Torrid ($CURV)- the popular plus-size women’s clothing brand joined the New York Stock Exchange on July 1st, with an opening market valuation of $2.3B dollars. Earnest compared Torrid shoppers with those of major competitors like Lane Bryant and ELOQUII for a comprehensive view of the brand. According to Torrid CEO, Liz Munoz, part of Torrid’s success (and its secret sauce), lies in its omnichannel approach. Torrid currently has around 600 physical stores, but attributes 70% of its sales to online purchases.

Prime Day is touted by Amazon as one of the largest online shopping events of the year. This year, Walmart and Target expanded their concurrent online shopping events to compete with Amazon’s Prime Day. Earnest analyzed the impact of the retail battle royale in late June on the performance of Amazon, Walmart, and Target. Prime Day gains in 2021 were more muted than past years with Amazon online sales increasing by 20% WoW. The lift was less than half of what the retailer experienced in both 2018 and 2019 and slightly lower than in 2020.

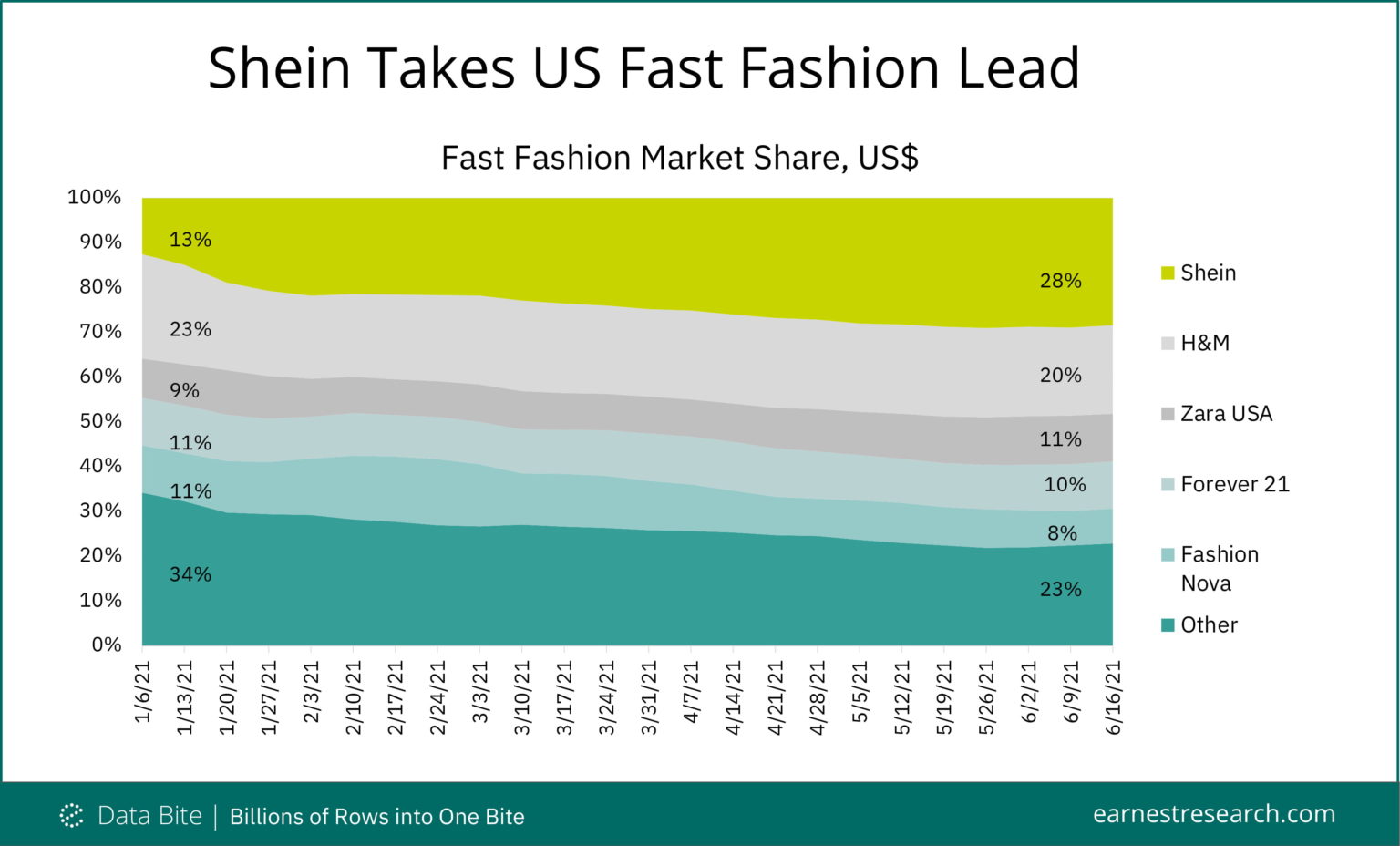

The Chinese brand loved by Gen Z and rumored to be exploring an IPO — Shein– is now the largest Fast Fashion retailer in the US by sales, only two months after displacing Amazon as the top e-commerce app downloaded in the US. Market share data from Earnest shows that Shein began 2021 with 13% of total Fast Fashion sales, trailing traditional leader H&M. Since January, Shein continued to gain share and now leads with 28% of the Fast Fashion market, with Zara the only other brand growing share during that period.

The pandemic-driven transformation to working remotely was one of the biggest shakeups of the past year, the effects of which we are still witnessing today. With just over half the US population now vaccinated and many local economies reopened, the nature of remote work is top-of-mind: are employees returning back to the office, or will remote work be a sustained new reality in the post-pandemic workforce?

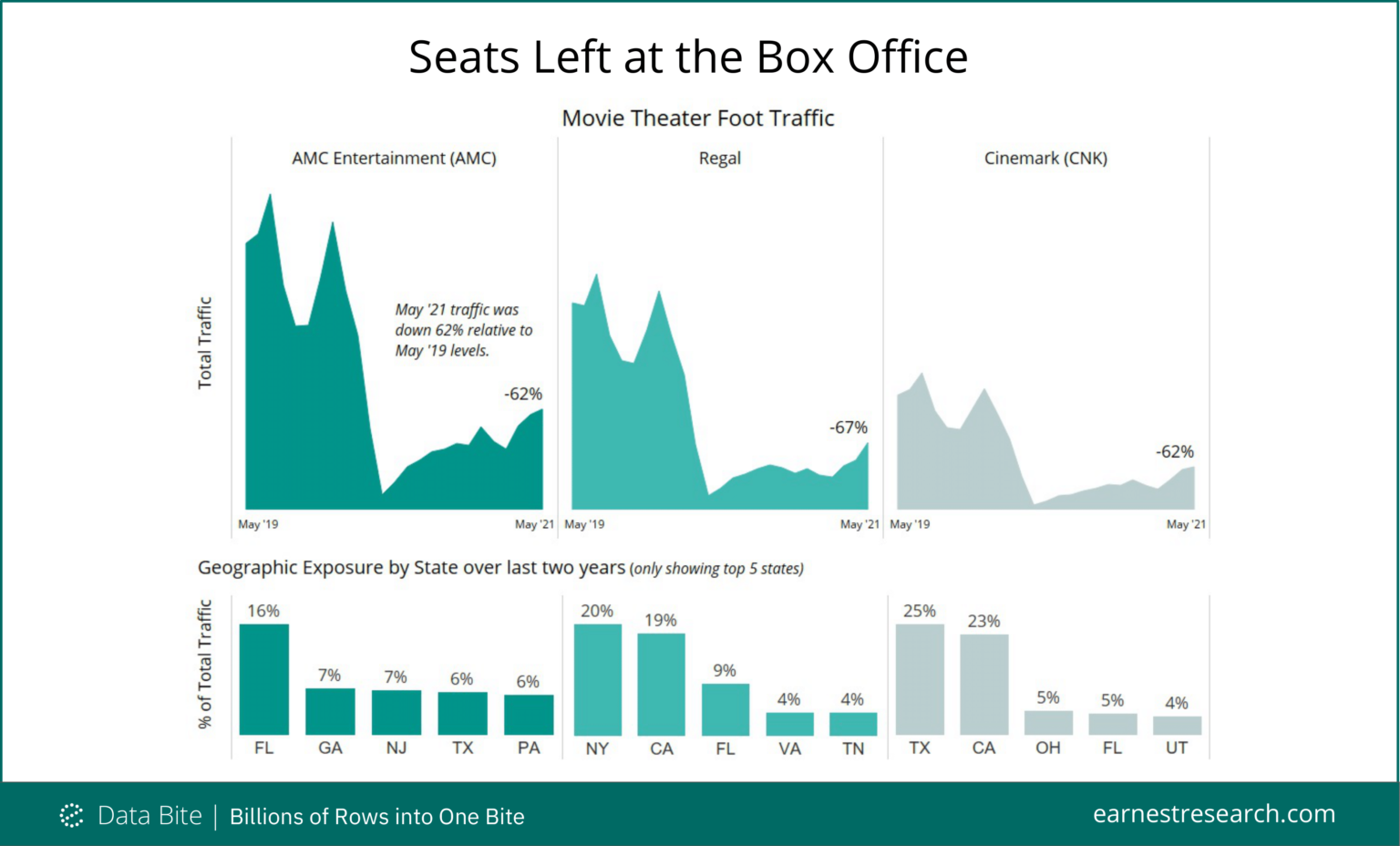

While much has been said about the latest meme-driven rally in AMC’s share price, we used Earnest Foot Traffic data to look at actual customer behavior and understand what’s really happening with movie theater attendance. AMC, with the largest footprint, recently saw traffic -62% of May 2019 levels—likely benefiting from the outperformance we’ve seen across several sectors in Florida, Georgia, and Texas, despite their lower vaccination rates.

The 2021 summer travel season has officially begun, and roughly half the US adult population is inoculated against the coronavirus. Is travel poised to recover from its near-death experience last year? We take a look at travel performance to date below. (See our prior analyses in this vaccinated-recovery series, including our general overview, our focus on dining, and on gyms).

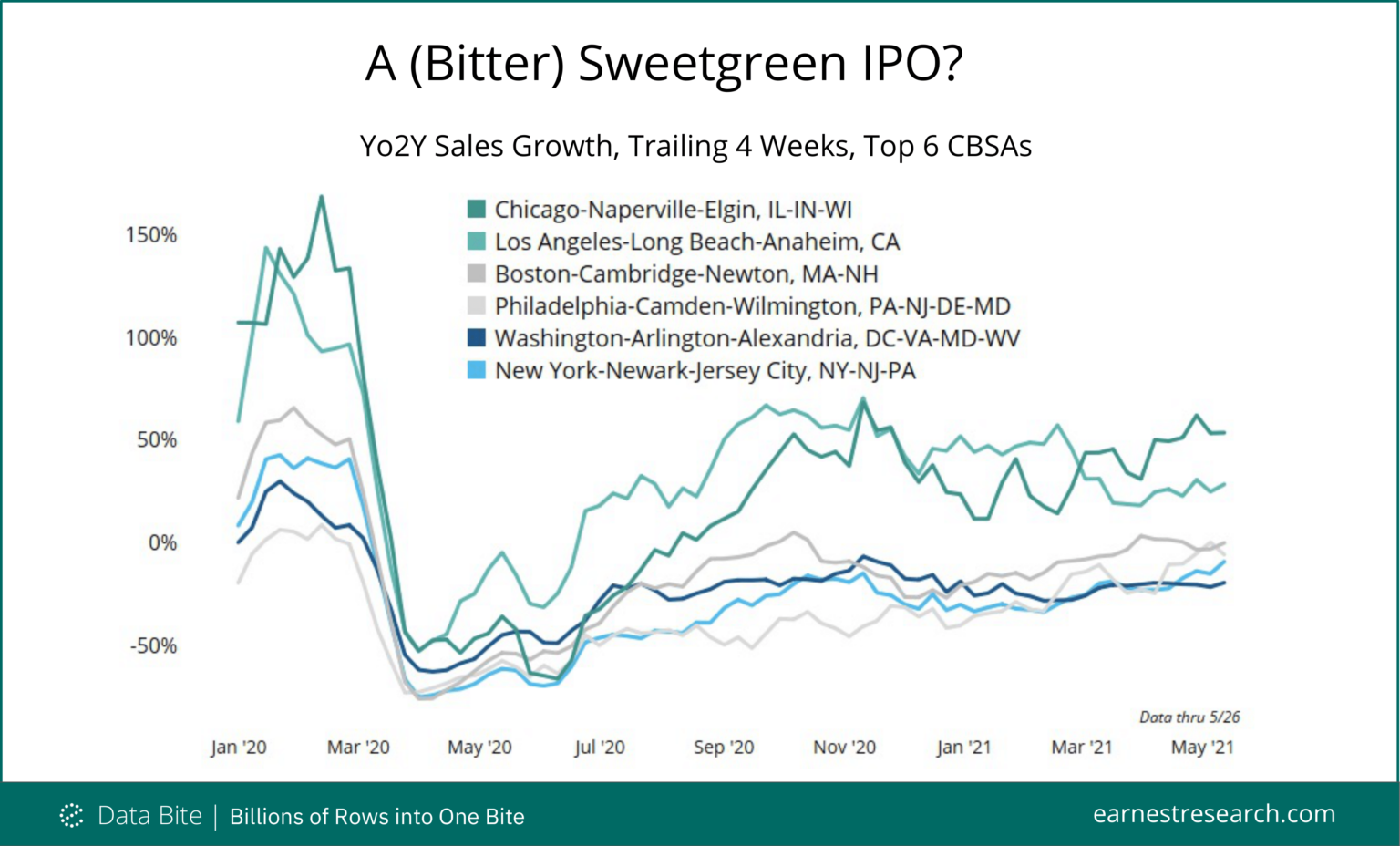

With reports that Sweetgreen is preparing to go public we looked at how the upscale salad chain has performed in its core urban markets. Regardless of pre-pandemic growth, all regions saw drops of 50% or more as offices closed and office lunches plummeted at the outbreak of COVID. Since then, Sweetgreen’s HQ market of Los Angeles rebounded the fastest, reaching >50% Yo2Y trailing 4 weeks in September last year, before tailing off to around 30% in recent weeks.

As the road to recovery continues, we looked at a leading indicator of returning to normal behavior: fitness spending and gym attendance. We also checked in on home fitness leader Peloton given its pandemic-driven spotlight. Note that parts of this analysis calculate growth relative to two years prior – written throughout as “Yo2Y” – in order to benchmark current performance against “normal” consumer levels.

With just under half the US population inoculated as of May 17th, we looked at the state of food spending across the US, particularly across Restaurant Delivery Aggregators, Online Grocers, Indoor Dining and Supermarket In-Store sales. Note that parts of this analysis calculate growth relative to two years prior – written throughout as “Yo2Y” – in order to benchmark current performance against “normal” spend levels.

With U.S. COVID cases receding and travel increasing once more, rental car firms are seeing demand sharply increase. However, having sold a larger portion of their fleets last year to generate cash, the lack of supply is now driving customer prices to record highs.

With a year passed since the start of the pandemic, people have shifted where they work, travel, and live. Using our foot traffic data, we refreshed our October analysis on the COVID-driven Urban Exodus, and analyzed whether this migration out of urban centers has continued to last, or whether people are now returning back to their pre-COVID urban life. We looked at particular urban cohorts pre-pandemic, and analyzed what share of each cohort moved away, where they moved to, and how many have since returned. We replicated this analysis in the prior year (i.e. cohorts from before March 2019) in order to establish and compare the COVID-driven migration and return to a benchmark of “normal” migration patterns exhibited in the data. We believe that the difference between 2020 vs. 2019’s migration is the appropriate way to measure any COVID-driven changes, and is the methodology we employ throughout the analysis.

Almost exactly one year after the start of the pandemic, the third and largest-to-date stimulus payment of $1400 per individual (vs. the second round’s $600 and the first round’s $1200) began rolling out to taxpayers in mid-March. In addition to its increased size, the timing of this payout is particularly interesting, coinciding with rising vaccination rates and the re-opening of many local economies, thus providing more ‘purchasing power’ this round. We dove into the data to see how this third stimulus round impacted consumer spending across various geographies, sectors, and retailers.

As we pass the anniversary of the start of the pandemic (the WHO declared COVID-19 a pandemic on March 11th), and with over 20% of the US population now vaccinated with at least one dose as of March 14th, we examined how consumers have behaved from then to now. We look at consumer spending and foot traffic across the most and least vaccinated states, how new shoppers acquired during COVID are being retained across retailers, and how share of wallet has potentially changed over the past year.

We’ve highlighted some recent examples of how Earnest data products tracked business health per management’s commentary for Target (TGT), Planet Fitness (PLNT), Lyft (LYFT), and Tractor Supply (TSCO).

With snow covering much of the U.S. and wreaking havoc in many southern states, we looked at consumer behavior in Texas, where the cold snap triggered widespread power outages and acute hardship. As the mercury dropped in Texas so did spending: down 19% YoY a full 14 points lower than the rest of the country in mid-February. With all sectors except Big-Box retailers and Grocery trending down double digits in Texas, even usually buoyant Online Marketplaces and Food Delivery Aggregators underperformed there by over 25 points.

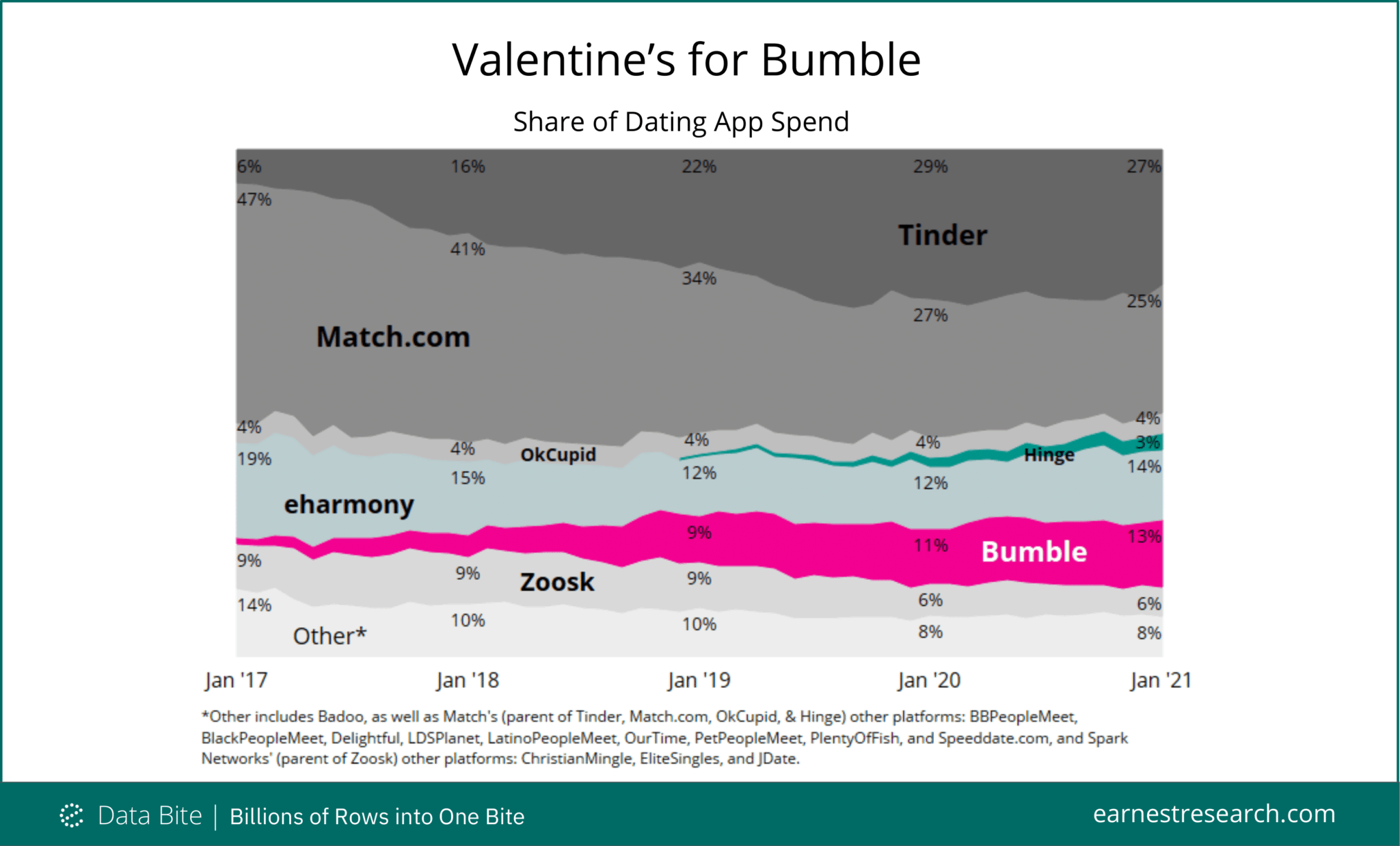

It seems that not even a global pandemic can keep people off dating apps – as female-marketed Bumble lands an $8B valuation in its IPO. In the last four years Bumble has grown from low single digits to capture 13% of the dating market by sales, while eharmony, Zoosk, and other* smaller services saw their shares decline.

In the ongoing fight against the COVID-19 pandemic, an additional $900B of stimulus relief funds were signed into law on December 27th, exactly nine months after and at roughly half the size of the original $2.2T stimulus package that Congress passed in March 2020. The new funds include direct stimulus payments of $600/$1200 to individuals/couples (vs. the first round’s $1200/$2400) plus an additional $600 per child (vs. the first round’s $500).

With Warner Bros. announcing plans to release new movies on HBO Max in 2021 for no additional fee, we looked at how the news impacted subscriptions and the Video On Demand space more broadly.

With COVID-19 vaccinations just beginning, alongside a further wave of the virus spreading across the globe, Earnest partnered with Fable Data, a European transaction data provider, to assess consumer spending trends across the US, UK, and Germany. We have compared performance across countries and within various sectors since the start of the pandemic, and assessed a ‘current-state-of-affairs’ (Dec ‘20) as consumers exit the holiday season of a global pandemic.

Aggregate consumer spending for the months of November and December declined \~5 and 6% YoY respectively, driven by foot traffic declines of \~14%, a drastic slowdown relative to the \~2% to 6% YoY sales growth exhibited in the same period in the last two years.