In this Placer Bytes, we dive into Kohl’s amidst wider concerns over the future of the department store and the impressive performances across the TJX portfolio.

Kohl’s

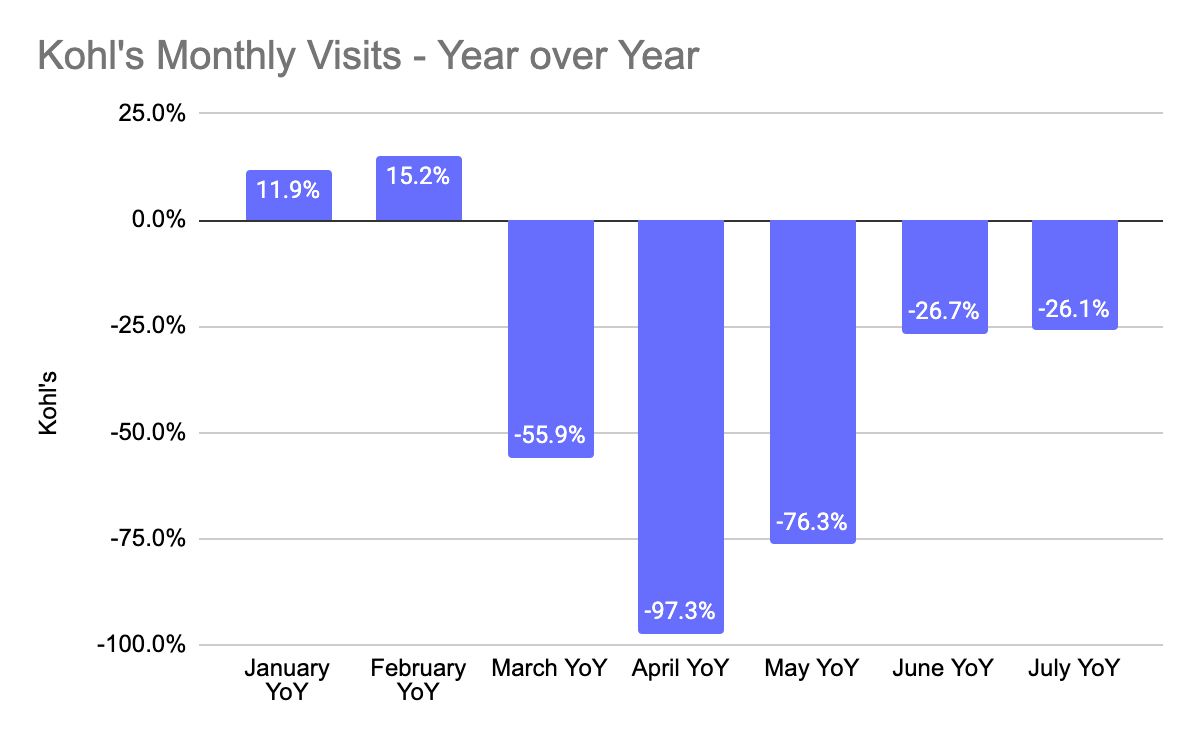

Kohl’s has experienced a strong recovery in recent months with June and July down just 26.7% and 26.1% year over year. And while this still marks significant declines, the brand has been hit hard by COVID resurgences in key states like California and Texas where they have a greater number of stores.

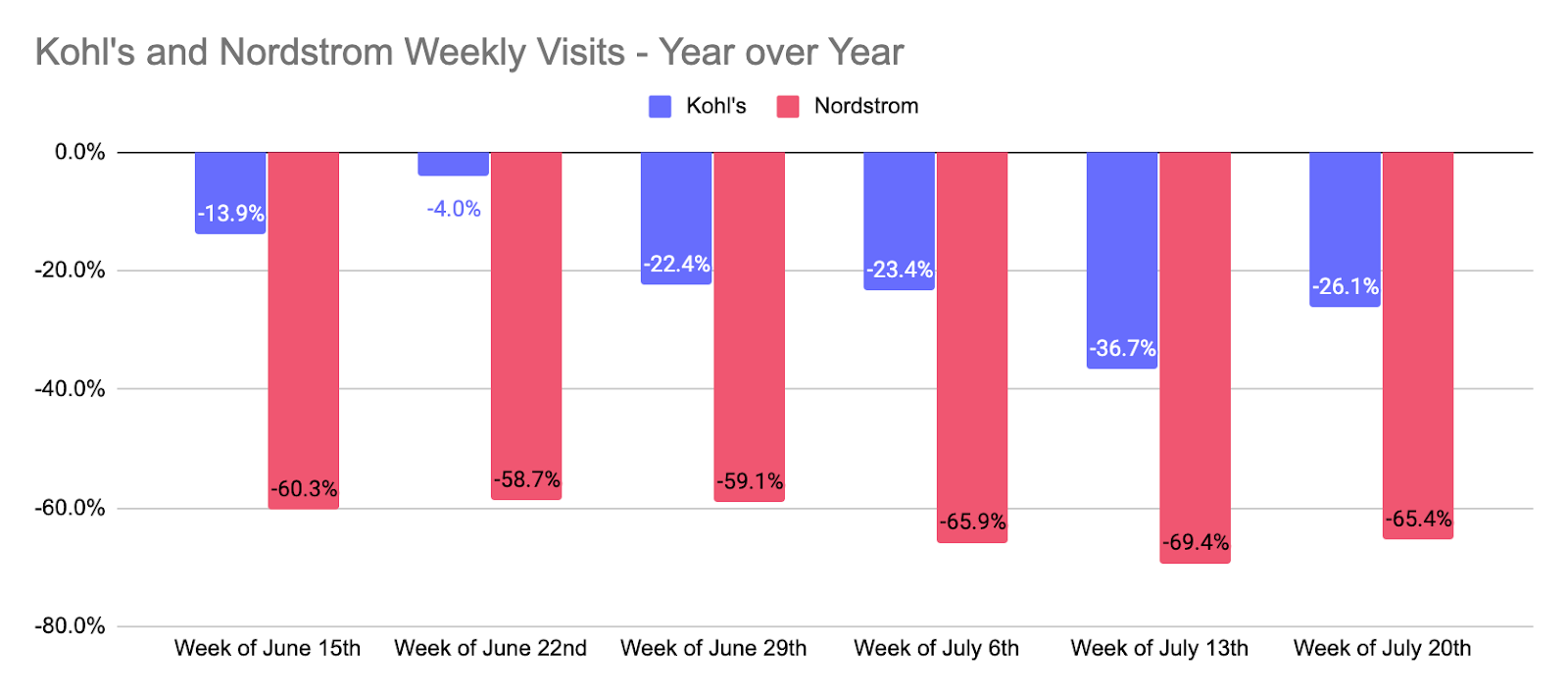

And this becomes clearer when looking at weekly visits data, where a strong rebound by late June was halted by the resurgence in cases.

Yet, even with these challenges, Kohl’s is still managing to outperform its direct competitors. Taking context from other department stores, while Kohl’s saw a year-over-year decline of 26.1% the week of July 20th, Nordstrom was down 65.4% and Macy’s was down 44.7%. Clearly Kohl’s has a unique take on the department store, but it was even outperforming a wider apparel sector that was down 32.2% that same week. So, while Kohl’s is clearly hoping for a reduction of COVID cases in California and Texas, they may be one of the best-positioned brands within the apparel sector for the coming months.

TJX – Recovery Across the Board

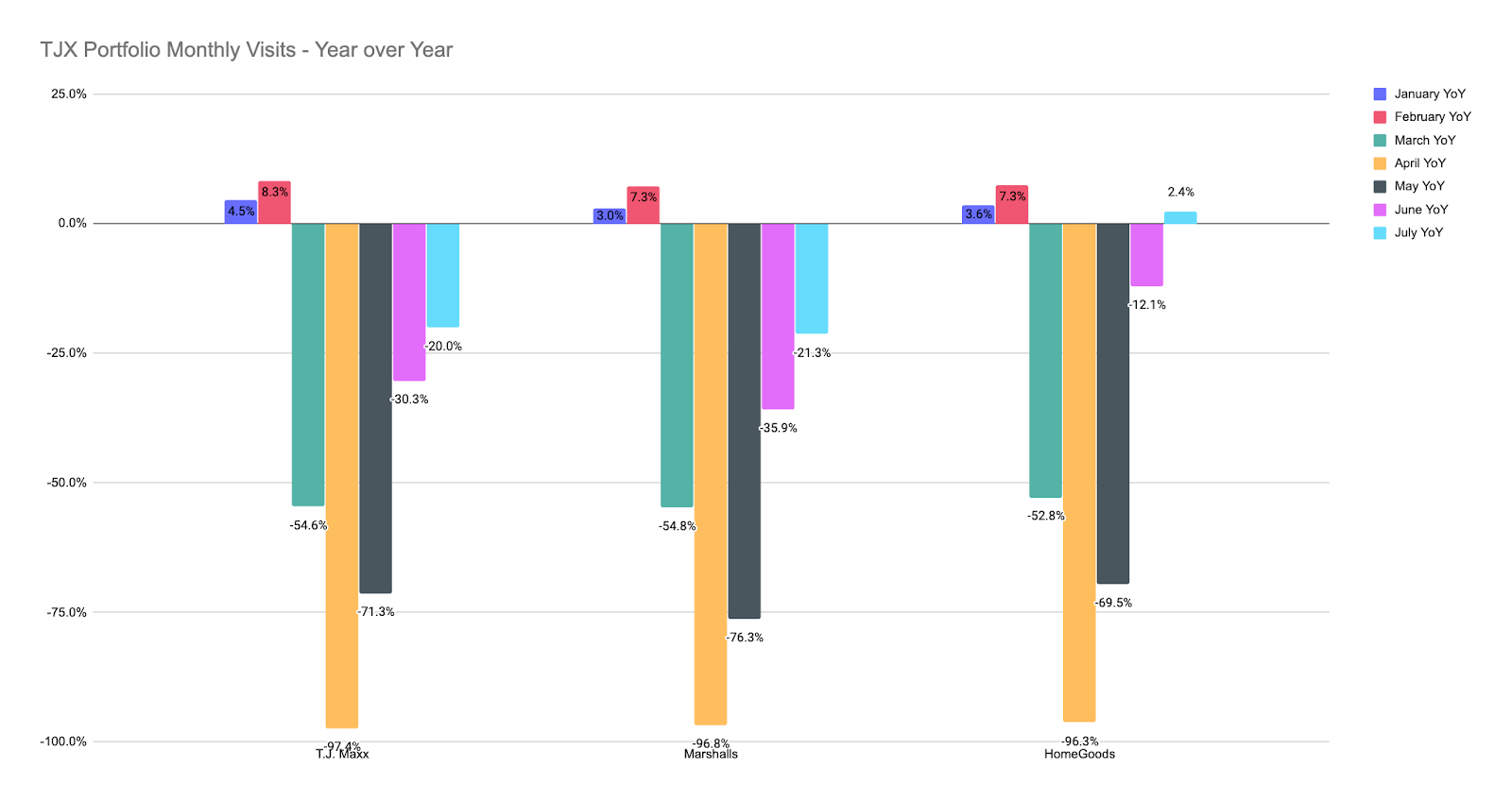

Another company with a significant apparel presence is TJX with its T.J. Maxx and Marshalls brands leading the way. And both are on a clear recovery with visits down just 20.0% and 21.3% respectively year over year in July. Yet, the unique element in this portfolio could be the home goods presence, led by the aptly named HomeGoods. And like much of the wider space, the brand is showing strength with 2.4% year-over-year visit growth in July.

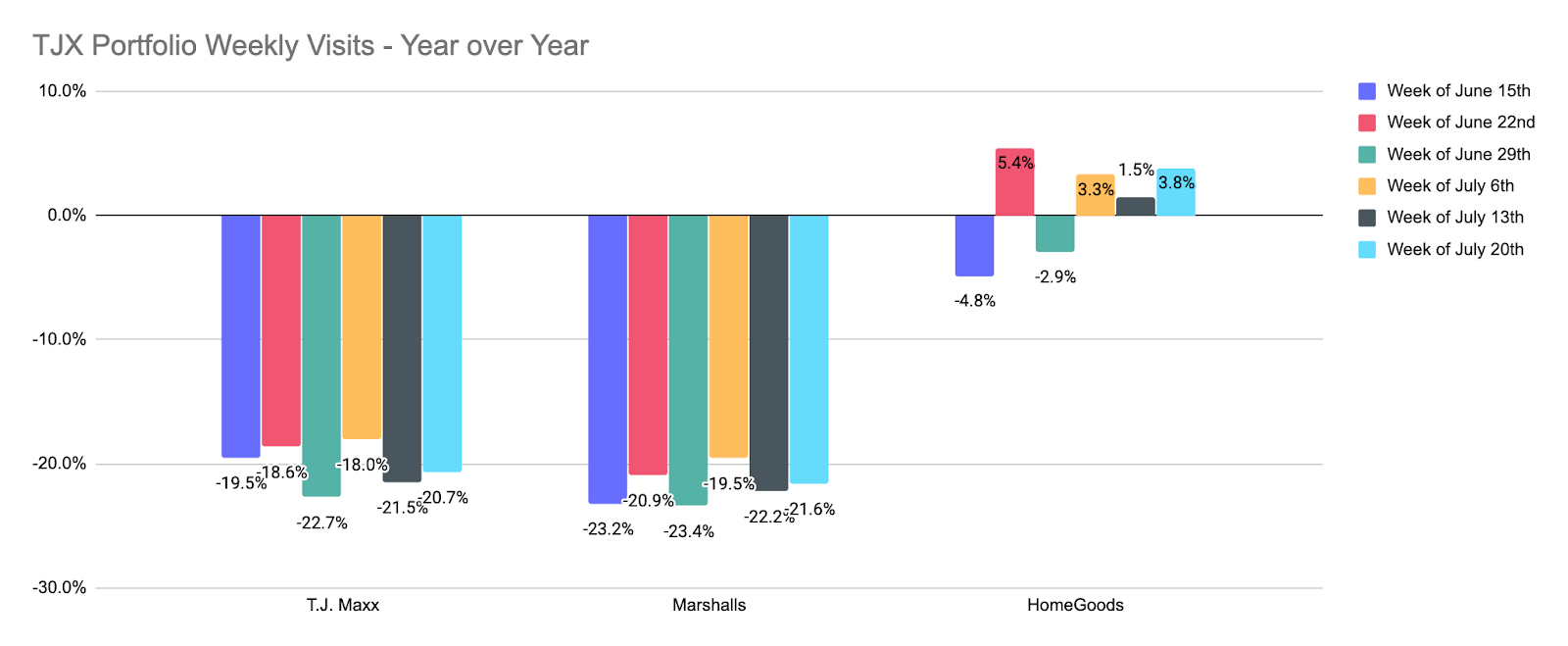

And weekly visits reinforce the strength of all three. While both apparel brands remained in the range of 20% year-over-year declines, this was well ahead of the pace for the wider apparel sector. For the week of July 20th, visits for apparel were down 32.2% nationwide, while T.J. Maxx and Marshalls were down just 20.7% and 21.6% respectively that week. And here too, the resurgence of cases hit regions with larger numbers of stores creating a significant impediment to more growth. The ability to show consistency in the face of such significant obstacles is a powerful indicator that as more states succeed in bringing the pandemic under control, visits could quickly return to 2019 levels, if not year-over-year growth, for both brands.

HomeGoods also showed consistency in July with the weeks of July 6th, 13th, and 20th all showing year-over-year growth. And the brand could be in for even bigger numbers as it enjoys the benefits from competitors closing, and a strong value orientation in a period of economic uncertainty all during a wider home goods sector surge.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.