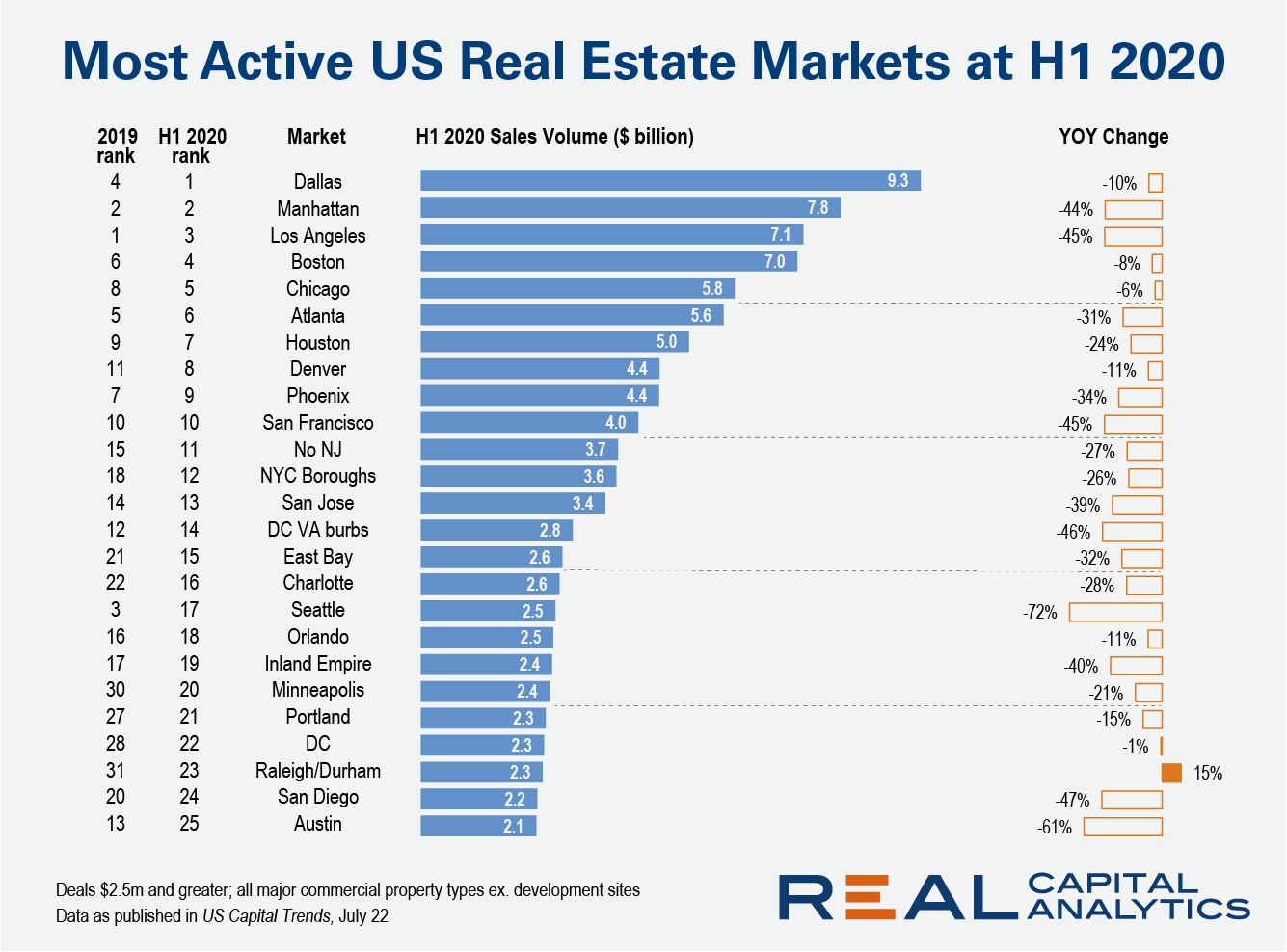

For the first time ever, Dallas ranked as the #1 U.S. commercial property market at the halfway mark of the year, despite a dip in investment activity. Dallas overtook Manhattan and Los Angeles, where sales activity fell by more than 40% compared to the first six months of 2019 as the Covid-19 crisis scuttled dealmaking and sidelined investors.

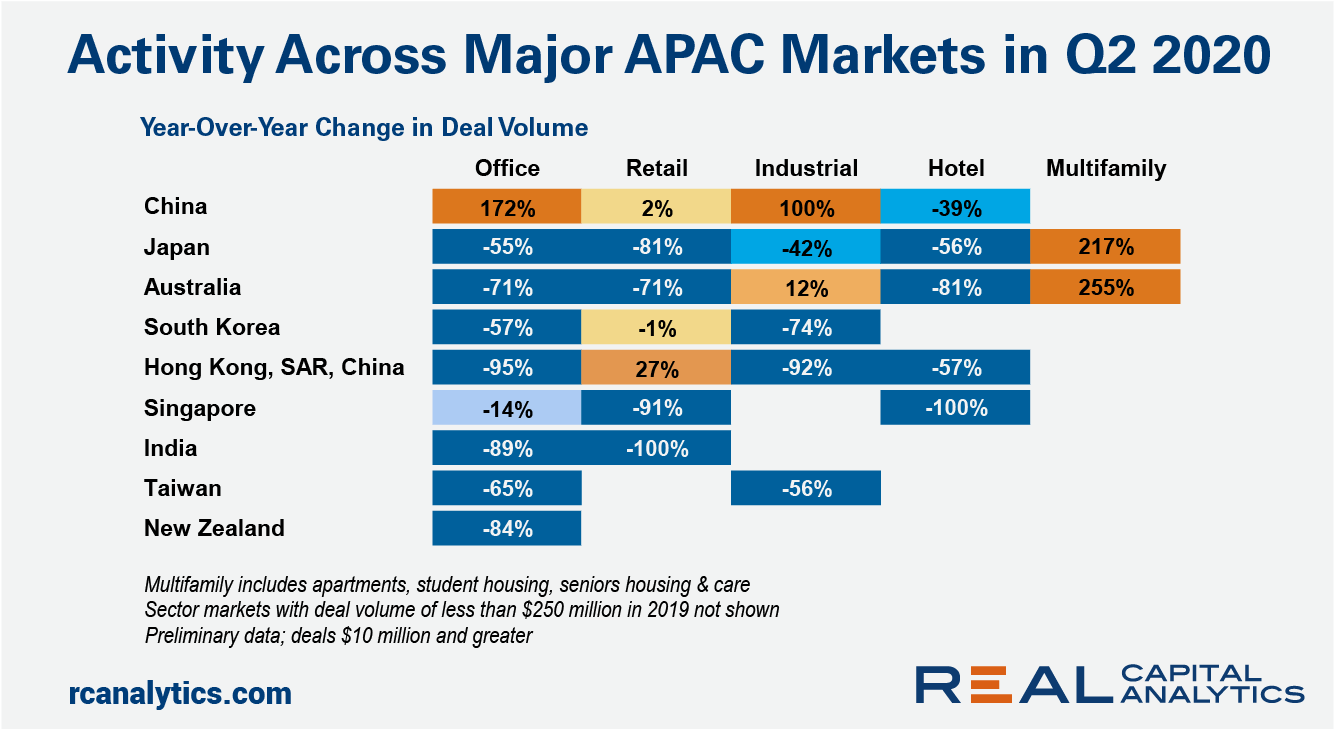

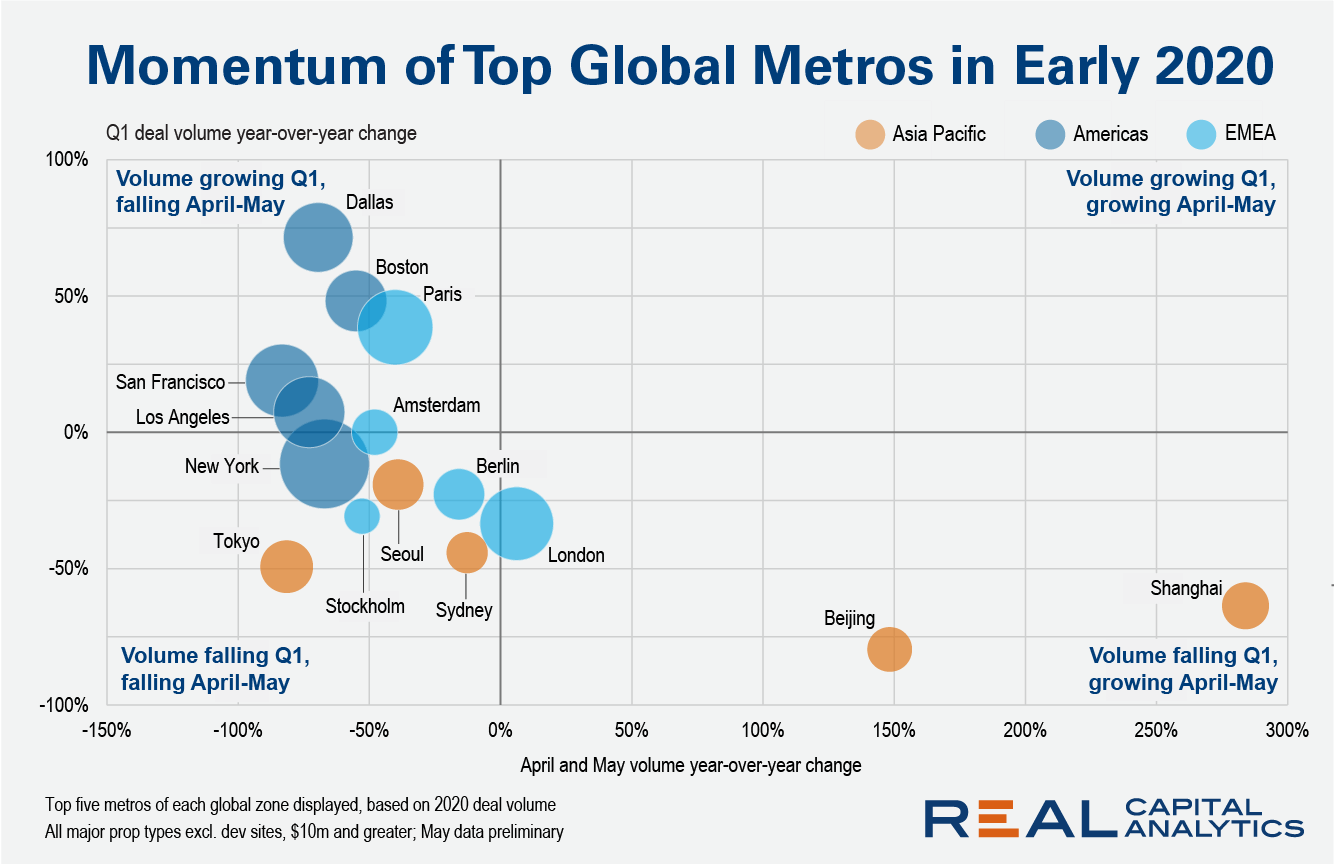

China’s commercial real estate market rebounded in the second quarter of 2020, while the worsening economic outlook took its toll on investment sentiment across the majority of sector-markets in the region. The demand for Chinese office skyscrapers leaped, with nine buildings priced over $250 million changing hands in the quarter.

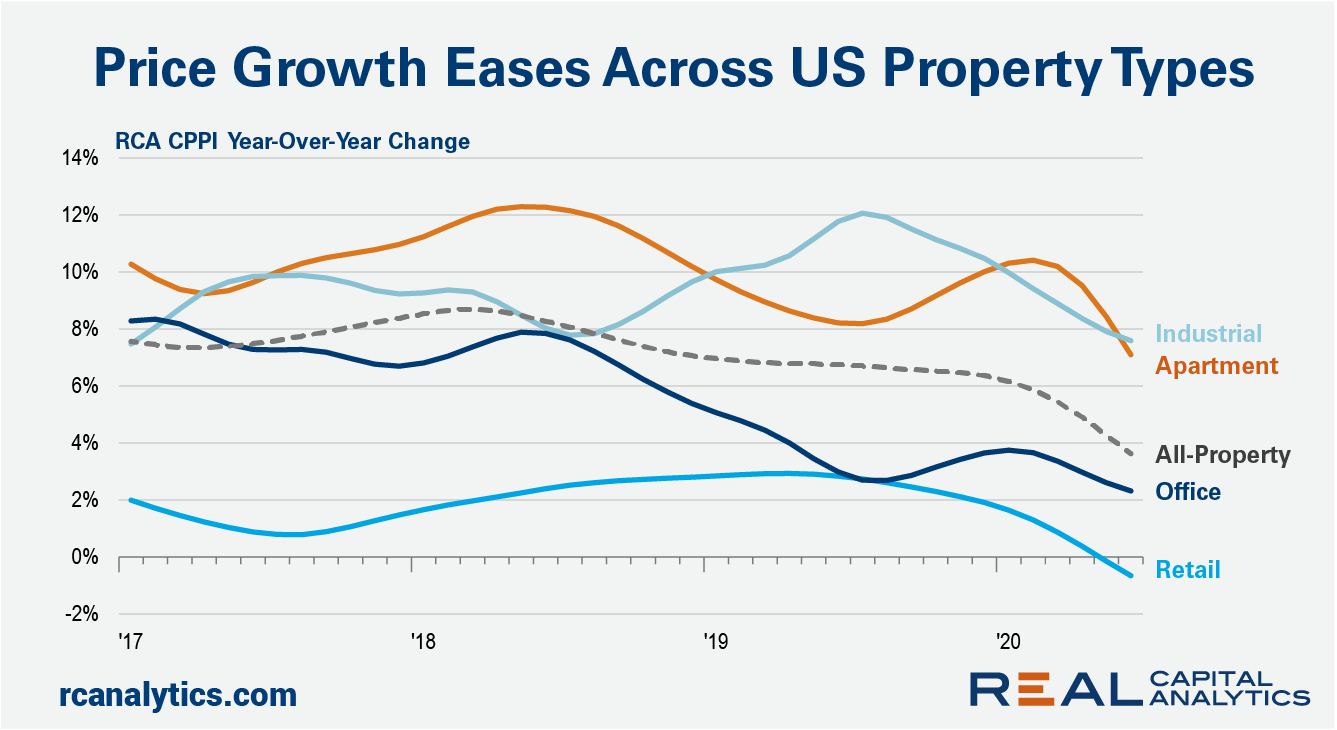

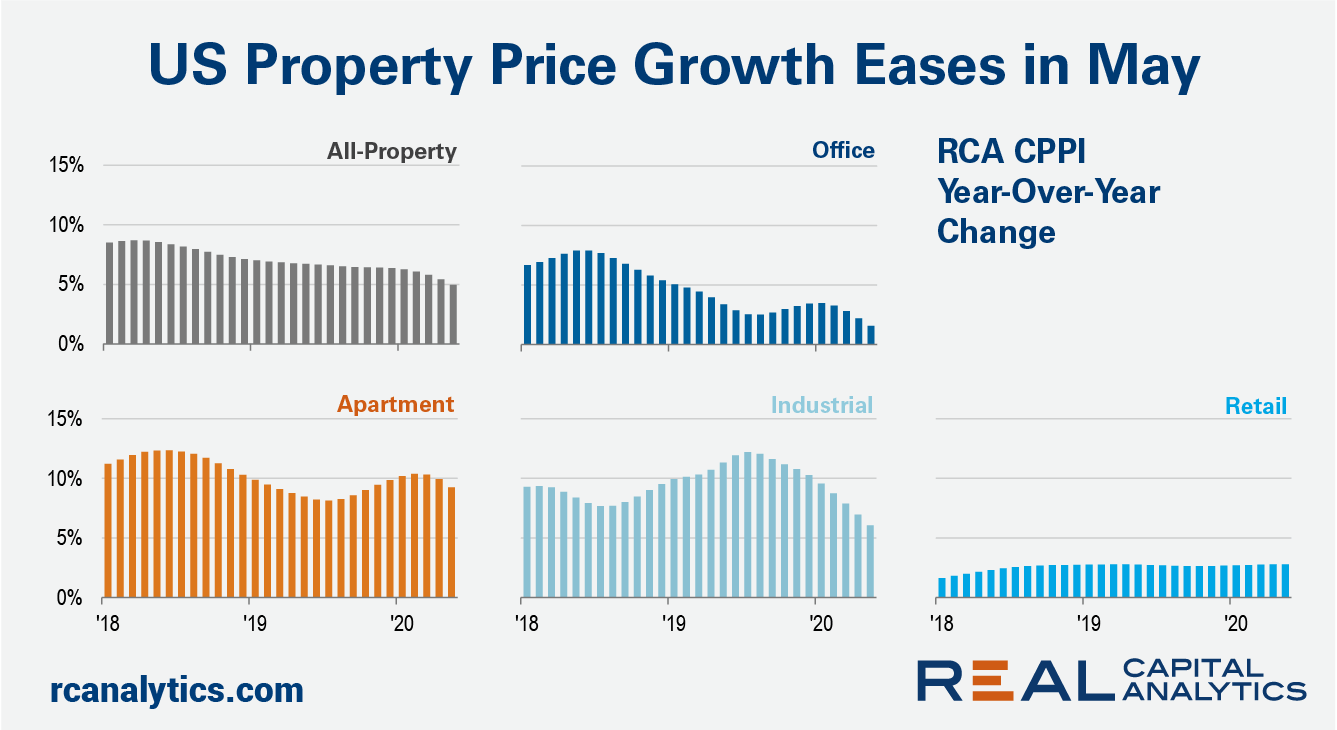

Commercial property price growth slowed in June across all U.S. property types, dragged down by the continued impact of the health and economic crisis. The US National All-Property Index was flat in June from May and gained just 3.6% year-over-year, the latest RCA CPPI summary report shows. Retail prices fared the worst of the sectors, dipping 0.3% from May and down 0.7% over the past year.

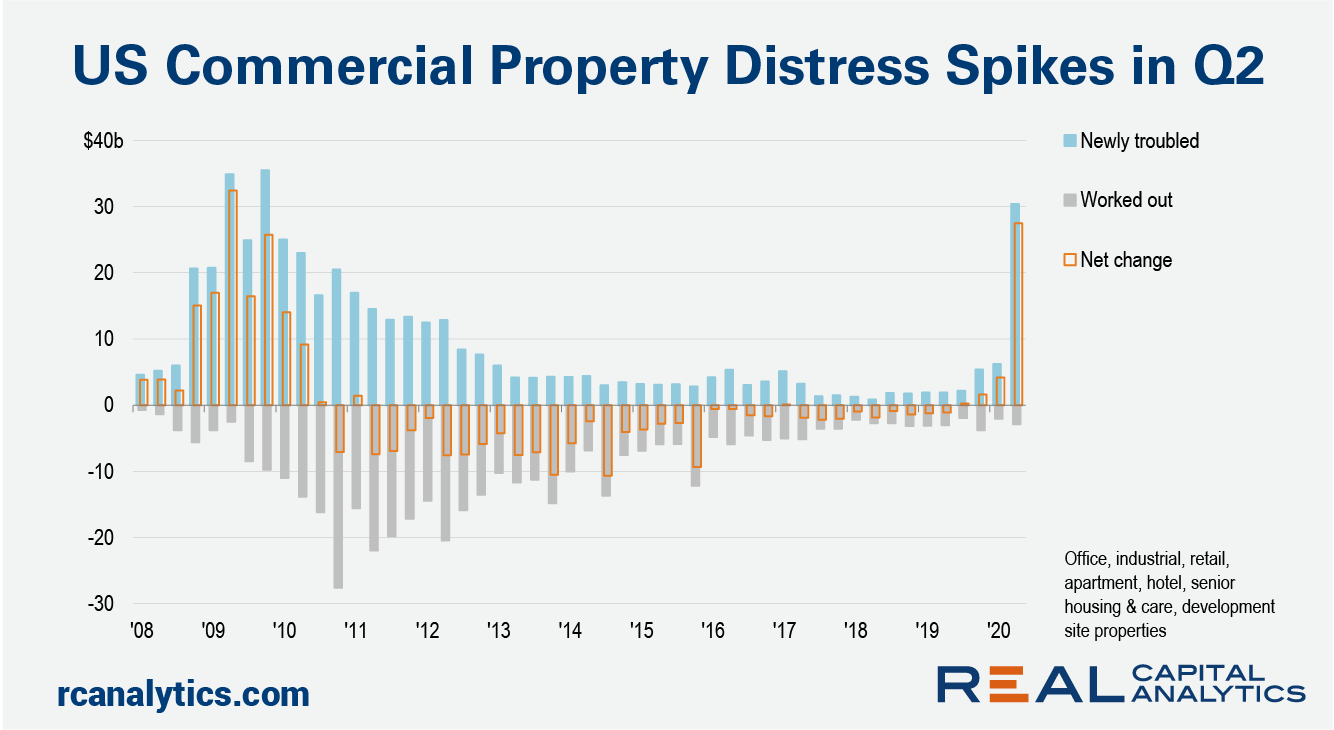

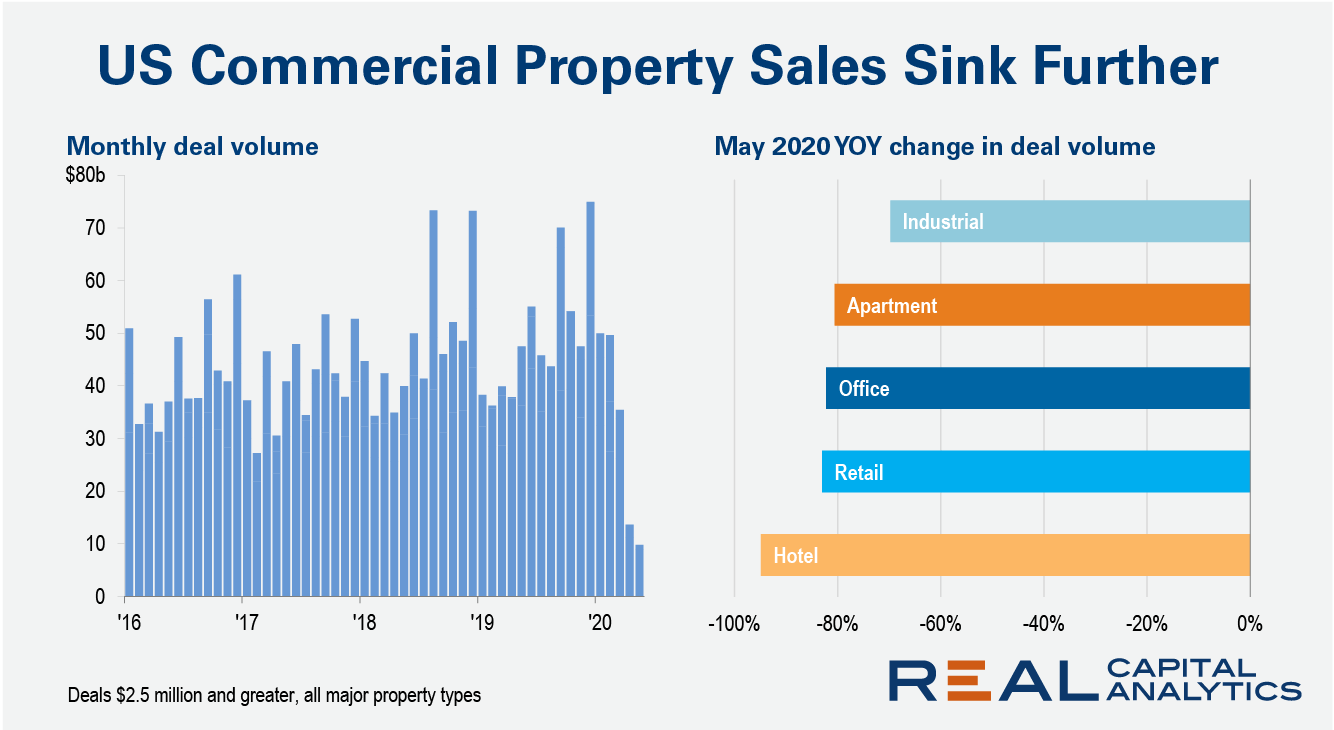

U.S. commercial real estate transaction activity during the coronavirus-blighted second quarter was far from the worst on record. However, the magnitude of the drop from the first quarter was unprecedented. Evidence of distress is mounting, according to Real Capital Analytics data, though it’s clear that the pain from the Covid-19 crisis has not been experienced equally across all the property types.

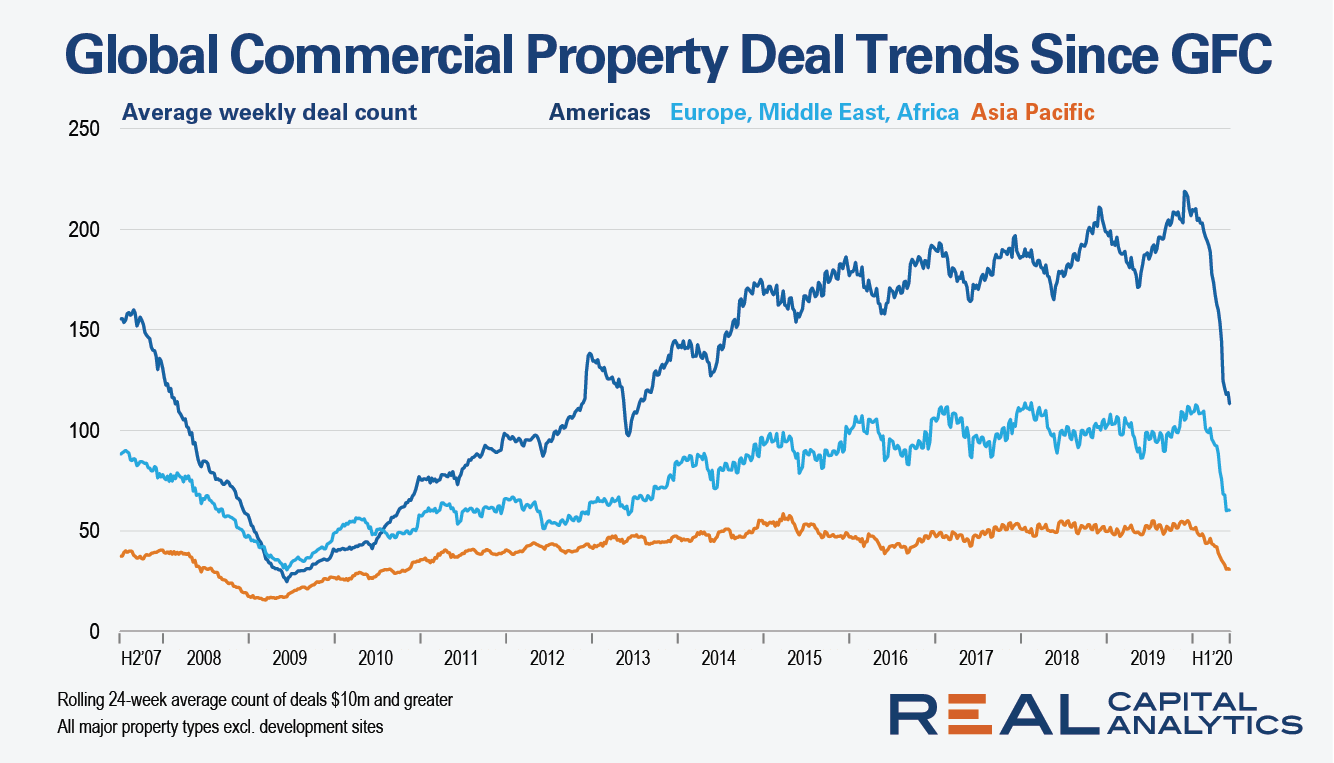

Prior to the Global Financial Crisis, the number of deals completed in a typical week was above 150 in the Americas, a little under 100 for Europe, Middle East, Africa (EMEA) and around 40 in Asia Pacific (APAC). Commercial real estate activity in both EMEA and the Americas slid to a low point in the middle of 2009. APAC had already trickled to just a handful of weekly deals at the start of 2009, staying at a low ebb for six months.

Investors of all stripes have a well-known tendency towards loss aversion and academic literature has consistently described that property owners tend to sell winners and hold losers. Therefore, at this time of market dislocation – when deal flow is down substantially and assets may be forced onto the market, either because of breached covenants or liquidity requirements – we have looked at how far prices would have to fall in the major global markets for owners to see their gains wiped out.

Australia has had a sluggish start to 2020 so far after a buoyant 2019 propelled by a record $14 billion of cross-border investment. The sharp downshift has drawn comparisons to the misery of 2008 which followed a bumper 2007, but the parallels in headline deal activity are just about where the similarities end. Back in 2007, Australia’s real estate investment landscape was very different.

As we reach the midpoint of 2020, the picture of commercial real estate transactions completed globally continues to worsen, Real Capital Analytics data indicates. Activity in the Americas is falling back more severely than seen earlier in the year. Cumulative volume in the Americas at day 170 is now down 30% from a year ago.

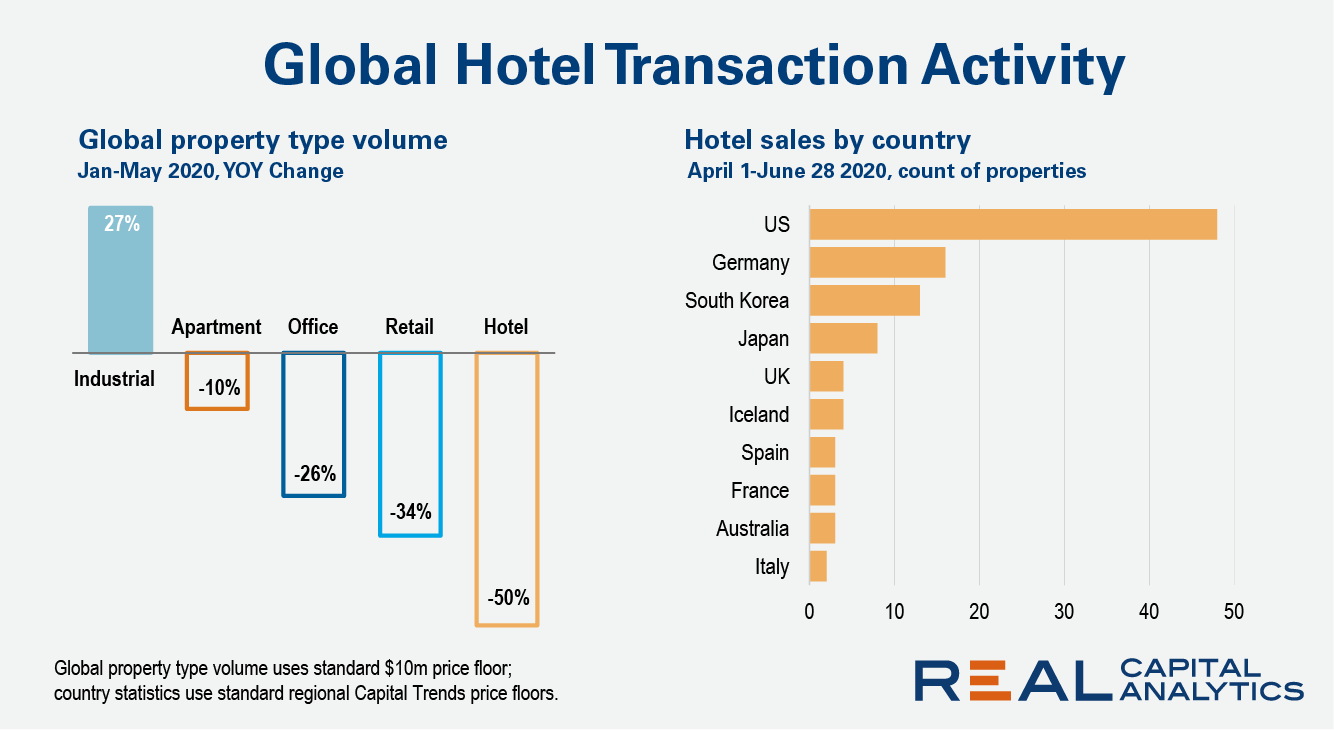

Globally, hotels have been the asset class most impacted by the Covid-19 crisis. Sales of hotels were down by one-half in the first five months of 2020 in comparison with 2019 and just 113 hotels have sold worldwide since the start of April. By way of comparison, more than 850 sold in the second quarter of 2019.

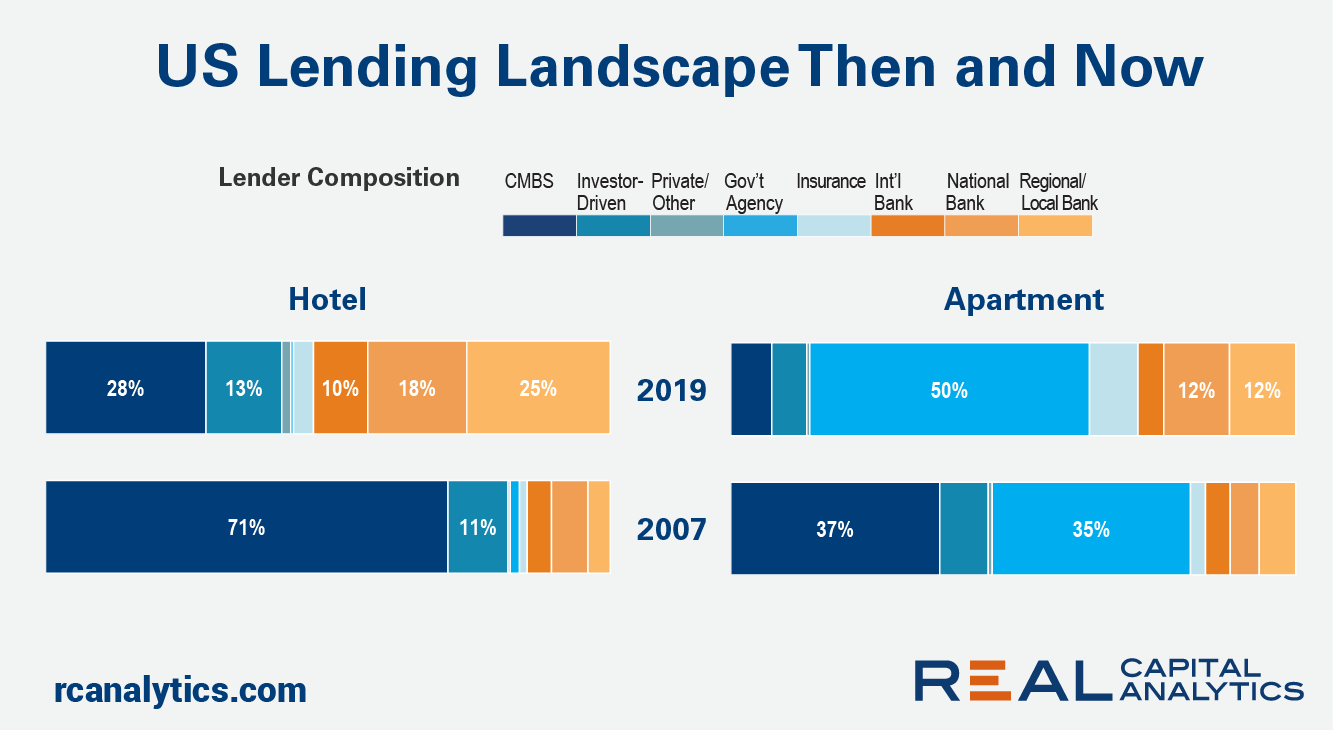

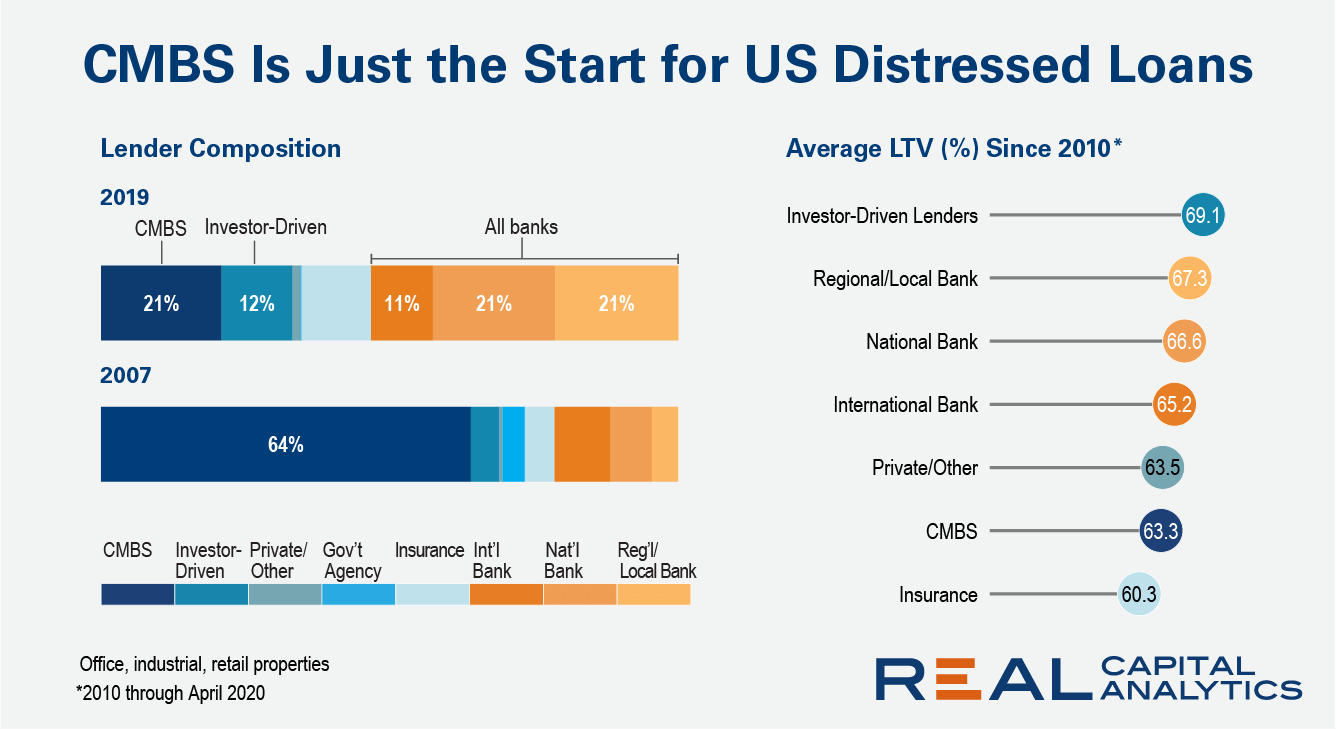

While CMBS still represented the largest slice of hotel lending in 2019, it was a much smaller piece of the pie. As the CMBS share fell back, other lender groups such as banks and investor-driven lenders filled the gap. For the apartment market, government agencies and the banks gained the most ground, while CMBS dropped to less than a 10% share of the market.

The effects of the Covid-19 crisis have begun to catch up with U.S. commercial real estate prices. The US National All-Property Index gained 4.9% in May from a year earlier, the slowest pace of growth since 2011, the latest RCA CPPI summary report shows.

Sales of U.S. commercial property sank again in May as the Covid-19 crisis kept investors on the sidelines, the latest edition of US Capital Trends reports. Transaction volume fell to the lowest level for a May since 2010 and none of the major property types escaped the continuing rout.

Investment from overseas players into the Central London office market has tumbled in the first five months of 2020 to the lowest level since 2009, Real Capital Analytics data shows. The Covid-19 shutdown, Brexit concerns and shifts in international flows are behind the collapse.

The Covid-19 crisis is scuppering commercial real estate transactions worldwide with the pandemic making it harder to complete deals and upending financial and economic projections. The number of terminated contract deals as a percentage of closed transactions has jumped across the U.S., Europe and Asia Pacific as the tally of completed transactions in those geographies has also sunk.

Do not be fooled into thinking that U.S. commercial property prices have already fallen at high double-digit rates. Until market participants can comfortably start visiting properties, clients, and other service providers – and we enter the [price discovery phase](https://www.rcanalytics.com/distress-cycle-looks-like/) of the downturn – prices cannot move. However, the spread between buyer and owner expectations on pricing has widened sharply.

Despite the slowdown in real estate markets accelerating across most of the world into the second quarter of the year, acquisition trends in two key global cities, both in China, have turned positive. Global volumes started to wane around March this year, but the weakness in Asia Pacific had already been apparent for some time, as all of the region’s top 10 metros suffered double-digit declines in the first quarter.

Commercial real estate transaction volume in Europe is resisting the slide seen across the Americas and Asia Pacific in the first 150 days of 2020 due to a string of multibillion-euro deals. The latest Real Capital Analytics data reading indicates that transaction volume for Europe, Middle East and Africa (EMEA) is just 6% lower than 2019 levels, while in the Americas volume is 18% down and in Asia Pacific activity is 45% lower.

Anybody trying to implement a successful investment strategy using the distress playbook from the Global Financial Crisis (GFC) is going to be disappointed. There will be opportunities for sure as the U.S. distress cycle progresses to the work-out stage, but the big chunk of problematic loans this time were not originated for the CMBS market. Trying to source distressed deals out of special servicers will overlook most of the opportunities.

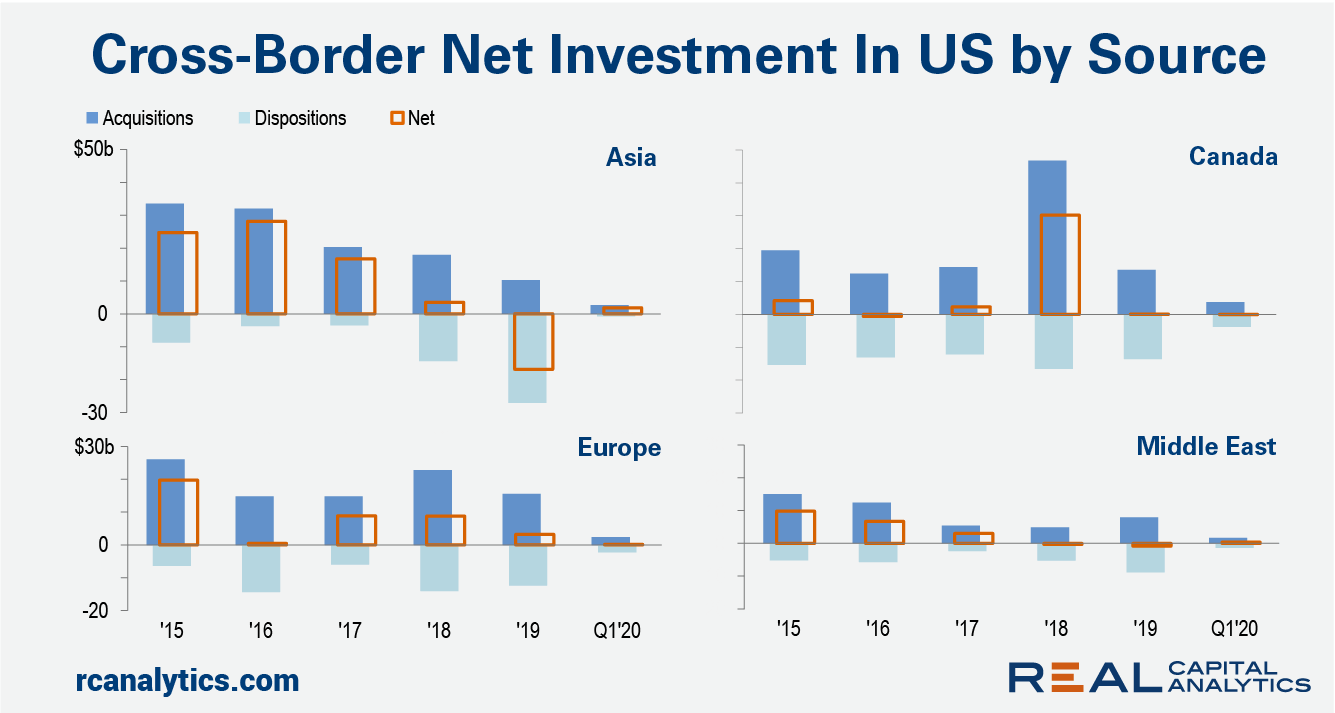

The pace of cross-border capital flowing into the U.S. commercial real estate market fell in the first quarter of 2020 compared with the year prior, the latest edition of the US Cross-Border Investment Compendium shows. The slowing marks the continuation of a trend seen before the global health crisis erupted.

The drivers of the current downturn in the economy and commercial property markets are distinct from those which led to the Global Financial Crisis (GFC). This Covid-19 downturn came on suddenly, while warning bells were ringing a number of years ahead of the collapse of the housing market in the last recession. The variation in drivers could lead to a faster race to the bottom for market prices this cycle.