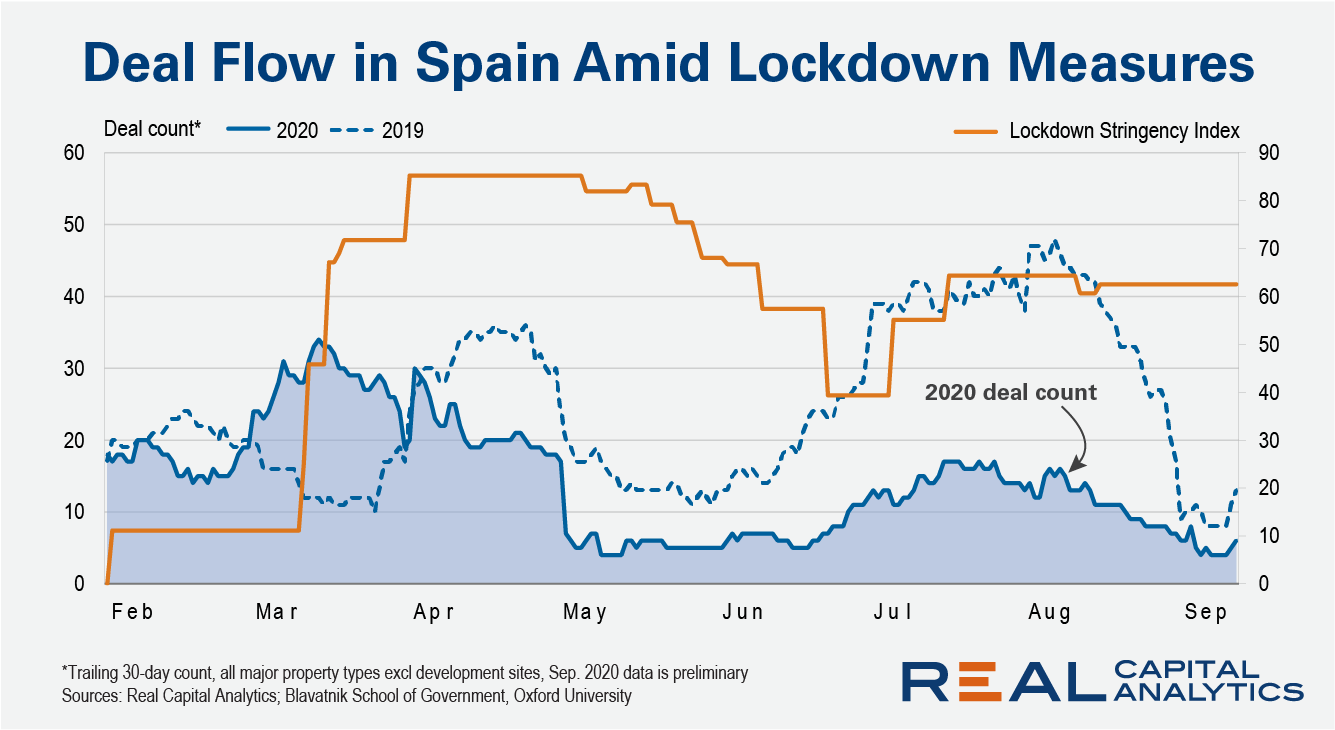

The Covid-19 pandemic has struck Spain particularly hard. Cases and total deaths from the first wave of the outbreak were among the highest in the world and a secondary surge is underway. The extent of the Spanish government’s lockdown and the resultant economic fallout has had a marked effect on the country’s commercial real estate market. Deal volume through the end of August fell 54% versus the same point in 2019 and the deal count dropped by 37%.

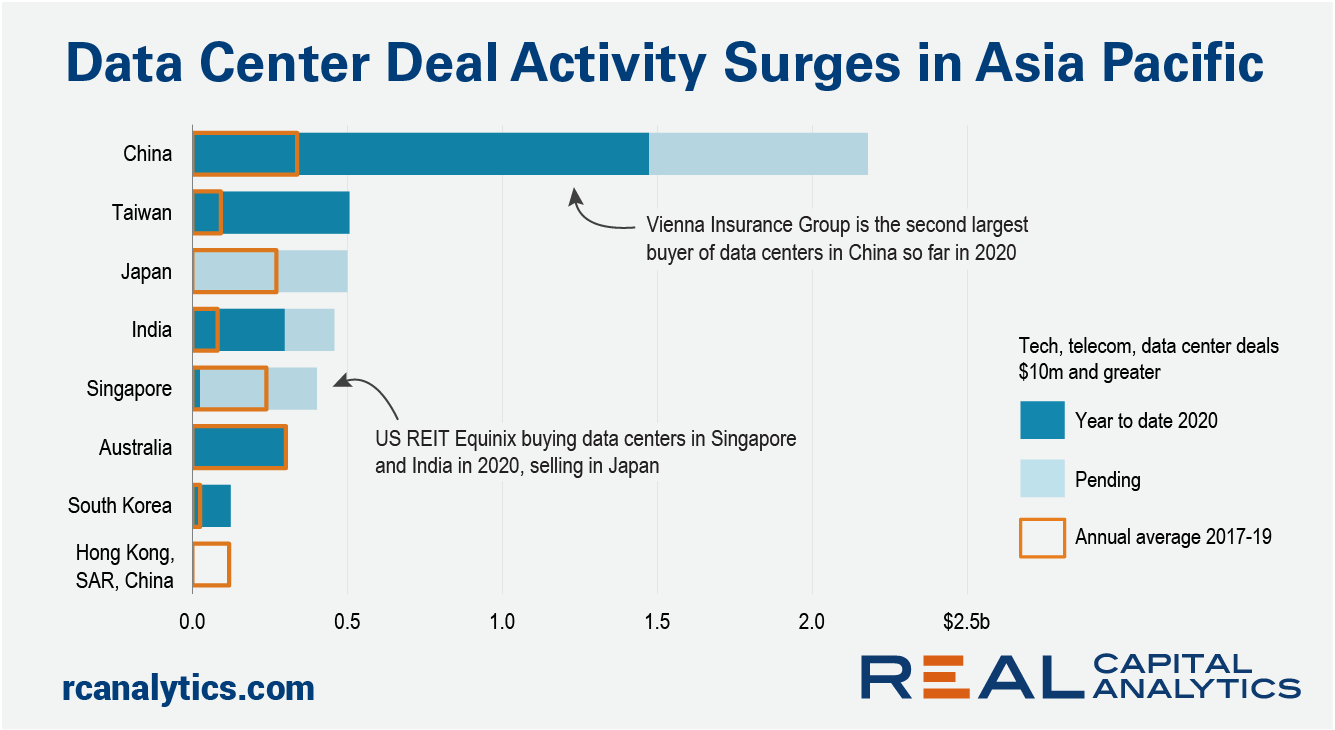

News of the planned sale of a Beijing data center campus for half a billion dollars may have come as a surprise to some. However, the deal — which, if it closes, would be the largest industrial deal in the Asia Pacific region in 2020 — is just one of a bundle of pending data center transactions in the region.

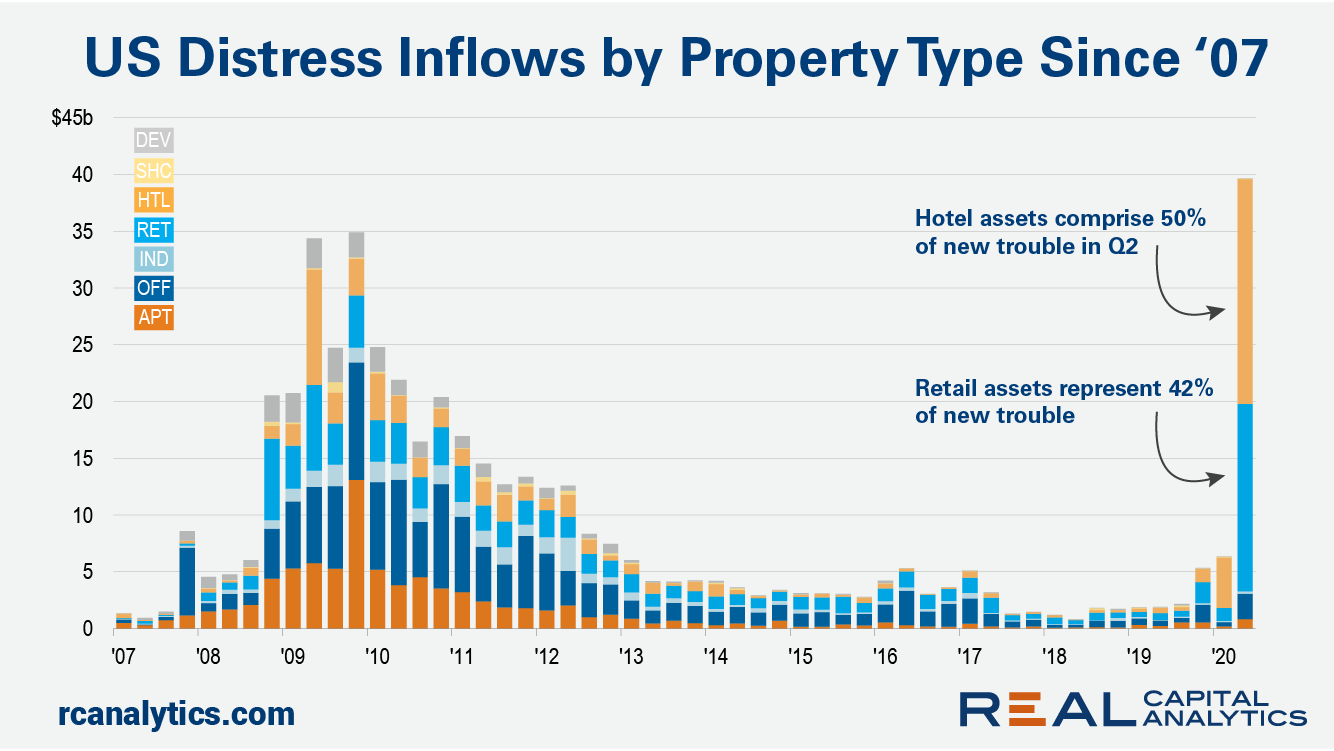

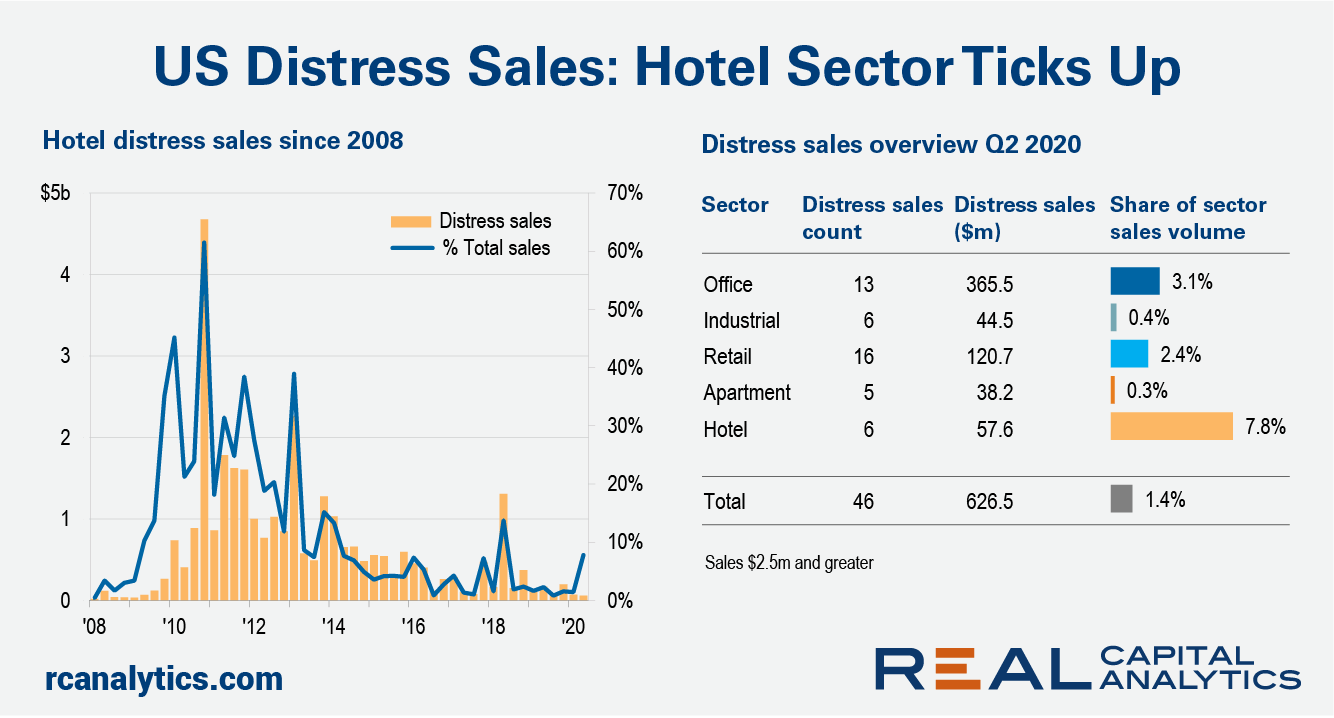

Given news headlines, it’s to be expected that retail and hotel properties would represent a large share of newly troubled assets since the start of this Covid-19 recession. The magnitude of their shares may be more surprising. Retail and hotel assets combined represented 92% of new trouble in the second quarter of 2020. In the depths of the GFC, these two sectors were behind only about half the total distress.

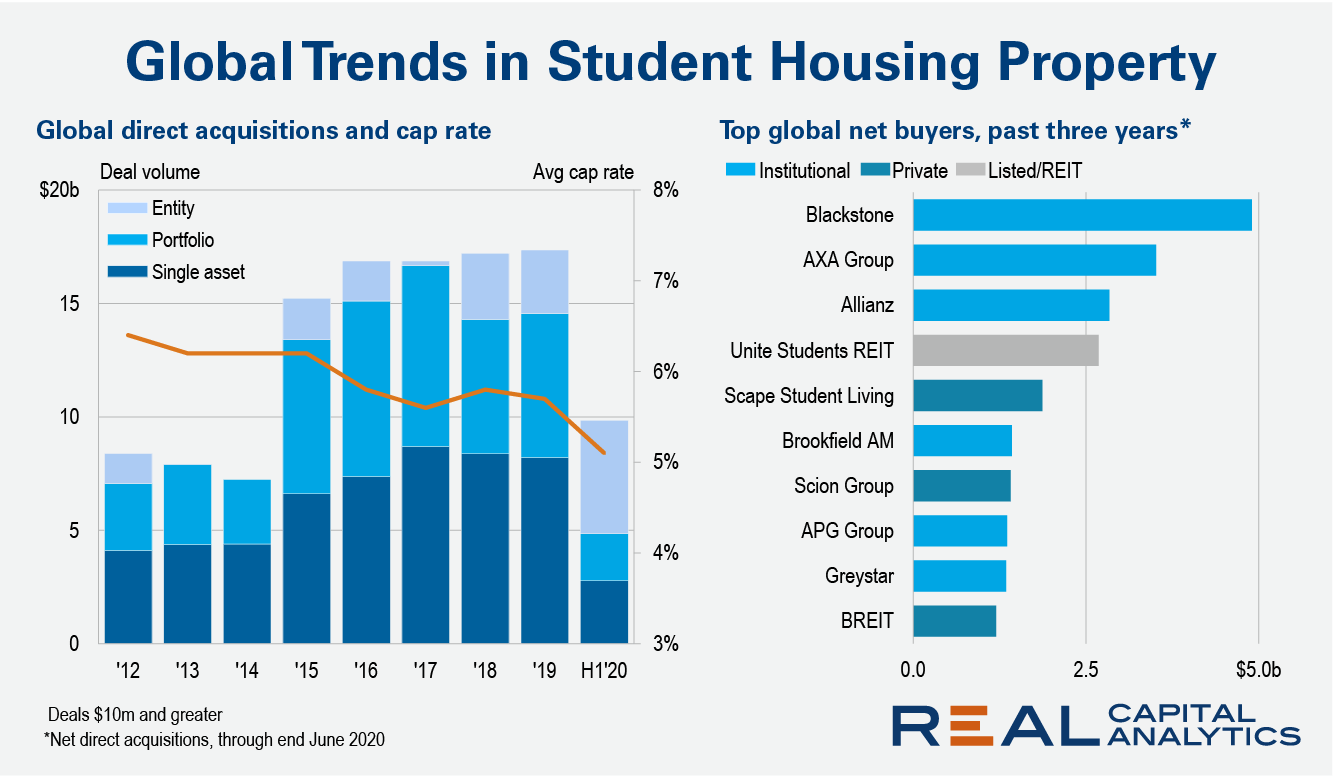

Over the past six years there has been an explosion of institutional investment into student accommodation around the world on the premise that demand for housing is robust. That premise has been thrown into doubt as Covid-19 forces universities to reduce or cancel in-person teaching and thwarts travel by international college students.

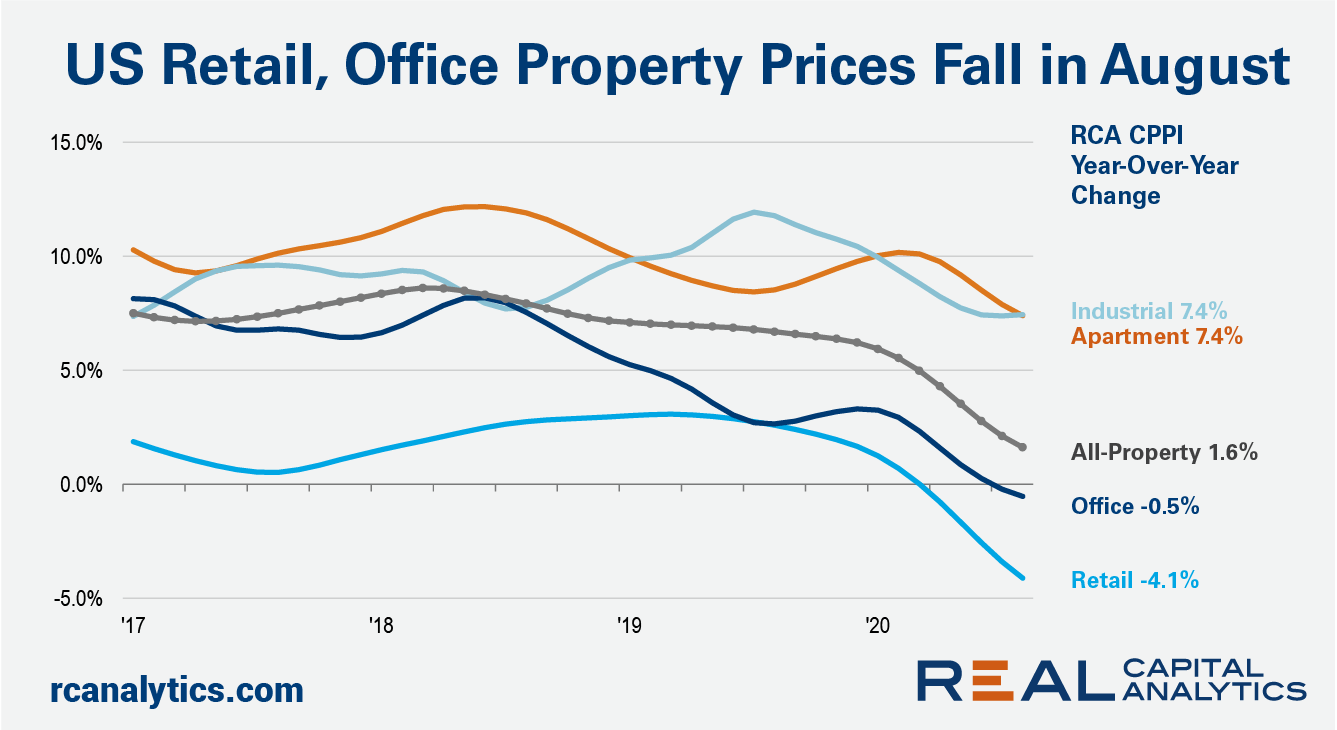

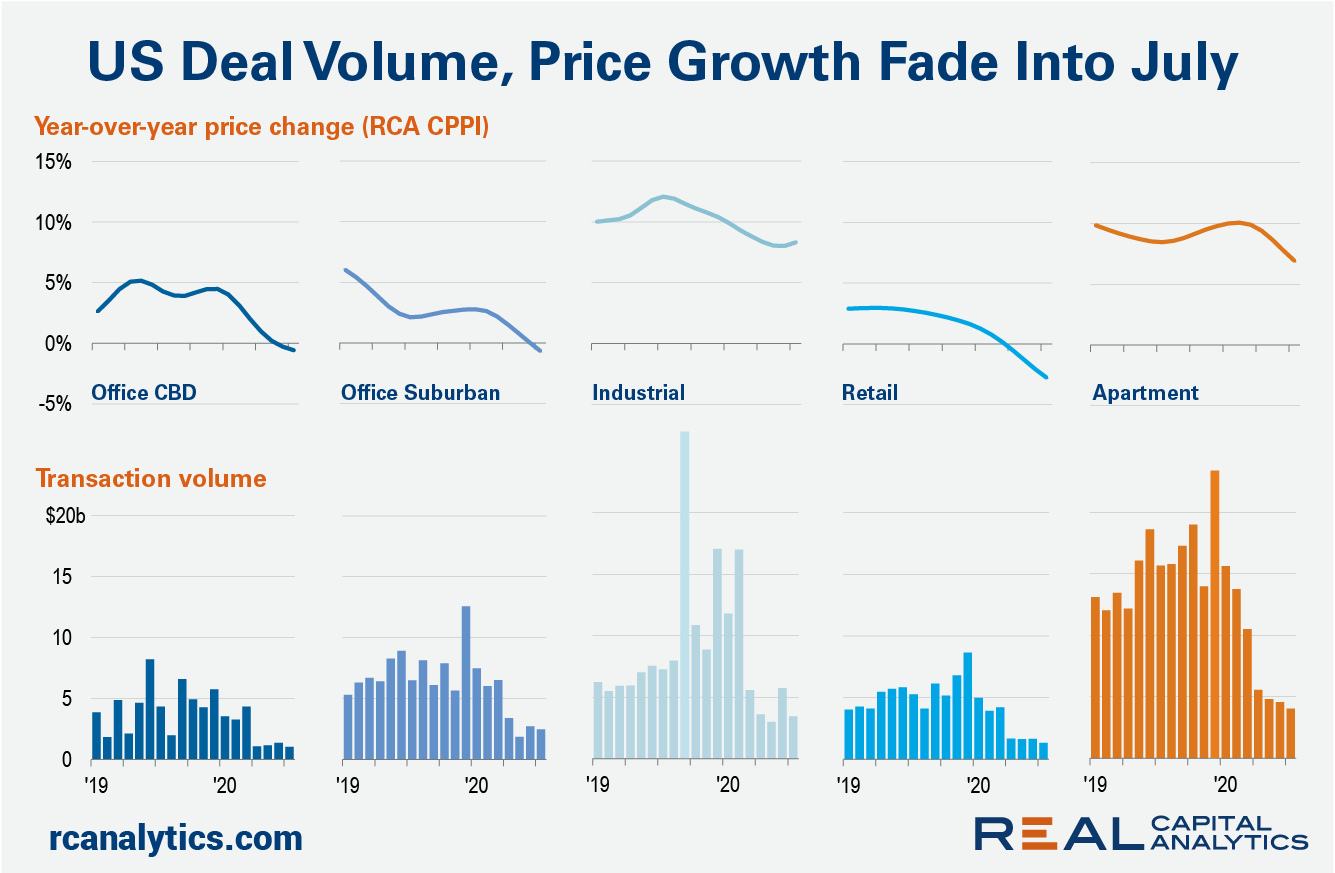

U.S. commercial property prices posted a 1.6% year-over-year gain in August as declines in retail and office pricing weighed against continued growth in industrial and apartment prices, the latest RCA CPPI summary report shows. The US National All-Property Index was rising at close to a 6% rate at the start of 2020, before the Covid-19 crisis hit the economy.

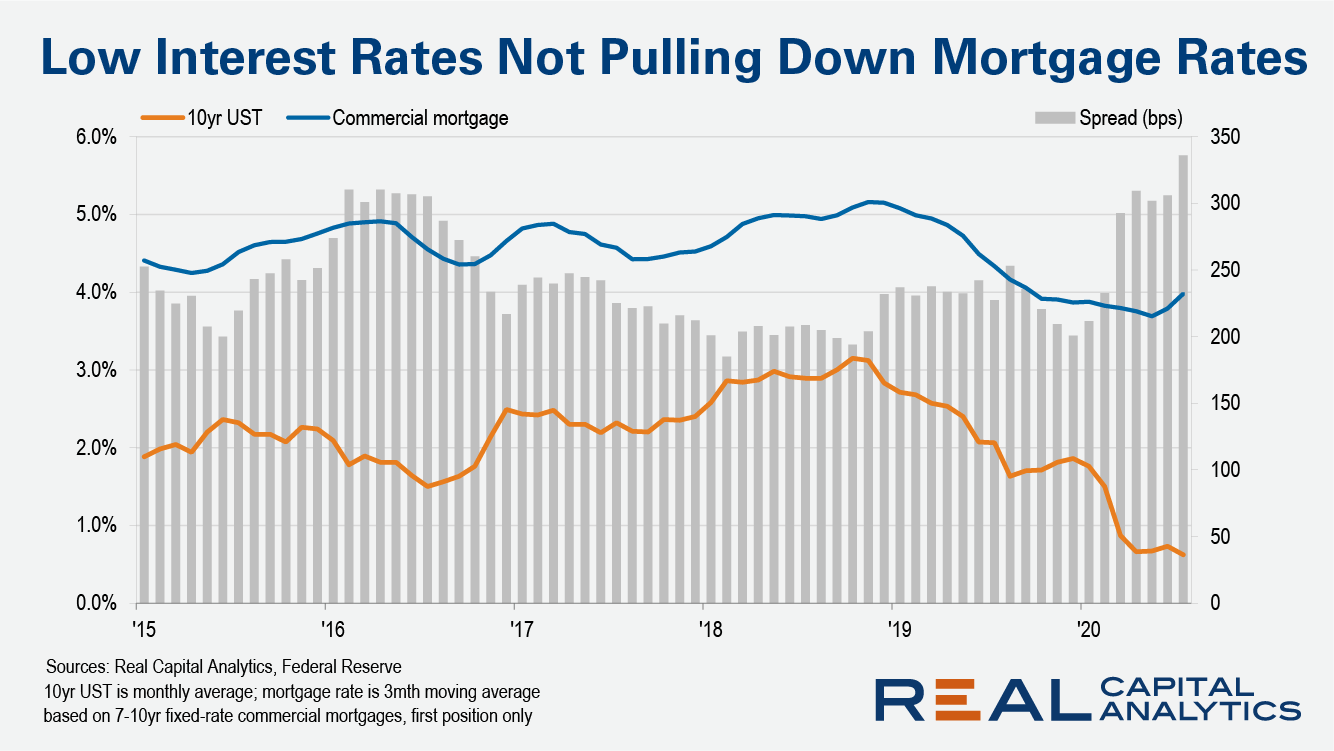

The 10yr US Treasury has averaged less than 1% every month since March 2020. Commercial mortgage rates have barely budged despite this sustained low level for the interest rate environment. In any normal period, low interest rates would be a positive sign for commercial real estate investment. Interest rates remaining at such a low level over a sustained period is a sign of weakness in the economy.

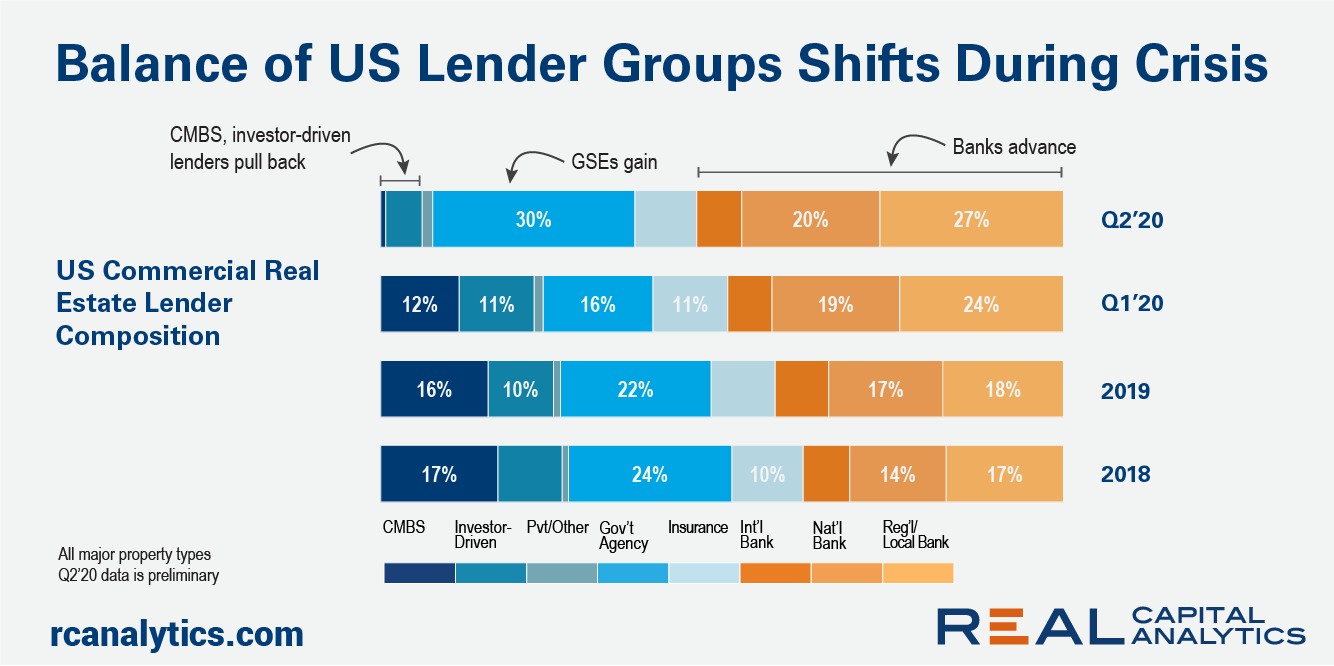

The debt portion of the U.S. capital stack has seen a tumultuous 2020. Key industry participants have pulled back on mortgage originations in response to the uncertainty around the Covid-19 recession. Commercial mortgage originations in the second quarter of 2020 were supported by banks and the GSEs. The debt portion of the capital stack is more stable today than it was in the last downturn.

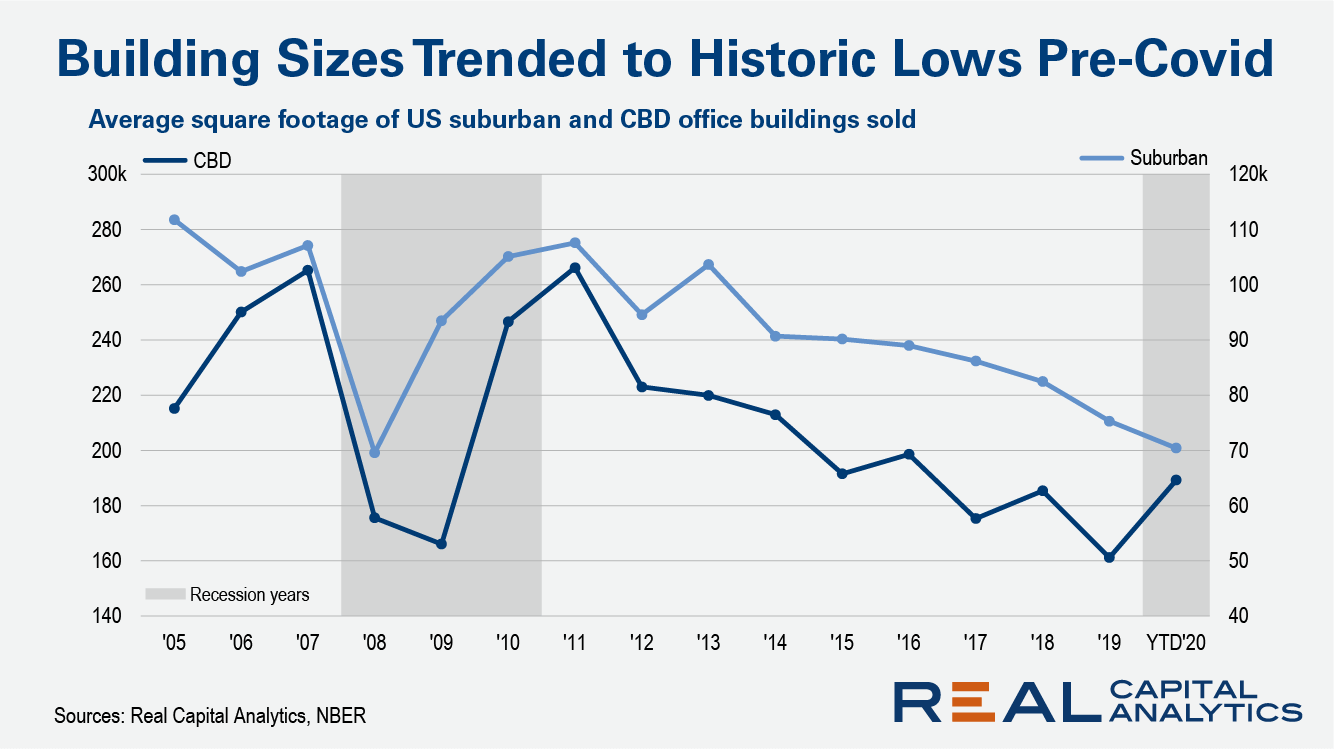

U.S. sales involving large office buildings had been on the decline throughout the economic expansion. As more small buildings sell, other measures of market health such as the dollar volume of deal activity can reveal a different meaning. A $100 billion market where half of the volume was concentrated in the purchase of expensive office towers is qualitatively distinct from a more broad-based market driven by the sale of a multitude of small buildings.

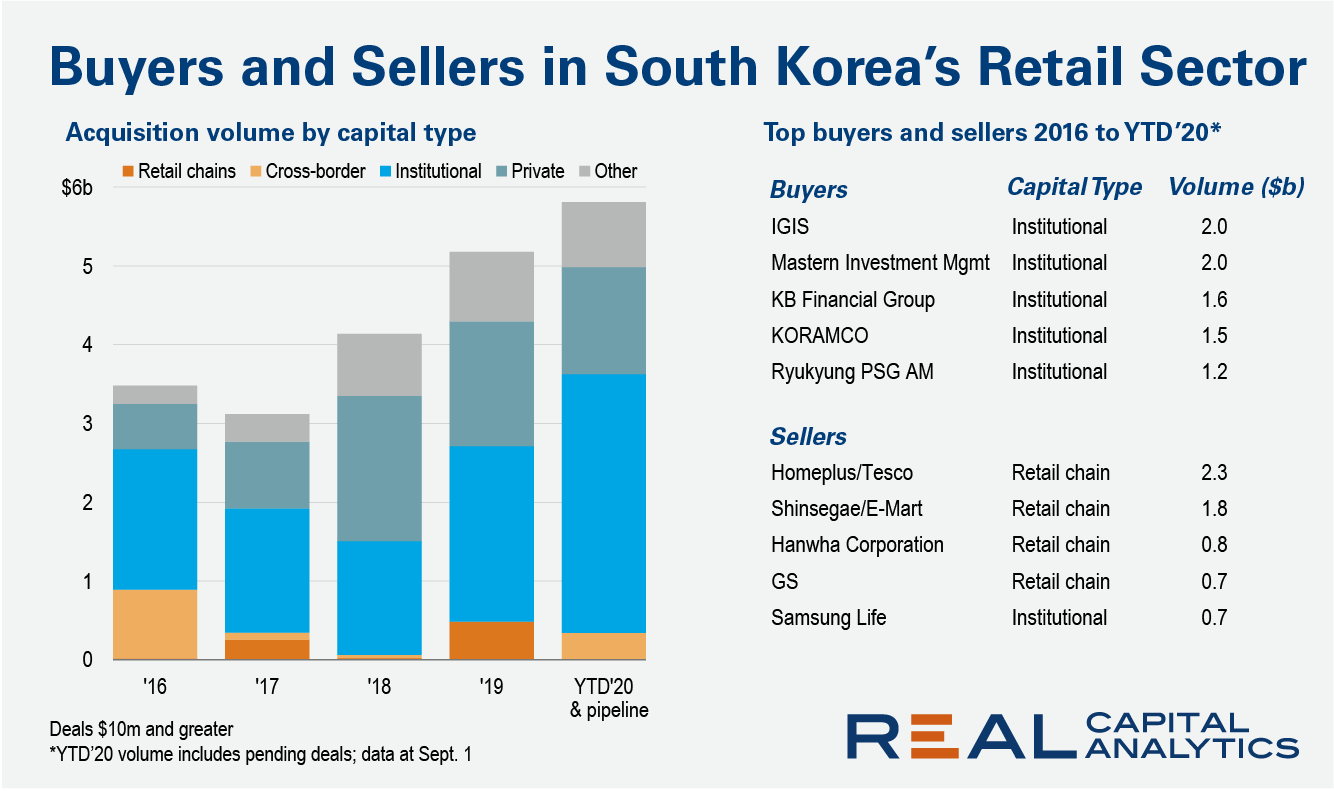

Over the first seven months of 2020, trading of retail assets has crumbled by more than half across all the major Asia Pacific economies bar one – South Korea. Should the current pipeline of deals close by year end, Korea’s 2020 retail investment total will surpass last year’s tally and could potentially become Asia Pacific’s biggest retail investment market, breaking the lock on the top three spots typically held by China, Japan and Australia.

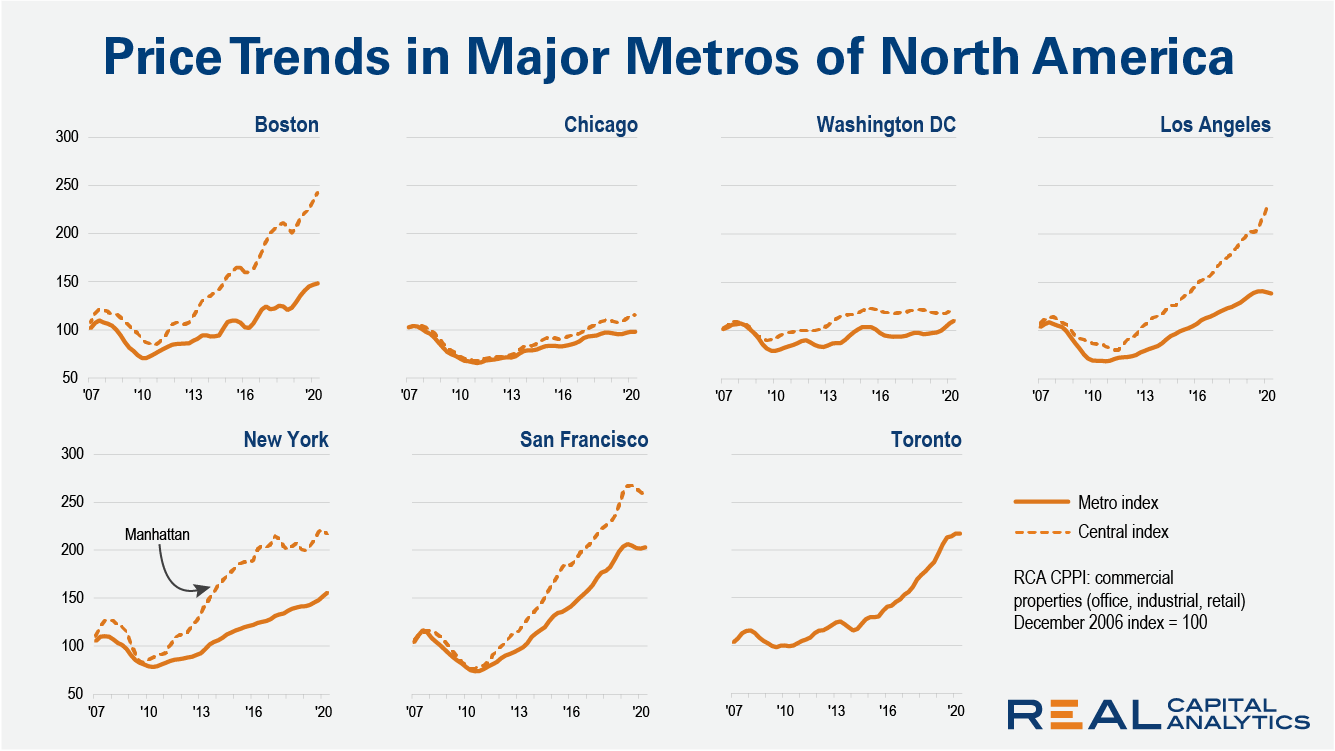

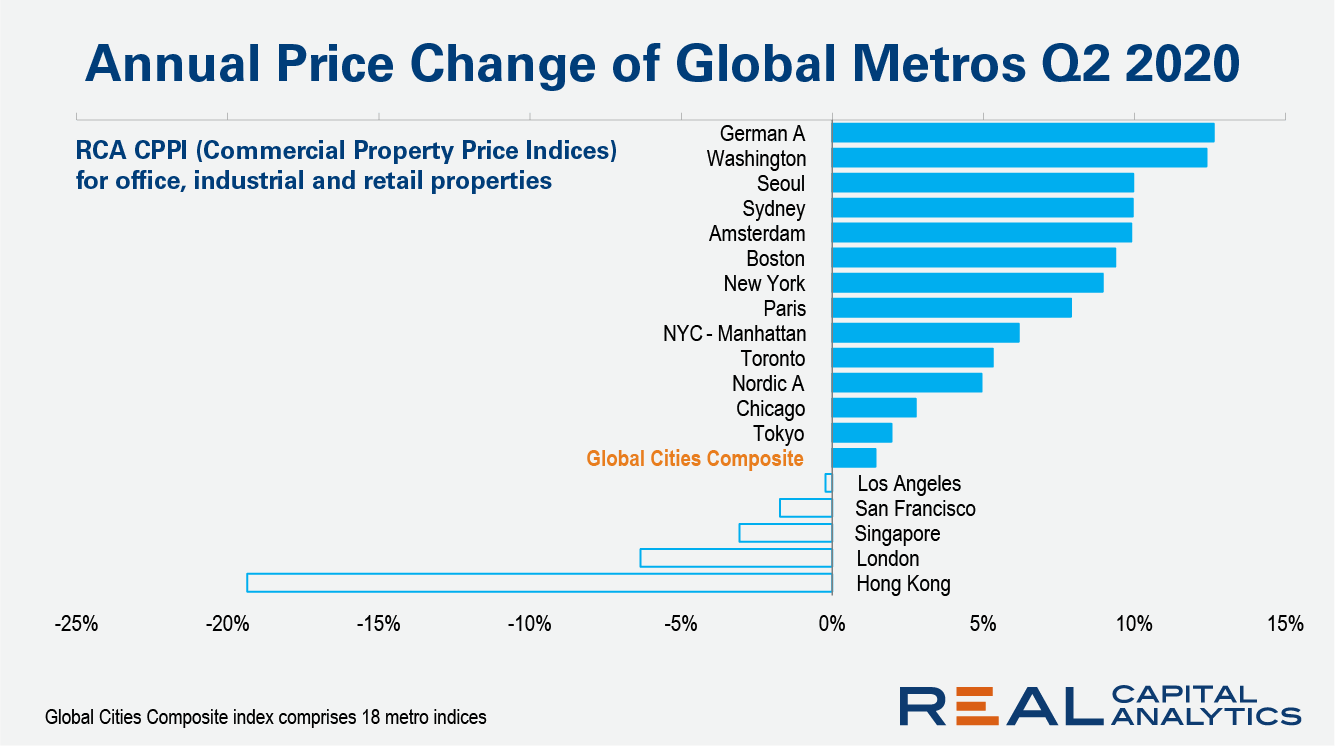

Despite historic challenges to commercial real estate deal activity in 2020, prices in most leading North American metros continued to move higher in the second quarter of the year, according to the latest RCA CPPI Global Cities report. New York metro area prices, which have lagged Manhattan price gains over the past decade, increased 9.0% from a year prior.

Rising distressed sales of commercial properties can be the push that topples commercial property prices, but with the exception of the hotel sector, such activity is still a small portion of the U.S. market. The economic calamity from the Covid-19 crisis has changed investor perceptions of prices with few still willing to step up to the high pricing set before the upheaval.

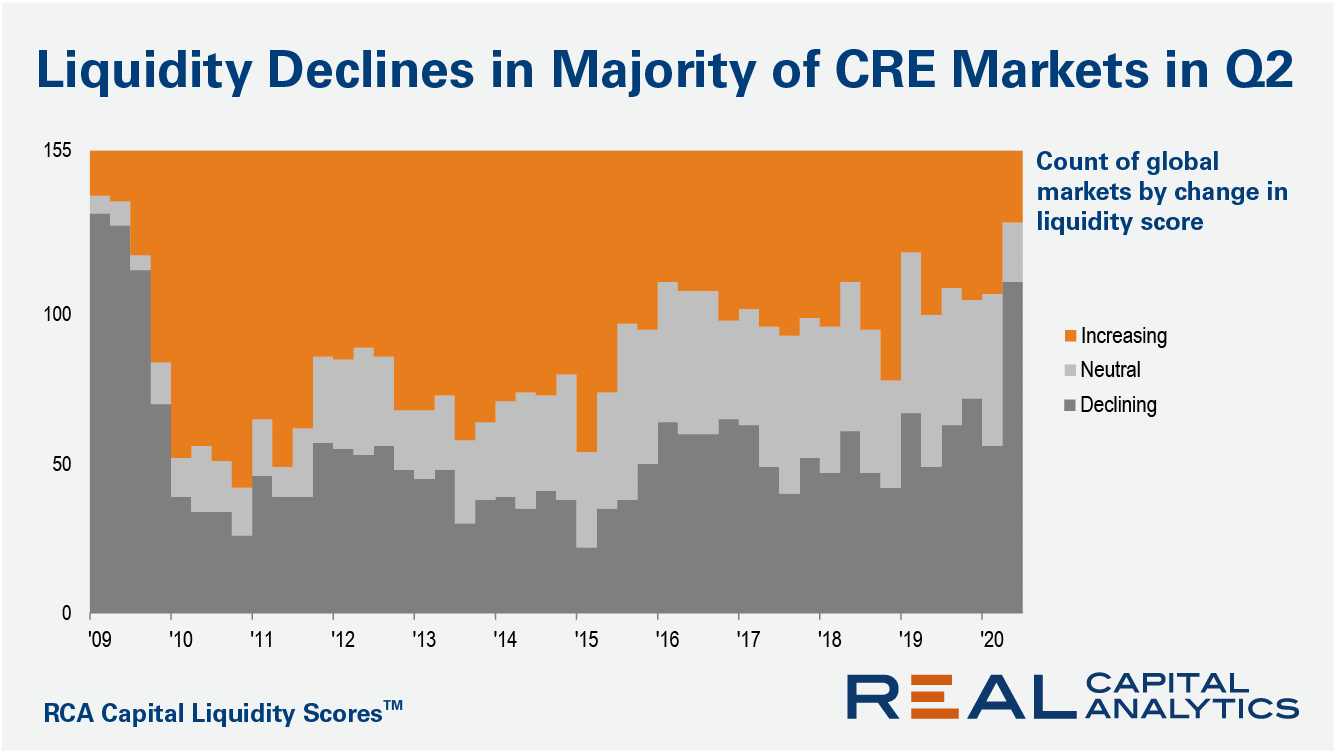

Market liquidity fell in 111 of 155 global commercial real estate markets in the second quarter of 2020, according to the midyear update of the RCA Capital Liquidity Scores. The count of markets posting lower quarter-on-quarter levels of liquidity is the worst since the Global Financial Crisis.

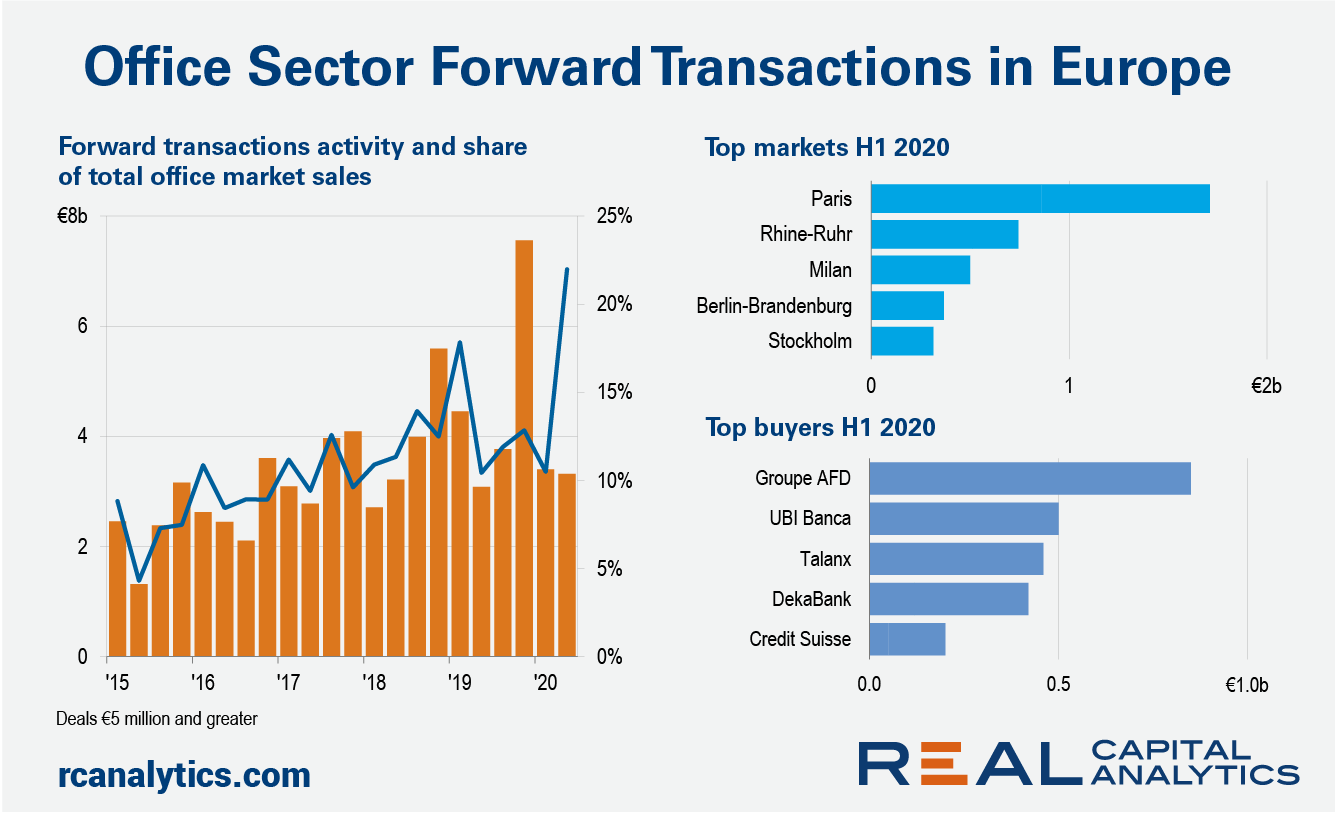

Investors stuck to the forward transactions route to acquire European office properties in the second quarter of 2020, indicating that investor demand for the asset type is still alive despite concerns over future needs for corporate space. Forward commitments leapt to a record proportion of European office deal volume, with the jump in share reflecting the resilience of these deals and the slump in the office market overall.

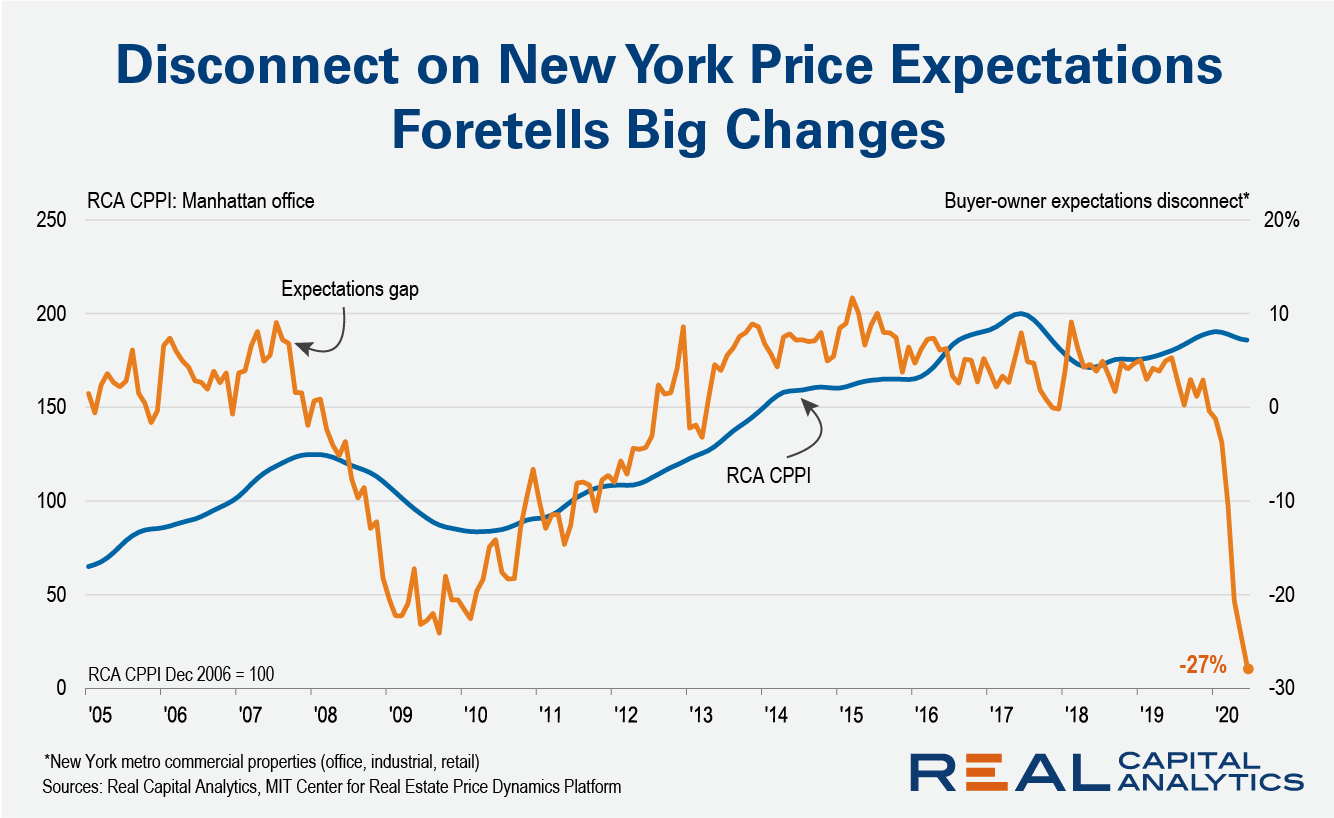

“Should I leave New York?” That is a question I am asking alongside tens of thousands of other knowledge sector workers. Many have already left and the city feels empty on my masked excursions across the bridge from Brooklyn into Manhattan. With so many of these high income workers tackling the question, commercial property prices are going to be hit. How much of a hit and for how long is the big issue.

Illiquidity continued to plague the U.S. commercial real estate market in July, with volume across the property types falling at high double-digit rates, the latest edition of US Capital Trends shows. Total U.S. sales activity fell 69% versus July 2019, the fourth month in a row that the Covid-19 crisis has scuttled dealmaking.

Cross-border institutional purchases have been one of the most resilient sources of capital in Asia Pacific in the first half of 2020, a surprising trend given that the practical advantages that domestic groups have during the Covid-19 pandemic. The volume of acquisitions by cross-border investors fell by 14% year-over-year, as compared with declines of around a half for listed and private entities.

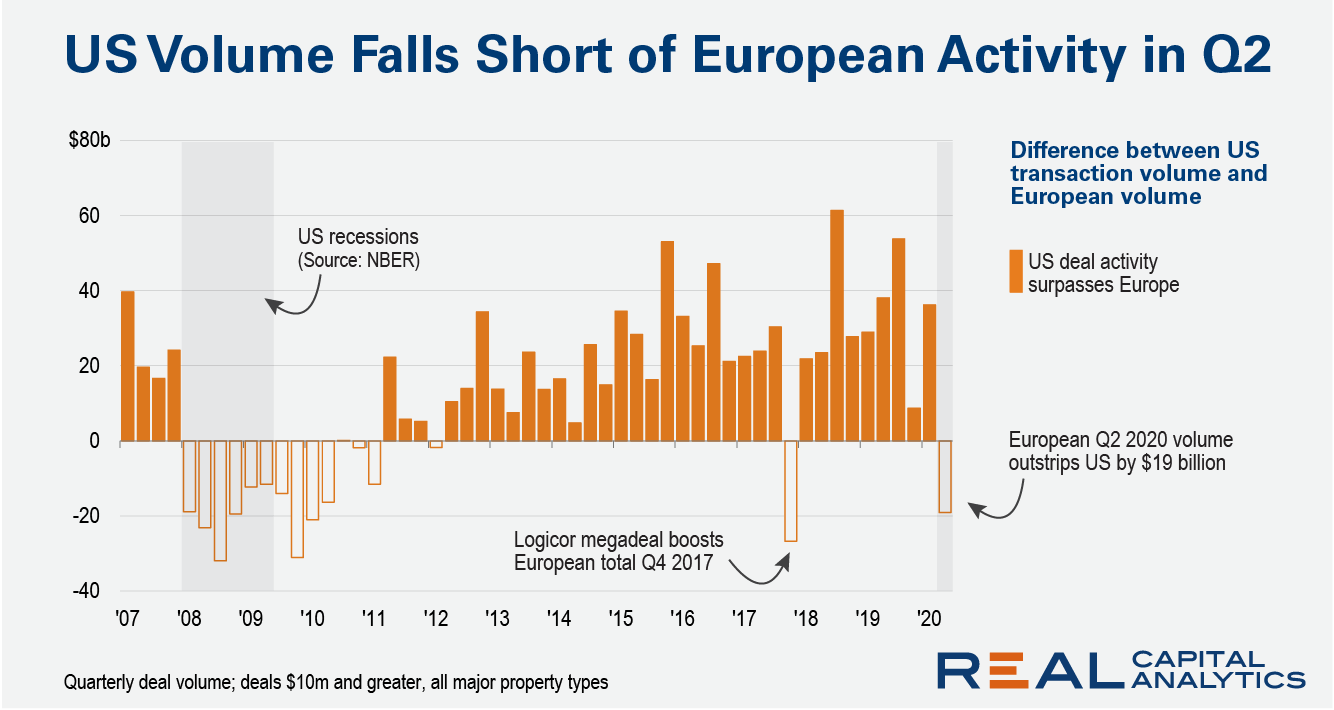

In normal periods the U.S. is the largest, most liquid region for commercial real estate deal activity worldwide. In the second quarter, however, Europe surpassed the U.S. as a hub for investment. Trends into July are not looking favorable for the U.S. Commercial real estate exists to support the needs of a local economy and deal volume can be a sign of the expectations for the health of that local economy.

The trajectories of deal volume and deal count continue to weaken for the Americas, the latest Real Capital Analytics data indicates, while in Asia Pacific and Europe the picture is little changed. The concaved path of deal volume in the Americas indicates a deepening slump. At day 220, deal volume was 37% lower than the same point in 2019 and the number of deals was down 40%, according to Real Capital Analytics data.

Eight of the 18 indices in the Global Cities Composite Index posted decreasing prices over the last quarter and of those cities, five posted declining returns over the year, as seen in the latest RCA CPPI Global Cities report. The Global Cities Composite Index slowed in the second quarter to 1.4% year-over-year as the effects of the global pandemic brought real estate transactions to a halt.

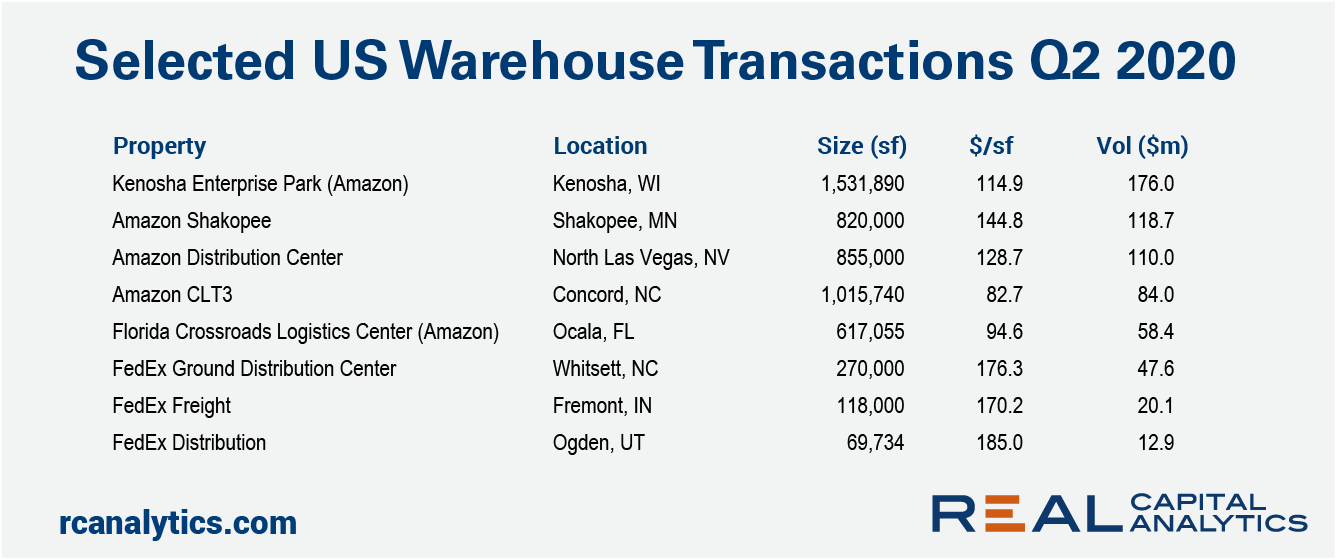

Distribution warehouses continued to be a target for investors in the second quarter of 2020 amid heightened attention on the backbone of logistics infrastructure. While sales activity in the U.S. industrial sector dropped during the quarter, buffeted by lockdown restrictions and economic uncertainties, the sector’s decline was the smallest of any major property type. And, of the $11.1 billion in industrial transaction volume, around one-third came from sales of distribution warehouses.