March Madness is here and millions of viewers will be tuning into this year's NCAA Basketball tournament to cheer on their favorite team, or live out the heartbreak of an upset. And while many die-hard fans will be glued to their monitors, this tourney offers non-sports addicts the opportunity to flex their luck by participating in bracket pools with their friends and colleagues.

In today’s difficult and unprecedented times, taking care of our mental health is more important than ever. With online mental health therapy services like BetterHelp, TalkSpace and Cerebral, consumers have a variety of options to meet with a therapist and support their mental health anytime, anywhere. We took a look at how these services have adjusted their ad spend throughout 2022 so far, and may continue to shift their spending with current events.

After Antenna reported that Netflix is losing subscribers for the first time in a decade, some saw it as a sign that streaming services are on the verge of decline. But the data tells a different story. Premium streaming subscriptions have grown nearly 25% year-over-year, with 37.4 million new subscribers in Q1 2022. At the same time, streaming services lost 29.8 million subscribers — suggesting that customers are ‘churning’, or bouncing from one service to another.

Even with gas prices skyrocketing and COVID-19 cases surging once again, this year’s summer travel season is poised to be one of the busiest on record. AirDNA reports that the booking pace for travel this spring was 49 percent higher than the same time last year, and 26 percent higher than 2019’s pre-pandemic levels. Ads for booking sites reflect this, with the top brands in the Travel Booking Services & Travel Agencies category unleashing a tidal wave of ads on streaming services like Hulu, Pluto TV, Tubi, and Peacock.

Memorial Day barbecues are back and better than ever — and so are the ads. Food and beverage brands are firing up their social media accounts and serving up ads for tasty snacks and refreshing beverages to kick off the start of summer. And with nearly 60 percent of Americans grilling over the holiday weekend, advertisers who get their channel strategy and creative messaging right have a lot to gain. Let’s look at how three of the top advertisers in the Food & Beverage category — Hershey’s candy, Frito-Lay, and Blue Moon — spent their digital advertising dollars from the beginning of May through Memorial Day.

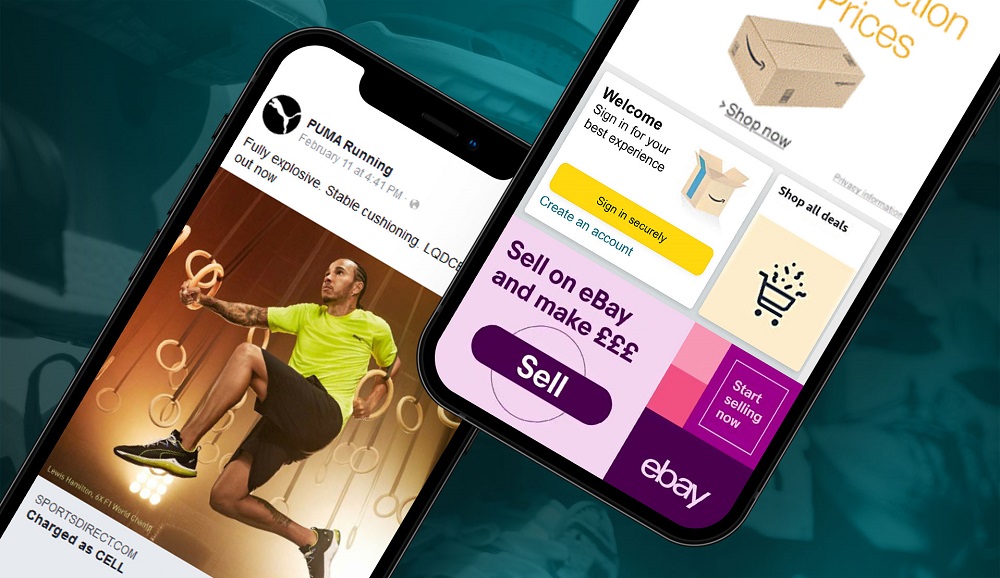

Snapchat started as a messaging app for close friends and has since evolved into a hub for users to stay up to date on the latest news and discover brands. Pathmatics now tracks and breaks out Snapchat advertising insights, which reveals that advertisers in the United States spent more than $250 million on the app in April 2022—and an average of $238 million each month between January and April. In our latest report, The State of Snapchat Advertising in the U.S., we analyzed Snapchat’s top 10 advertisers by digital ad spend and examined the Telecom, Food & Drinks Services, Sportswear, and Gaming categories.

Since TikTok introduced TikTok for Business, advertisers have been investing massively in the platform that has quickly become a household favorite among Gen Z users. Pathmatics now tracks and breaks out TikTok insights, which reveals that U.S. advertisers spent an average of $338 million per month on the platform—and more than $400 million in April alone. In our latest report, The State of TikTok Advertising in the U.S., we analyze how the top U.S.-based advertisers are spending and crafting their messaging on TikTok.

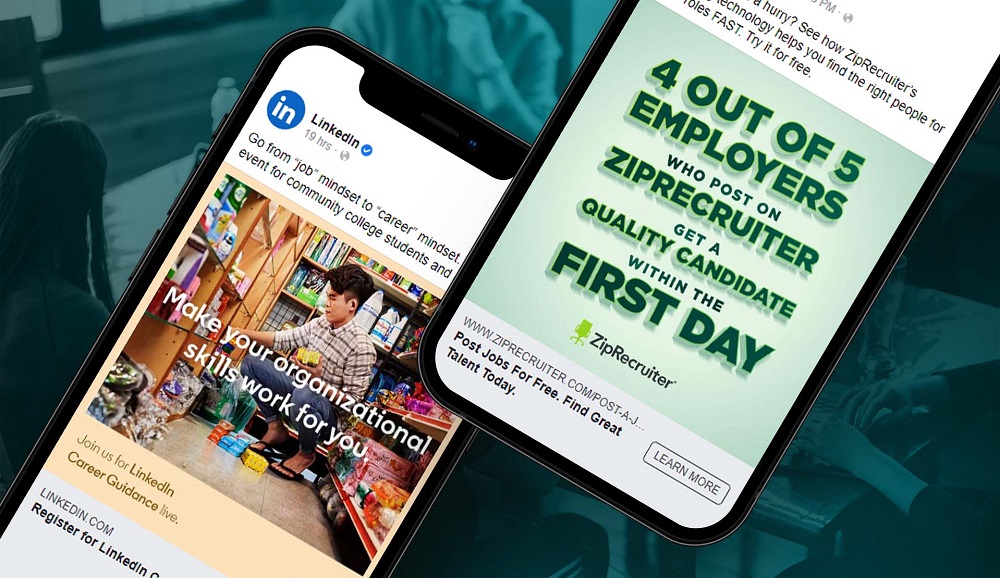

If you're hiring for an open position, gear up for another wild year. Job openings are at their highest level in years, and there simply aren't enough workers to go around. This is making it harder to fill open positions and forcing employers to get creative in order to attract talent. According to the U.S. Bureau of Labor Statistics, there were 11.5 million openings in the United States at the end of March. Voluntary separations are also up, with 4.5 million workers retiring or quitting their jobs in favor of a better opportunity. Many of these employees will turn to recruiting sites to find jobs that offer higher pay, better benefits, and more flexible work arrangements.

Snapchat and TikTok reach billions of millennial and Gen Z users every day and have changed the social media landscape for brands, advertisers, publishers, and investors. Today, we’re thrilled to share that ad intelligence for Snapchat and TikTok is now available in Pathmatics Explorer. Customers will have full visibility into how brands are including these platforms as part of their media mix, as well as how seasonal trends are affecting share of voice and creative strategies.

TikTok’s users aren’t the only ones singing DJ Khaled and Migos’ “major bag alert” in 2022. Since TikTok introduced TikTok for Business, advertisers have been investing massively in the platform that has quickly become a household favorite among Gen Z users. To that point, Pathmatics data shows that the top 10 advertisers on TikTok have spent more than $126 million on the platform between January 1 and May 1, garnering over 12.6 billion impressions. Let’s dive into the top advertisers on TikTok by ad spend and how they are building engaging ad content on the app to target their audiences.

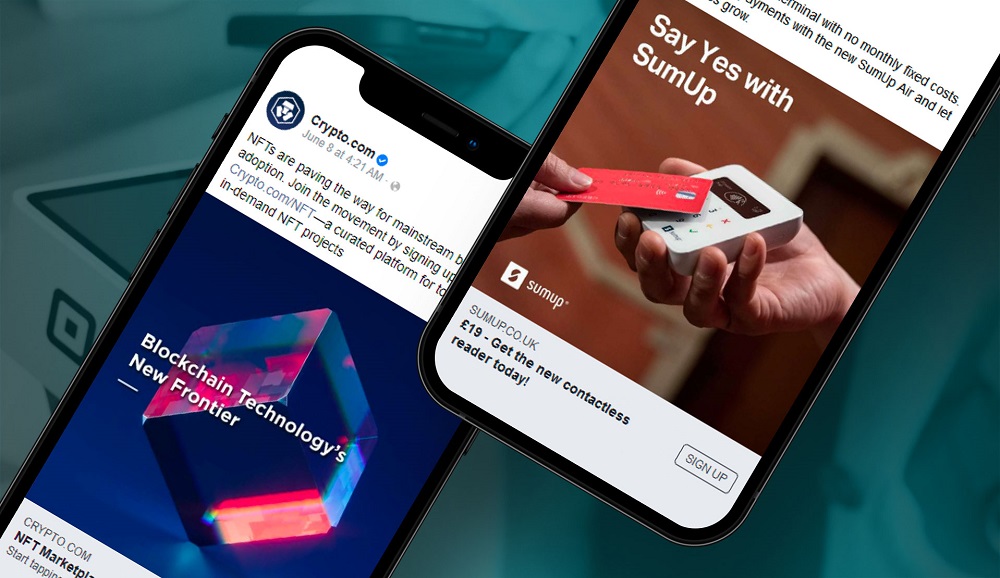

Digital advertisers in the fintech industry are paying up for creative spots. Pathmatics data reveals that in Q1 2022, PayPal, Starling Bank, and Lloyds Banking were the top three advertisers by ad spend. Our new State of Fintech Advertising report, available now as a free download, analyzes the top fintech trends and advertisers in the United Kingdom between Q1 2019 and Q1 2022. In the Point-of-Sale (POS) System & Services category, PayPal’s POS ad spending increased 570 percent from less than $2 million in 2019 to $13 million in 2021.

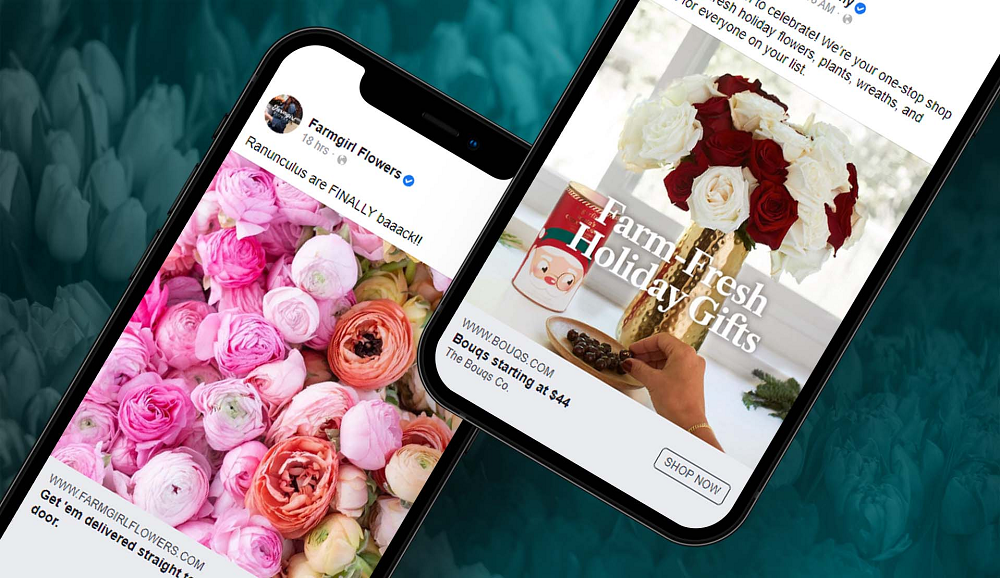

Spring is the time of year when plant shops are at their busiest. From February to May, florists spend most of their time creating flower arrangements and shipping plants for Valentine’s Day, Easter, and Mother’s Day. As such, spring represents a crucial time for plant shops to set themselves apart from the pack. That’s no small feat, given the number of plant startups that have been sprouting up online in the last few years, each selling the same proposition: better flowers delivered quicker.

While drivers feel pain at the pump, record high new and used car prices only add insult to injury. According to a CarFax report, listing prices for used cars in January 2022 were up 40 percent year-over-year. The ongoing global microchip shortage is primarily to blame. Auto manufacturers cannot get their hands on enough chips to keep production lines running, contributing to the sharp uptick in used sales. The biggest players in the used car marketplace have been tailoring their messaging to reluctant buyers and eager sellers.

While retail advertising took a hit in early 2020 at the start of the COVID-19 pandemic, ad spend has fully bounced back and reached new heights in 2021. Our new State of Retail Advertising report, available now as a free download, looks at how top retailers in the United Kingdom are adjusting their ad spend and creative strategies in such a competitive and ever-evolving market. Outside of a small dip at the start of the pandemic, investment in Retail advertising has grown steadily in recent years. In 2021, retail advertisers spent $870 million, an increase

Pathmatics data reveals that March’s top 10 advertisers spent more than $136 million on Hulu, Pluto TV, Tubi, Peacock, Paramount+, and other OTT streaming services, with creatives garnering more than five billion impressions. The month’s top three categories were Financial Services, Health & Wellness, and Auto, which ranked in the top three for the first time overall. Let’s see how the top 10 advertisers were spending on OTT in the last month.

The COVID-19 pandemic dramatically changed our personal care routines. With many of us spending more time at home and wearing masks when we go out, consumers are swapping out full-face foundation and concealer for serums, oils, and creams. That’s great news for skincare brands, but it’s unclear how this trend will change as normal life resumes. We do know that big skincare and personal hygiene advertisers Curology, Neutrogena, and CeraVe have all been increasing their ad investments since 2021, so let’s see what has changed and just how much they’ve been spending from January through the first week of March 2022.

As traditional linear TV consumption continues to decline, OTT streaming providers such as Hulu, Pluto TV, Tubi, Peacock, and Paramount+ have seen significant growth, making them a go-to for advertisers and brands to reach audiences as they cut the cord. Pathmatics now tracks and breaks out this unique data, which shows—at a high level—that U.S. advertisers spend a combined average of $1 billion per month in their effort to reach consumers via OTT channels. Our new State of OTT Advertising in the U.S. report provides an in-depth analysis of the latest advertising trends on OTT, including those in the Financial Services and Food & Beverage categories specifically.

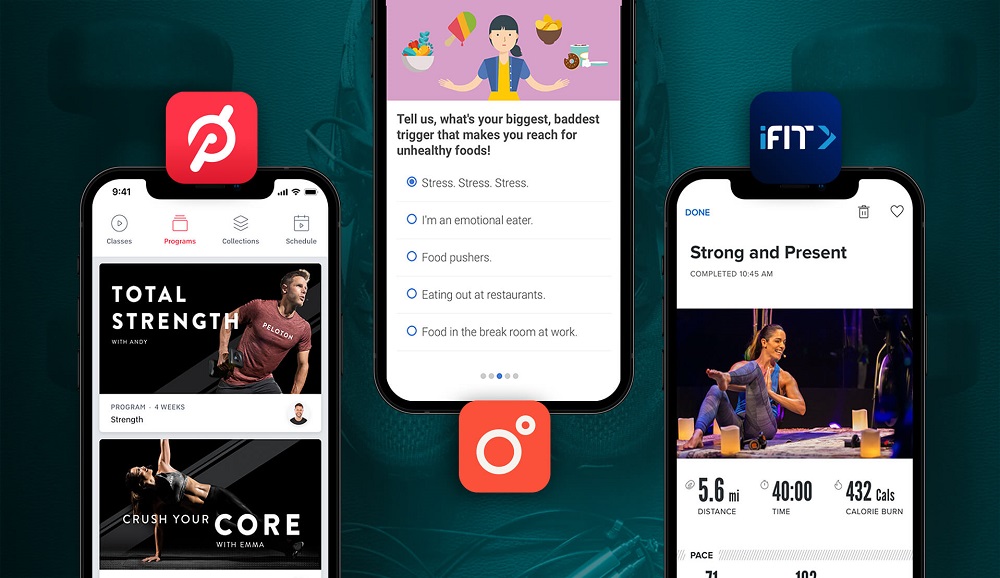

If it seems like your Facebook feed is suddenly full of diet and workout ads, you’re not imagining things. Pathmatics data from January 2022 tells us that fitness and weight loss brands like Noom, Peloton, and iFit have been investing heavily in Facebook ads. In fact, all three brands have spent more on this channel than any other in January 2022, and far more than they did in January 2021. So which devices are these three companies advertising on, and just how much have they beefed up their ad spend?

Like so many other industries, major league sports have shifted their advertising strategies to adapt to the ongoing pandemic. During the pandemic, major athletics went through a transformation, with most games canceled, postponed, or held to cardboard cutouts of adoring fans. While this disruption impacted athletes and fans alike, it also posed an even bigger challenge for the leagues' marketing teams. We'll dive into how professional sports leagues pivoted their digital advertising strategies during the pandemic.

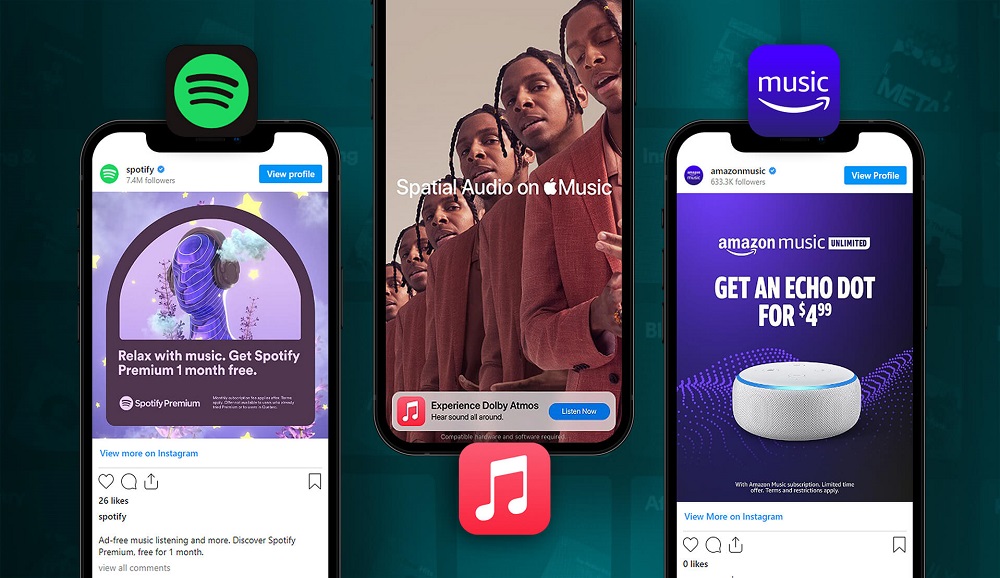

For music lovers, Spotify is practically synonymous with music streaming. And for good reason: The streaming giant says it had 172 million paid subscribers and 381 million monthly active users as of October 2021 — more than any other music streaming service. Its closest competitors, Apple Music and Amazon, are more tight-lipped about their exact subscriber count, but media analyst Midia Research put them at around 79 million and 68 million, respectively. While Spotify reigns supreme, both Amazon and Apple Music have been making moves to attract new listeners.