Kuaishou’s meteoric rise to the top culminated during its February 5, 2021 Hong Kong debut that raised $5.4 billion from its initial public offering, raising its shares nearly 200%. The blockbuster deal placed Kuaishou at the top as the world’s biggest internet IPO since Uber Technologies Inc.’s $8.1 billion share sale in the US in May 2019.

Kuaishou faces stiff competition in China from local platforms: from internet companies that operate content-based social platforms, to online marketing businesses and e-commerce platforms. Which leads many observers to ask, after its blockbuster IPO, “will Kuaishou maintain and sustain its momentum?”

Though it may be too early to throw in opinions on the question, some insights are available and can draw a picture of how Kuaishou has been doing post-IPO fever - and what the road ahead might look like.

Kuaishou’s user strategy is to concentrate in lower tier cities for now. It hopes to increase its penetration to higher tier cities, and seize the part of the market from among competitor users like Douyin.

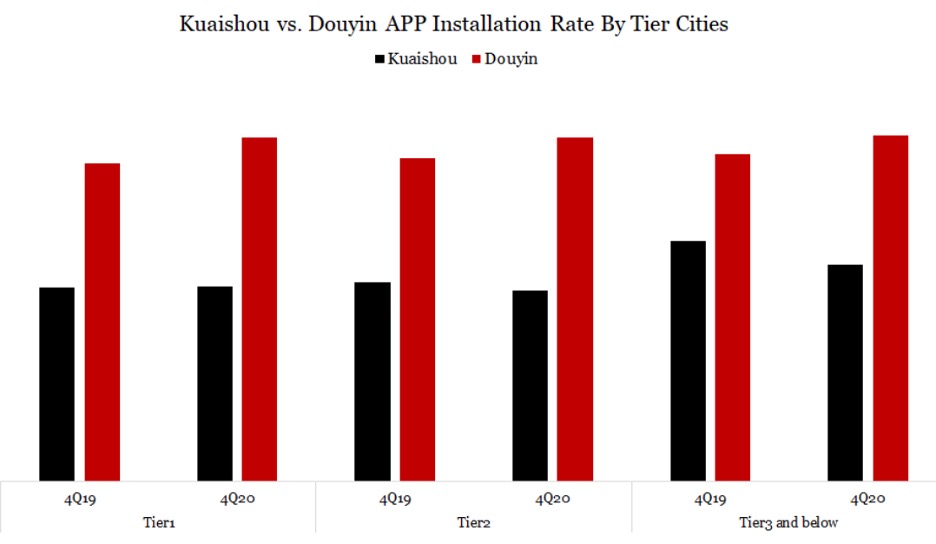

Kuaishou’s App installment also points to the story above. Sandalwood China App data shows its App installment (1) is skewed towards lower tier cities vs Douyin which is evenly distributed; (2) declines overall, specifically declines in tier 3 and below cities vs Douyin which increases overall; and (3) installment amount is lower than Douyin overall.

For its user profile, our data shows that installment rate for age group below 25 is relatively steady. Mid and senior age group quickly ramped up in 2018 and 2019, then slightly decreased in 2020 vs. Douyin ramping up in 2018 and 2019, then stabilizing in 2020 across all age groups.

Overall, Kuaishou is banking on its plan of vigorously developing a diversified content, paid content and subsidized originality, more celebrities, supporting music, animation, games and others, to improve the conversion ratio of paid users. Whether this plan will work to realize revenue targets from Kuaishou’s live streaming business remains to be seen, although the growth rate might not increase significantly.

Speaking of revenue generation, Kuaishou’s e-commerce business is the major potential driver of its future growth. The monetization of the industry as a whole still offers much room for revenue growth, primarily in e-commerce commission and advertising revenue. For Kuaishou, the strategy for the next 1-2 years is to rely mainly on low-commission strategy to compete with mainstream e-commerce players. The goal is to make sure brands stay in Kwai Shop, allowing merchants to expand, scale and make more money with guaranteed brand live sales platforms.

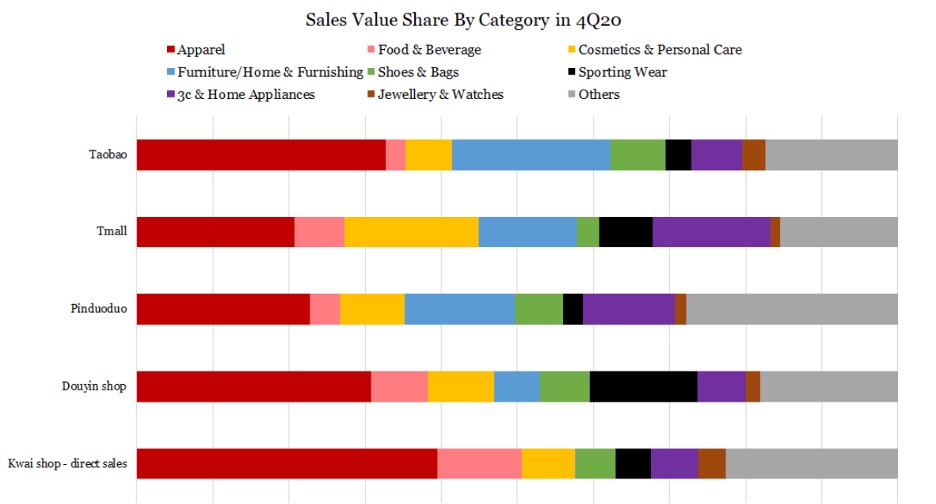

We observe from web scraping data that Kuaishou’s e-commerce business platform (1) is less diversified compared to other players; (2) more concentrated on lower price categories like apparel, F&B, and cosmetics. This leaves more room for growth for the company to expand its e-commerce business, which can translate into more room for revenue growth.

Kuaishou’s live streaming business has seen a weaker traffic growth rate, and the company has targeted 18-25% growth rate for 2021 and 2022, respectively.

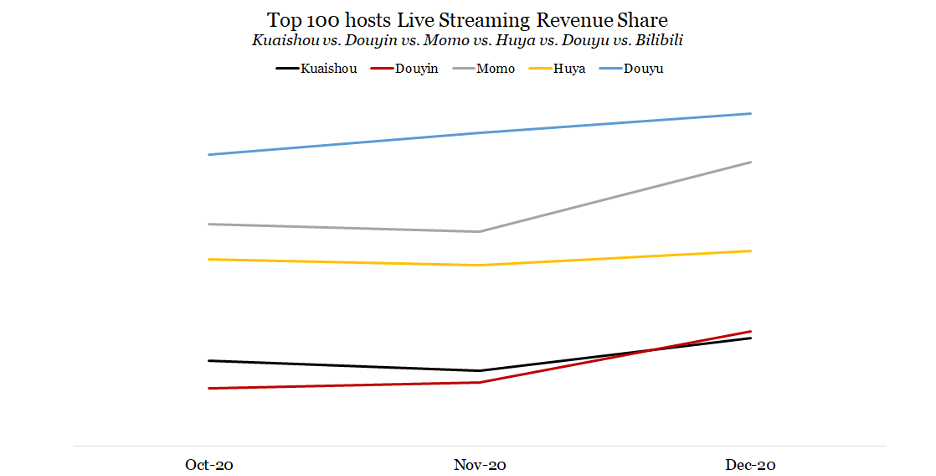

Sandalwood web scraping data shows top host revenue share among total live streaming revenue share is way below competitors like Momo, Huya, and Douyu. However, there is a similar trend with Douyin, which indicates that the difference of popularity between various levels of streamers is relatively small. This lowers and diversifies the risk of losing top streamers to other platforms. Kuaishou’s main development strategy for its live streaming business is to increase the rate of paid conversion by diversifying content and majorly supporting mid to lower-level hosts to increase user payment ratio.

Another unique strategy that Kuaishou started to build is the creation of live streaming e-commerce industry bases, cooperating with cities to build their own localized live streaming bases, leading to industrialized scale effects, empowerment of merchants, intensified development, increased efficiency, and reduced costs.

To learn more about the data behind this article and what Sandalwood has to offer, visit http://www.sandalwoodadvisors.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.