Valentine’s Day is here, and love is in the air. At least, that’s the hope of dating sites that are taking aim at singles looking for a serious relationship. Data from our ad intelligence tool, Pathmatics Explorer, shows that the top 3 advertisers in the Dating category spent nearly $7M on digital ads from January 1 through February 1, 2022. Let’s take a closer look at how Match.com, eHarmony, and Tawkify advertised as Valentine’s Day approached this year.

Pathmatics now offers granular data directly from viewers on Connected TV (CTV) devices that show who’s advertising on subscription over-the-top (OTT) video platforms including Hulu, Pluto TV, Tubi, Peacock, and Paramount+. For example, Pathmatics Explorer reveals that Procter & Gamble (P&G) was the No. 1 advertiser across our supported streaming platforms from January 1, 2022 through January 15, 2022, spending more than $9 million with its creatives garnering over 353 million impressions.

As the U.S. continues to adapt to the COVID-19 pandemic, there is more attention than ever on the health and wellness space, from COVID vaccines to rapid tests. This ever-changing medical landscape made it essential for advertisers to quickly adjust their spending and creative strategies to keep up with the latest trends. Pathmatics has recently released new, deeper categories in Explorer, allowing you to find insights into Health & Wellness advertising like never before.

The end of 2021 marked the release of a huge batch of new games, including Final Fantasy XIV: Endwalker on December 7, and the eagerly-awaited Halo Infinite, which dropped on December 8. In addition to new releases from AAA publishers, there was also a flurry of new games from indie studios, including Loop Hero from Four Quarters and Anvil: Vault Breakers from Action Square.

Despite ominous headlines warning of ‘major toy shortages’, big retailers are gearing up for a record holiday shopping season. Walmart hired nearly 200,000 workers in the third quarter in anticipation for the holiday rush. Meanwhile, Amazon has said it will lay out several billion dollars to manage labor and supply chain shortages in the lead up to Christmas. Whether there will be enough Xboxes and Paw Patrol plushies for Christmas remains to be seen. However, we do know that Amazon, Walmart, and Target are all plunging ahead on their advertising to compete for shoppers’ hard-earned cash.

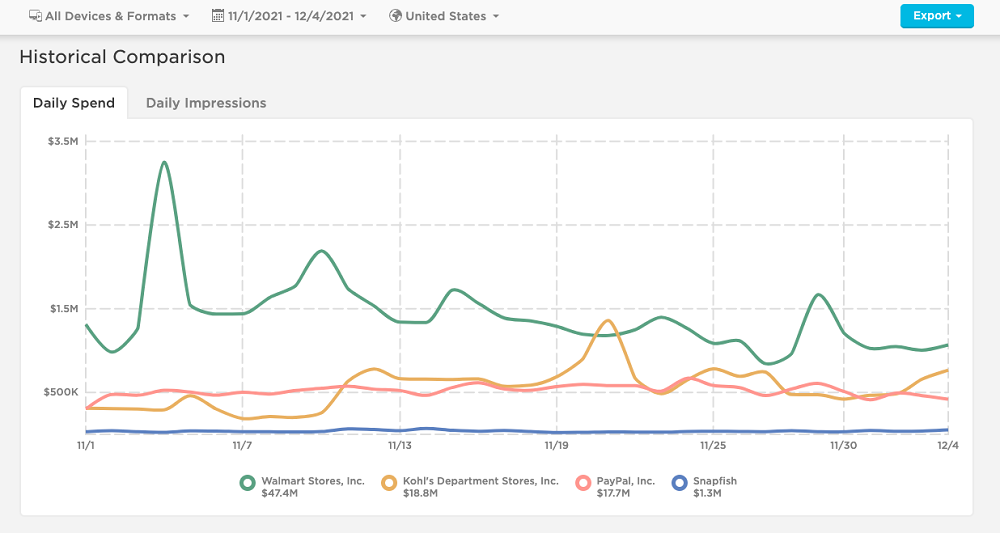

Following a record-breaking year for eCommerce, retailers are itching to get consumers to shop more than ever ahead of the holiday sale season. With a looming supply chain crisis, brands like Walmart, Kohls, Snapfish and more, have gone full throttle, encouraging consumers to buy earlier than ever this year. Since mid-October, digital ads have been popping up in droves on social media and the internet with familiar shopping adrenaline-triggering words: “Black Friday, Cyber Monday, Christmas.” Every brand has to take a unique approach with its digital ads to cut through the holiday madness.

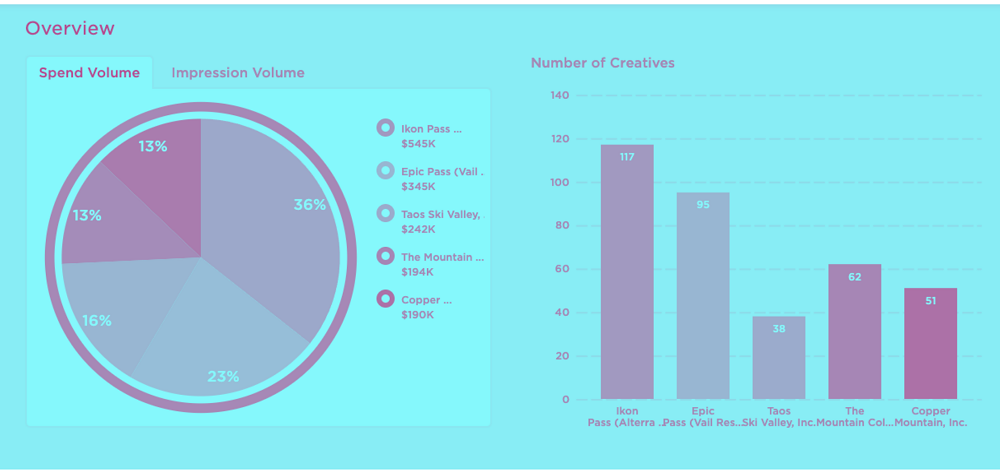

Ski and snowboard resorts were one of the first business categories to take a major hit during the first wave of COVID lockdown orders in March 2020. Now, in 2021, industry demand has slowly but surely recovered as domestic travel edges back up to pre-pandemic levels. Today, we'll review how the top three advertisers in the Ski Mountains, Lodges & Resorts category from September until now have ramped up their advertising efforts to prepare for a highly anticipated 2022 winter season.

At the beginning of the pandemic, the automotive (OEM) category pulled the emergency brake and endured a long, uphill battle against supply chain shortages, operational hurdles, and disruptions to long-term development strategies. By April 2020, car sales in the U.S. plummeted by 47%. As we turn the corner to a new year, many of these consequences have since resolved themselves but have left permanent scars on the automotive industry.

Covid-19 had consumers scrubbing every inch of their hands and homes throughout the pandemic. Cleaning and disinfectant products and brands jumped on the momentum to digitally advertise to consumers, showcasing how each product might help consumers stay safe during the pandemic. We’ll take a look at how top advertisers in the Household Cleaning Supplies, Cleaning and Disinfectant, and Hand Sanitizers categories performed in January of 2020 through August of 2021, and how things may shake out through the rest of the year.

If hotel prices are any indication, COVID-19 surges aren't going to keep travelers home this holiday season. The average daily rate for a hotel room in the US is $143.30— up 6% from 2019. In popular destinations like Hawaii, average daily rates are as high as $258.65, according to data from hospitality analytics firm STR. Which leaves many eager travelers (myself included) looking for alternative accommodations for family get-togethers or tropical getaways.

Buying a home is considered the American dream, but during a pandemic, that dream swiftly vanished, especially for real estate brands trying to advertise to consumers who, ironically, were stuck in their homes. We analyzed the top advertisers in the space to find out how their spend, strategy, and creatives adapted to the changing pandemic landscape, and a 2021 housing market which finds consumers paying top dollar for a scarce supply of homes.

Retail advertisers’ creative messaging has shifted during the Covid-19 pandemic as they continued to meet consumers changing needs. Top creatives in 2020 and 2021 were meaningful promotions highlighting new job opportunities, being present for the community, and even convenient pick-up options. Today, we’re taking a look at the retail category’s top three advertisers during the summer (June-September) of 2020 and 2021.

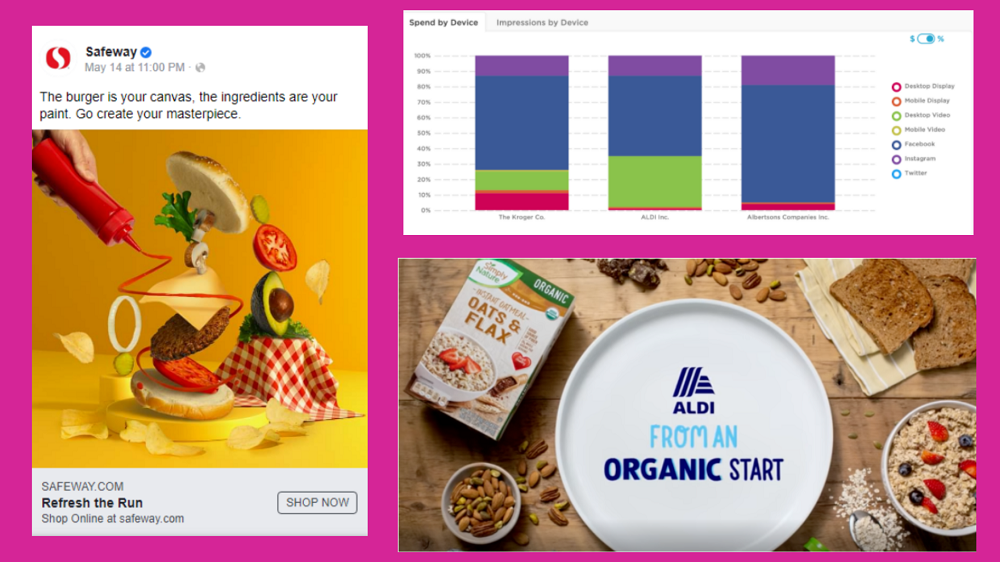

Before the pandemic, it was typical for many of us to make several weekly runs to our neighborhood grocery stores so we could throw together a last-minute dinner. And if we were too tired to cook, dining in at our local restaurant would also work in a pinch. Since COVID-19 was declared a global pandemic, those carefree grocery habits and preferences have evolved for consumers around the country. Initially, customers embraced these new behaviors out of necessity. However, as the pandemic persisted, these new habits ended up sticking around as life adjusted around this new normal.

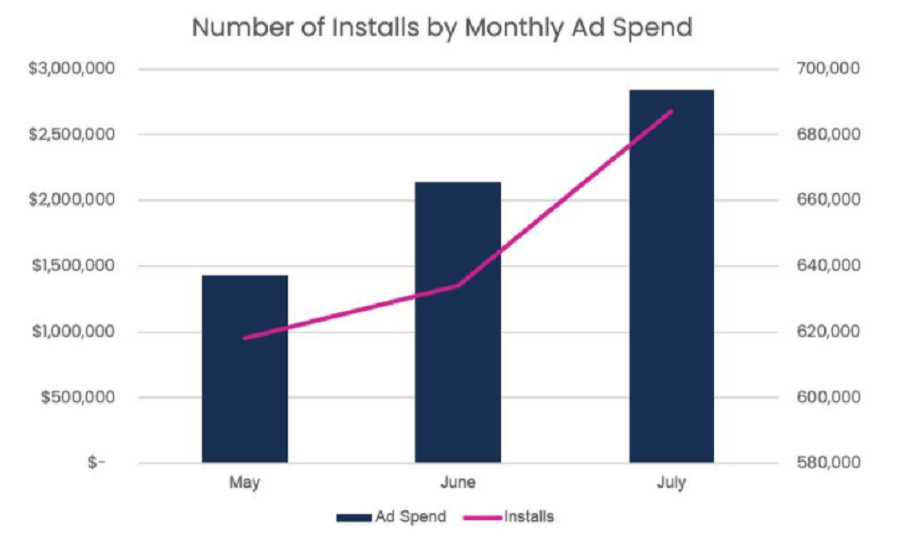

Many businesses, small and large, have taken a hit due to the coronavirus outbreak. But one category, in particular, enjoyed predicted and substantial gains: online grocery delivery. The pandemic converted millions of Americans into first-time online grocery shoppers, fueling a 54% growth in web sales across the category in 2020. So how did grocery delivery connect with consumers during the height of the pandemic? Drizly, Instacart and Shipt emerged as the top three advertisers in the grocery delivery category during this period.

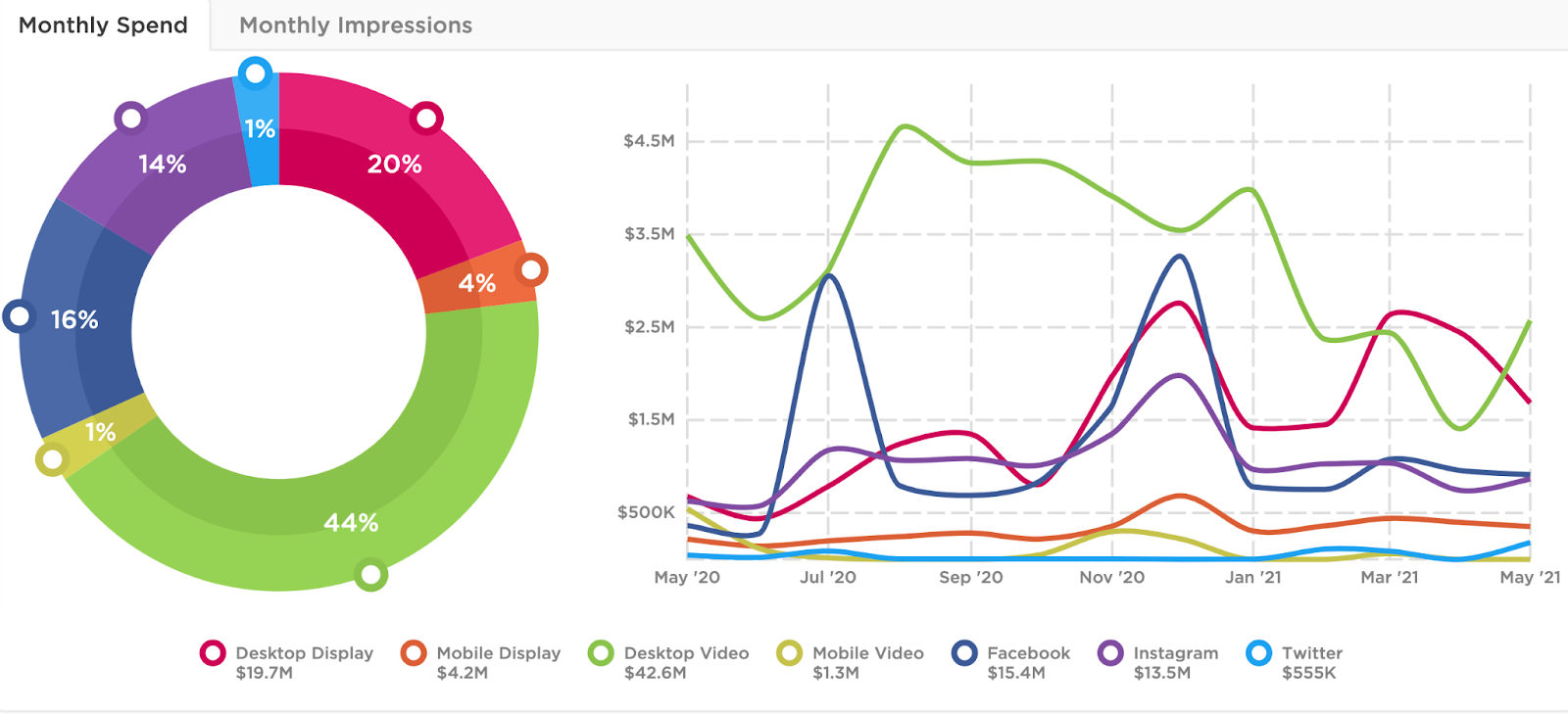

Still the top category in digital advertising, CPG takes on aspects of nearly every other vertical, with multiple sub-categories and products that span the entire digital landscape. We analyzed the top 5 CPG advertisers over the last 3 years, for seasonal, spend, and creative trends, to explain what keeps it at the top of the (individually wrapped) food chain.

With singles "vaxxed and waxed," will 2021 turn out to be the summer of love? Unfortunately, Pathmatics Explorer can't help us predict the future. But it can tell us how the top dating sites and apps are advertising. Pathmatics data shows us that dating apps overwhelmingly favor Facebook, Instagram, and Hulu, with over 90% of digital advertising budgets devoted to these three platforms. So who are the top advertisers in the dating industry, and how are they using digital to woo new customers?

The pharma and healthcare market is making moves to claim its space in the digital arena. By the end of 2021, industry ad spend is expected to surpass $11 billion, a 32% increase in just two years. Pharma and healthcare's gradual expansion into the digital space is primarily being driven by the COVID-19 pandemic, as consumers spend more time online instead of being exposed to traditional, static advertising.

The COVID-19 pandemic has affected every facet of day-to-day life. Rising unemployment rates, decreased recreational spending, and lockdown measures have taken a toll on our collective psyche and spending habits. The beauty and fashion industry did not go unspared from the pandemic's death grip; big-name brands were forced to shutter their storefronts and furlough thousands of corporate and retail-level employees. At the same time, a dramatic increase in online sales put pressure on key industry players to re-examine and invest in their respective e-commerce strategies.

As vaccination numbers rise, no one is more excited to welcome back consumers than department stores. Brick-and-mortar retailers were already struggling before the pandemic as malls fell out of fashion and Amazon expanded its online shopping empire. And as you would expect, a deadly virus didn’t make things any easier. Sales plummeted when COVID-19 closed stores for weeks on end. Barney’s, JCPenney, Neiman Marcus, and Lord & Taylor were among dozens of iconic retailers that filed for bankruptcy during the pandemic.

It's been a year for ride-share advertisers, and the drivers that keep them on the road. With quarantine in full force, the customer base dried up, with few, if any, willing to catch a ride with a stranger, mask or no mask. However, it didn't only affect the consumer, but the drivers too, as the contract employees shed their chauffeur status for whatever job was available. Flash forward to 2021 - the pandemic is in a new phase as the country is flush with vaccines - and with renewed demand, drivers are getting back in gear.