More than half of U.S. advertising is expected to be spent on digital advertising this year—with the strongest growth in social media, video, eCommerce and search.

Snapchat is one of the social media platforms seeing this growth in action.

It’s been a while since we checked in with Snap. How did it perform during Q3 and have there been any significant changes among its advertisers due to the pandemic?

Snapchat users are more engaged in 2020

Snapchat has been going strong this year, rolling out new augmented reality features and content sharing experiments.

“We’re always exploring ways to make it even easier to view Snapchat’s engaging and topical content and share it with your friends,” a Snap spokesperson told Axios. These new features keep the platform engaging and competitive with other social media sites like TikTok and Instagram.

With the release of their latest quarterly earnings, Snapchat’s CEO, Evan Spiegel commented that “the adoption of augmented reality is happening faster than we had previously anticipated, and [Snapchat is] working as a team to execute on the many opportunities in front of us.”

As a result of that hard work, Spiegel and the Snap team have a lot to be excited about. The platform had 249 million daily active users last quarter (Q3 2020), up 18% from the same time last year. These users were more engaged and the number of daily ‘snaps’ published increased by 25%.

As the number of daily active users and other engagement metrics increased, advertisers began to shift more of their budgets to the platform.

“They really have managed to diversify and stay competitive,” Erica Patrick, VP and Director of paid social media at MediaHub Global, told Digiday. Advertisers who have low funnel needs and who target young audiences especially rely on Snapchat as a choice publisher.

Who are the top advertisers on the platform this year—and how do they compare to last year, considering the massive changes our world has gone through?

MediaRadar Insights

Methodology

This analysis looks at the advertising trends in January – October 2020 and compares that activity to the same period in 2019.

Findings

There wasn’t a significant change in the number of advertisers on Snap this year. Between January and November 2019, there were 1,300 advertisers on Snapchat. This year, there were 1,200 advertisers in the same time period.

Despite the slight dip in number of advertisers, ad spend rose. Ad spend increased 19% YoY, and in Q3, their revenue increased 52% to $679M YoY.

The decrease in advertisers and increase in spend suggests that though fewer brands are advertising with Snapchat, marketing budgets are funneled to targeted social media strategies.

In 2019, the top five brands advertising on Snapchat were:

These brands come from the Media & Entertainment, Travel, and Retail categories.

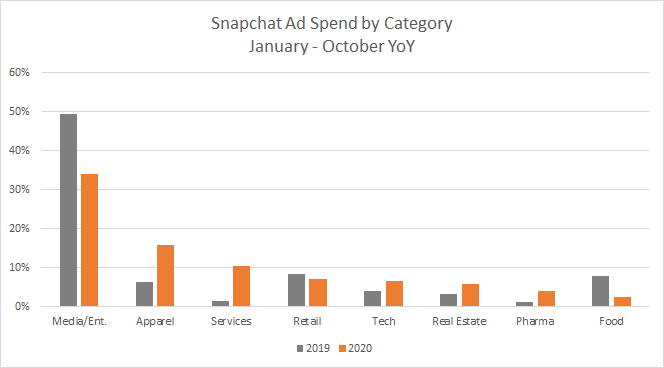

While the Media & Entertainment category has remained the top advertising category this year, it has made up only 34% of total ad spend so far, compared to 50% in 2019.

Other categories that increased their spend this year are:

In 2020, the top spending brands on Snapchat are:

The new mixture of Technology and Professional Services are a reflection of how brands adjusted to the pandemic.

The U.S. Army, limited in their ability to do in-person recruiting, turned towards social media. Discord, originally a popular communication tool for gamers went through a rebranding amid the pandemic. Now it’s a place for gardening enthusiasts, study groups, and other niche communities looking for something different than a social media platform or forum.

For brands going through major pivots this year, Snap provided a great place to target new (and younger) users. Snap reaped the benefits, and feels optimistic about future updates and partnerships with brands.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.