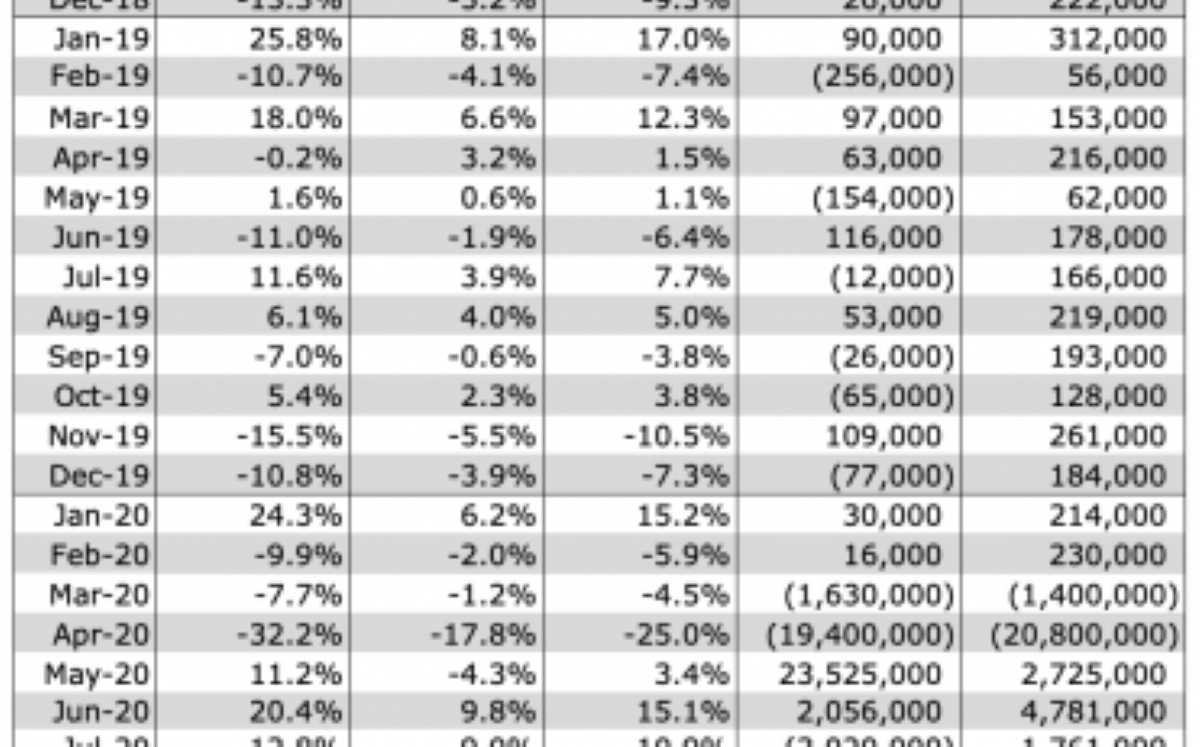

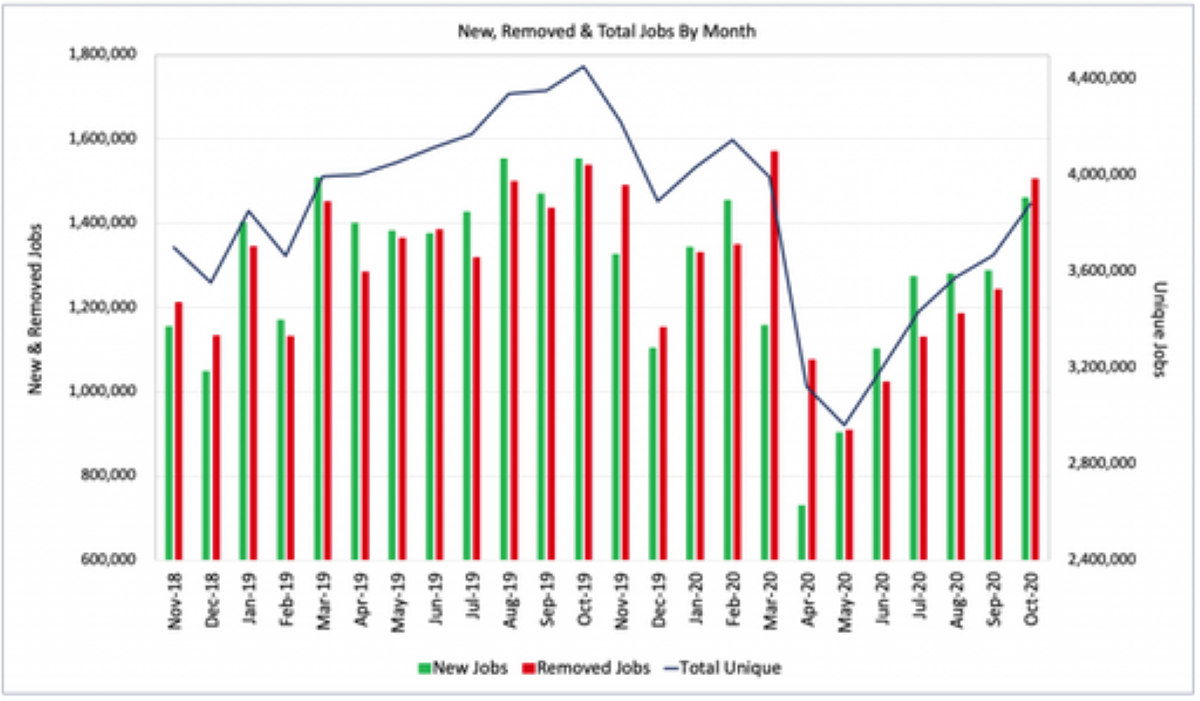

In true 2020 fashion, just a few short months have brought dramatic changes in the labor market. Job listings have shifted from a gradual slowdown to a steady downhill slide. While the -4% decline in job listings we saw in November is the first drop in total job listings since recovery began in May,

We are way behind schedule getting our non-farm payroll (NFP) forecast posted this week, and we’ll publish a bunch of additional job market data for November over the next few days, but in order to get our NFP forecast published as quickly as possible, we’ll truncate the number of charts (as well as accompanying commentary) to the two tables below.

The rumor mill began churning last Thursday with rumblings that software giant Salesforce had interest in acquiring work tools company, Slack. Official news is expected soon – and we all wait with bated breath to see how this will impact our inter-office GIF strategies.

For what feels like the first time since 2020 began, there is good news on the horizon. Less than one year since the novel coronavirus changed our world, several vaccines boasting impressive efficacy are nearly ready to go to market, and even more are in the works.

As coronavirus continues to spark volatility in the U.S. economy, LinkUp’s jobs dataset provides unique insights into COVID-19’s impact on the labor market. In the most recent edition of our quarterly Economic Indicators Report, we observe a labor market edging toward recovery from the devastating hits doled out by the pandemic.

Overall, October job listings appear to mirror the modest increases we witnessed in September. The most striking change can be seen in created job listings which were up 6% in October, after a flat September. Deleted job listings largely held steady, finishing the month at 12%, just slightly above September’s increase of 11%.

The impact that coronavirus has had on our working lives in the last 8 months has been truly staggering. For a large portion of the workforce, the pandemic has brought about changes that range from a move to remote work to reduced hours or job loss. These massive shifts have left many struggling to find their footing amid an uncertain new reality.

U.S. job openings on company websites globally rose 6% in October, continuing the steady recovery in U.S. labor demand that began in May. New Job listings posted to company websites rose 13% while the number of jobs removed from company websites, either because the jobs were filled or the employer no longer intended to fill the opening, rose 21%.

In recent weeks, the term “K-shaped recovery” has been popping up with increased frequency; used by political figures, economists and media personalities alike. Investopedia, in short, defines a K-shaped recovery as when “different parts of the economy recover at different rates, times, or magnitudes.”

Typically this time of year finds our analysts at LinkUp pouring over our jobs data to get a preview of holiday labor demand. Generally, we’d be looking at when seasonal hiring begins, who is doing the most hiring, and what all this might mean for holiday retail. But if we’ve learned anything over the past months, it’s that 2020 is anything but typical.

While U.S. job openings on company websites globally rose 2% in September, continuing the steady recovery in U.S. labor demand that began in May, the rate of increase was the slowest in the past 4 months.

To say that 2020 has been a year like no other would be a staggering understatement. Our health, well being and livelihoods have been stress-tested in ways we couldn’t have imagined just one year ago. In order to make sense of the chaos, and search for some sign of light at the end of the tunnel, we took a deeper look at our jobs data to see what it can tell us about the labor market and economy amid the global pandemic.

Back in July, LinkUp wrote an article testing the hypothesis that government stimulus was preventing workers from returning to work. The prevailing narrative was that some workers were receiving more compensation through the CARES Act than they would by returning to many low-paying jobs, so those workers were opting out and low-paying jobs were going unfilled. In our article, we concluded that LinkUp’s data did not support this claim at that time.

As we mark half a year of grappling with COVID, one industry that has weathered major turmoil is Food Service. Looking at the data to determine the shape of the industry today, we see both positive and negative signs. Noted in our recent monthly recap, Accommodation and Food Services was the industry that saw the biggest decline in August, down -9.29% for the month. (Utilities was the only other industry down, while the other 87% of industries saw improvement.)

As Labor Day closed the books on what is arguably the strangest summer in modern history, we decided to take a peek in the rearview mirror and recap what happened over the last 90 days (or was it 90 years? What is time anyway?!?)

Labor demand continued to rise in August, with steady gains in total, new and removed job openings across the U.S. that continued the steady gains seen in June and July. The LinkUp 10,000, a metric that measures the job openings for the 10,000 global employers with the most job openings in the U.S. for the month, rose 3.6% in August.

The U.S. job market is making a recovery according to data from LinkUp. Through the middle of August, over one million new positions were published which is in line with numbers from a year ago. The rebound in job postings in July and August is especially encouraging considering the sharp decline in hiring as a result of the COVID-19 economic shutdown.

There are few industries that have experienced more change in our pandemic world than healthcare. Since COVID concerns came to light, there has been no shortage of news stories about everything from scandals at the nation’s largest hospitals to AI’s role in reinventing the industry.

As the coronavirus continues to affect nearly every city in the U.S., many are struggling to envision what the road to recovery may look like. Moody’s Analytics sought to provide clarity for that vision in a recent report. They examined the top 100 metro areas in the U.S. to identify the 10 cities best positioned to recover from the coronavirus, as well as the 10 worst. We then took a look at the cities Moody’s highlighted to understand if our jobs data could add additional insights on prospects for economic recovery.

There is a strong narrative present in today’s media that the $600 a week provided by the CARES Act is creating a disincentive for Americans to return to work. This narrative can be seen in Washington as politicians argue over the pros and cons of extending some benefits of the CARES Act. In this post we will examine whether LinkUp’s job listing dataset can provide support to this narrative.