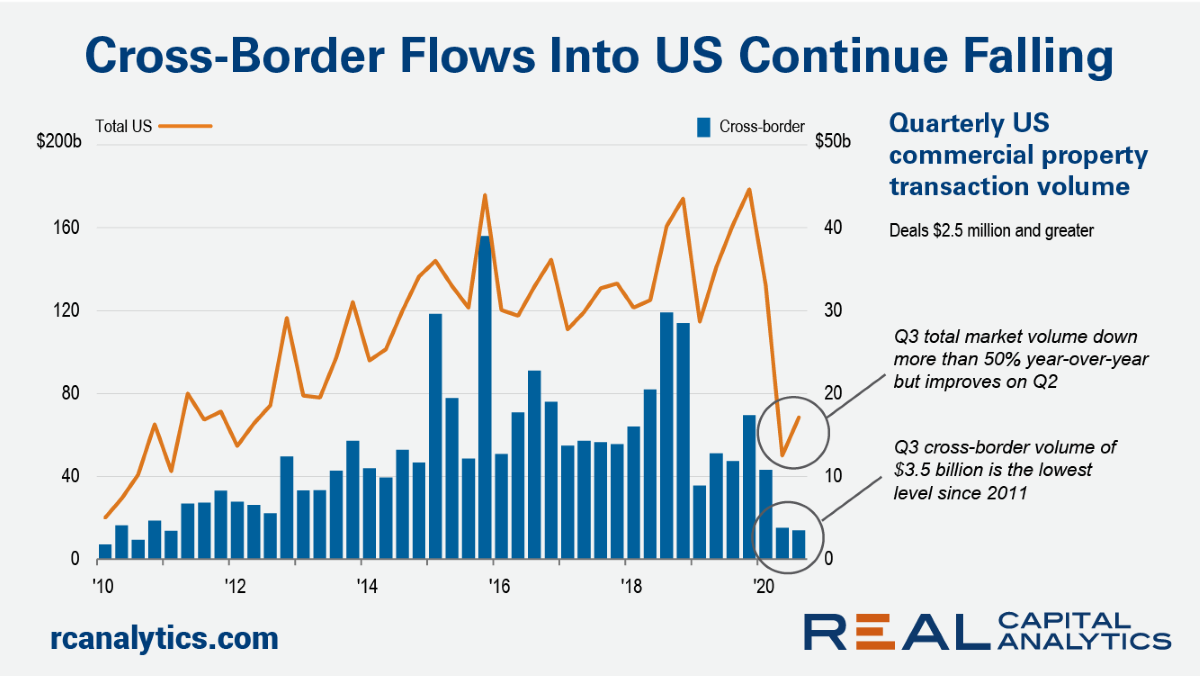

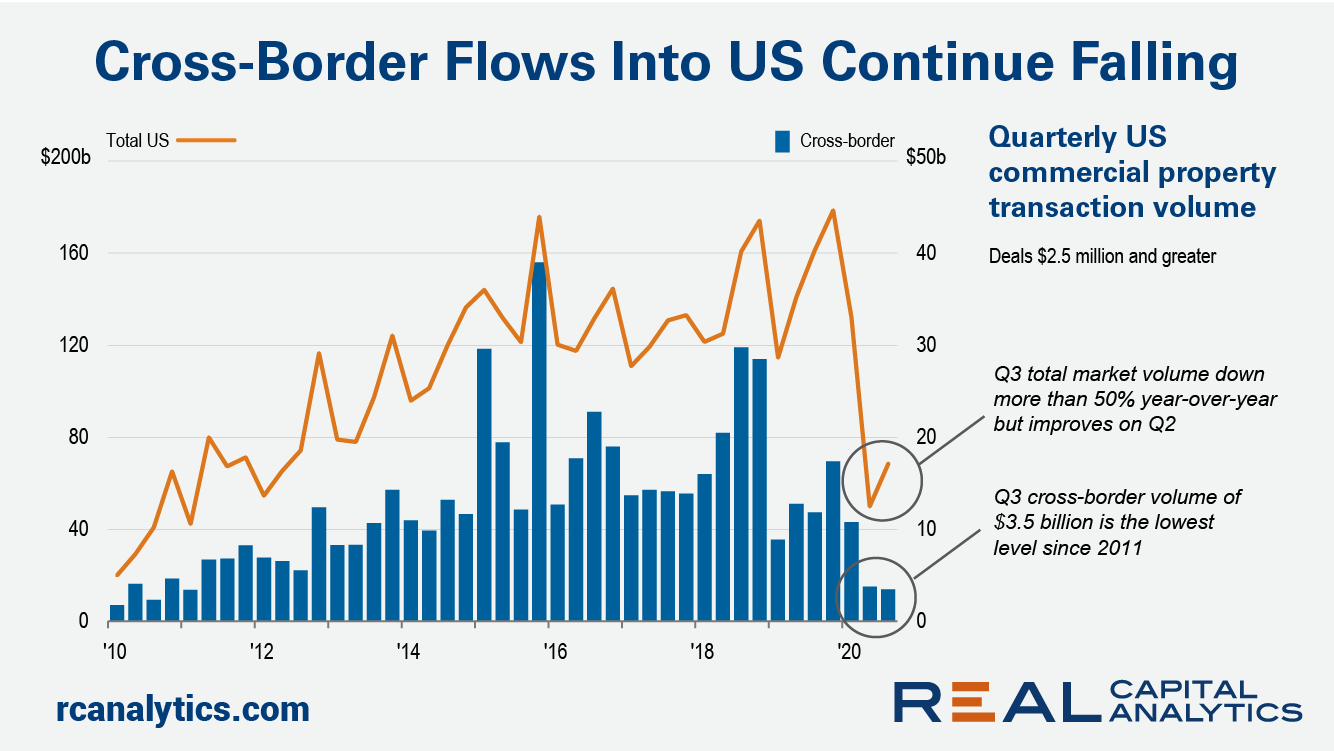

Total U.S. investment activity improved to some degree in Q3 2020, with sales volume up more relative to Q2 2020 than normal seasonal patterns would suggest. Not so for cross-border investment. Deal volume for cross-border buyers edged lower in the third quarter.

Cross-border investors were behind $3.5 billion of deal volume in Q3 2020, down 71% from the level of Q3 2019. Still, this third quarter level is better than the low of $0.5 billion seen in the depths of the Global Financial Crisis.

Cross-border investors are usually focused on particular types of properties. These investors have large amounts of capital to deploy, and while cap rates might look fantastic in areas like suburban Tulsa, for example, the types of properties these investors pursue are not often found in smaller markets. The issue is one of economies of scale, with cross-border groups finding it easier to purchase larger properties.

Looking at U.S. sales volume by the size of the deals involved, the sharpest declines have been for the largest transactions. Sales for assets priced greater than $50 million fell 61% year-over-year in the third quarter, versus a 39% year-over-year pace of decline for properties priced $5 million and below. Local investors and especially private capital sources are more focused on this smaller end of the market.

Deal activity on the larger end of the spectrum is always more volatile than the market overall, with higher highs and lower lows for rates of growth. Cross-border investors operate in this more volatile segment of the market, helping to explain at least some of the lack of a rebound in third quarter deal activity. A rebound, however, is not in the cards so long as the Covid-19 pandemic restrains international travel.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.