As consumers navigate through a pandemic-defined holiday season, we took the opportunity to dig into the start of this season’s behavior utilizing our spend, foot traffic, and retail pricing data, as well as our newly launched income data. Our analysis is an overview of sales data to date* this season. We will be evaluating the full holiday performance after the New Year.

Black Friday is traditionally associated with shoppers flocking to brick and mortar stores for blockbuster deals. However, this year online sales as a percentage of total purchases surged, suggesting shoppers mostly stayed home. Notably, 57% of Apparel & Accessories and Department Store sales occurred online during the Thanksgiving shopping period ended the following Wednesday, up from 46% in 2019.

In anticipation of DoorDash’s IPO, we reviewed statements made in the company’s S-1 and compared them with our spend data of millions of de-identified US consumers. In-line with what’s referenced in the S-1, our data shows DoorDash captured nearly 50% of the food delivery market, an impressive \~35 point increase since January 2018. Grubhub was the primary victim, with its share going from 49% to 19% over the same period.

In anticipation of Airbnb’s IPO, we reviewed statements made in the company’s S-1 and compared them with our spend data of millions of de-identified US consumers. We’ve also added an appendix with a backtest of our data against the company reported GBV. Please reference for detail on biases and alignment with our data.

As we head into the holiday season, the health of the newly acquired COVID shopper is top of mind. With the pandemic driving shoppers online, the retention and significance of this newly acquired cohort has become an increasingly important question.

November 16, 2020

/

Business

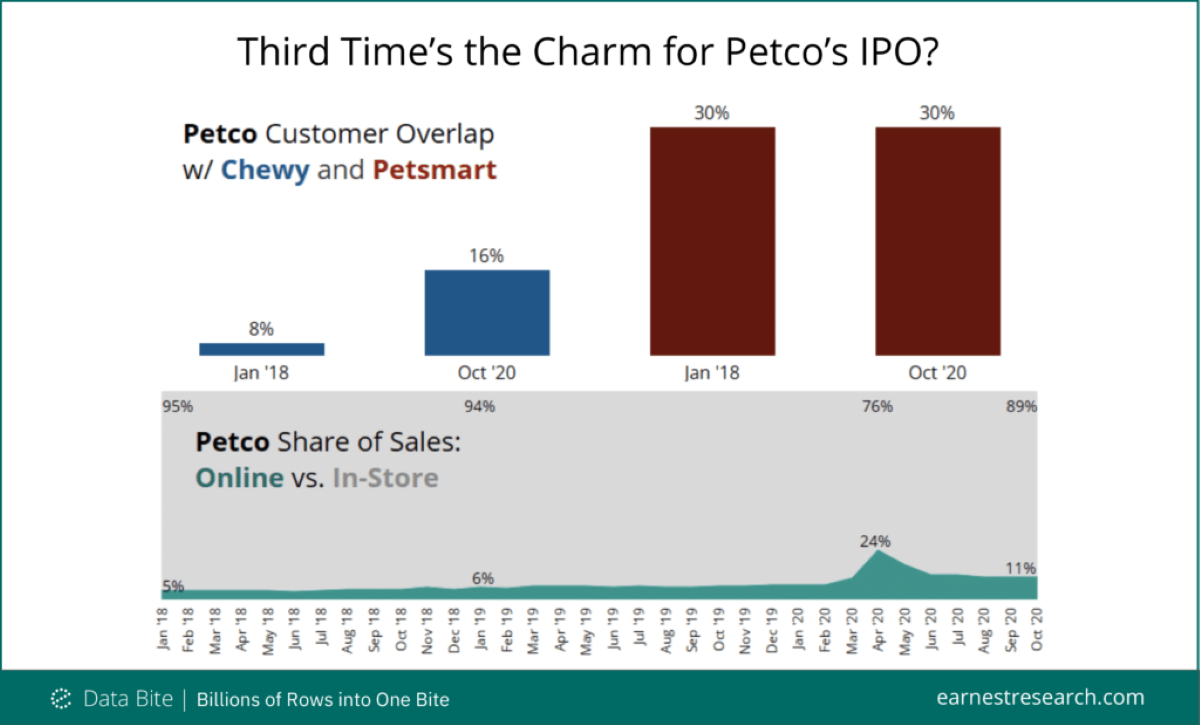

Petco’s IPO

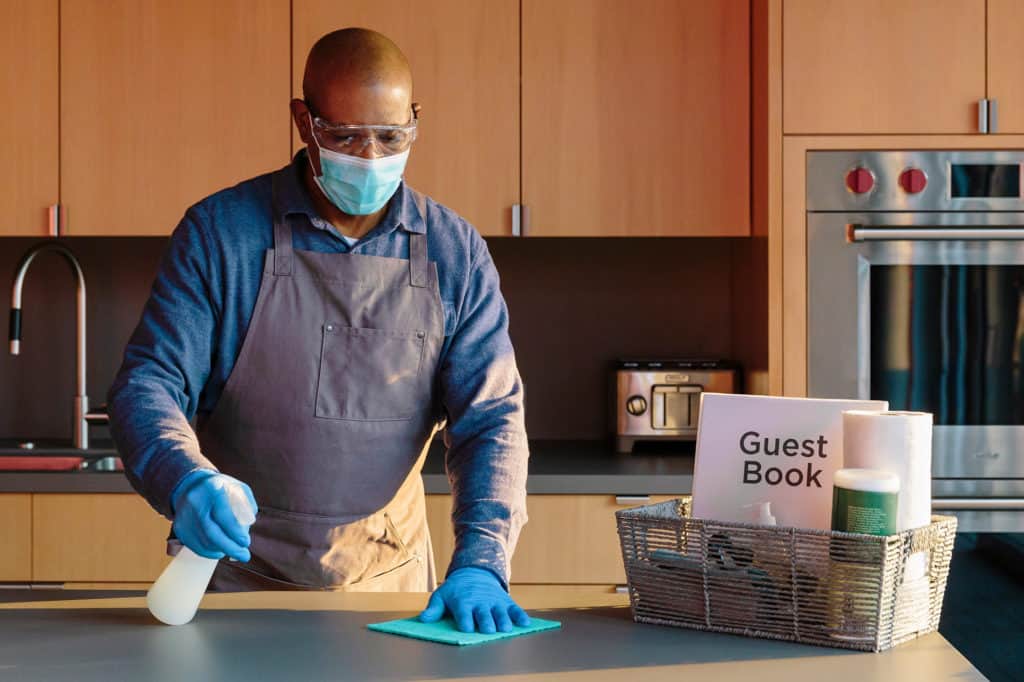

With news of Petco planning to IPO (again) we looked at how they’ve performed against their main competitor, PetSmart. It’s interesting to note that the overlap of Petco shoppers also shopping at PetSmart’s online-only brand Chewy—while doubling from Jan’18 to Oct’20—is still relatively small at 16%

The COVID-19 pandemic has done more than change consumer habits; it has resulted in a mass migration out of urban centers across the country. Using our Foot Traffic data, we analyzed migration patterns in and out of cities before and during the pandemic to understand just how this exodus occurred.

In anticipation of Academy Sports & Outdoors’ upcoming IPO, we analyzed the retailer’s market share, channel performance, the impact of its geographic profile, and shopper cohorts including recipients of the federally granted stimulus check. Additionally, we looked at sporting goods’ wallet share among Academy’s most vs. least loyal customers. Here’s what we found.

We have refreshed our back to school (B2S) analysis (read Part One) now that the full season is behind us, and added a detailed analysis on discounting and average selling price (ASP) trends utilizing our newest Retail Pricing data. This web-sourced sku-level dataset will be featured in our upcoming product Earnest Retail Pricing, which tracks retailers’ pricing and discounting trends, providing insight into gross profit margins.

The overall distribution of consumer traffic (inclusive of all sectors) during COVID has seen morning and evening activity slow, picking up by midday. Midday (11am-3pm) share of traffic has increased about 400 bps to 33% since the middle of March. As a result of this shift to the middle of the day, weekday visits to restaurants now more closely align with visitation patterns previously seen during weekends.

Earnest continues to monitor the consumer response to the resurgence of coronavirus cases across parts of the U.S. In this refresh, we take a look at spending and foot traffic in the first half of July across states and categories, and drill-down into Restaurant and Home categories in Florida and New York. Additionally, we provide a brief check-in on Amazon’s delayed Prime Day, and review how alcohol sales are performing in light of the resurgence.

After months of wild spending patterns, June saw some signs of normalization with Restaurants, General Merchandise, and Grocers returning to growth profiles of low single-digits. But the virus has now resurged. The last week of June saw a material slowdown in spending growth, particularly in the lockdown-driven sectors; Ecommerce and Home categories slowed 20 points WoW, and General Merchandise and Grocers slowed 10 points to a 5% YoY decline.

After two months of closure from coronavirus concerns, Las Vegas officially opened back up on June 4. Using Earnest Foot Traffic data, we examined the first two weeks since the city’s reopening to better understand its road to recovery, regional dynamics, and local vs. tourist behavior. In aggregate, foot traffic to Nevada casinos remains down 60% YoY, and while still improving, the data is seeing growth plateau.

Along with the Nasdaq, many eCommerce and online focused businesses soared during quarantine. The thinking was that these businesses were either gaining new customers or were getting existing customers to spend in new ways. The belief was that when quarantine ends these gains would become permanent. If these gains aren’t permanent and the sales bump was only driven by hoarding behavior or other one-time purchases, this shouldn’t drive stocks higher since it will not add to long term company earnings.

As of June 1st, nationwide spending growth improved over 20 points from trough. While the stay-at-home orders for all but five states expired*(DC, NJ, OR, PA, VA), retail activity is still reopening at varied phases in different regions across the country. As a result, spending improvements have continued to stagger and look different across states.

Earnest continues to monitor consumer behavior as state economies reopen across the country. In this refresh, we look at state performance in the context of stay-at-home orders expiring, foot traffic divergences across categories, a Texas drill-down, and how spending by channel is behaving in a staggered reopened economy.