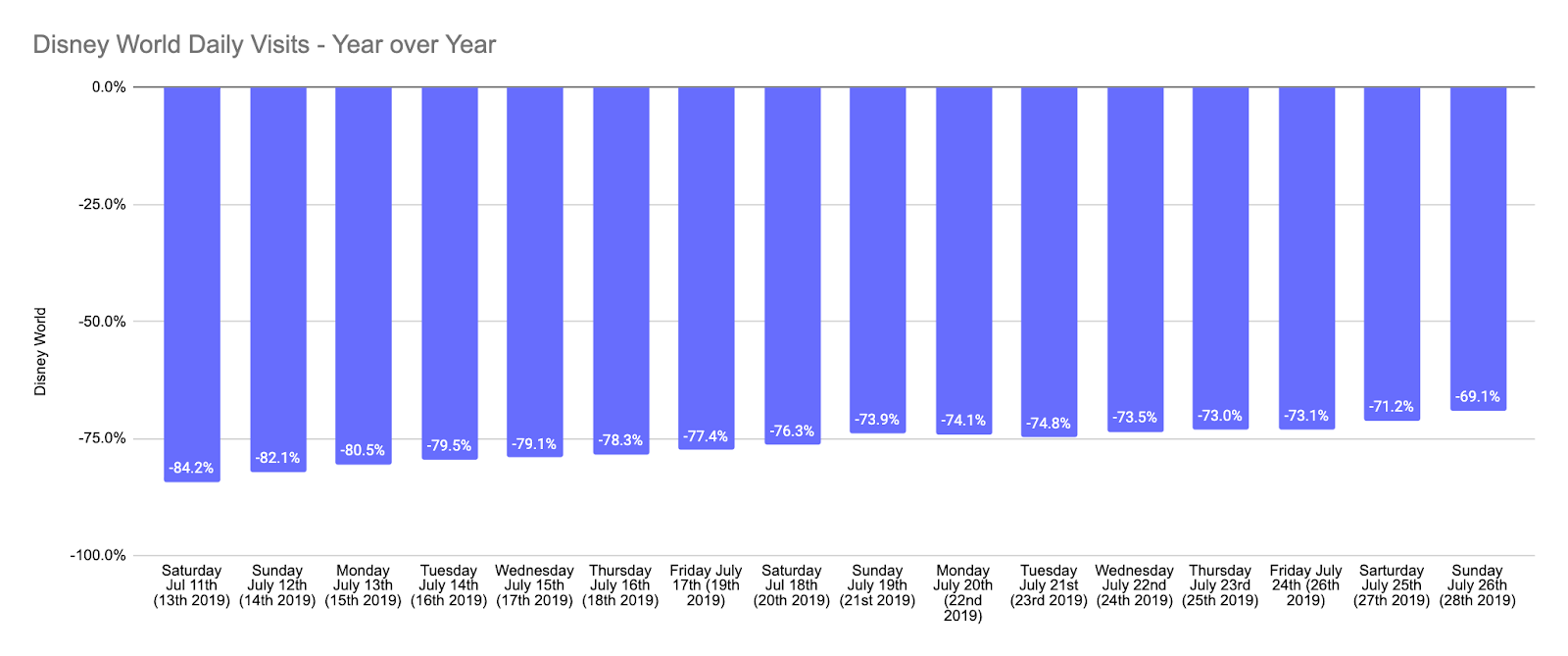

And Disney is seeing consistent growth. Daily visits on Sunday, July 19th saw a decline of 73.9% year over year, a huge step forward from the week before when Sunday visits were down 82.0%. And by Sunday, July 26th, that gap had dropped to just 69.1%. While the numbers are clearly not near ‘normal’, the ability to consistently grow this small audience to help mitigate losses could be a powerful sign of the theme park’s ability to rebound strongly as COVID concerns dissipate.

The Bull Case for Planet Fitness

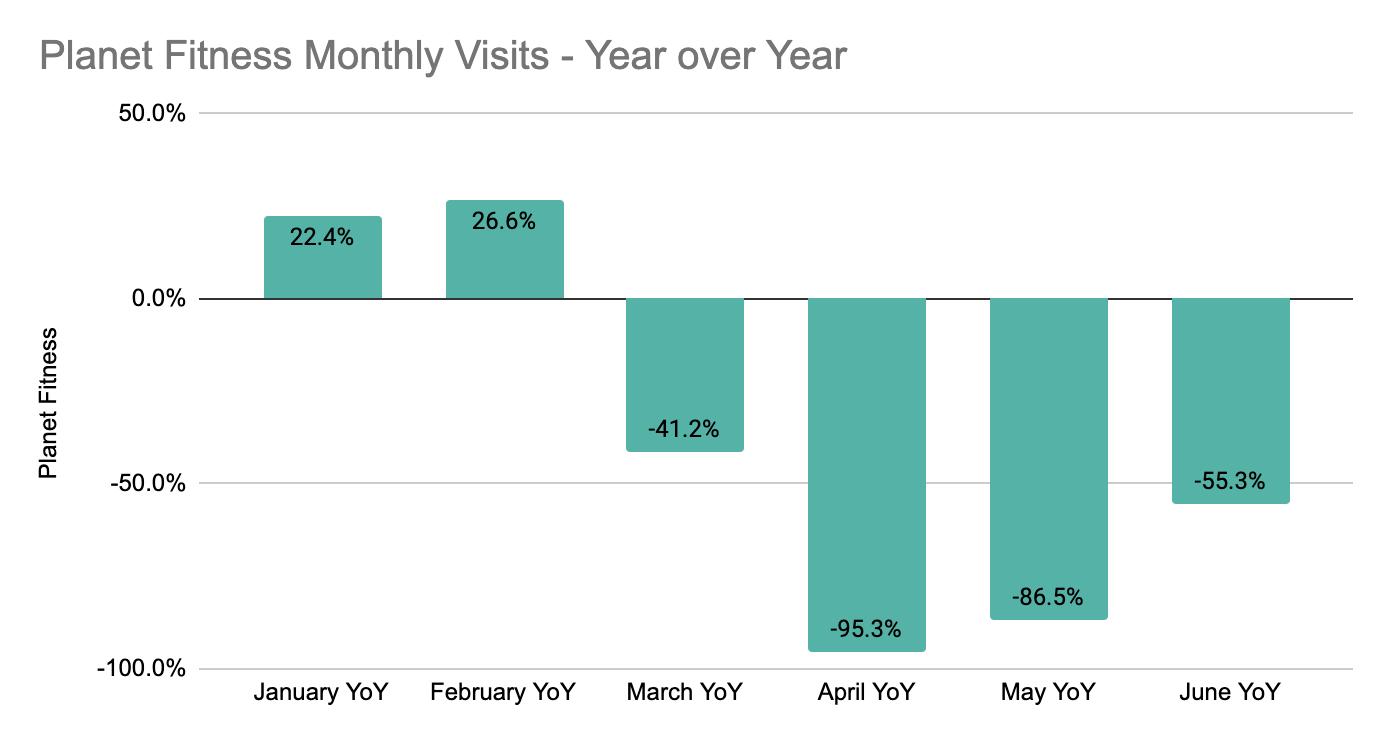

The wider fitness sector was hit very hard by the pandemic, but one brand that might actually benefit in the longer term is Planet Fitness. Prior to COVID, the chain had been on a tear with monthly visits up over 20.0% year over year in January and February.

And, July is looking even better with weekly visits down 48.7% on average, even with the resurgence of cases in key states. But the big kicker is the struggles of competitors. 24 Hour Fitness saw average weekly visits down 75.3% those same weeks and Gold’s Gym visits were down 50.7%. Much of this centers around store closures with both of the latter two announcing a significant number of shutterings. For both 24 Hour Fitness and Gold’s Gym, looking at data since the start of 2019, visitors were more likely to have also been to a Planet Fitness location than any other chain. This indicates that Planet Fitness could be best positioned to fill the void being left by these closures, giving them a unique chance to recover faster in the coming months.

Best Buy Surges Back

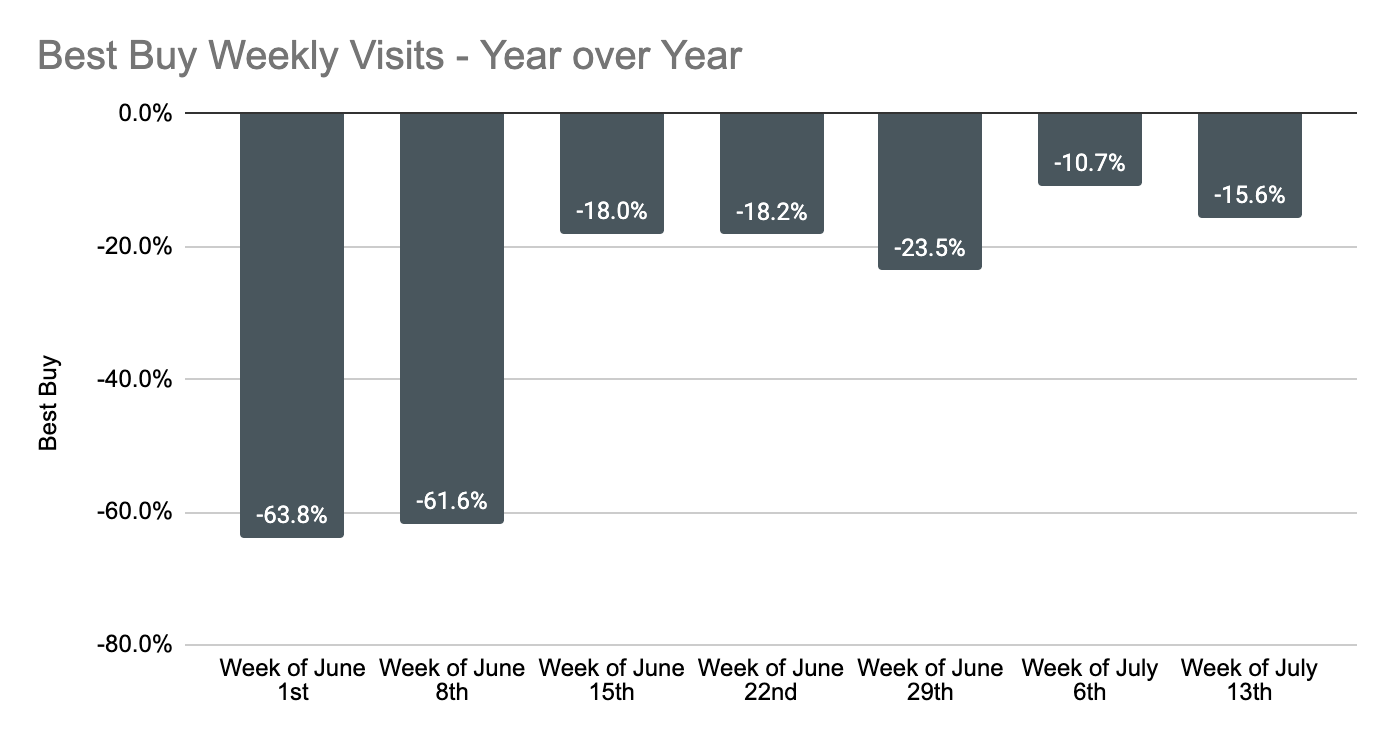

Best Buy is incredibly good at retail. After finding a channel for appointment-only visits that held visit rates at around 40% of normal levels in the early stages of the recovery, the brand opened its doors to a surge of traffic. The week of the reopening saw visits pull within 18.0% of 2019 numbers, jumping 98.5% on the week prior. And while there were minor dips, it is on par with the impact resurgences in COVID cases are having on other retail categories like superstores or shopping centers.

And the best might still be on the horizon with a critical back-to-school season dovetailing with a rise in the value and importance of the home office. Even the potential for college students to be working remotely could drive an increase in the need for at-home technologies.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.