Source: https://www.placer.ai/blog/wholesale-update-costcos-back-bjs-and-sams-club-continue-to-rise/

The wholesale sector has been so thoroughly dominated by Costco in recent years, that one can be forgiven for ignoring other players in the space. Yet, Sam’s Club has been on the rise and BJ’s Wholesale has seen a massive surge since the start of the pandemic.

So, has the space gotten more competitive with Costco seeing downturns in visits for the first time in years? Can the giant recover considering it still operates heavily in some of the hardest-hit states?

We dove into the data to find out.

Wholesale’s Pandemic Pattern

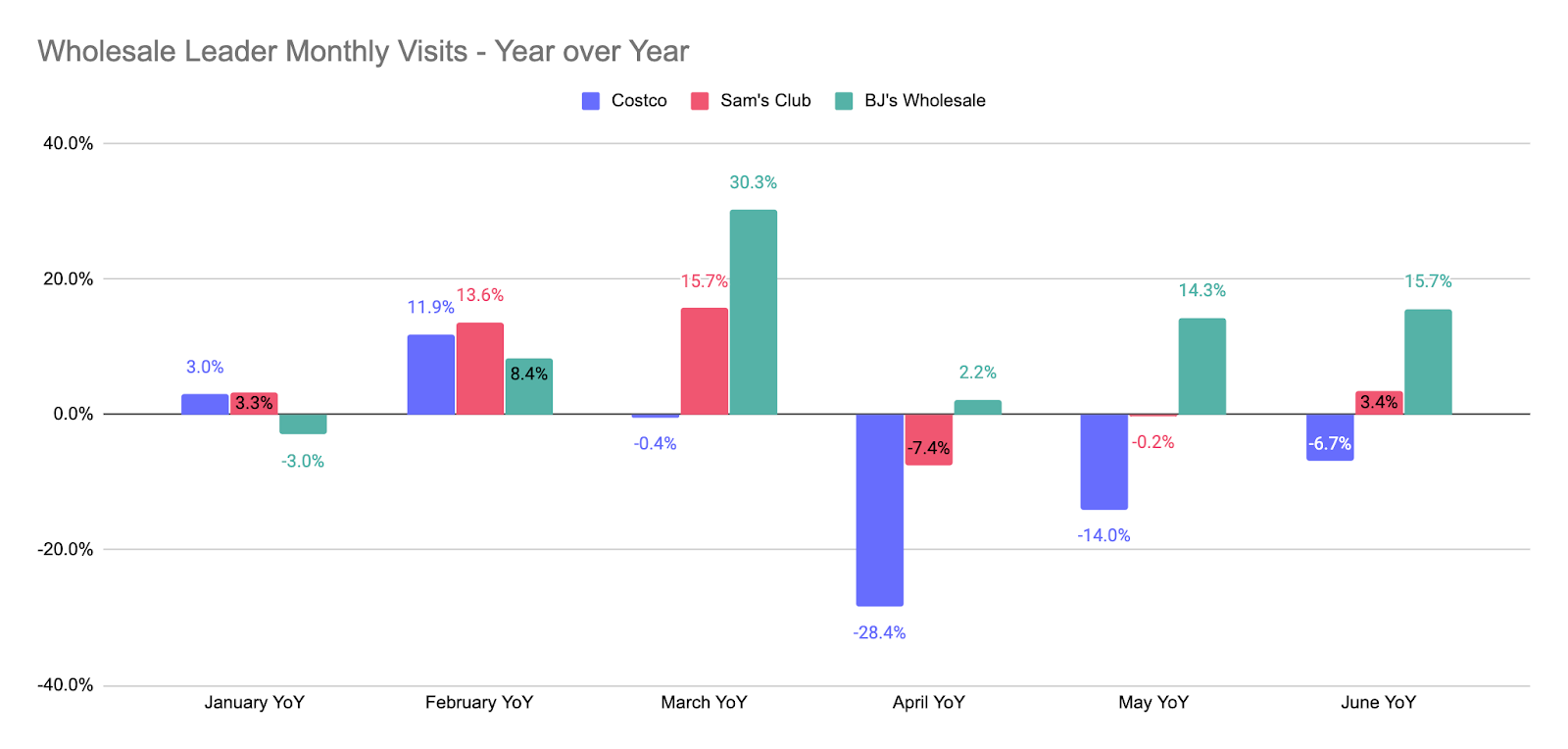

Costco kicked off 2020 with the type of growth that many brands would celebrate, but the king of wholesale’s progress was as expected. Visits rose 3.0% and 11.9% year over year in January and February respectively, but the pandemic did hit visits hard from March. Even with a massive surge in the early weeks of March, Costco still saw an overall visit decline of 0.4% with declines continuing through June. While larger basket sizes and eCommerce help, the trend was still important to note.

Sam’s Club also saw visits looking strong in early 2020, but its regional distribution and lower starting point – the brand has seen a resurgence since the middle of 2019 – helped it see significant gains in March as well before visits began to decline year over year in April. And while Sam’s Club should be thrilled with visits in June up year over year by 3.4%, the true ‘winner’ within the category is BJ’s Wholesale Club.

BJ’s had seen fairly consistent year-over-year declines in monthly visits in 2019, and kicked off 2020 with January visits down 3.0%. Yet, from February, BJ’s Wholesale has been surging. Visits in March were up 30.3% year over year, and this growth has sustained throughout the pandemic with June visits rising 15.7% year over year.

Weekly Visits – Examining Pace

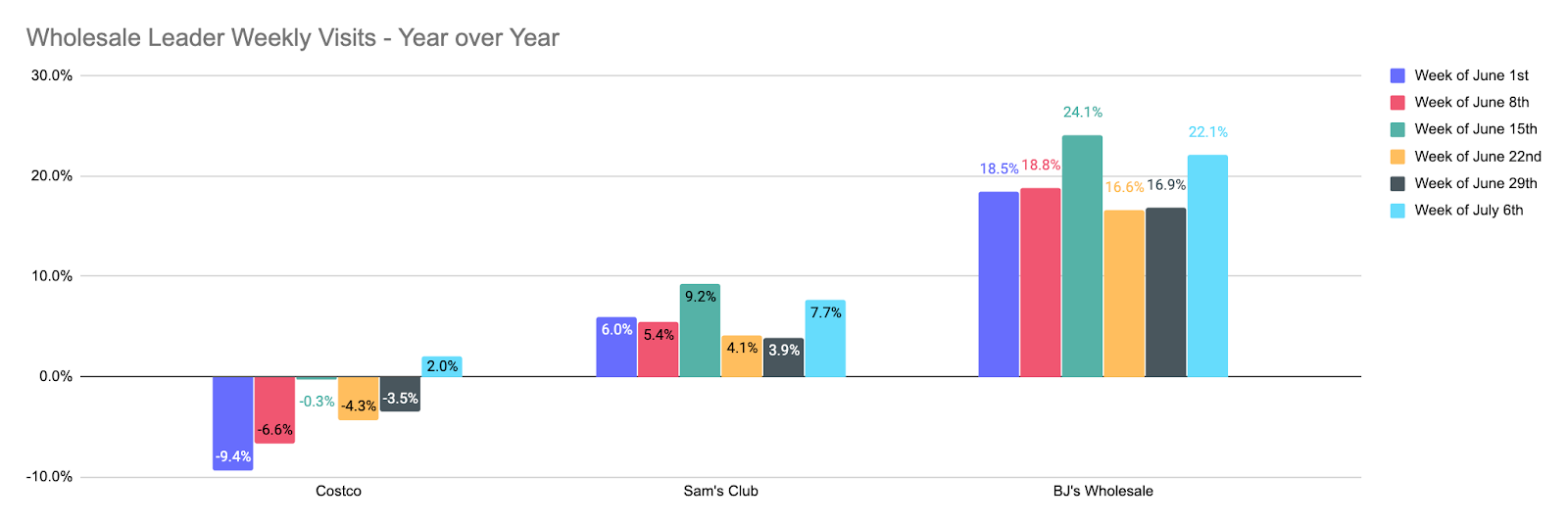

And the pace for the sector has been steady with a pickup the week of July 6th. Clearly, rising concerns of a new shutdown are providing a lift. But it is critical to remember the built-in effect that club memberships benefit from in driving repeat visits. If you’re willing to shell out money for a yearly membership, the likelihood of you returning to maximize this ‘investment’ is very high. Not to mention that the value orientation of these brands is clearly a strong fit in the current economic environment. As a result, Sam’s Club and BJ’s both saw weekly visits at 7.7% and 22.1% respectively in terms of year over year growth that week – impressive numbers.

But the biggest story when analyzing weekly data is Costco. For this first time since the pandemic kicked off, Costco weekly visits were up year over year with 2.0% growth – and every day that week apart from Sunday the 12th saw daily year-over-year growth. Considering the higher basket size and strength of Costco’s online offering, this could amount to a huge uplift – and all this without key business units like travel or in-store services. And impressively, the signs were actually apparent a week earlier when July 3rd visits rose 19.6% year over year – giving the brand its best day since March. So while competitors have been rising, Costco’s strength has been on clear display in recent weeks putting to bed any concerns about this giant’s short term future.

Trending in the Face of Change

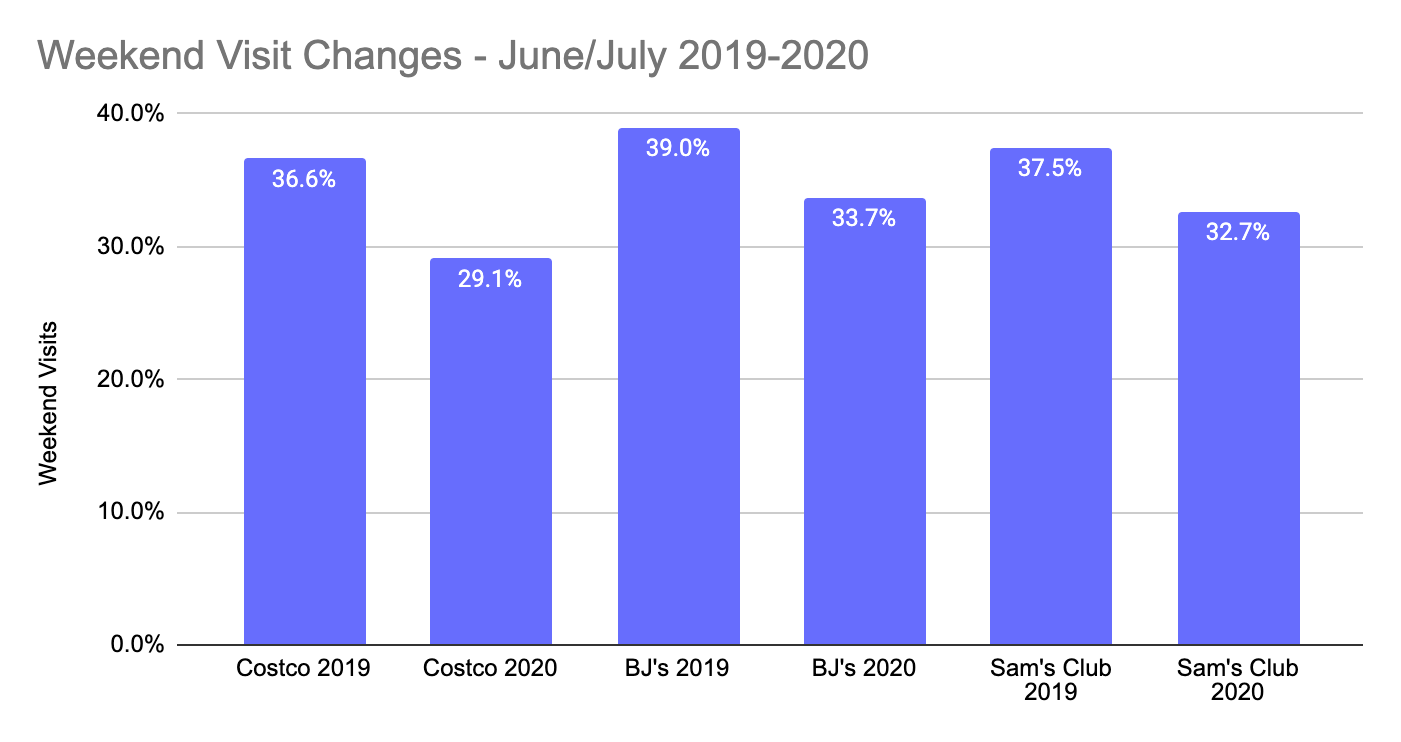

Perhaps most impressively, these returns are happening with consumer behavior trends still

very different than “normal”. All brands analyzed saw the percentage of weekend visits drop significantly between 2019 and 2020.

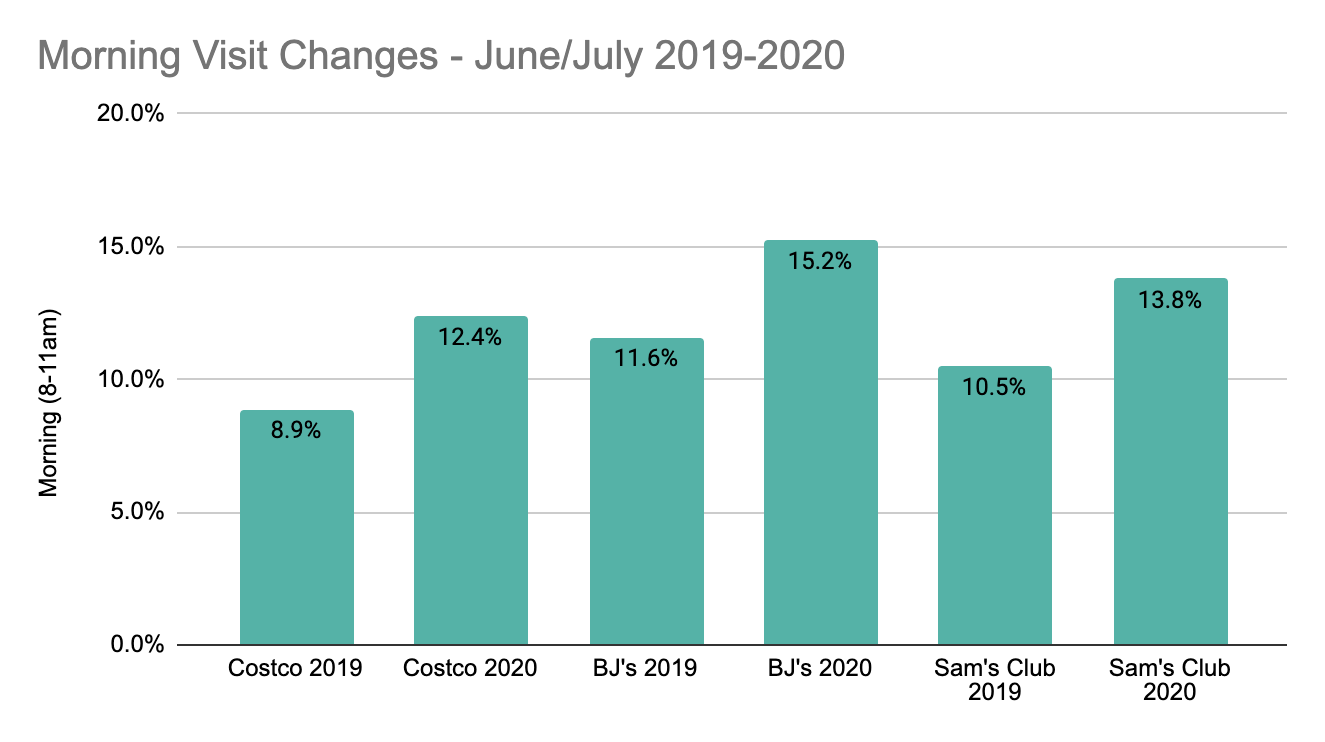

And the same was true with the time of day visits took place, where a clear shift towards the morning was visible. The ability to drive visits in this environment is especially powerful because it shows that the pull of these brands is not routine dependent like other sectors. Instead, it demonstrates that visitors have such a strong brand relationship that they will find ways to fit these players into their routine – whatever that routine may look like.

Conclusions

Wholesale’s king is on the rise again and the performance should push the brand into the rarified class of the biggest and strongest of retailers. Considering the loss of business units, the operations in the hardest-hit states, and the self-imposed restriction, the numbers are truly exceptional.

Yet, Sam’s Club and BJ’s Wholesale are rising, giving an added level of intrigue to the sector and positioning these players to battle for position in what is sure to be a growing space.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.