Whole Foods and Trader Joe's compete for grocer foot traffic in the premium grocery store category in San Francisco (SFO). Whole Foods operates eight stores in the area, while Trader Joe's operates six stores. They each offer prepared foods and options from local farmers as well as convenience and traditional grocery industry services. In each case, the geographic disbursement of each grocery store is more dense in the city and less so away from the urban center.

J.C. Penney recently announced the closures of 154 stores across 38 states. We decided to look at the affected stores to find out how their human traffic patterns have been impacted by COVID-19 policies in their respective states.

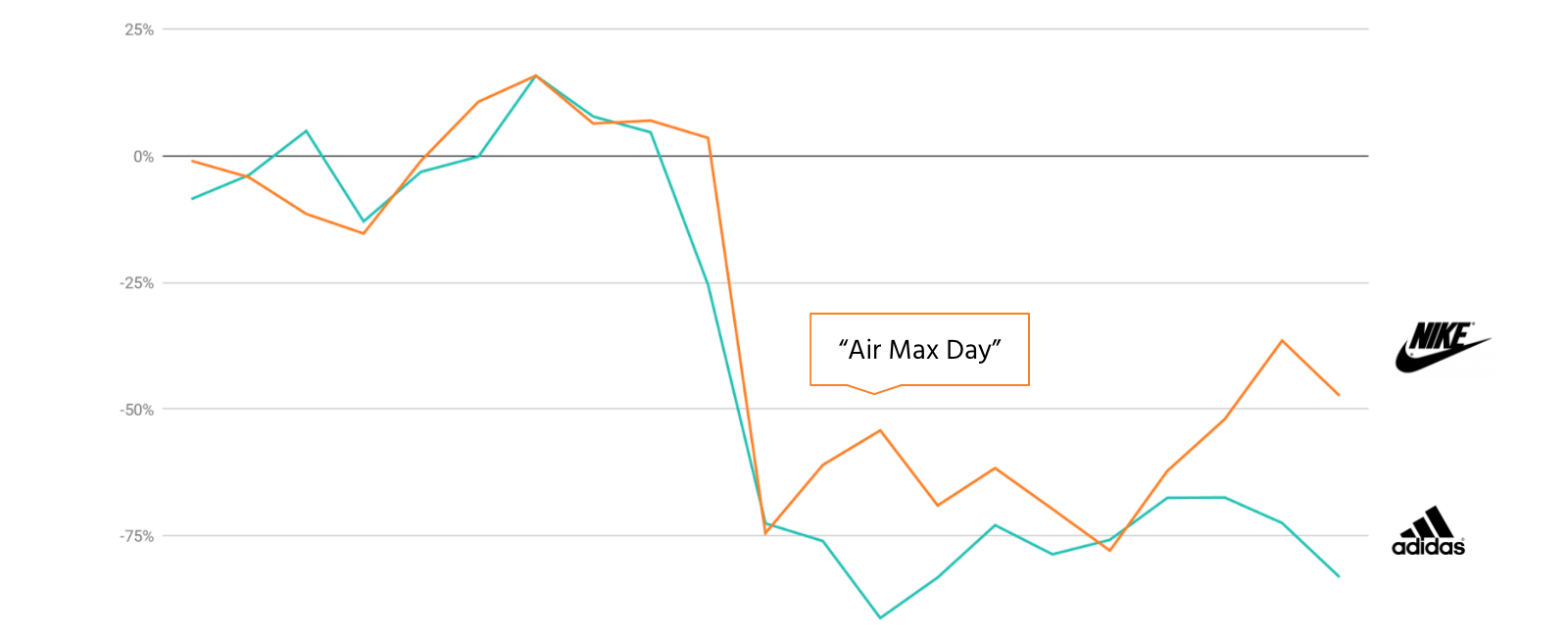

There is still a little time left on the clock, but a week before Christmas 2020 and right at the start of the 2021 NBA season, Nike continues to dominate Adidas in the COVID-19 recovery game. Since we last checked in mid-June, Nike has widened the gap, with total foot traffic at their outlet locations back to within 30% of 2019 levels. That’s up from -55% when we last checked the brand score.

Nearly nine months into the global COVID-19 pandemic, luxury retailers in big cities across the U.S. wait and hope that Black Friday will inject a much-needed dose of foot traffic into local stores. But with infection rates rising, migration from big cities underway, and a lack of tourists, luxury brands need more than hope.

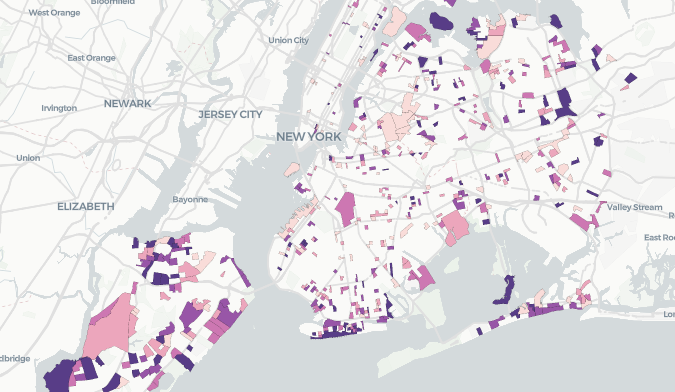

In general, we found that the areas that have returned Workers the most are the same - often low-income - areas hardest-hit by COVID-19, and that Workers in these areas tend to live around where they work. Conversely, the areas that have not returned as many Workers have a higher percentage of commuters, and are often more developed office building-oriented. When we dig in a little deeper, further distinctions arise between different boroughs and neighborhoods.

From a high level, downtown areas have been slow to recover. Visitation remains very low in CBGs with large volumes of office space, while the use of public areas and some parks by Residents and Locals has actually exceeded 2019 visitation levels, even though mobility overall is still down about 50% as of this writing, largely due to out-of-town Workers staying home and Tourists staying away.

The travel and hospitality category generally continues along a weak recovery trend much as it has since mid-April when visitation bottomed-out between -60% and -80% for most brands. That’s up to a national average of within \~50% of pre-COVID levels, as of this writing. The motel sector is recovering faster on the whole than the hotel sector, though the states leading the recovery charge could soon face a second wave of restrictions.

J.C. Penney recently announced the closures of 154 stores across 38 states. We decided to look at the affected stores to find out how their human traffic patterns have been impacted by COVID-19 policies in their respective states. In general, we found that J.C. Penney stores that are closing are actually getting more visitors currently than stores that will stay open.

U.S. clothing retailers got a welcomed jolt of recovery heading into June 2020 as more people headed back to bricks and mortar locations. Store visits had fallen as much as 90% in some states since shutdown orders were first issued, while the national average sits about -50% since reopening began, significantly lagging restaurant or grocery retailer visits.

The restaurant industry has been heavily impacted by the global COVID-19 pandemic. Stay-at-home orders and the closure of large swaths of the economy in many U.S. states have limited human mobility for weeks and in some cases months. To remain competitive, or just afloat, many restaurant operators have pivoted to offer delivery, or curbside pick-up options, and it’s been working pretty well.