In previous outputs we have looked extensively at how footfall across UK urban centres has changed in response to Covid-19, and more recently at how catchment areas have undergone similar transformation over the same period. In this analysis we use our mobile geo-location data to explore how dwell time – the duration of visitors to high-streets and town centres – has changed in the past 14 months and contrast those differences by income group.

Footfall across Europe’s clothing, hospitality and leisure industries has fallen by almost a third so far in February amid a broader consumer sector decline as the continent faces a new wave of the virus. All in-store activity indices are pushing lower as reports of tightening restrictions and slow vaccine roll-out appear to be hitting consumer confidence and mobility according to data from Huq Industries.

The European defence industry is making a strong recovery from the effects of the pandemic as worker activity reaches its highest level since the outbreak began. On-site staffing has reached over 70 percent of pre-Covid 19 figures, and are continuing to rise ahead of the wider European industrial sector.

Transits through British ports have climbed back to pre-Brexit levels and delays are showing signs of creeping down. Levels of traffic dropped by more than a quarter after the trade deal was struck and delays jumped by 15 per cent as port officials struggled with the new rules, according to Huq Industries high frequency index. But freight volumes have risen back to 94 per cent of normal levels before Covid-19 – roughly equal to their pre-Brexit levels – and they appear to be still rising.

Footfall across British clothes shops has been lower than the rest of Europe for the entire pandemic as tough lockdown measures push customers to online retailers. While footfall across UK clothing retailers has flatlined during this second lockdown, it’s significant to note that equivalent levels in Europe have been tracking at 30pts since early December.

The impact of the pandemic on the travel industry, and aviation in particular, is laid bare in mobility data showing how outbound trips from the UK reduced by 75% throughout most of last year. High frequency data from Huq Industries shows how total trips abroad fell significantly during the first lockdown and have never recovered – currently languishing at 25 percent of 2019 levels.

The pandemic has touched all parts of society. But as new data from Huq Industries shows, the effect has been felt unevenly and particularly in respect of different socio-economic groups. We are all encouraged to stay at home where possible, and to limit our movements and social interactions. To that end, the chart below offers a measure of footfall into town and city centres across the UK, broken out by income group tercile.

As reported in today’s Financial Times, traffic through UK ports remains a quarter down on the levels seen pre-Brexit with delays up nearly a fifth. But levels associated with Brexit are muted in comparison to those seen during the first wave of the Covid-19 pandemic.

Britain’s battered pub and restaurant sector is staring at its worst period of the pandemic as footfall flatlines for more than a month. The Huq Index for Restaurants & Pubs fell sharply post December 10th, and has stood at 5pts since January 9th – down 4.6pts in the last 30 days and little discernible movement in the last seven. Of the three constituent sectors, Pubs, Restaurants and QSR, Pubs have been the worst affected – reading less than 1pt over the equivalent period.

The charge to produce vaccines and treatments for the Covid-19 outbreak is reflected in the relative strength of productivity across biotechnology research and production facilities, compared with its wider industrial peers.On the 26th January, Biotech came within -9.2% of year-on-year levels – averaging 83.2pts for the month of January. By contrast, on Jan 23rd Huq’s European industrial average fell 41.5pts behind year-on-year levels, averaging 71.8pts for so far this year.

Mobility levels in the big northern cities failed to recover to their pre-pandemic levels following lockdown in the summer, in contrast to their southern counterparts new data shows. Footfall in cities across the North and South dropped to just above half of their usual levels during the first lockdown recovered over a period of 8 weeks, according to Huq Industries’ high frequency mobile data.

EU residents are returning to their places of work after the Christmas break but UK staff appear more constrained, less enthusiastic – or both. The latest data from Huq Industries puts European office workers 7% ahead of their UK counterparts in the 20 days since the year began, and that gap is widening still.

Footfall across the UK’s biggest supermarkets has fallen by 51 percent in the last year despite their essential retailer status and booming food sales. The big chains reported record sales during the Coronavirus pandemic and festive season claiming consumers treated themselves to luxury items to get them through the lockdowns and to compensate for the closed hospitality industries.

Foot traffic on London’s Oxford St paints a positive picture of what may come as pedestrian traffic touched pre-Covid levels between lockdowns ahead of Christmas. Having regained 80%+ of previous levels for much of the summer, the Indicator fell sharply during Lockdown #2 before peaking at 98pts ahead of Christmas on Dec 9th.

In the nine days since the Brexit transition period ended, high-frequency data from Huq Industries shows journeys through UK ports down 26% on January 2020. At the same time, the time spent transiting through UK ports has risen 10% since December 31st to read 112.6pts.

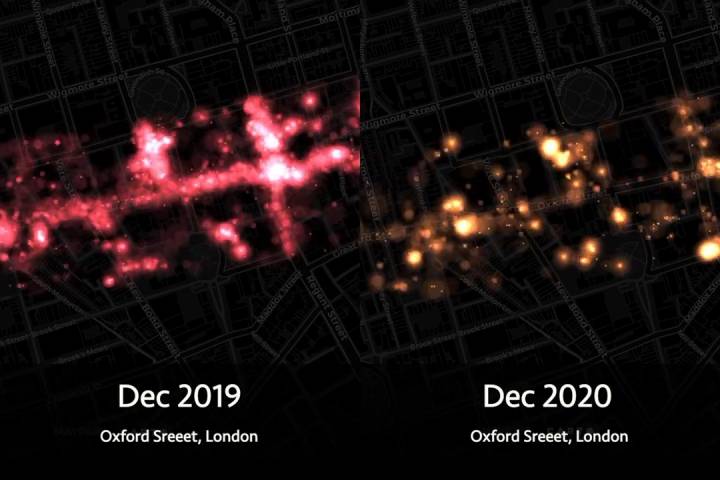

With the festive season behind us and the new year begun, Huq looks back at high-street footfall during the Christmas shopping period between December 15-24th for Oxford Street, London and the Grand Vía, Madrid. We often provide outputs from our geolocaton dataset in the form of a time-series index as this is one of the most effective ways to highlight the information contained within the underlying mobility data.

Elf presence across Christmas workshops in Lapland has reached a new high today, with The Elf Index showing a significant rise in Elf productivity over the course of the last week.

Workplace attendance in the UK is nearing zero as the second national lockdown and subsequent tired system sends employees back to the home office. The number of people going into work had reached a similar low in April / May before gradually returning to almost 40% of YOY levels by the Autumn

Movement through UK ports fell by some measure over the last month, as reports show ‘gridlock’ at container ports such as Felixstowe, Southampton and London Gateway were experiencing reduced access. Happily for the businesses that import / export goods however that trend appears to be recovering.

Footfall to UK restaurants has risen sharply following the end of the second national lockdown, but levels remain around a fifth of what they usually are at this time of year. The Huq Index suggests that the recovery of restaurant trade could be taking more of a ‘V’ shape than the gradual recovery seen after the first national lockdown ended on 4 July