Consumer credit and debit spending grew YoY in February, despite the systemic shock of the Ukraine-Russia War. However spending decelerated 3 points from February to the preliminary period between March 1st and 9th. This suggests that US consumers could already be adjusting their behavior based on the economic outlook of the war. Spending growth across most major subcategories decelerated from February to the preliminary March period (1-9), with one notable exception.

Breakfast spending is back to near pre-pandemic levels at Starbucks, but midday and afternoon are the fastest growing dayparts. Visits to Starbucks locations in suburban, drive-thru formats outperformed downtown visits up to 50% in some New York City locations. Starbucks’ average ticket growth accelerated in 1Q22 sharply as inflation adjustments were passed along to customers. Starbucks North American revenue grew 23% YoY in 1Q22 on a 12% YoY increase in transactions and a 6% YoY increase in average ticket, directionally consistent with Earnest Research transaction data.

Total aggregate consumer spending grew 3% YoY in the week ending Dec 7th according to the Earnest Research Spend Index (ERSI*), a measure of sales growth for 2,500+ U.S. consumer discretionary and staples businesses. This was a deceleration from the 9% YoY growth during the first 10 days of the preliminary holiday season (Nov 1 to 10th). Strong average transaction size growth, possibly due to inflation or reduced discounting, was partially offset by fewer transactions (-1% YoY), a deceleration from the 6% YoY transaction growth in October.

The Earnest First Choice Retailer Rankings are based on the credit and debit card spend of millions of de-identified U.S. consumers. Earnest identifies each shopper’s First Choice Retailer by comparing their spend across 1000 retailers between Thanksgiving and Cyber Monday. For example, if Shopper A spent $70 at Amazon, $50 at Walmart, and $30 at Target, their First Choice Retailer would be Amazon.

Holiday retail is up 9% YoY so far according to the Earnest Research Spend Index (ERSI*), a measure of sales growth for 2,500+ U.S. consumer discretionary and staples businesses. Preliminary data reflects sales during the early holiday retail season starting Nov. 1 as defined by the National Retail Federation, to Nov. 10. Growth decelerated from October and remains slightly below the 2020’s holiday retail season levels. ERSI consumer spending growth peaked in early 2021 on a YoY basis as the data lapped Covid-19 related closures.

There was speculation this past summer that, come Labor Day, workers would begin their return back to the office. Fast forward some months, with the Delta variant spreading and the Great Resignation testing the market, the nature of remote work remains top-of-mind: are employees returning back to the office, or will remote work be a sustained new reality in a post-pandemic workforce? We have refreshed our May analysis on measuring workers’ return to the office via consumer foot traffic to dense urban Starbucks locations near large office buildings.*

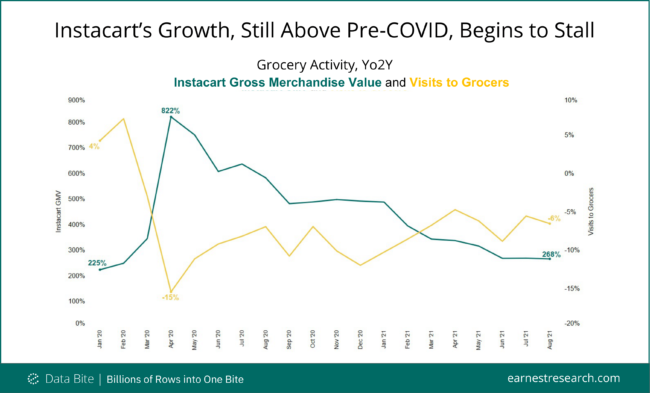

An analysis of Earnest Research data by Emory professor Dan McCarthy noted that GMV (Gross Merchandise Value) growth on Instacart is slowing faster than other convenience economy brands after peaking in April 2020. Earnest Research data in the report highlights that newly acquired Instacart customers are becoming less active over time—in contrast to restaurant delivery platforms such as DoorDash. The findings suggest that consumers’ switch to online grocery shopping may not have the staying power of other Covid-19 shifts.

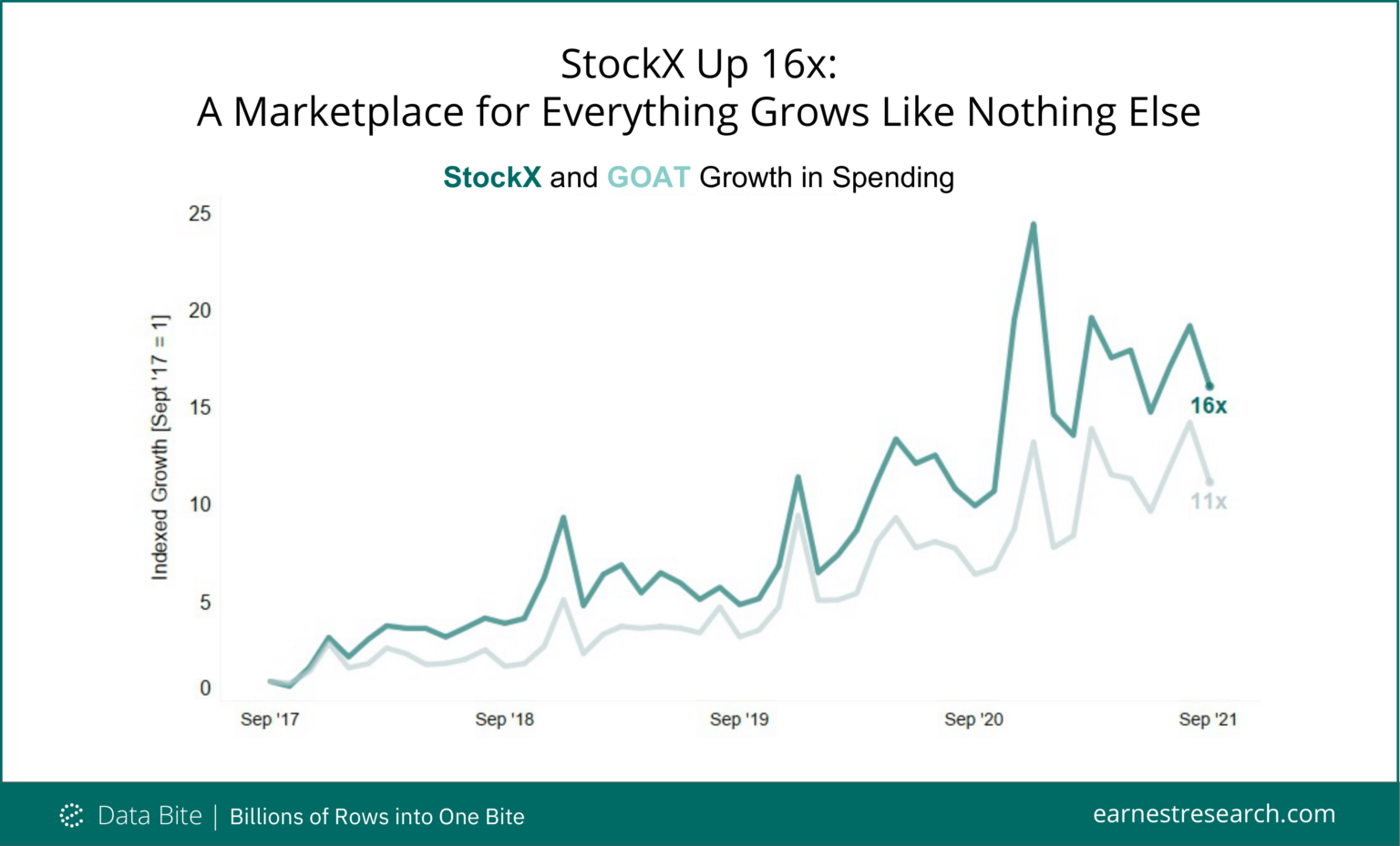

When StockX announced a $255 million funding raise in April, valuing the company at $3.8 billion, much was said of StockX’s uniqueness as a company: a “stock market of hype,” many of the goods bought and sold through its marketplace represent Gen-Z consumers’ interest in alternatives to traditional investments. Best known for apparel and accessory resale—primarily sneakers, streetwear, handbags, and watches—products on StockX have broadened to include collectibles and electronics.

While many retailers took a cautious approach to expansion following the COVID outbreak, Dollar General bucked the trend, deciding instead to launch a new concept, Popshelf, mid-pandemic. Courting a new type of customer, it plans to open up to 50 of these locations by the end of the year. Popshelf is attracting higher-income shoppers: 29% of its customer spend in 2021 came from households with annual earnings of more than $150K, while this figure was 22% at its parent, Dollar General.

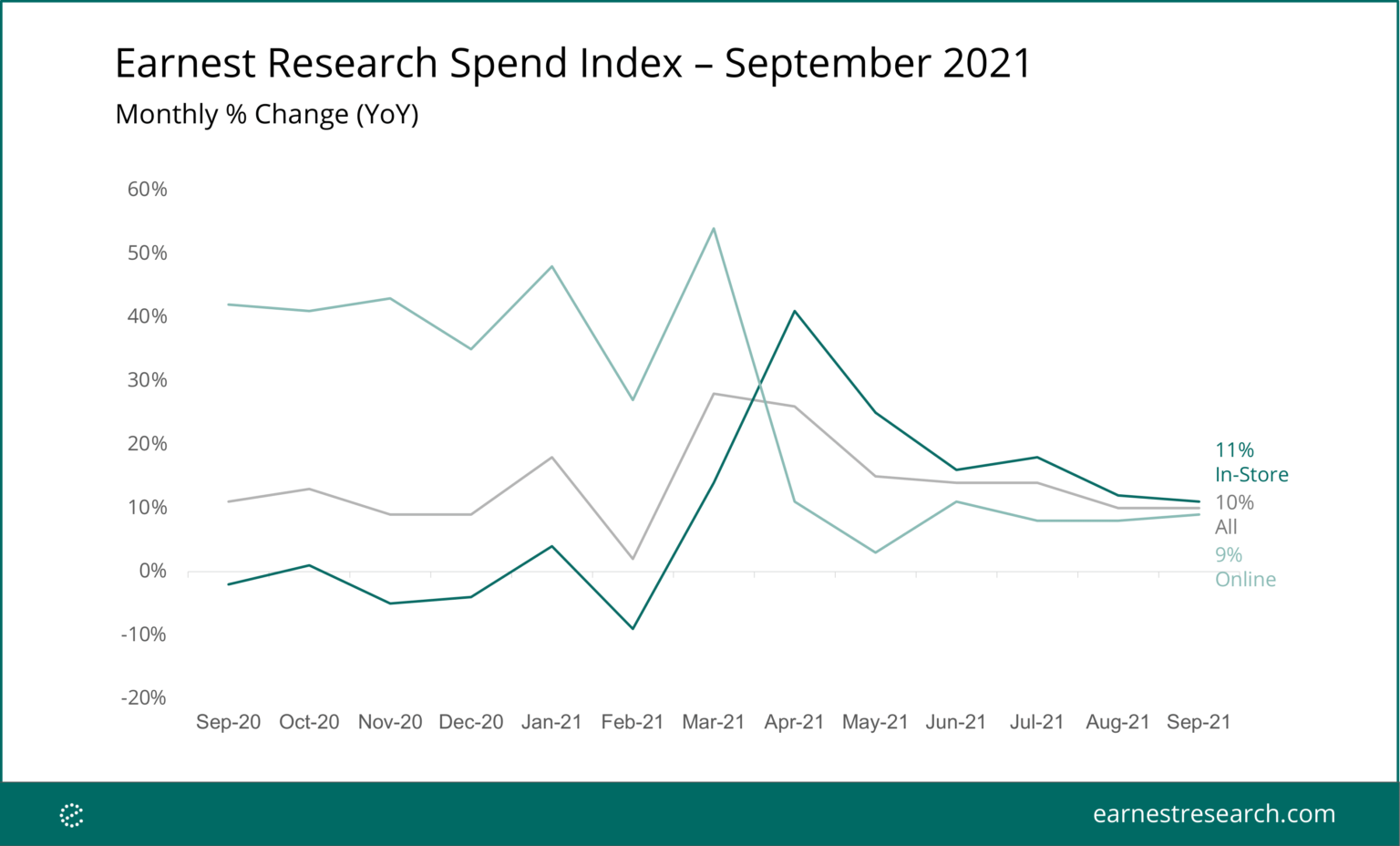

The Earnest Research Spend Index* was flat compared to the prior month with in-store growth continuing to decelerate and online accelerating slightly. Yo2Y spend accelerated 2pp both in-store and online. Foot traffic to consumer businesses was up slightly versus 2019 levels for the first month since February 2020, a sharp reversal from August suggesting a recovery in consumer activity.

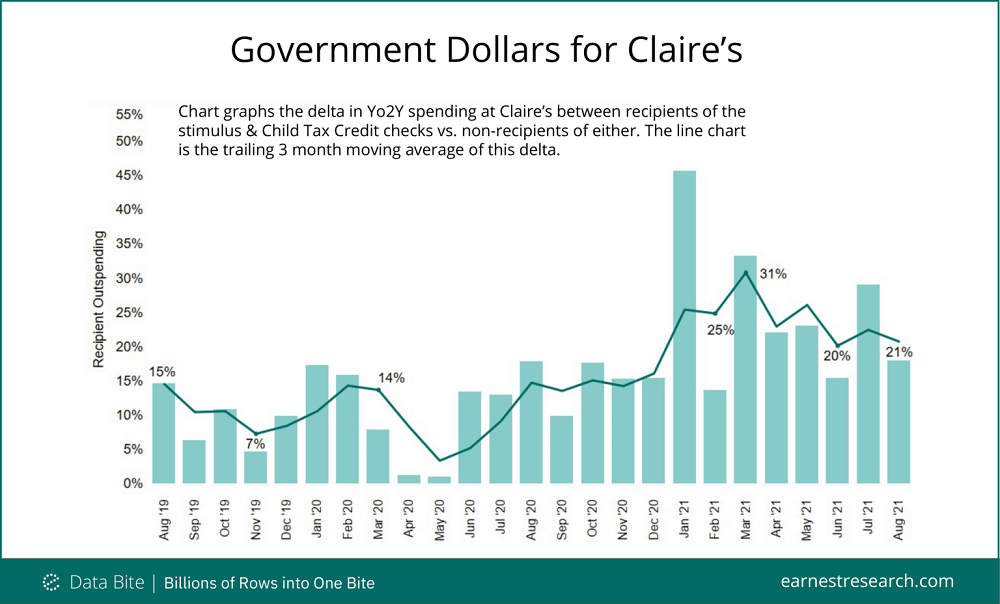

Teen/tween retailer Claire’s, known primarily for its fashion jewelry and ear piercing services, has filed for an IPO—several years after a private equity takeover and emergence from Chapter 11 bankruptcy. In its recent prospectus, Claire’s noted that for the first half of fiscal year 2021, North American sales grew 124.3% compared to 2020 and 23.2% compared to 2019; much of this was driven by ear piercing-related transactions.

The full back-to-school (B2S) season saw no growth relative to 2019 (Yo2Y), an improvement from last year’s stunted season, but still shy of the 4% Yo2Y growth levels pre-pandemic. In-store spending declined 10% Yo2Y while online spending grew 27%. Foot traffic data to malls reflected a 16% decline this season compared to 2019; still a ways towards full recovery. Majority of states saw lower levels of spending relative to pre-pandemic, like D.C. and Louisiana (20+ points lower), California and Texas (10+ points) and New York (6+ points).

September 17, 2021

/

Business

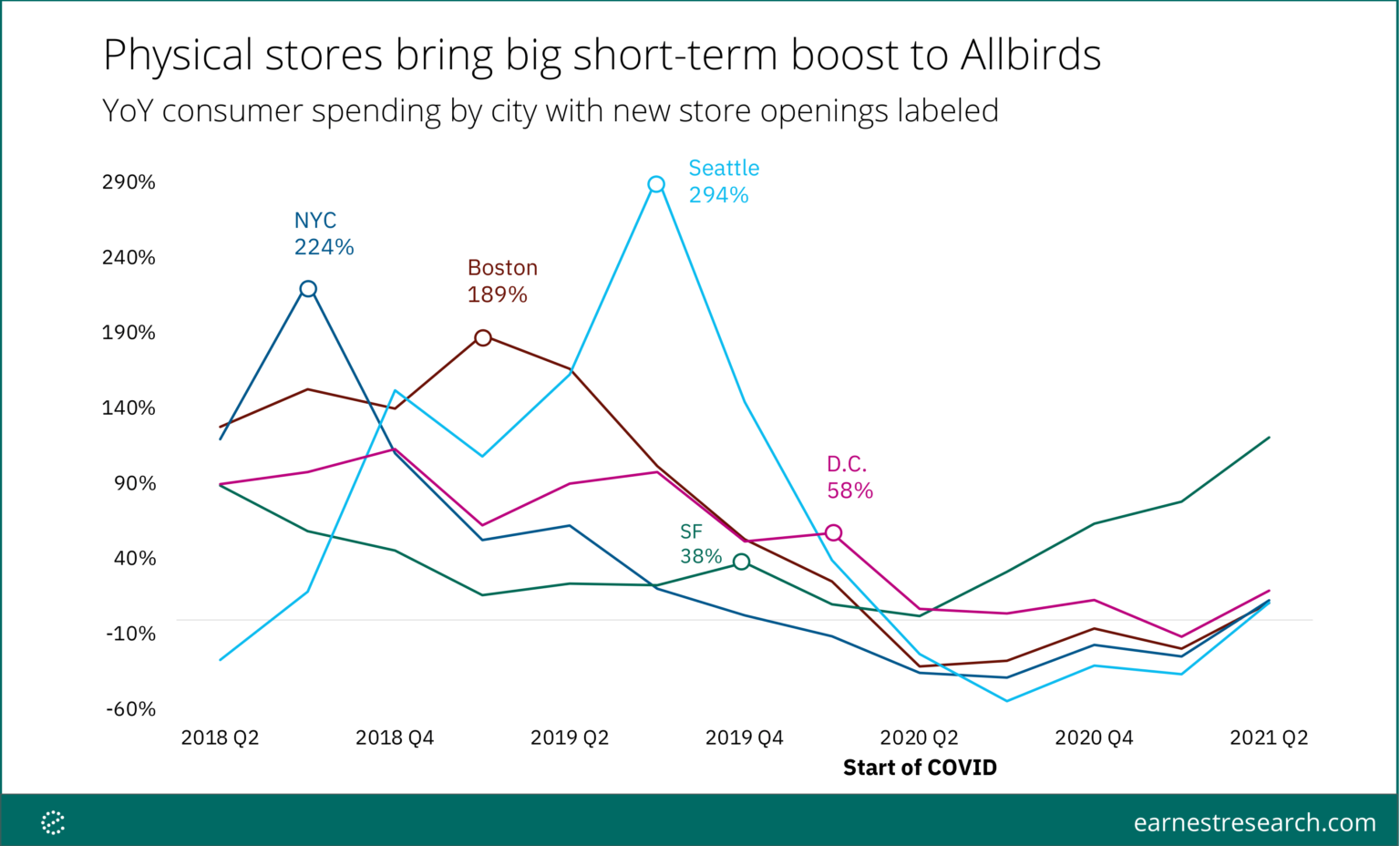

Allbirds IPO

Sustainable footwear brand Allbirds has filed for an IPO to trade as $BIRD on the Nasdaq, joining a slew of other DTC brands going public. While Allbirds built its brand on direct e-commerce sales (almost 90% of Allbirds sales happen online), opening physical stores is increasingly important to the brand in attracting new customers, as cited in Allbirds’ S-1. Using Earnest consumer spend data, we analyzed the degree to which Allbirds sales were impacted by new store openings in cities across the U.S.

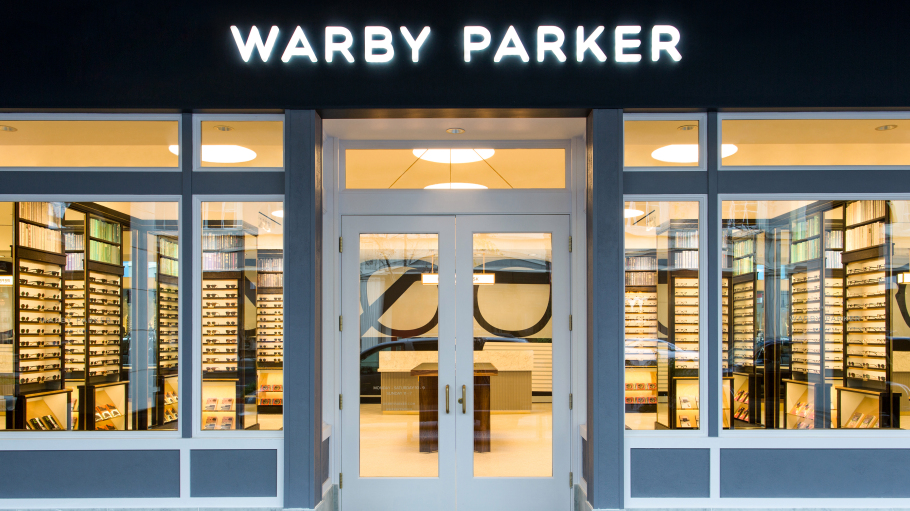

Warby Parker is the latest direct-to-consumer company planning to go public. We reviewed statements made in the company’s S-1 and compared them with Earnest spend data, analyzing how Warby Parker has performed in the eyewear market among competitors like Lenscrafters, Sunglass Hut, and Zenni. We also looked at which eyewear companies have been most successful in retaining existing customers while attracting new buyers.

For some school districts*, the back-to-school shopping season has arrived. Following a year of mostly remote learning and a resulting stunted 2020 school shopping period, we looked at our data to see if 2021 would be any different. Good news for retailers: a return to in-person classes and some extra cash from the first Child Tax Credit payment shows the retail tide may be turning.

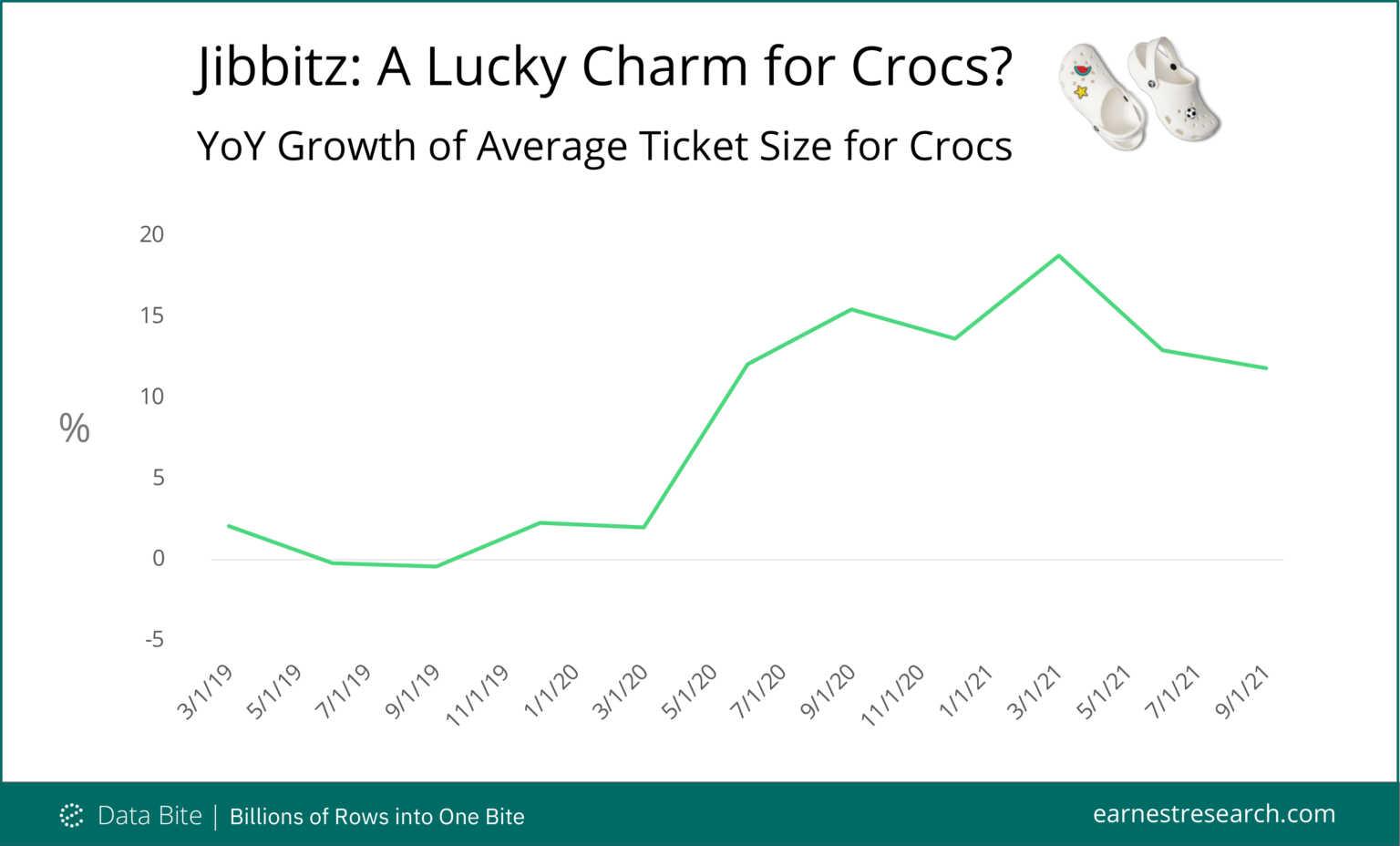

Few footwear choices have garnered such polarized opinions as Crocs ($CROX), whose signature foam clogs have developed loyal fans among medical professionals and home gardeners alike. In recent months, the shoe company has skyrocketed in popularity with Gen Z shoppers in particular, perhaps in part due to celebrity endorsements and even fast food partnerships. In any case, Crocs reported a >60% increase in sales last quarter, and the company expects yet another uptick this year.

The phrase “no place like home” took on new meaning for many at the height of the pandemic, with much of the country pivoting to a new normal of quarantine and remote work. Some of the biggest beneficiaries of this development were the Home Improvement and Home Furnishing sectors as consumers increasingly took on DIY home projects and invested in home offices—to the tune of $420 billion last year.

Ahead of its forthcoming $35B IPO, we looked into Robinhood’s stated growth strategy to “continue adding new customers to \[their\] platform” as well as which customer cohorts are most valuable for the trading app. Customers who joined the Robinhood platform in 1Q20 or later have a far greater Cumulative Deposit Value than prior cohorts, starting with a higher initial deposit, in the range of $240-$340, vs. an appx. $200 in previous periods.

As summer gets underway, which travel platforms are luring eager travelers? Using Earnest spend data we reviewed how Airbnb is performing after COVID disrupted travel, and shone a light on the platform’s extended-stay and quarantine-friendly business model. With continued restrictions on international travel, it’s not surprising Airbnb has maintained its stronghold in the Online Travel Agency (OTA) market, continuing to capture 50% of the sector. By comparison, Vrbo including HomeAway, a clear beneficiary during the pandemic peaking at 32% market share in 2Q20

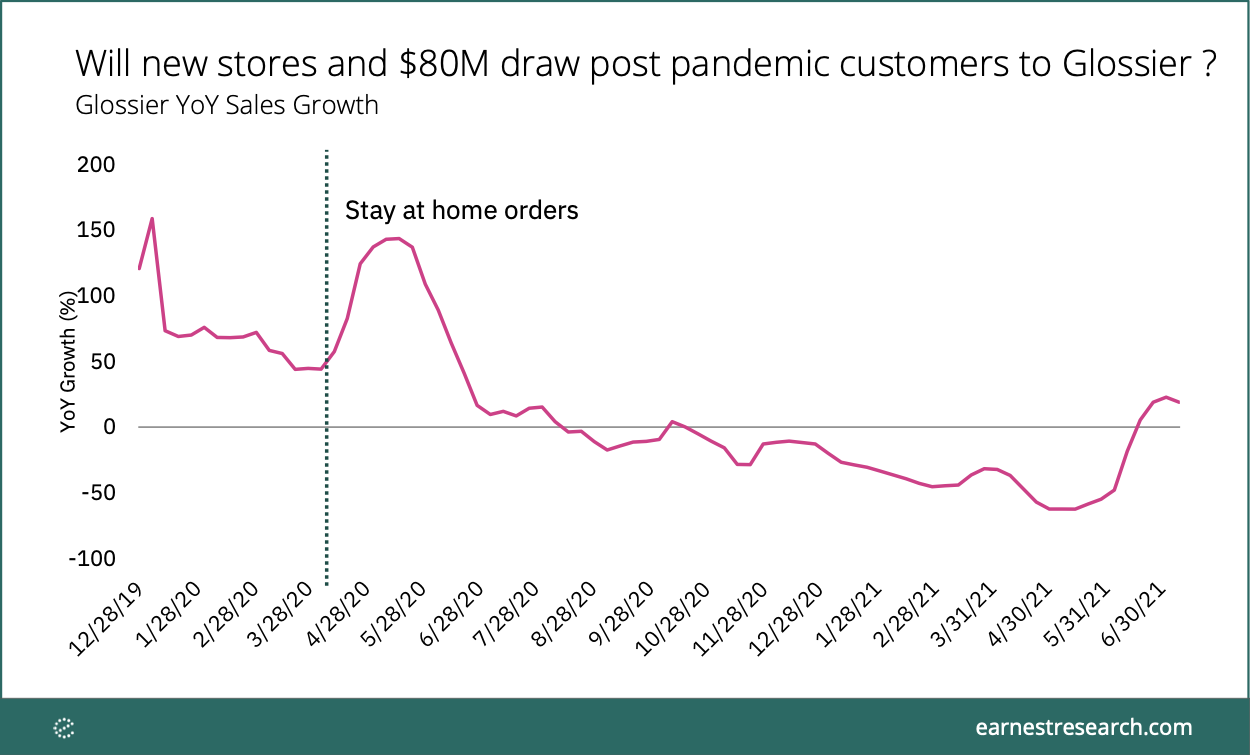

With news that Glossier recently closed a Series E round of $80M (led by Lone Pine Capital) now bringing the DTC company’s valuation to $1.2 billion, we looked at our spend data to see how the beauty brand has fared throughout the pandemic and beyond. Glossier YoY sales peaked in mid-May growing 143%, coinciding with stay-at-home orders that left many shoppers with online marketplaces as the only place to checkout. As COVID cases continued to grow, Glossier’s sales declined, hitting negative growth by late summer 2020