Over the past few years, Ulta has established itself as one of the nation’s leading retailers. Despite the significant challenges facing discretionary retailers in the wake of COVID and ongoing inflation, the beauty chain continues to experience remarkable growth, with second-quarter net sales increasing 16.8% percent compared to last year. In May, the company launched its own retail media network – utilizing its diverse and expanding customer base to offer partners targeted advertising opportunities, both on and off its website.

The holiday season is an important time not just for retailers but for coffee chains as well, as these brands get a boost in foot traffic from thirsty consumers going about their holiday shopping. As Black Friday draws nearer – and with the official kickoff of holiday shopping – we dove into the foot traffic data for department stores and Starbucks to take a closer look at the status of holiday retail thus far.

With COVID concerns fading, many consumers are now ready to enjoy life’s simpler pleasures, from decorating their lawns for Halloween to going to the movies. So while inflation continues to dominate many of the retail headlines, diving into foot traffic trends in key discretionary categories provides plenty of reasons for optimism as 2022’s holiday season picks up steam.

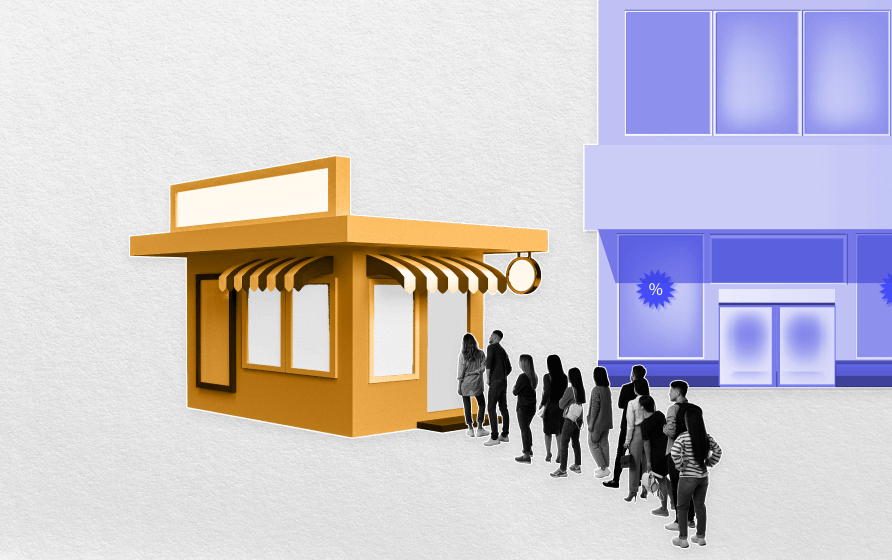

Our latest white paper takes a closer look at the growing trend of retailers adding small-format stores to their fleets. We dove into the foot traffic data of four leading chains to see how retailers can use small-format stores to increase visit density, cater to niche audiences, and foster brand loyalty. Below is a taste of our findings.

We dove into the foot traffic data to the off-price apparel sector and took a closer look at two leading sports retailers, Hibbett Sports and Dick’s Sporting Goods to see what visits can tell us about the upcoming holiday season. There are four chains that dominate the off-price apparel category – T.J. Maxx and Marshalls, which are owned by the same parent company, Ross Dress For Less, and Burlington. These retailers performed remarkably well during the pandemic, consistently outperforming the overall apparel sector – a trend that has persisted in recent months.

Wholesale clubs, which experienced significant foot traffic gains in 2021, continued to outperform pre-pandemic visits for much of 2022. And with inflation still impacting budgets going into the holiday season, consumers are as meticulous about choosing where they shop as they are about finding the perfect gift. We dove into the data for the three leaders in the space – Costco Wholesale, Sam’s Club, and BJ’s Wholesale Club – to take a closer look at the foot traffic trends driving visits as we approach the biggest retail months of the year.

Retail foot traffic picked up again in October ahead of a much anticipated holiday season. We dove into the visit data to find out which categories are making the biggest comeback and how this year’s extended holiday season stacks up against 2021. September was difficult for much of the retail landscape, as inflation took a toll on consumer spending. But the tide has turned in recently, with weekly visits since mid-October up relative to pre-pandemic 2019. Early holiday shoppers stocking up on gifts and consumers making peace with the current prices drove an October retail rebound ahead of a critical holiday season.

With the peak of the retail holiday season kicking into high gear, we dove into the visit performance for two of retail’s giants. In 2021, both Target and Walmart saw uniquely strong performances during Back-to-School season and again in October as retailers pushed to extend the holiday shopping period earlier. Last year’s visit peaks set a critical context for understanding the traffic to both retailers in recent months. Target saw year-over-year (YoY) declines of 0.9% and 2.1% in August and October – relatively minimal considering the heights hit during those months in 2021.

The office recovery has plateaued over the past couple of months as many workers settle into a hybrid working model, and the pattern largely continued in October. New York City and Chicago saw the smallest year-over-year (YoY) increase in monthly office visits since the start of the workplace recovery in April 2021, with October visits up by only 6.8% and 10.9%, respectively. In Houston and Miami, where the office recovery started earlier and picked up steam faster than in the rest of the country, visits were actually slightly lower this October when compared to last year – a clear sign that the return to office rates are leveling off in some regions – at least temporarily.

The end of the pandemic was supposed to trigger an extended period of retail success, with brands finally seeing the wider constraints of COVID removed. Yet, with the decline of the pandemic came the rise of significant economic headwinds like rising inflation and gas prices. And so the challenges have continued with the retail sector pushing to cope with a seemingly endless period of volatility. But how would malls cope in October following challenging summer months ahead of a critical holiday shopping season?

Health and wellness remains a booming industry in 2022, as more and more Americans prioritize self-care in the wake of COVID. And while online fitness classes still provide a convenient option for many, premature predictions of the demise of the gym have proven greatly exaggerated: People crave community and human interaction – and they’re willing to leave the house to get it. Despite inflation rates hovering above eight percent throughout the summer, a year that started off well for the fitness industry has gotten even better.

As the acute phase of the pandemic has waned and life has returned to normal, leading players in the pharmacy space have been forced to confront the challenging retail environment – characterized by inflation and consumer trading down – facing other sectors. Traditional drugstore giants CVS Pharmacy, Inc. and Walgreens Co. have also had to contend with increasing competition from Amazon, Walmart and others. A look at foot traffic for the past few months confirms, however, that despite these challenges, both chains are still experiencing strong performances.

When we last looked at the coffee segment, several of the biggest players were seeing significant visit boosts driven by their seasonal drink releases. As the holiday season approaches, we checked in again to see how these java giants are faring. Starbucks, the largest coffee chain in the country with almost 16,00 locations, outperformed the wider coffee segment in a challenging economic period. The weeks of October 10th and 17th saw year-over-year (YoY) foot traffic down 7.6% and 8.1%, as the challenging economic context and comparisons to a uniquely successful 2021 limited this year’s visit peaks.

Whether it’s a meal for one or a pie to share, pizza is a staple of the restaurant landscape. We dove into the visit data for four restaurant chains doing exciting things in the pizza category – Taco Bell, Papa John’s Pizza, Pizza Hut, and Pizza Inn – and took a closer look at changes that are driving visits. While the visit metrics don’t fully capture drive-thru, takeaway, or deliveries, the data can still provide a sense of visitation trends in the pizza space.

As noted in our Domestic Migration Trends white paper, COVID strengthened, rather than upended, existing migration patterns. Many cities and states that were already attracting new residents before the pandemic saw their inbound migration pick up pace, while some areas where the population was stagnant or declining before COVID saw these negative trends accelerate as well.

When we last checked in with Texas Roadhouse, the steakhouse chain was performing admirably. The brand is still displaying elevated foot traffic levels at a time when many other restaurants are feeling the dual pinch of COVID aftershocks and inflation. Texas Roadhouse’s success is driven in part by its willingness to use technology to drive in-house dining, and recent foot traffic data confirms the strength of the company’s strategy.

Our last analysis of department stores highlighted the foot traffic potential for the space heading into the summer months. Now, with the holiday retail season already heating up, we dove into the visit data for department stores as well as upscale shopping corridors to take a closer look at this past summer’s foot traffic and the momentum being carried into the holiday season.

With Q3 2022 behind us, we took a closer look at two of the most well-known restaurant chains, McDonald’s and Chipotle, to see what their foot traffic patterns reveal about their current position within the wider food industry. McDonald’s is one of the most well-known food chains in the world, with nearly 40,000 locations worldwide, almost 14,000 of those within the U.S. The company is now planning to expand its store fleet for the first time in eight years.

Our latest white paper, the Q3 2022 Quarterly Index, looks at foot traffic patterns across key retail, dining, and service categories in Q3 2022. For each sector, we broke down weekly foot traffic data over the past quarter and identified several foot traffic leaders that represent the continued resilience of brick-and-mortar businesses over the past quarter. Below is a taste of our findings. For the full report, read the white paper.

This past year has been a particularly interesting year for the restaurant space. Migration trends, new store formats, and fleet expansion during a turbulent economic period have all made for intriguing storylines. We dove into the visit data for five fast food chains and took a look at the foot traffic trends that earn them a spot on our list of Hot Restaurant Brands for 2023. Founded in Baton Rouge, LA. in 1996, Raising Cane’s is known for chicken finger meals and “Cane’s Sauce” – made daily from a top-secret recipe. The chain boasts more than 600 locations, over 300 of which opened in the last few years.