Over the first seven months of 2020, trading of retail assets has crumbled by more than half across all the major Asia Pacific economies bar one – South Korea. Should the current pipeline of deals close by year end, Korea’s 2020 retail investment total will surpass last year’s tally and could potentially become Asia Pacific’s biggest retail investment market, breaking the lock on the top three spots typically held by China, Japan and Australia.

The buoyancy in sentiment tallies with the fact that South Korea was one of the few nations to have avoided a coronavirus lockdown, and safe-distancing measures have been comparatively modest as well. As a result, retailers have remained relatively unscathed. Average daily visitor traffic to shops, entertainment and supermarket outlets dipped in the first quarter, but only moderately, according Google’s Covid-19 Community Mobility Reports. By the second quarter, South Korea had reopened most of its shopping malls and retailers endured the least disruption of the 20 largest economies in the world, mobility data shows.

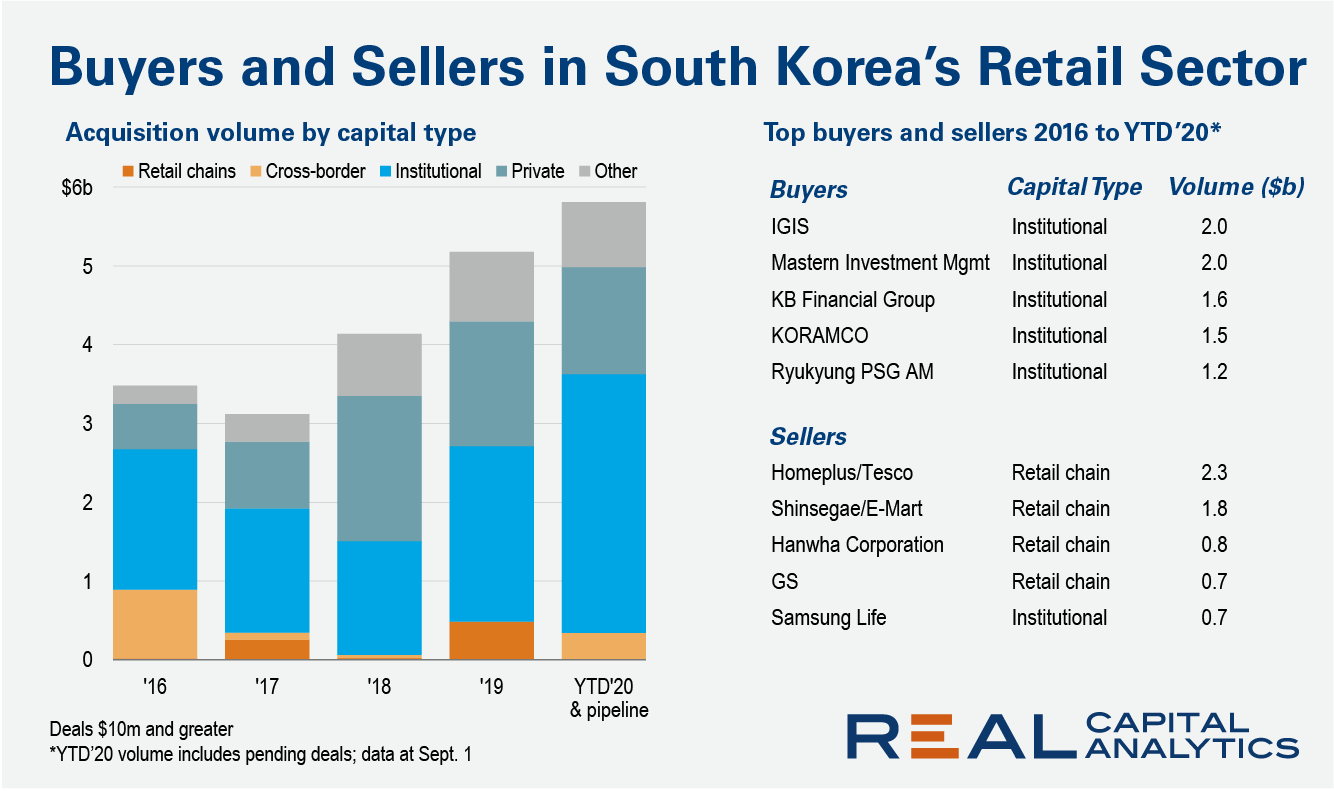

Another contributing factor has been the weight of domestic institutional capital chasing after real estate assets. With a relatively small REIT market to turn to, retail investors have parked their capital with Korean institutional real estate funds, giving them even more firepower to spend. Institutional buying of retail properties grew over 50% to reach $2.2 billion in 2019, and looks on track to replicate that growth again this year.

Notably, there has been one group of investors absent from the flurry of buying activity. Retail conglomerates, which operate various shopping mall and outlet chains, were active buyers in the first half of the last decade, but turned net sellers in the second half. Retailers made up four of the top five sellers of retail malls in South Korea in the recent past.

Atop the list of sellers sits Homeplus, the rebranded retail arm of British retailer Tesco, which was bought by private equity firm MBK Partners in 2015. While most of the major retailer disposals since 2018 were leaseback deals with domestic institutional buyers, the notable exceptions came from Homeplus selling off stores planned for closure in Bucheon, Daejeon and Ansan.

Like Homeplus, most of the other malls sold by retailers have also been outside of the Seoul metropolitan area. With retail traffic still flowing, sellers have been unwilling to let go of their most liquid assets within the capital at a discount. This means that pricing of retail assets in South Korea has held up so far this year.

In contrast to declines for the other major markets such as Australia, China and Singapore, retail pricing (as measured by the RCA Hedonic Series price per square foot) has edged up 2% in South Korea over the first half of 2020. Still, with a resurgence in cases in Seoul at the start of August, the reintroduction of social distancing measures could spell a different outlook for the rest of the year in terms of footfall, investment volumes and price growth.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.