The Coinbase initial public offering (IPO) is making headlines. Only the Coinbase IPO isn’t actually an IPO.

Following in the footsteps of Slack and Spotify, the cryptocurrency trading platform opted to go public via a direct listing. With a direct listing, no new shares are created and there are no intermediaries – investment banks, brokerages, or underwriters. Once public, Coinbase shares will be available for trading on NASDAQ with the ticker CBASE. With a valuation expected to exceed $100 billion, there is a lot of hype around this company’s stock market debut.

Coinbase is popular with both retail and institutional investors, looking to invest in cryptocurrencies, the two most known being Bitcoin and Ethereum.

Because Coinbase makes commissions on crypto trades, it is effectively a “toll booth” in an increasingly congested market. Its revenue, and therefore its value, is intrinsically linked to the volume and intensity of Bitcoin trading and other kinds of cryptocurrencies. The price of Bitcoin is historically marked by volatility, most recently soaring to an all-time high of $58,238 on Feb. 21. Coinbase stock might be the purest exposure to the crypto market for retail investors.

Thinking about investing in Coinbase? Here’s what our digital data has to say about the company.

Key Takeaways:

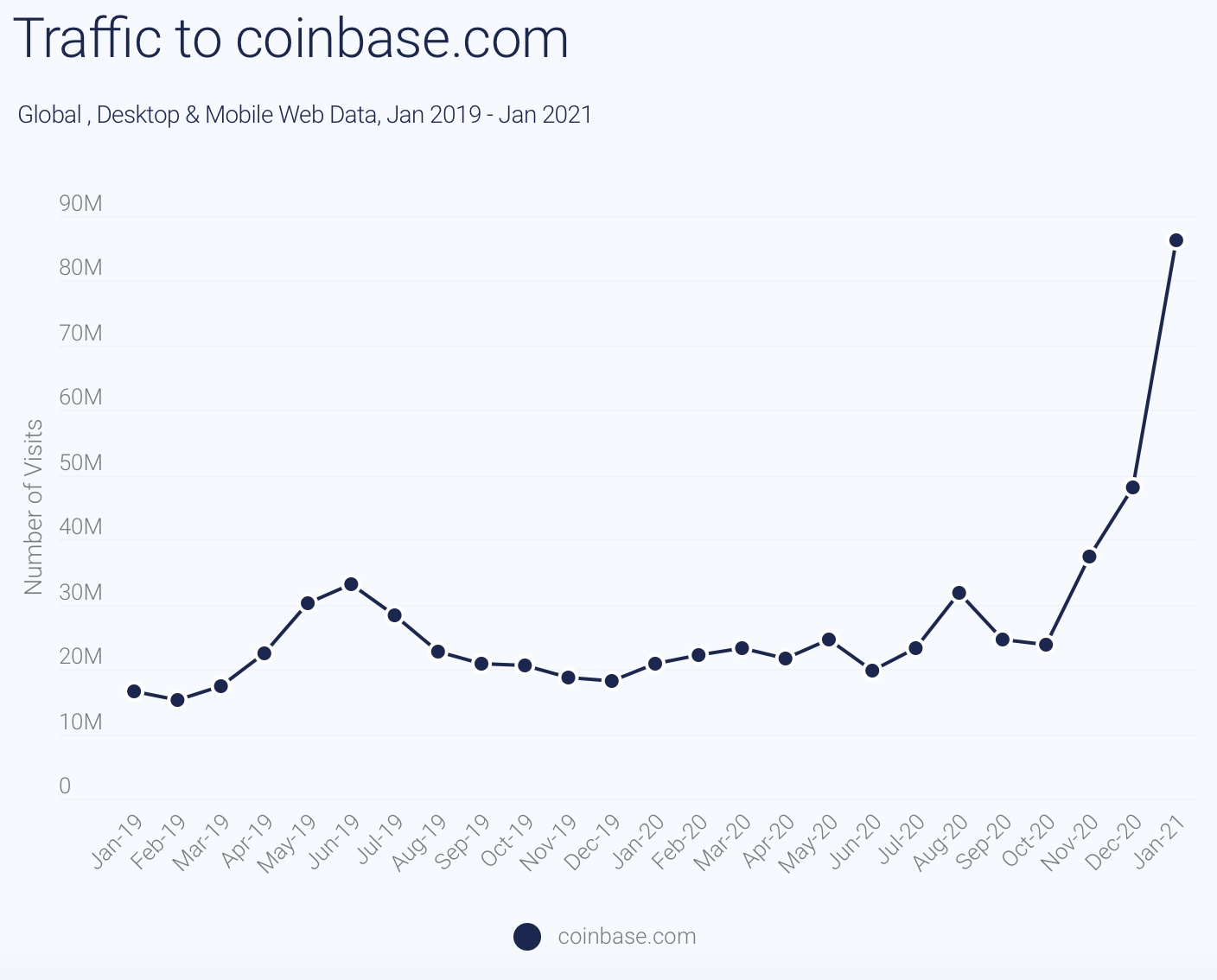

For context, monthly visits to coinbase.com globally had been relatively flat since January 2019, peaking at slightly over 30 million visits in 2020. This started to change in 4Q20 when monthly visits jumped to 86.4 million in January – an 80% increase from the previous month.

The growth seen in January, is reminiscent of Robinhood’s growth in trading volume in the same month.

A rush of new crypto-traders

The surge in traffic to coinbase.com in January suggests that the greater engagement from retail investors was not limited to equity trading.

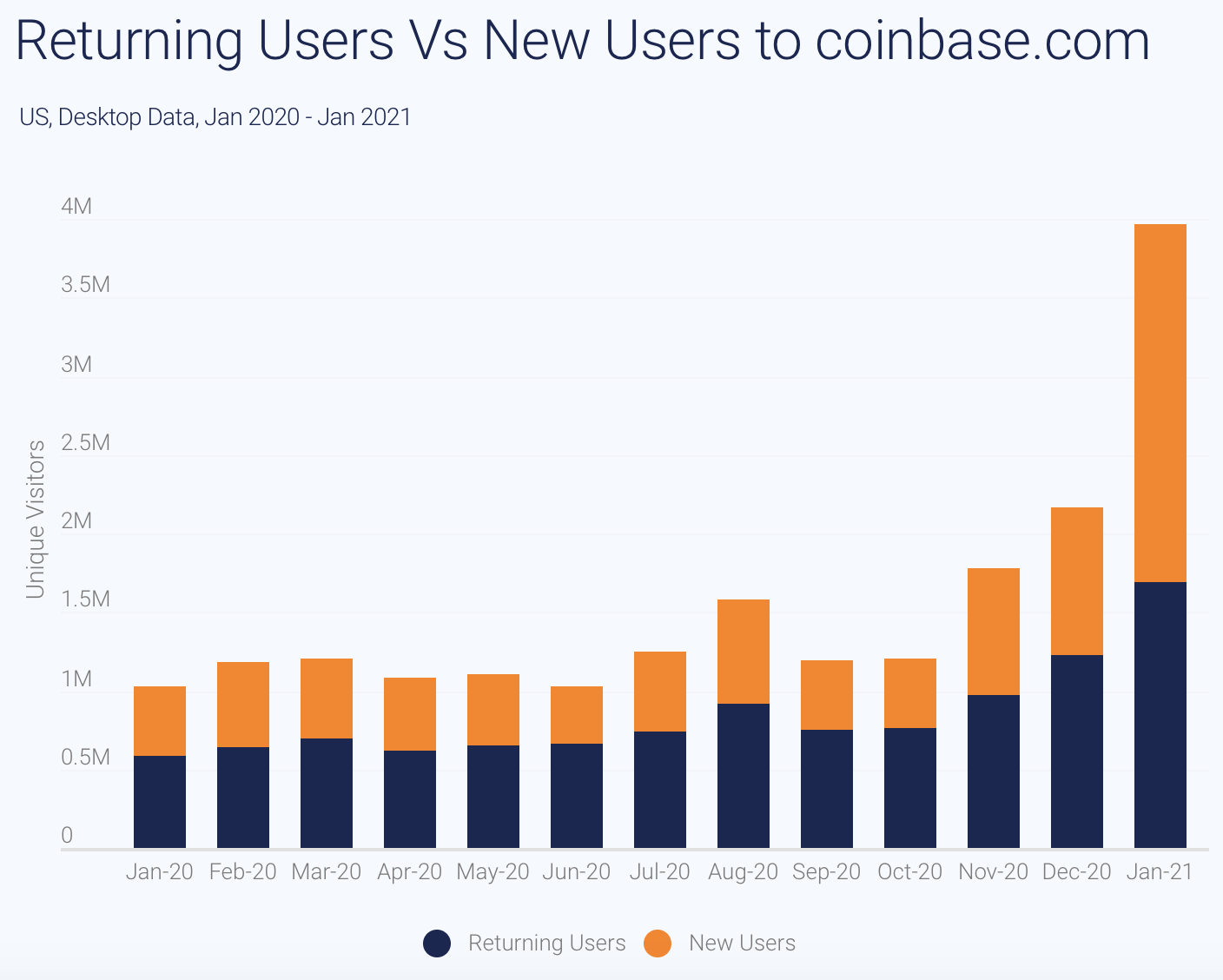

The U.S. accounted for ~50% of coinbase.com’s traffic in 4Q20. During that period visits to coinbase.com were dominated by returning users. By comparison in January, a month that saw a surge in activity from retail investors, the number of new users overtook the number of returning users in the U.S. for the first time.

Increased activity from retail crypto-traders

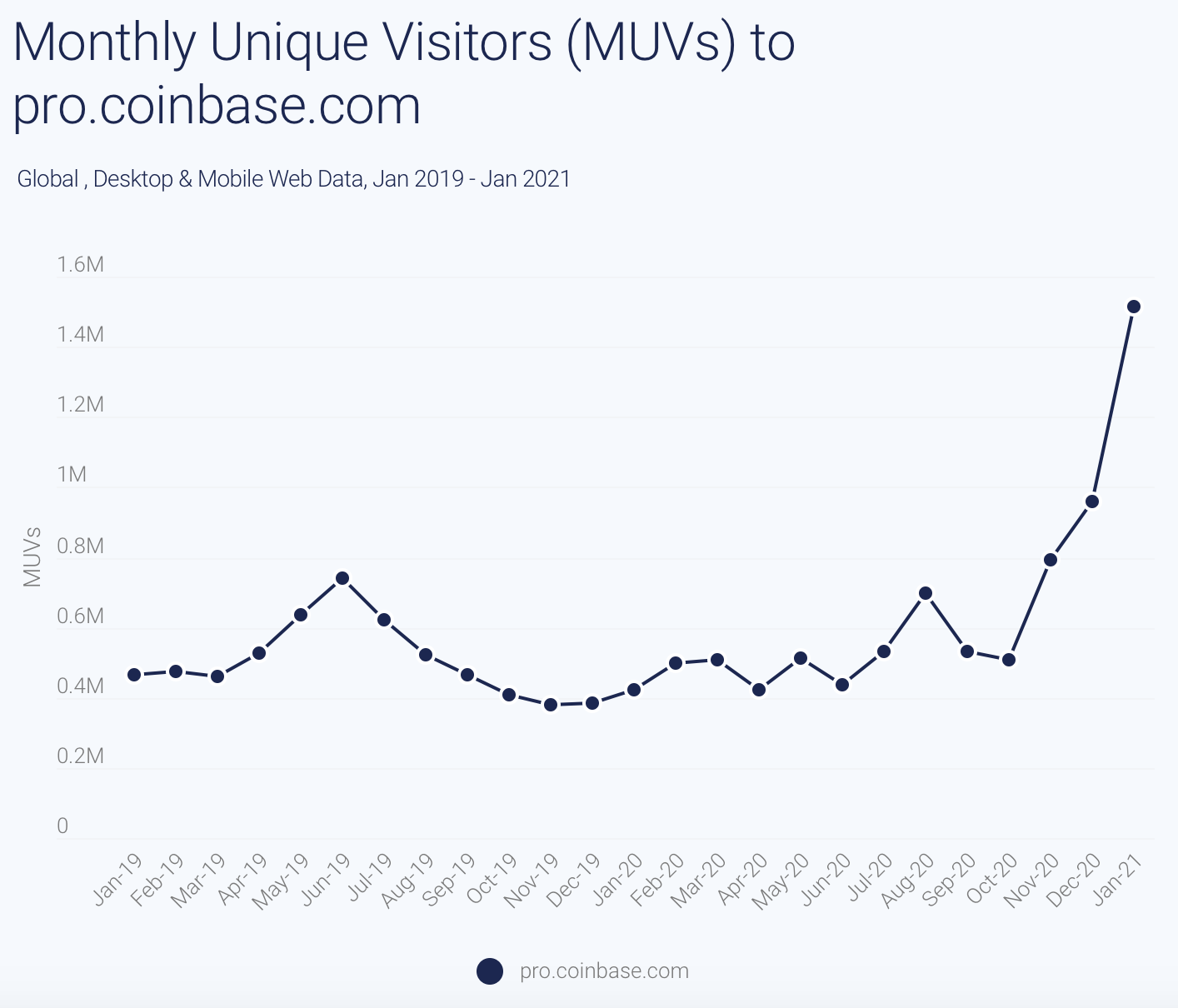

Coinbase Pro is coinbase’s cryptocurrency exchange for retail investors to trade Bitcoin, Ethereum and many other digital currencies.

Monthly unique visitors (MUVs) to pro.coinbase.com globally have also seen a huge increase since 4Q20, and crossed the one million mark in January.

To learn more about the data behind this article and what Similarweb has to offer, visit https://www.similarweb.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.