First-time home buyers have been a growing share of the home buying population, a trend that accelerated in 2020. According to CoreLogic Fraud Consortium Loan Application data, the share of first-time buyers surged to 39% in 2020, up from 30% in 2016. While it may seem that first-time homebuyers have been highly encouraged by the onset of the pandemic and ensuing drop in mortgage interest rates, , our previous analysis suggests that the wave of first-time buyers was imminent irrespective of the pandemic as the largest cohort of millennials were settling down and approaching the median first-time home buying age of 32.

The share of mortgages that were 30 to 59 days past due – considered early-stage delinquencies – was 1.4% in November 2020, down sharply from a post-pandemic high of 4.2% in April 2020 and below the year ago rate of 2%. The share of mortgages 60 to 89 days past due was 0.6% in November 2020, unchanged from 0.6% in November 2019 and down from 2.8% in May 2020. The drop in early and mid-stage delinquencies from the spring indicates a lower share of mortgages entering delinquency after the initial surge after the start of the pandemic in the U.S.

The construction of new homes is important to meet the shelter needs of America’s expanding population. CoreLogic public records data show that closings on single-family new-home sales were up 12% year-over-year in the six months before the pandemic hit. The pandemic derailed closings last spring, but only temporarily. Completions of one-family homes rebounded by summer, remained brisk the rest of 2020, and were the highest annual total since 2007.

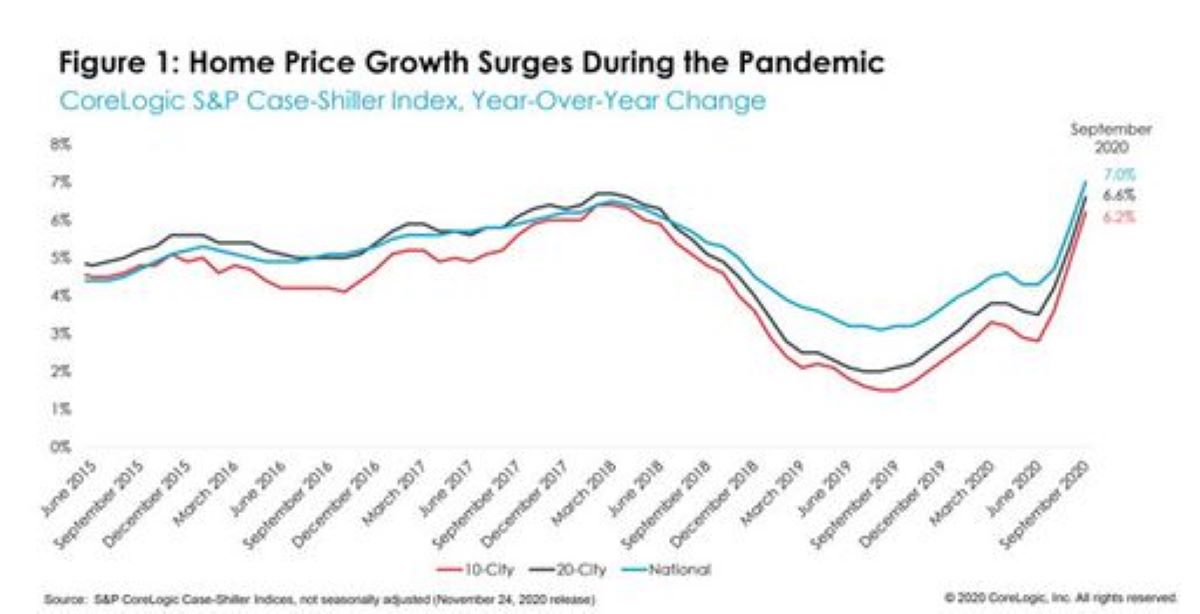

National home prices increased 9.2% year over year in December 2020, according to the latest CoreLogic Home Price Index (HPI®) Report. The December 2020 HPI gain was up from the December 2019 gain of 4% and was the highest year-over-year gain since February 2014. Price appreciation averaged 5.7% for full year 2020, up from the 2019 full year average of 3.8%. Home price growth in 2020 started off at a modest 4.3% rate in the first quarter, but as the pandemic limited supply throughout 2020, home price growth picked up, ending the year with an increase of 8.3% for the fourth quarter.

As the COVID-19 global pandemic has created havoc in the global economy, millions of American homeowners are struggling to keep up with their mortgage payments. As a result, the mortgage delinquency rate has soared. The CoreLogic Loan Performance Insights Report analyzes mortgage performance for all home loans. Based on this report, the serious delinquency rate for October 2020 was 4.1 percent, representing a 2.8 percentage point increase compared with October 2019.

U.S. single-family rent growth strengthened in November, increasing 3.7% year over year, showing solid improvement from the low of 1.4% reported for June 2020, and up from the 2.8% rate recorded for November 2019.

In October 2020, 6.1% of home mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure), a small decrease from September 2020, but a 2.4-percentage point increase from October 2019, according to the latest CoreLogic Loan Performance Insights Report.

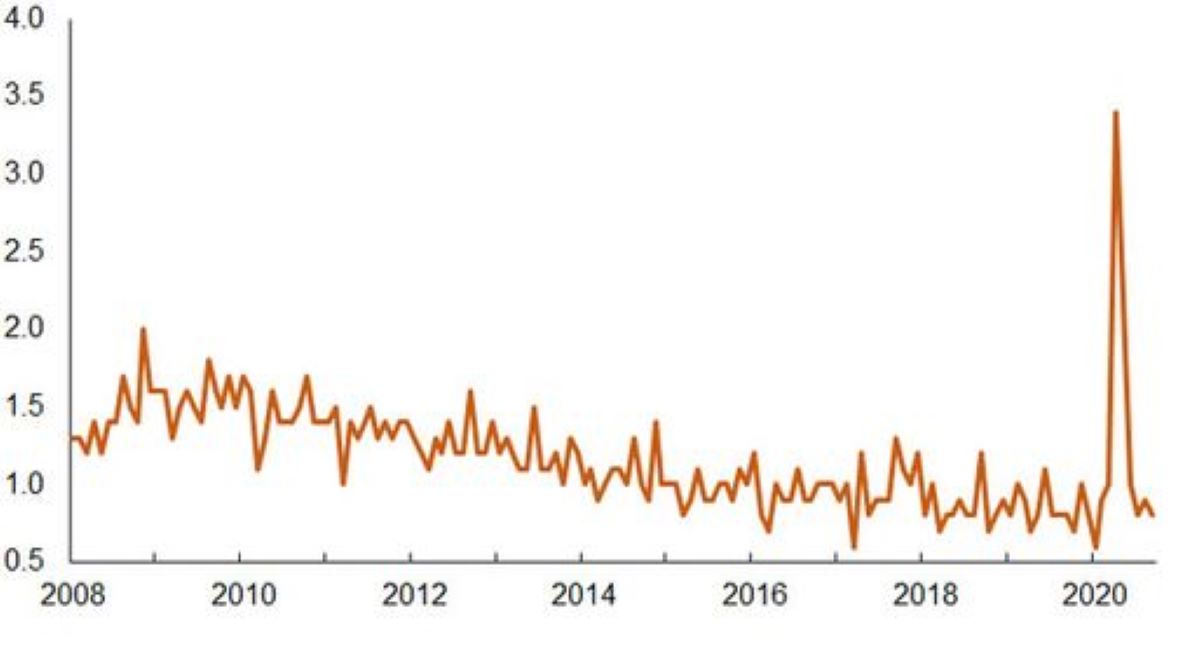

Applications by prospective tenants for a rental home generally pick-up each spring. The President’s declaration of a national emergency on March 13 triggered Shelter-In-Place restrictions and disrupted the seasonal rise. By the end of March applications for rental homes were down 42% from the same period one year earlier.

National home prices increased 8.2% year over year in November 2020, according to the latest CoreLogic Home Price Index (HPI®) Report. The November 2020 HPI gain was up from the November 2019 gain of 3.7% and was the highest year-over-year gain since March 2014. Home sales for the year are expected to register above 2019 levels. Meanwhile, the availability of for-sale homes has dwindled as demand increased and coronavirus (COVID-19) outbreaks continued across the country, which delayed some sellers from putting their homes on the market.

As the last housing market indicator in 2020, the S&P CoreLogic Case-Shiller Index finishes the year on a high note during this trying year. Home purchase activity remained consistently elevated through the end of the year, with some expected seasonal slowdown turning up as winter months approached. Still, the slowdown appears to be smaller than in a typical year.

After the pandemic took hold in the U.S. in early 2020, stay-at-home orders and uncertainty in the economy delayed listings from going live on the market. The typical spring home buying season was pushed into summer in 2020 and continued into fall. Meanwhile, low interest rates motivated home buyers.

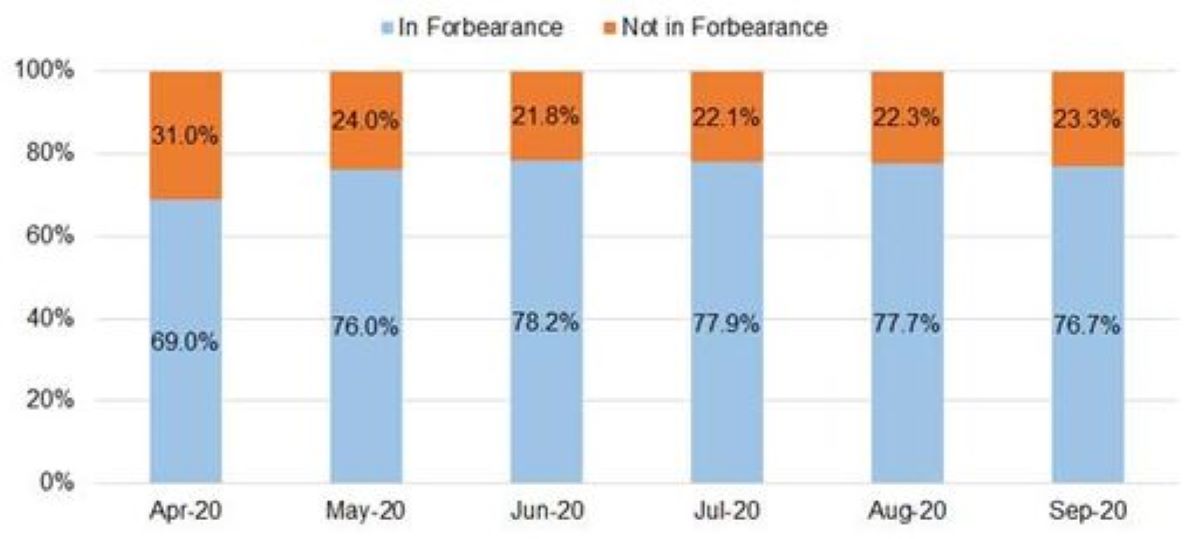

Six months after the CARES Act was signed into law on March 27, 2020, mortgage forbearances remain elevated as millions of Americans sought payment relief after the onset of the COVID-19 pandemic. Beginning in April, forborne loans falling behind payment have become a significant presence in recorded mortgage delinquencies (Figure 1), representing over two-thirds of all delinquent loans

U.S. single-family rent growth strengthened in October, increasing 3.1% year over year, showing solid improvement from the low of 1.4% reported for June 2020, and up from the 2.9% rate recorded for October 2019, according to the CoreLogic Single-Family Rent Index (SFRI)

Mortgage rates have hit record lows in 2020, generating a refinance boom as borrowers seek to save on their mortgage payments. CoreLogic has been monitoring the share of outstanding mortgage debt with interest rates above the current market rates and found that a large share of current mortgage borrowers could benefit from a refinance.

In September 2020, 6.3% of home mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure), a small decrease from August 2020, but a 2.5-percentage point increase from September 2019, according to the latest CoreLogic Loan Performance Insights Report.

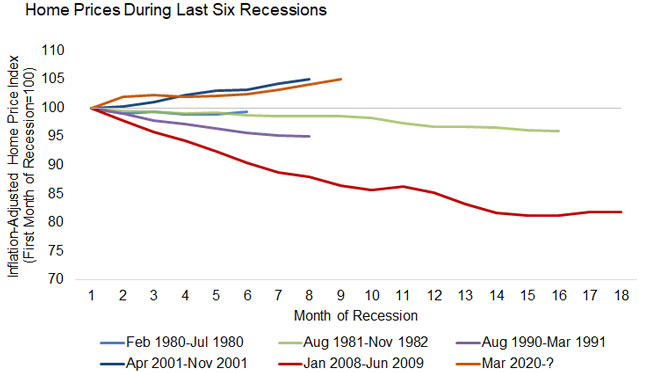

2020 was a truly unprecedented year. With it behind us, let’s look ahead at three housing market trends that are likely during the next three years. First, exceptionally low mortgage rates are likely to be around for an extended period. We expect 30-year fixed-rate loans to remain below 3% during early 2021 and average about 3.2% during the next three years.

National home prices increased 7.3% year over year in October 2020, according to the latest CoreLogic Home Price Index (HPI®) Report. The October 2020 HPI gain was up from the October 2019 gain of 3.5% and was the highest year-over-year gain since April 2014. The pandemic has shifted home buyer interest toward detached rather than attached homes as detached homes have more living area and tend to be located in less densely populated neighborhoods.

While 2020 has left little to be surprised about, the home purchase market has surprised for the better. Strong home buying activity continued to soar into autumn, with September reaching the strongest annual growth since pre-Great Recession.

Following the temporary housing market freeze during April’s nation-wide shutdowns, national sales of homes during the summer outpaced last year’s levels with September sales averaging 10% higher compared to last September. And according to the latest home buying contracts signed, also known as Pending Sales, the positive trend is expected to continue in the autumn.

U.S. single-family rent growth strengthened in September, increasing 2.5% year over year, showing solid improvement from the low of 1.4% reported for June 2020, but a slowdown from the 3% rate recorded for September 2019, according to the CoreLogic Single-Family Rent Index (SFRI).