According to a Harris Poll survey conducted at the end of April this year, 39% of urban dwellers said the COVID-19 crisis has prompted them to consider leaving for a less crowded place. In addition, a number of recent news articles bring into question desirability of high-density living. In the following analysis, we examine recent changes in demand for condominiums as well as any potential impact on prices and inventory.

National home prices increased 5.5% year over year in July 2020, according to the latest CoreLogic Home Price Index (HPI®) Report. The July 2020 HPI gain was up from the July 2019 gain of 3.4% and was the highest year-over-year gain since August 2018. Strong demand, low mortgage interest rates and low supply of for-sale homes helped push home prices higher in July.

Following the longest period of economic growth in the U.S., the onset of the COVID-19 pandemic led to a decline in economic activity and a resultant recession. According to the National Bureau of Economic Research, February 2020 marked the end of the expansion that began in June 2009 and the beginning of a recession.

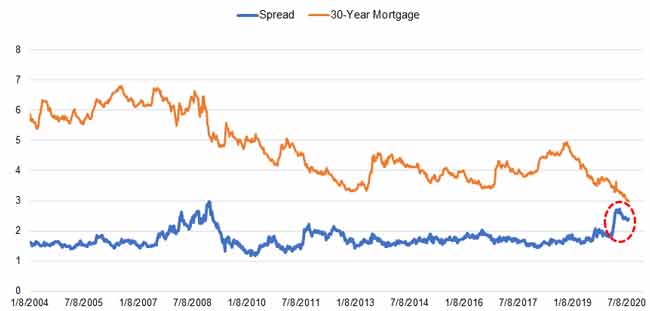

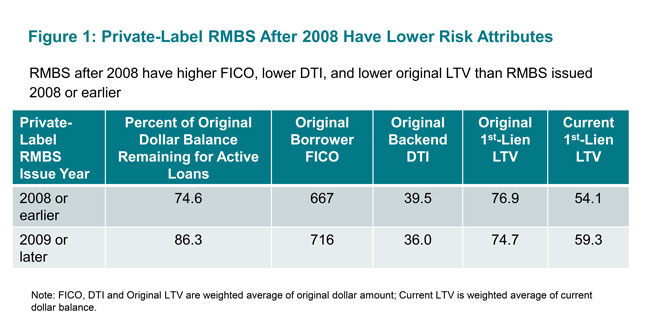

Amidst the COVID-19 pandemic, many lenders are reportedly tightening credit by raising the minimum FICO score requirement or increasing down payment requirements to 20%. The credit tightening is driven by a familiar credit market phenomenon known as flight to quality – in time of economic crisis and market uncertainty, investors tend to become more risk averse and will reduce exposures to higher risk loans or loan products.

Though the COVID-19 pandemic is occupying all attention at the moment, hurricane season has begun and natural catastrophes do not take a holiday. Forecasts for 2020 project higher than average hurricane activity, implying higher levels of devastating storm surge. Heading into hurricane season, the prospect of confronting a large natural catastrophe like a hurricane or flood during the coronavirus crisis may seem daunting.

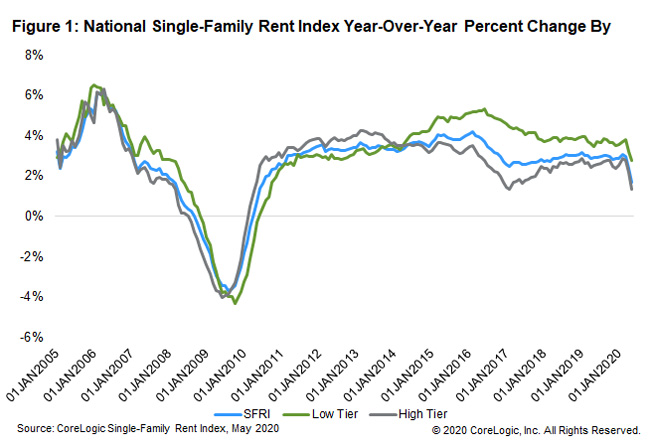

U.S. single-family rent growth continued to downshift in June, increasing 1.4% year over year in June 2020, a sharp slowdown from the prior year, and the lowest growth rate since May 2010, according to the CoreLogic Single-Family Rent Index (SFRI). Lower-priced rentals continued to prop up national rent price growth, which has been an ongoing trend since April 2014.

For millennials, first-time homebuyers (FTHBs), and down-sizing baby boomers, condos can be the most reasonable option when buying a property. Their values and lifestyle drive them toward buying condos because they tend to be more affordable than single-family homes and because condos typically come with a lower maintenance burden and are mostly located in urban cores.

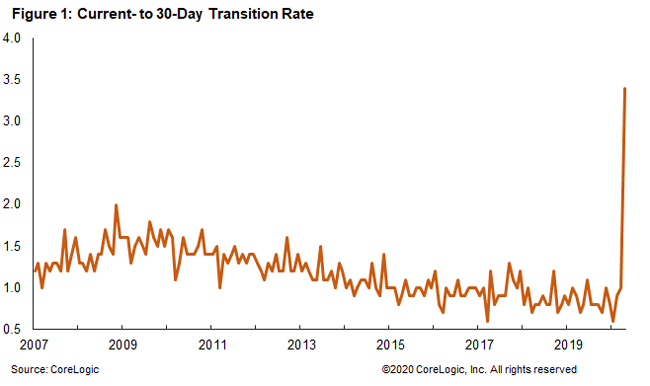

n May 2020, 7.3% of home mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure)\[1\], the highest overall delinquency rate since August 2014, according to the latest CoreLogic Loan Performance Insights Report. The May 2020 overall delinquency rate jumped 1.2 percentage points from the prior month as the impact of the coronavirus pandemic and resulting recession made it difficult for borrowers to make their monthly mortgage payments.

National home prices increased 4.9% year over year in June 2020, according to the latest CoreLogic Home Price Index (HPI®) Report. The June 2020 HPI gain was up from the June 2019 gain of 3.5%. Strong demand, especially by younger home buyers, and low supply helped push home prices higher in June.

Many families were caught financially unprepared with the sudden onset of the pandemic in the U.S. earlier this year. The national unemployment rate spiked from a 50-year low of 3.5% in February 2020 to an 80-year high of 14.7% in April. And while the sudden loss of income was partly muted by an income tax refund and enhanced unemployment insurance payments for eligible taxpayers and workers, nonetheless, many homeowners are struggling to stay on top of their mortgage loans, resulting in a jump in non-payment.

U.S. single-family rents increased 1.7% year over year in May 2020, a sharp slowdown from the prior month, and the lowest growth rate since July 2010, according to the CoreLogic Single-Family Rent Index (SFRI). The index measures rent changes among single-family rental homes, including condominiums, using a repeat-rent analysis to measure the same rental properties over time.

In April 2020, 6.1% of home mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure), the highest overall delinquency rate since January 2016, according to the latest CoreLogic Loan Performance Insights Report. The April 2020 overall delinquency rate jumped 2.5 percentage points from the prior month as the impact of the coronavirus pandemic and resulting recession made it difficult for borrowers to make their monthly mortgage payments.

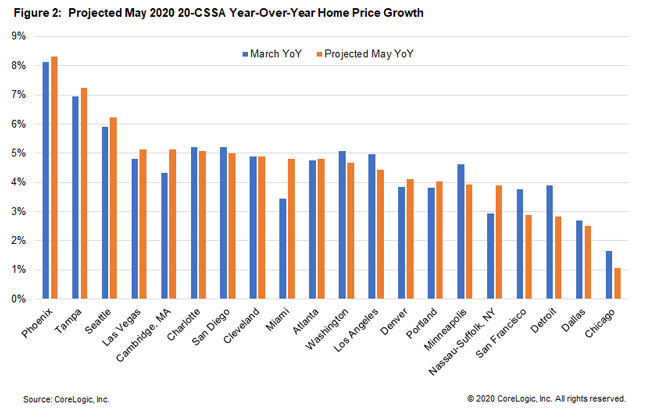

The newly released CoreLogic HPI for May shows that home prices held up very well in the United States. However, most of the home prices captured in the May report were from transactions negotiated in April or March since it takes on average 30 to 45 days to settle a transaction. Many states have entered different reopening phases since the beginning of May, and as a result housing market activity has increased.

The newly released CoreLogic HPI for May shows that home prices held up very well in the United States. However, most of the home prices captured in the May report were from transactions negotiated in April or March since it takes on average 30 to 45 days to settle a transaction. Many states have entered different reopening phases since the beginning of May, and as a result housing market activity has increased. What does that mean for June or even July home prices?

National home prices increased 4.8% year over year in May 2020, according to the latest CoreLogic Home Price Index (HPI®) Report. The May 2020 HPI gain was up from the May 2019 gain of 3.6%. Strong demand, especially by younger home buyers, and low supply helped push home prices higher in May. The economic downturn that started in March 2020 is predicted to cause a 6.6% drop in the HPI by May 2021, which would be the first decrease in annual home prices in over 9 years.

Rent increases slowed across all price levels, though rents for lower-priced homes increased faster than those of higher-priced homes in April compared with a year earlier. Phoenix had the highest increase in rent in April from a year earlier, showing only a small slowdown in growth.

The housing market collapse of 2008 and 2009 underscored the importance of keeping a watchful eye on combined loan-to-value (CLTV)—a ratio of all secured loans on a property to the value of the property. Lenders use the CLTV ratio, along with other calculations, to determine the risk of extending a loan to a borrower.

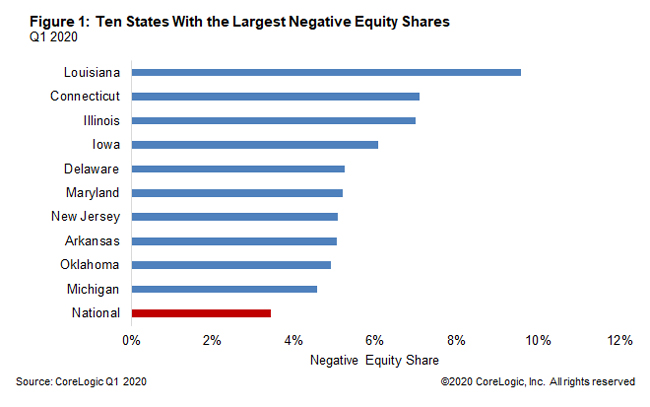

The amount of equity in mortgaged real estate increased by $590 billion in the first quarter of 2020 from the first quarter of 2019, an annual increase of 6.5%, according to the latest CoreLogic Equity Report. Borrower equity hit a new high in the first quarter of 2020, and borrowers have gained over $6 trillion in equity in the last 10 years.

In March 2020, 3.6% of home mortgages were in some stage of delinquency, down from 4% a year earlier and the lowest for the month of March in more than 21 years, according to the latest CoreLogic Loan Performance Insights Report. The measure, also known as the overall delinquency rate, includes all home loans 30 days or more past due, including those in foreclosure.

The newly released CoreLogic March Home Price Index (HPI) shows that prior to the COVID-19 outbreak home prices were starting to heat up in most places in the United States. However, home prices captured in the March report were from transactions negotiated prior to the implementation of shelter-in-place mandates, and there was a wide expectation that the growth may have decelerated in response to this interruption in demand.