Even before the pandemic hit, big box retailers were both expanding their e-commerce platforms and making significant investments in brick-and-mortar store upgrades in order to stay relevant in the face of new competition. Now, as the country reopens, it’s more important than ever for these retailers to have attractive in-store shopping opportunities in order to compete with both each other and with exclusively online retailers.

The period around the July 4th holiday is typically regarded as one of the biggest summer sales times for retailers, both in terms of traditional Independence Day celebration supplies and other summer products going on sale, and even the early signs of back-to-school spending. This year’s July 4th promised particularly high sales, both because of the holiday’s weekend timing and pent-up demand as the country reopens.

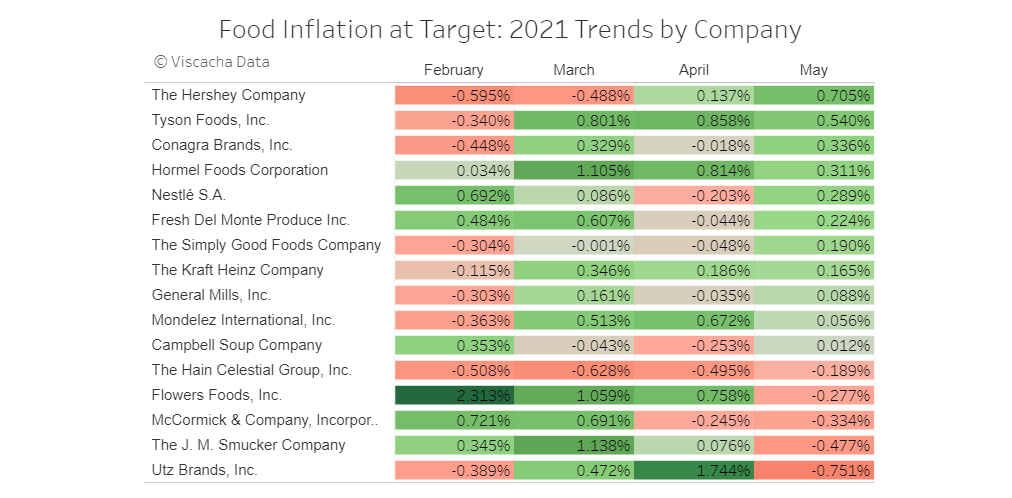

Over the last several weeks, inflation concerns have been a hot topic, as the combination of increased demand as the country reopens, supply chain constraints and high commodity prices has pushed up prices across categories. Although categories like used cars and gas saw the most dramatic increases last month, CPG companies have felt the impact as well.

After Colonial Pipeline - the largest pipeline for refined oil in the U.S. - halted operations after being hacked on May 7, eastern U.S. states have faced the possibility of acute gasoline shortages. Although the pipeline was restarted last Wednesday May 12, many states are seeing lingering shortages. As of the morning of May 17, North Carolina, the state hit hardest, had almost 60 percent of its stations out of gas.

Over the last fourteen months, rapid shifts in consumer demand during the pandemic have fueled acute shortages. Retailers haven’t been able to keep products on the shelf ranging from toilet paper and seltzer to bicycles and lumber. Even as the country opens back up, new shortages are popping up in “post-pandemic” categories.

In the early days of the legal cannabis industry, public companies were concentrated in Canada where regulated marijuana sales were first allowed. Investors in both Canada and the United States poured investment into these stocks with the hope that Canadian companies could expand in the US as more states legalized medical and adult use. However, as piecemeal licensing regimes have rolled out, Canadian players have struggled to maintain an edge against newer US companies. Viscacha Data sheds some light on the latest in US versus Canadian pot stocks in this analysis drawing upon our realtime sales dataset covering over 25% of dispensaries across the US and Canada.

Athleisure -- the fastest growing apparel category of the past decade -- has drawn the attention of both incumbent retailers and new entrants. Within this niche, Lululemon stands out as a leader with its loyal customer base and premium lines. The innovative DTC retailer, which sells through both online and brick-and-mortar stores, sets an example for others. Using Viscacha Data’s granular inventory & sales statistics, we analyze how consumers respond to Lululemon’s pricing and product strategy over the winter-spring transition to inform future strategy. First, we analyze the promotional mix at Lululemon, both frequency of promotions and magnitude of discount by product category and gender. Over the last two months, Lululemon has steadily reduced the total proportion of products on sale, from around 40 percent in early February to roughly 25 percent by the end of March.

Realtime sales and inventory information can be useful to look at both short- and long-term trends. Previously, Viscacha has written about how long-term changes in weather factors like temperature impact sales by category. Here, we dive into the immediate effects of an extreme weather event on a home improvement retailer. Ace Hardware’s sales swung dramatically during Texas’s unusually harsh 2021 winter. Viscacha’s subscribers were able to see in real time which products and categories were spiking and by how much.

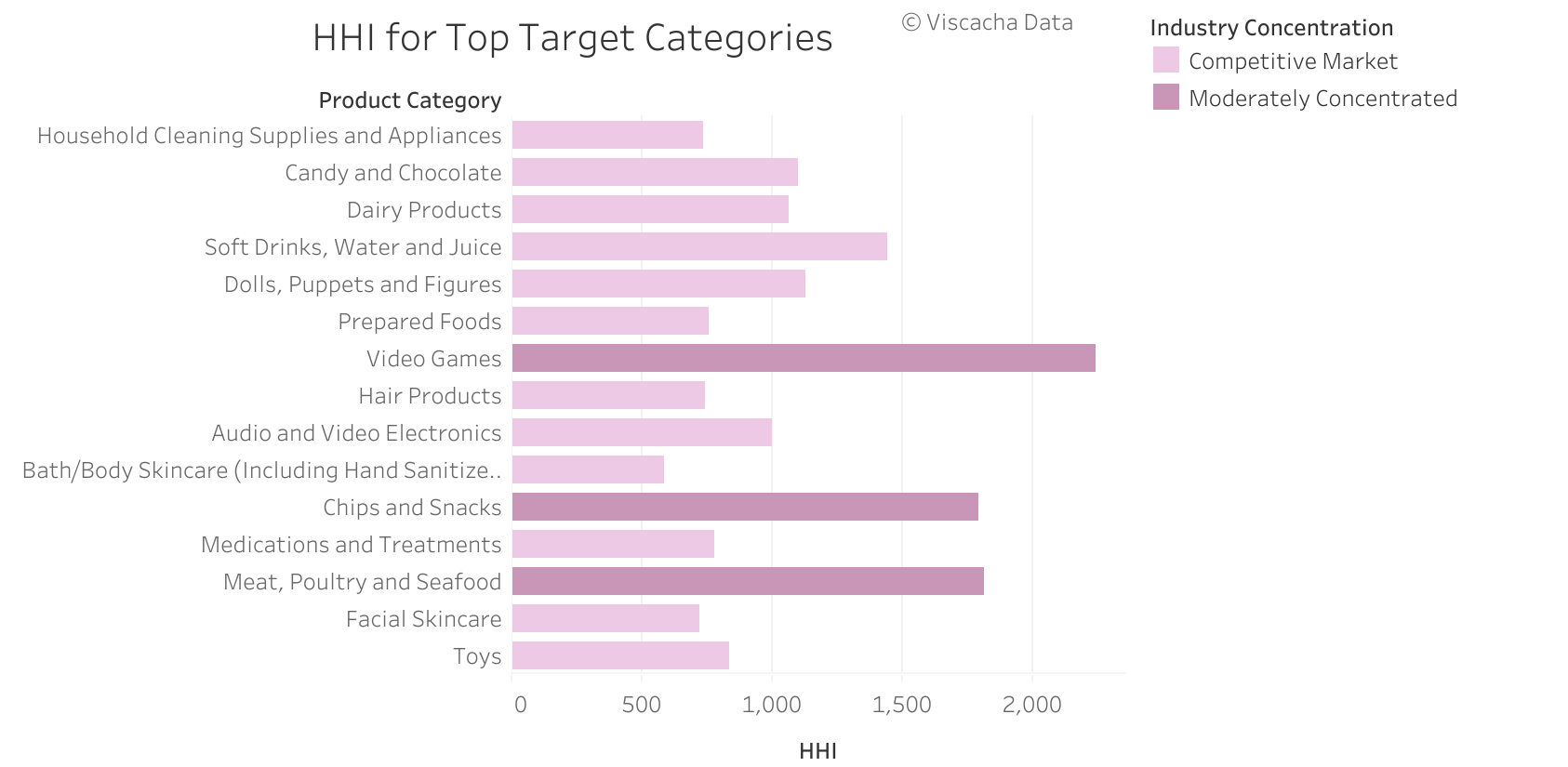

Antitrust has returned to the limelight with the rise of tech giants after enforcement fell during the Reagan administration. While public focus and congressional hearings have centered around market power among FAANGs, the potential for stronger antitrust regulation contained in proposals like that of Senator Amy Klobuchar would also have implications for large retailers and CPG brands. Viscacha Data’s store-level price and sales data helps to produce nuanced insights into antitrust risk that could result from changes in pricing strategy, mergers and acquisitions, and exclusive distribution agreements.