In this Placer Bytes, we analyze Burlington’s up-and-down recovery, Ulta’s drive to normalcy and how Big Lots trends have differed from others in the space.

Burlington Rises, Dips and is Rising Again

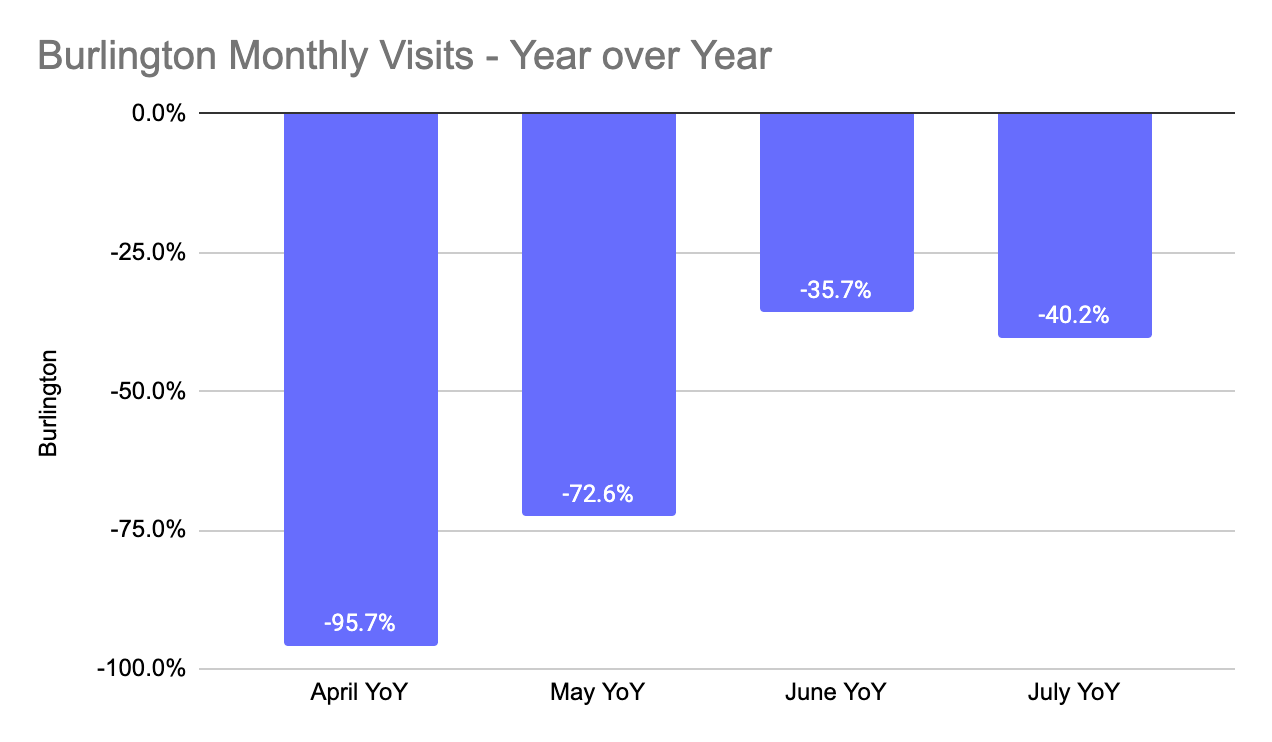

When Burlington reopened stores, the visits started to flood back in and traffic had returned to just 35.7% down year over year in June. Yet, in July the retailer took a step back with visits down 40.2% year over year. Unsurprisingly, this happened as COVID cases were rising, creating challenges in key states like Texas, California and Florida.

However, a turnaround does appear to be underway with traffic growing each week since late June. By the week beginning August 3rd, visits for Burlington were down 36.6% – aligned with June visits. And this number is especially strong as it compares with the strongest week Burlington had during the back-to-school period in 2019. The combination of the positive trajectory and wider COVID bounce backs in key states should help drive visits closer to 2019 levels.

Big Lots Rise and Fall

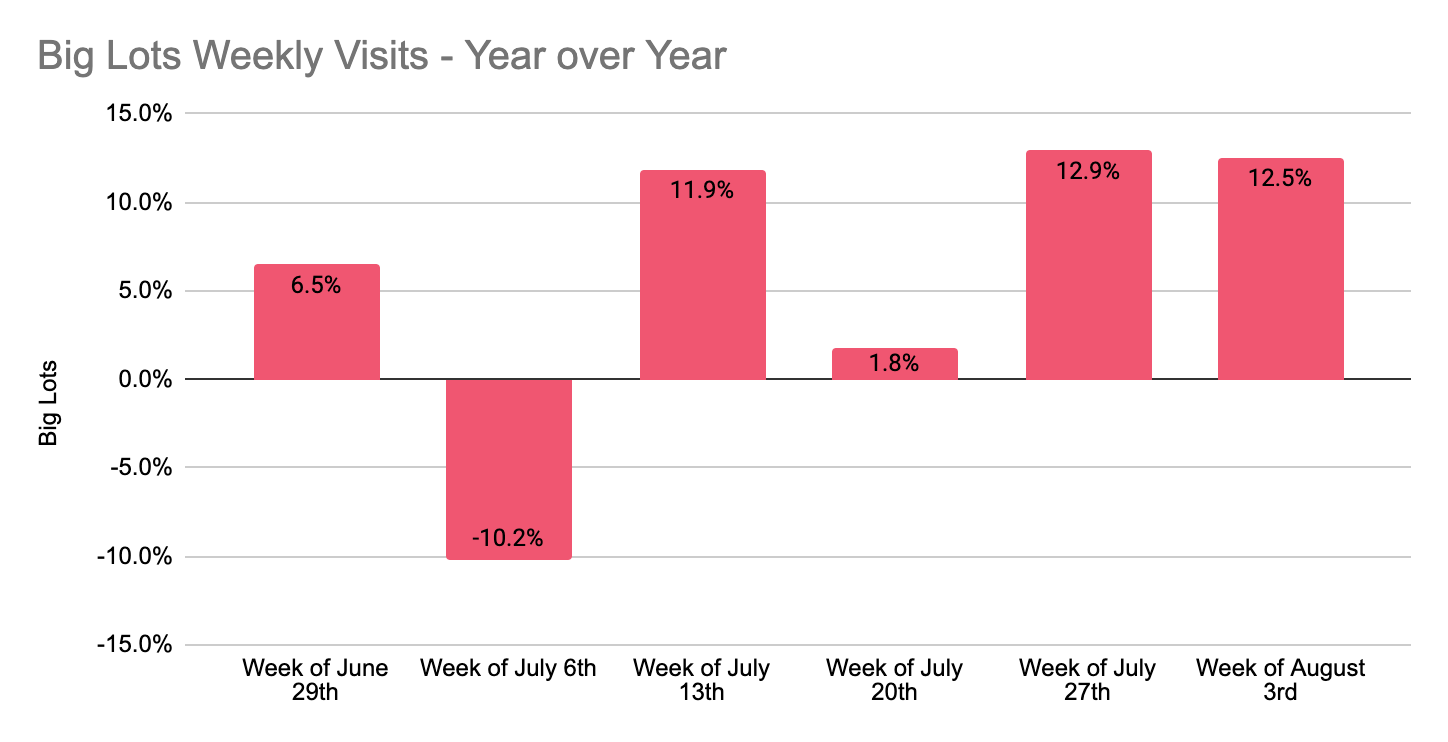

While most of the players offering value orientations saw April’s declines building into steady recoveries, Big Lots has seen a different pattern. The brand had a huge May surge with visits rising 38.1% year over year, before less extreme but still impressive year-over-year increases of 13.9% and 2.5% in June and July respectively.

But visit rates from late July and early August do paint a picture much more like June than July. Visits the weeks beginning July 27th and August 3rd were up 12.9% and 12.5% year over year, indicating that the coming weeks could be especially productive for the brand.

Will Burlington continue its upward trend? Can Ulta reach year-over-year growth in August? Will August Big Lots visits remind us of the June high or July low?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.